The global financial system has been dominated for decades by the U.S. dollar. But in recent years, the BRICS nations—Brazil, Russia, India, China, and South Africa—have been actively exploring alternatives to the dollar-centric framework. One of the most discussed initiatives is the creation of a BRICS currency.

This bold idea aims to redefine global trade, challenge U.S. financial hegemony, and offer an alternative to existing global payment systems. But can it work? What are the potential benefits and pitfalls of a unified BRICS currency?

In this article, we break down everything you need to know: what the BRICS currency is, how it works, who it serves, and whether it's viable soon.

What Is the BRICS Currency?

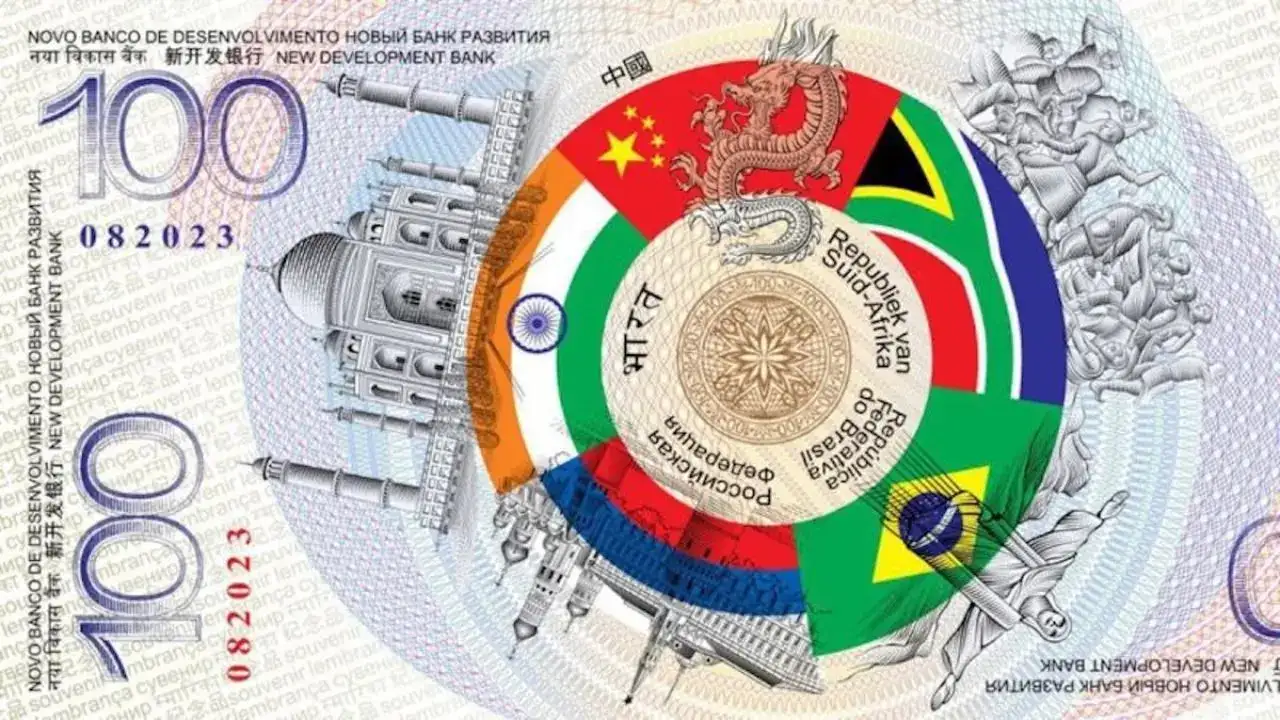

The BRICS currency is a proposed joint financial instrument designed to facilitate trade and investment among the BRICS countries without relying on the U.S. dollar or other Western-backed systems such as SWIFT.

Rather than being a single fiat currency like the euro, the BRICS currency is envisioned as a digital or commodity-backed unit of account, potentially tied to a basket of the member nations' currencies or natural resources such as gold, oil, or rare earth minerals.

However, contrary to popular belief, an official BRICS currency is not on the horizon. Despite speculation and political posturing, including from Brazil and Russia, leaders at the July 6–7, 2025, summit in Rio confirmed that while exploration continues, no new currency launch was announced.

Instead, the group is intensifying its focus on local currency settlements and developing digital infrastructure, BRICS Pay, to lessen dependence on the U.S. dollar.

Why Is the BRICS Currency Being Proposed?

1. Reducing U.S. Dollar Dependence

The dollar currently accounts for over 85% of global trade and more than 60% of global central bank reserves. It gives the U.S. outsized influence over the financial system.

By developing their own currency, BRICS nations aim to reduce exposure to dollar volatility and U.S. monetary policy.

2. Economic Sovereignty & Sanctions Resilience

Sanctions on Russia, Iran, and Venezuela highlighted the vulnerabilities of dollar dependency. As a result, BRICS nations are rapidly expanding local-currency trade, which surged to approximately 90% of intra-bloc commerce in mid-2025, up from 65% just two years prior.

3. Diversification of Global Currency Reserves

Worldwide confidence in the U.S. dollar, which has been the primary reserve currency, is beginning to diminish as reserves remain at 58%. However, they are under growing examination due to concerns about U.S. debt and inflation.

4. Shifting Geopolitical Power

With BRICS now representing 46% of global GDP (PPP) and 55% of the world population, its member states are leveraging collective economic weight to foster a more multipolar financial system.

How Would a BRICS Currency Work?

1. Digital Currency (CBDC-Based Model)

Each BRICS country could issue its own central bank digital currency (CBDC) and connect them via a unified cross-border settlement platform. This system would allow seamless currency conversion and faster, lower-cost transactions.

For example, India could trade directly with Russia using rupees and rubles via a BRICS clearing house, bypassing the need for dollars.

2. Commodity-Backed Currency

Some experts suggest a currency backed by a basket of commodities—such as gold, oil, and agricultural goods—could create inherent value and avoid inflationary risks.

It would mimic historical gold standards and increase trust in the currency's long-term stability.

3. Special Drawing Rights (SDR) Style System

Inspired by the IMF's SDR, BRICS could create a synthetic currency representing a weighted basket of member currencies (real, ruble, rupee, yuan, rand). It would hedge against individual currency volatility and allow gradual integration.

Potential Benefits of a BRICS Currency or Settlement System

1) Enhanced Trade Efficiency

Local-currency mechanisms bypass exchange-rate friction and reduce transaction costs, facilitating smoother trade among BRICS and partner nations.

2) Reduced Exposure to Dollar Volatility

By conducting trade in local currencies or through BRICS Pay channels, members can protect themselves from dollar volatility and changes in U.S. monetary policy.

3) Strengthened Political Autonomy

Reduced reliance on the dollar offers protection from financial restrictions associated with SWIFT participation, sanctions, and geopolitical conflicts.

4) Building a BRICS‑Centric Financial Architecture

The New Development Bank (NDB) and Contingent Reserve Arrangement (CRA) are gaining prominence as alternative financing and liquidity networks designed to support a BRICS financial ecosystem.

Risks & Challenges Ahead

1. Lack of Monetary Cohesion

In contrast to the cohesive eurozone, BRICS countries differ widely in their political structures, central bank independence, inflation levels, and capital control measures. Establishing any currency peg or currency basket requires extensive coordination beforehand.

2. Political Fragmentation

India and Brazil have expressed caution, and internal rivalries—especially between China and India—pose challenges to consolidation.

3. Geopolitical Retaliation

U.S. officials have warned of trade retaliation and tariffs if BRICS nations develop a currency rival to the dollar.

4. Operational Complexity & Currency Imbalances

Managing adjustable exchange-rate regimes and balancing economic disparities within a currency union would require institutional frameworks that BRICS currently lacks.

5. Market Volatility in Transition

A transitional basket currency or patchwork of national currencies could provoke volatility and uncertain capital flows, undermining investor confidence.

Strategic Scenarios for Investors

Scenario A: Market-Neutral Settlement in Local Currencies

BRICS nations maintain bilateral transactions and digital settlement systems in BRICS Pay, minimising effects on trade and finance, leading to minimal disruption in international markets.

Investor Strategy: Continue diversified exposure to emerging markets while hedging FX risk through currency-hedged ETFs.

Scenario B: Basket Currency or Partial Monetary Integration

Introduction of a BRICS currency basket used selectively in trade finance or official settlements, but not replacing all national currencies.

Investor Strategy: Consider allocating a small FX-weighted basket fund allocation to BRICS currencies and keep an eye on domestic government bonds.

Scenario C: Full BRICS Currency Union (Low Probability)

A unified BRICS currency similar to the euro necessitates significant political and financial alignment.

Investor Strategy: Hedge using currency futures or options; diversify beyond BRICS equities to mitigate systemic restructuring risk.

BRICS Currency vs. U.S. Dollar: A Realistic Threat?

The idea of the BRICS currency replacing the U.S. dollar as the world reserve currency is ambitious, but is it realistic?

Short-Term: Complement, Not Replace

In the next 5–10 years, the BRICS currency is more likely to act as a supplementary trade tool than a complete replacement. The dollar's deep liquidity, global acceptance, and central role in commodities like oil remain unmatched.

Long-Term: Strategic Challenge

If BRICS countries can build trust, develop digital infrastructure, and tie their currency to real assets, the BRICS currency could evolve into a viable alternative in specific trade zones, especially in the global South.

Its success would likely depend on gradual adoption, increased intra-BRICS trade, and consistent macroeconomic policies among member states.

Conclusion

In conclusion, the BRICS currency vision is not dead, but it is evolving pragmatically. The group has chosen incrementalism over grand designs: focusing on local currency settlement, regional payment systems, and financial institution-building

For investors, this signals a need for vigilant monitoring rather than immediate action. Opportunities lie in currency-hedged EM allocations, emerging-market financial exposure, and tactical plays on trade-session volatility.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.