In the ever-evolving world of financial markets, Contract for Difference (CFD) trading has emerged as a popular method for retail traders to access a variety of instruments without owning the underlying assets.

A specific field attracting interest from both novice and seasoned traders is CFD indices trading. This approach offers a straightforward and adaptable means of predicting shifts in stock market indexes.

In this detailed guide, we'll explore what CFD indices are, how they work, and why they might be an ideal entry point for beginners in the world of trading.

Understanding the Basics of Indices

Before diving into CFDs, it's crucial to understand what indices are. A stock market index measures the performance of a group of stocks, typically representing a specific sector, region, or economy. Common examples include the S&P 500, FTSE 100, NASDAQ 100, and Nikkei 225.

These indices provide traders with a snapshot of how market sectors are performing. Instead of investing in individual stocks, investors can gain exposure to an entire market or industry through an index.

What Are CFD Indices?

CFD indices refer to the trading of stock indices through Contracts for Difference. When you trade a CFD index, you are speculating on the price movement of that index without buying the underlying assets.

For example, if you believe the S&P 500 will rise, you can take a "buy" position on the CFD. If it rises, you profit from the price difference. If it falls, you incur a loss.

This method differs from traditional investing because you never actually own any of the shares that make up the index. You're simply agreeing with a broker to settle the price difference from the time the contract is opened to when it is closed.

How CFD Index Trading Works

Trading CFD indices involves predicting whether the index will differ in value. If your prediction is correct, you earn a profit based on the size of your position and the movement of the index. If the market moves against your prediction, you incur a loss.

The process is simple. You choose an index (like the Dow Jones or DAX), decide on the direction (buy or sell), and then open a CFD position with your broker. Your profit or loss is determined by the difference between the opening and closing prices of your position, multiplied by the size of your trade.

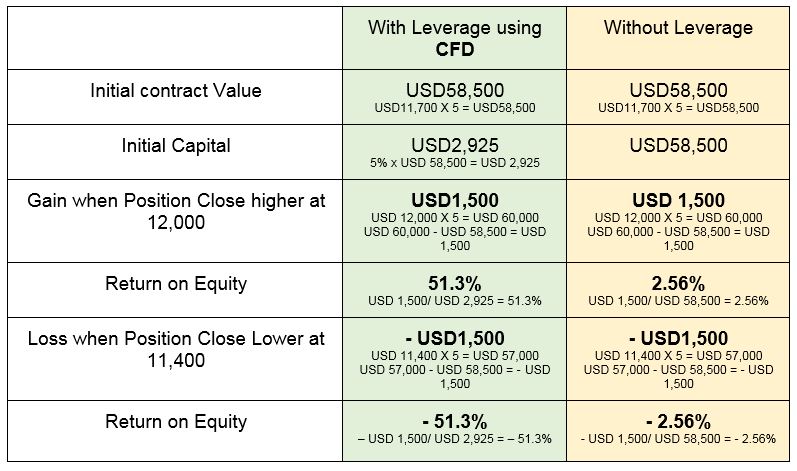

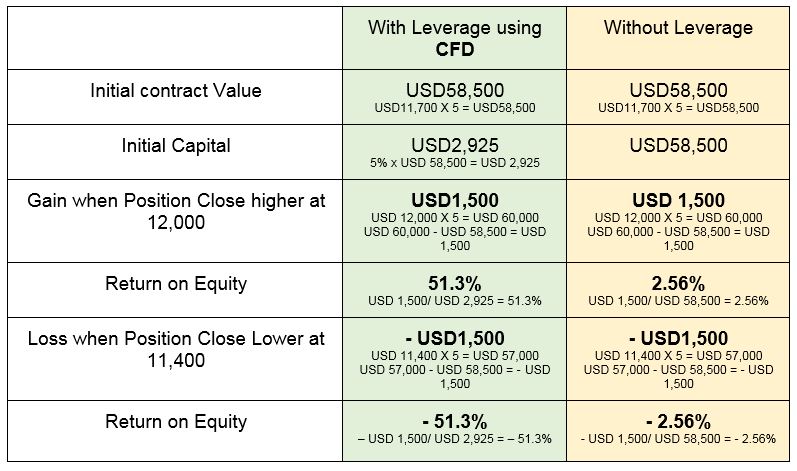

Leverage and Margin in Index CFDs

One of the key features of cfd trading is leverage. Leverage allows you to open positions much larger than your initial investment. For example, with 10:1 leverage, a $1,000 margin could control a $10,000 position. While this increases the potential for higher profits, it also magnifies the risk of losses.

Margin is the amount of money required to open a leveraged position. It's crucial to monitor your margin level, as falling below a certain threshold may trigger a margin call, requiring you to deposit more funds or risk your position being closed automatically.

Trading Hours

Unlike traditional stock exchanges, many CFD brokers offer extended trading hours for CFD indices. It allows traders to react to news and events outside of normal market hours.

However, it's crucial to exercise caution while trading at slower times of the day because the spreads and liquidity can change based on the time of day.

Always check with your broker for specific trading hours and holidays, as these can vary by region and platform.

Why Trade CFD Indices?

There are several reasons why traders choose to use CFDs to trade indices rather than buying into mutual funds or ETFs.

First, index CFDs allow for both long and short positions. This means you can potentially profit in both rising and falling markets, providing more flexibility during volatile market conditions.

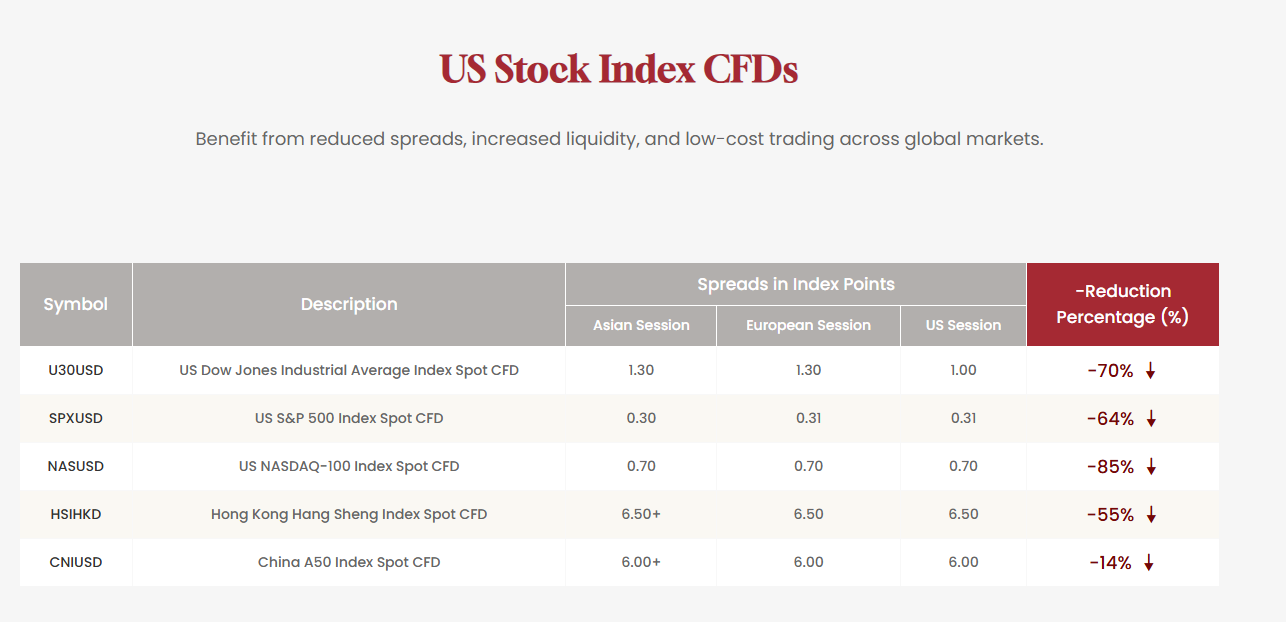

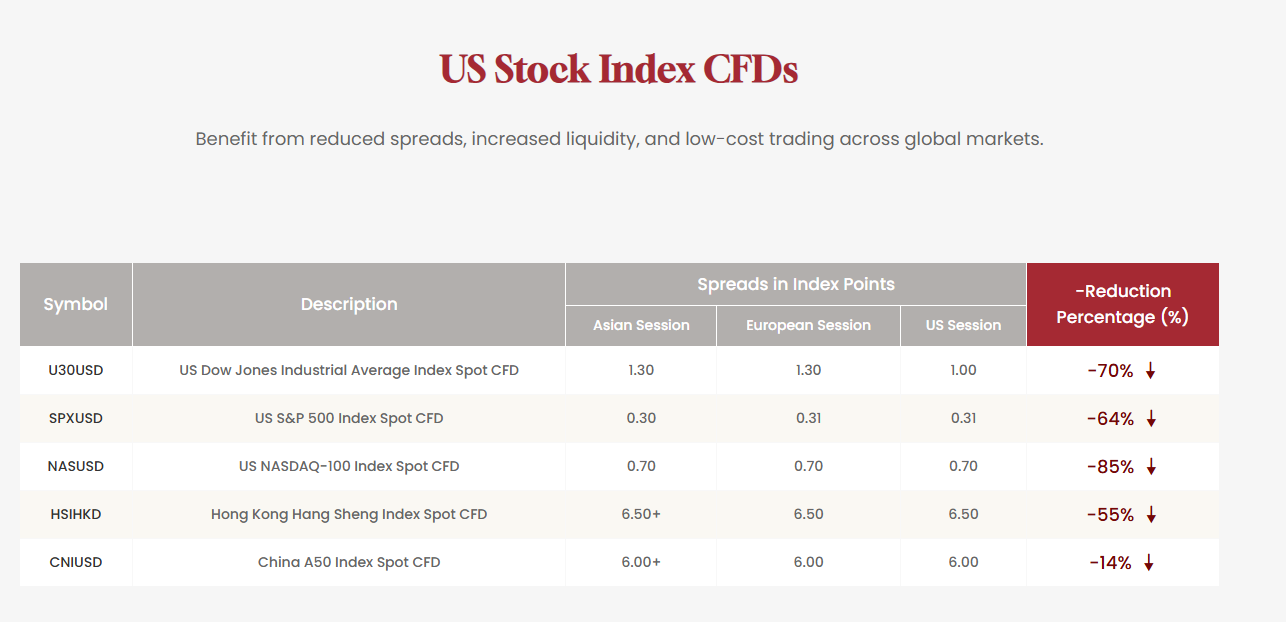

Second, CFD indices offer high liquidity and tight spreads, making them an attractive option for day traders and scalpers who rely on quick executions and low trading costs.

Third, without requiring several brokerage accounts, traders may diversify their portfolios and speculate on various economies worldwide thanks to CFDs, which offer global access to major stock indices.

Popular CFD Indices to Trade

Traders can choose from a wide variety of global indices when trading CFDs. Some of the most popular include:

S&P 500: Tracks 500 of the largest publicly traded companies in the U.S.

Dow Jones Industrial Average (DJIA): Represents 30 major U.S. companies.

NASDAQ 100: Includes 100 top tech and growth stocks in the U.S.

FTSE 100: Represents the 100 largest companies listed on the London Stock Exchange.

DAX 40: Tracks 40 major German companies on the Frankfurt Stock Exchange.

Nikkei 225: The leading index for the Tokyo Stock Exchange.

Hang Seng Index: Represents the top 50 companies listed in Hong Kong.

Each index has its own trading hours, volatility characteristics, and sensitivity to global events, which makes it suitable for different trading strategies and risk profiles.

Strategies for Trading CFD Indices

There are several strategies that beginners can use when trading CFD indices. Each comes with its own risk profile and complexity level.

One common approach is trend following. It involves identifying the direction of the overall market and trading in the same direction. Technical indicators such as moving averages, trendlines, and momentum oscillators are often used to confirm trends.

Another strategy is range trading, where traders look for indices that are moving within a specific range. By buying at support and selling at resistance, traders can aim to profit from smaller price movements.

News trading is another approach where traders react to economic reports, earnings releases, or geopolitical events that may impact the index. This strategy requires quick decision-making and a strong knowledge of global events.

Risk Management

Managing risk is essential in CFD index trading. The use of leverage means that even small market movements can have a massive impact on your capital.

Setting stop-loss orders is crucial to limit potential losses. A stop-loss automatically closes your position if the price moves against you by a predetermined amount. Similarly, take-profit orders help lock in gains when your target price is reached.

It's also advisable to risk only a small percentage of your trading capital on each trade. Most experienced traders recommend risking no more than 1–2% per trade to preserve your capital over the long term.

Monitoring market news, understanding the economic calendar, and maintaining discipline are also key elements of a sound risk management plan.

Conclusion

In conclusion, CFD indices offer a flexible, efficient, and potentially profitable way to engage with the stock market, especially for those who prefer not to invest in individual companies. By trading an entire market or sector through a single position, you can take advantage of macro trends, diversify your trades, and access global opportunities.

However, like all trading instruments, CFD indices carry risks from leverage. Beginners should take time to understand how index trading works, use demo accounts to practice, and start with small positions while they learn.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.