Imagine waking up tomorrow and realising the world's most trusted currency, the US dollar, has suddenly lost its power. It's like discovering that the foundation of a skyscraper has crumbled overnight. The building still stands for a moment, but cracks begin to spread quickly, threatening everything above.

The US dollar isn't just America's money; it's the lifeblood of global trade, finance, and savings. More than 88% of international transactions involve the use of dollars in some form, and nearly 60% of global foreign exchange reserves are held in USD. [1]

So when people ask, "What happens if the US dollar collapses?" they're really asking: What happens if the world's financial glue suddenly stops sticking?

Why People Fear a Potential Dollar Collapse in 2025?

Throughout history, great empires have often been closely tied to their respective currencies. The British pound once ruled world trade, only to fade after World War II. The dollar replaced it as the dominant "reserve currency."

Today, fears of a 2025 US dollar collapse are fueled by:

Rising US debt is now above $37 trillion (as of September 2025). [2]

Geopolitical shifts, with BRICS nations exploring alternatives.

Central bank diversification away from the dollar.

Digital currencies (Bitcoin, CBDCs) are challenging the dollar's monopoly.

However, unlike the currency failures of small nations like Lebanon's pound or Zimbabwe's dollar, the US dollar is intricately integrated into global systems, akin to oxygen in our atmosphere. Its collapse would ripple through every corner of the financial world.

What Happens If the US Dollar Collapses? 3 Immediate Outcomes

1. Inflation at Home

If the dollar collapses, Americans would feel it first and hardest. Imports, ranging from iPhones to oil, would immediately become significantly more expensive.

Think of it like going to the supermarket and realising your grocery bill has doubled overnight, not because food got scarce, but because your money suddenly buys less. That's hyperinflation, and it has destroyed economies before (see Venezuela or Weimar Germany). [3]

The Federal Reserve could try to step in with emergency measures, but once confidence evaporates, it's nearly impossible to restore it fully. The dollar's fall would feel like quicksand. The more you fight it, the deeper you sink.

2. Global Trade Spirals into Chaos

Given that a significant portion of global trade is priced in USD, a breakdown would disrupt contracts, obligations, and arrangements.

Oil and Commodities: Nearly all oil is priced in dollars. Should the USD fail, oil-exporting nations might reject dollar payments, insisting on euros, yuan, or gold instead.

Shipping & Logistics: Imagine thousands of cargo ships with contracts priced in dollars. Overnight, those agreements become unstable.

Developing Nations: Many countries borrow in dollars. A collapse would crush their capacity to repay, triggering a worldwide debt crisis.

3. Financial Markets Meltdown

Wall Street isn't just America's playground; it's where the world parks its savings. If the dollar collapses:

US stocks could crash as foreign investors flee.

US bonds (Treasuries), once seen as the safest asset, would lose credibility.

Gold and alternative currencies could skyrocket as investors seek a safe haven.

Historically, gold has risen 10–20% during periods of USD weakness, while oil often spikes 15–25% in downturns. Bitcoin and stablecoins could also see speculative inflows.

Winners and Losers in a Dollar Collapse

Not everyone would lose equally. History reveals that during crises, specific sectors adjust or even prosper.

For example:

The British pound lost dominance gradually, not overnight.

Hyperinflations in Zimbabwe, Venezuela, and Lebanon illustrate the severe impact on daily life when confidence in currency collapses.

However, in each case, people found workarounds by using US dollars, gold, or barter. So if the dollar collapsed, people worldwide would adapt, just not without pain.

Winners:

Gold and Precious Metals: Traditional hedges against inflation and currency risk.

Cryptocurrencies: If people seek alternatives, Bitcoin and stablecoins might gain advantages.

Export-driven countries: Nations less dependent on dollar trade might gain.

Losers:

Import-heavy economies like the US: The expenses for products would surge dramatically.

Emerging markets with dollar debt: Repayments would be impossible.

Global stock investors: Equity markets would likely tank in the chaos.

Dollar Collapse Scenarios: Best, Base, Worst Case

| Scenario |

What It Looks Like |

Global Impact |

Investment Outcome |

| Best Case |

Gradual dollar decline, controlled transition to mixed-currency system. |

Stability with adjustments. |

Gold rises moderately (5 to 10%), USD remains reserve currency. |

| Base Case |

Dollar weakens but remains dominant. BRICS and digital currencies grow in parallel. |

Some trade reallocation, but order preserved. |

USD down modestly, gold/oil steady, equities mixed. |

| Worst Case |

Sudden dollar collapse, loss of confidence. |

Hyperinflation in US, global trade shock, debt defaults. |

Gold surges 20%+, oil >$150/barrel, equities crash. |

Could the Dollar Really Collapse?

Here's the important part: while "collapse" sounds dramatic, a sudden total failure is unlikely in the near term. The US dollar remains deeply entrenched:

Over 50% of global trade is invoiced in dollars

Central banks hold USD reserves as a hedge, even those sceptical of US politics.

US Treasuries are still the world's go-to "risk-free" asset.

A more realistic scenario is the gradual erosion of dominance, such as the decrease of the British pound.

Importantly, the pound didn't vanish overnight; its global role eroded over three decades after World War II. The dollar's path may follow a similar glacier-like slowdown.

What Are Signs That the Dollar Is Weakening?

If you want to know whether the dollar is heading for trouble, here are key warning signals to watch:

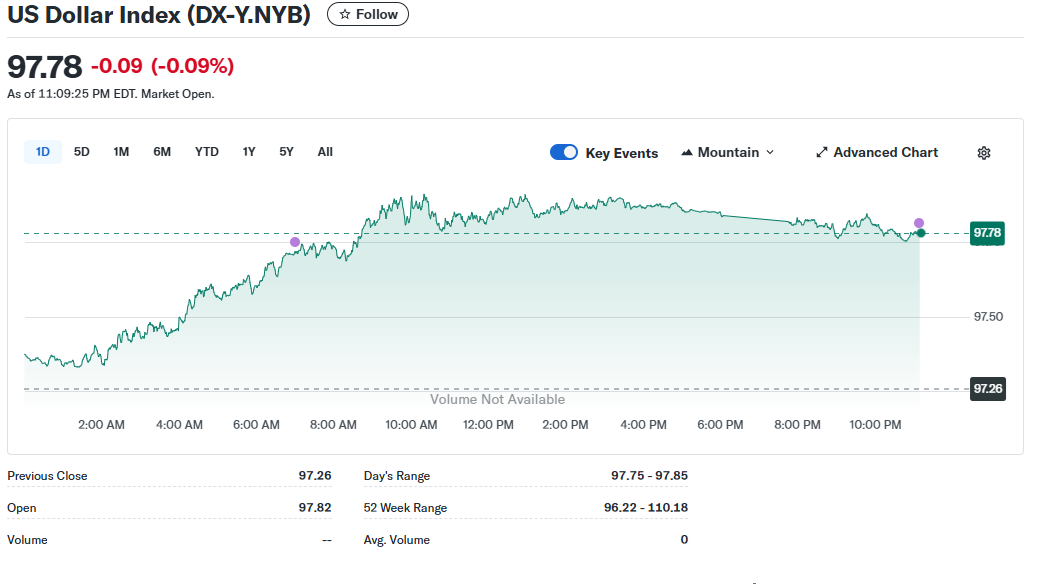

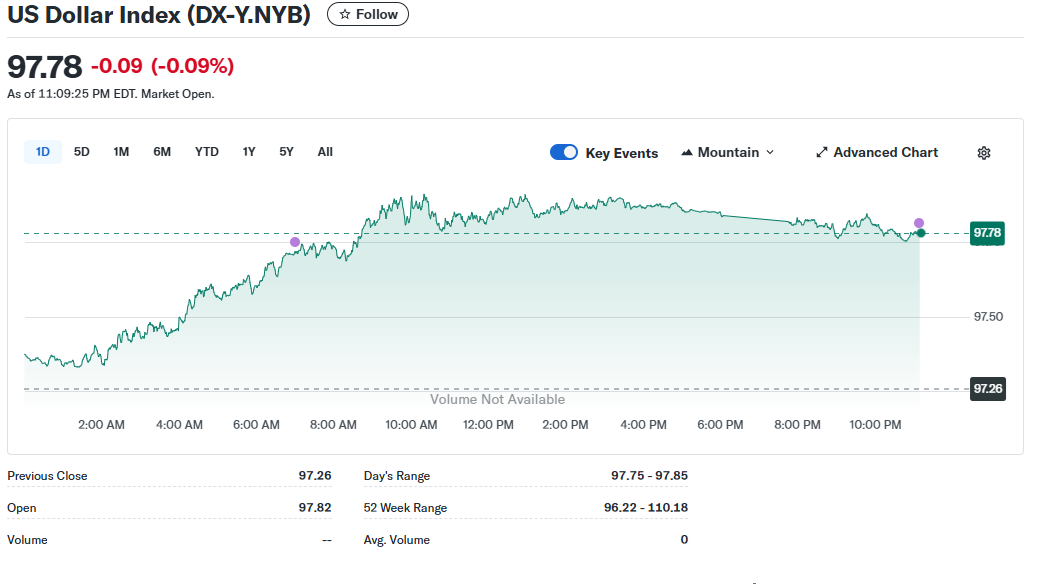

A sharp, sustained fall in the Dollar Index (DXY). As of September 2025, DXY stands around 96–98, weaker than 2022 highs (~114).

Central banks are aggressively diversifying away from USD reserves.

Major commodities are priced in non-dollar currencies (for example, oil traded in yuan).

US debt markets are failing to attract buyers without much higher interest rates.

Could Another Currency Replace the Dollar?

Replacing the dollar would be like trying to replace electricity: alternatives exist, but none are as thoroughly embedded at this point.

Candidates often mentioned include:

Euro: Large economy, stable, but fragmented politically.

Chinese Yuan: Growing, but capital controls limit trust.

BRICS currency proposal: Still in discussion, not implemented.

Bitcoin or Digital Assets: Possible as a complementary store of value, but volatility is a barrier.

At best, challengers may share dominance, not fully replace the dollar.

Frequently Asked Questions

1. What Would Immediately Happen if the US Dollar Collapsed?

Markets would panic, Treasuries would sell off, and gold and oil would spike sharply.

2. Would the US Economy Collapse Along With the Dollar?

Not entirely. America still has strong industries (tech, agriculture), but imports would become unaffordable.

3. Can the US Dollar Actually Collapse in 2025?

A full collapse is unlikely. While the dollar has weakened at times due to Fed rate cuts in 2025 and rising BRICS de-dollarisation efforts, it remains the world's dominant reserve currency.

4. How Can Investors Protect Themselves if the Dollar Collapses?

Diversify with:

Gold & Silver (historical safe havens)

Energy & commodities (hard assets)

Non-dollar currencies (CHF, JPY, EUR)

Cryptocurrencies (as alternative hedges)

Global equities (especially in emerging markets less tied to the dollar).

5. What's the Difference Between a Weakening Dollar vs. Collapse?

A weakening dollar is a gradual depreciation (common in cycles). A collapse is a sudden loss of trust and value, triggering systemic panic.

Conclusion

In conclusion, a 2025 US dollar collapse would be one of the most earth-shaking financial events in history. While unlikely in the short term, it's a situation that emphasises the extent of global interconnectedness.

For now, the dollar remains king of global finance, but its throne is being challenged. The best move for investors is diversification across hard assets, non-dollar currencies, and worldwide markets, while closely monitoring the warning signals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.federalreserve.gov/econres/notes/feds-notes/the-international-role-of-the-us-dollar-post-covid-edition-20230623.html

[2] https://www.pgpf.org/article/the-national-debt-is-now-more-than-37-trillion-what-does-that-mean/

[3] https://www.economicsobservatory.com/why-did-venezuelas-economy-collapse