The US30 Index, also known as the Dow Jones Industrial Average (DJIA), is one of the most iconic stock market indices globally. Often used as a barometer for the health of the U.S. economy and stock market, the US30 comprises a select group of large-cap blue-chip companies.

For traders and investors, understanding how this index works, what it includes, and how to develop trading strategies around it is key to capturing its opportunities in 2025 and beyond.

In this guide, we break down what the US30 is, its components, how it moves, and actionable ways to trade it.

What Is the US30 Index?

The US30 Index, also called the Dow Jones Industrial Average, was created in 1896 by Charles Dow and Edward Jones. It tracks 30 of the largest and most influential publicly traded companies listed on U.S. stock exchanges.

While it is not as broad as other indices, such as the S&P 500, it is considered highly representative of the industrial and corporate landscape of the United States.

What sets the US30 apart is its price-weighted methodology. Unlike market-cap-weighted indices, where the size of a company determines its weight, the US30 gives more influence to companies with higher share prices. It implies that changes in the prices of expensive stocks can greatly impact the entire index.

Components of the US30 Index in 2025

As of 2025, the US30 comprises 30 leading companies across various sectors, from technology, healthcare, finance, consumer goods, and industrials. A committee chooses these companies to represent the essential sectors of the U.S.

Some of the most influential companies in the US30 include:

Apple Inc.

Microsoft Corp.

The Boeing Company

Goldman Sachs Group

Johnson & Johnson

McDonald's Corporation

The Home Depot

Walmart Inc.

Visa Inc.

Coca-Cola Company

The composition can change based on mergers, performance, and relevance to the U.S. economy. Any changes are typically announced well in advance.

Why Is the Index Important for Traders?

The US30 is a powerful benchmark for understanding market sentiment. It often reacts quickly to macroeconomic data, earnings reports from its components, Federal Reserve announcements, and geopolitical events. Traders take advantage of the US30 for technical and fundamental strategies due to its liquidity, volatility, and strong trending ability.

Since the index includes sector leaders, it is considered a trustworthy measure of economic performance. When the US30 increases, it's frequently interpreted as an indicator that major, prosperous companies are thriving—reflecting general stability.

Additionally, since it's so widely followed, institutional and retail traders alike include it in their watchlists, adding to its trading volume and liquidity.

How to Trade the US30 Index

CFDs (Contracts for Difference)

CFDs are popular among retail traders who want to speculate on the price of the US30 without owning the underlying stocks. They provide options for leveraged trading and enable positions to be held both long and short, effective in fluctuating markets.

Futures Contracts

US30 futures are standardised agreements that are exchanged on regulated platforms. Institutional investors prefer them, and they provide 24-hour access on weekdays, making them ideal for continuous trading approaches.

ETFs (Exchange-Traded Funds)

ETFs such as the SPDR Dow Jones Industrial Average ETF (DIA) track the performance of the index and are available to stock traders. They're ideal for long-term investors who prefer a traditional brokerage account.

Options

Traders may utilise US30-based options for hedging or speculation. Options strategies provide flexibility but require a deeper understanding of volatility and pricing.

For passive investors, mutual funds and index funds that mirror the DJIA are a simple way to gain exposure without active trading.

Key Trading Hours

The core trading hours for the US30 are aligned with the New York Stock Exchange:

However, futures and CFD versions of the US30 can be traded nearly 24/5, offering flexibility to traders in different time zones. It is particularly beneficial for responding to overnight news, financial results, or geopolitical occurrences.

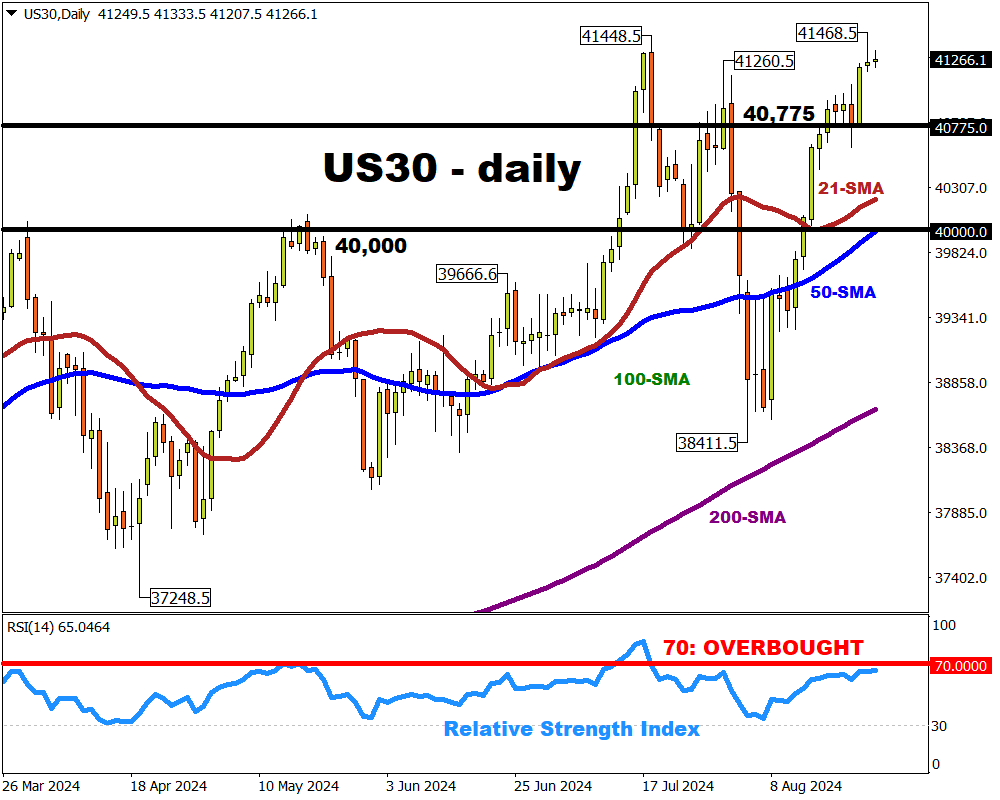

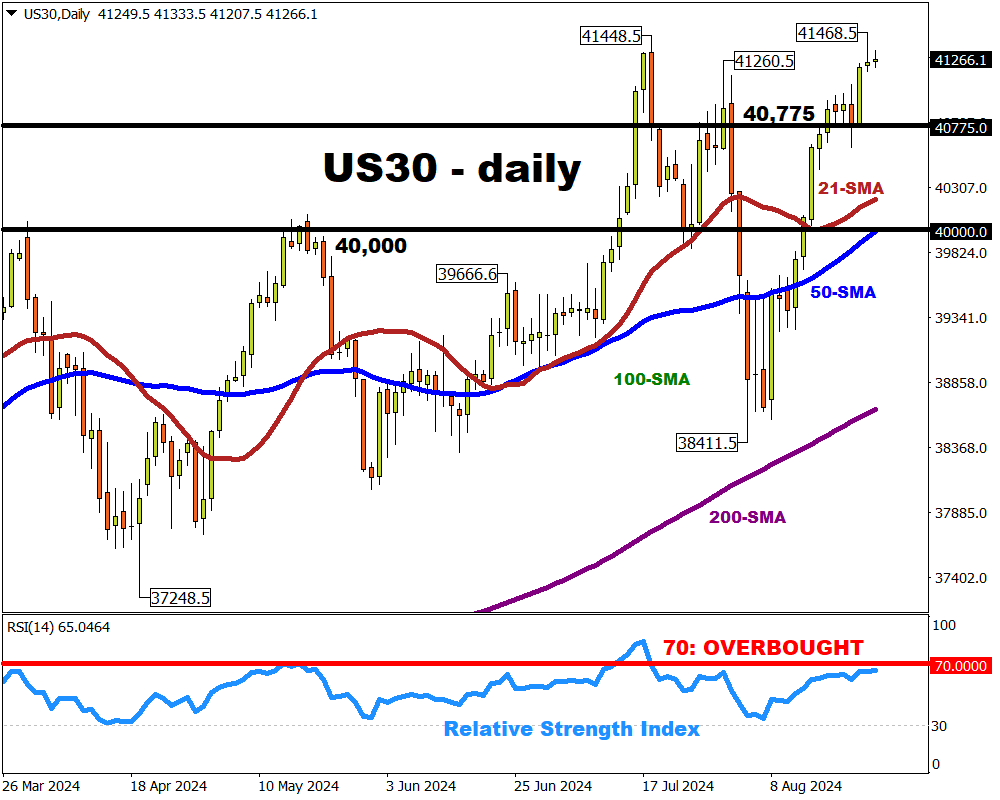

Best Strategies

Momentum traders seek significant price movements on elevated volume, usually employing indicators such as the Relative Strength Index (RSI) or Moving Averages to initiate trades. The first and last hours of the trading day often present ideal momentum conditions due to increased volume.

Breakout strategies focus on trading the US30 when it moves beyond established support or resistance levels. The goal is to capture significant directional shifts frequently instigated by economic data announcements or earnings periods.

Swing Trading

Swing traders hold positions for several days to take advantage of medium-term trends. They combine technical indicators with macroeconomic news to build positions aligned with broader market direction.

Trend Following

This approach works well with the US30, especially in strong bull or bear markets. Using trend indicators like the MACD or ADX can help identify when to ride a trend and when to exit.

Common Mistakes to Avoid

Traders new to the US30 often make predictable errors that can be avoided:

Overtrading: Striving to monitor every action results in exhaustion and impulsive choices.

Ignoring News: The US30 is sensitive to breaking news. Trading without awareness during economic announcements can lead to significant losses.

Neglecting Time Zones: Trading the US30 from outside the U.S. requires understanding when volume and volatility peak.

Failing to Backtest Strategies: Many new traders dive in without testing their strategies under different market conditions.

Learning from these mistakes and maintaining a trading journal can dramatically improve long-term performance.

Conclusion

In conclusion, the US30 index offers a unique combination of historical relevance, price volatility, and access to industry leaders across various sectors.

Whether you're day trading with CFDs, swing trading through options, or investing via ETFs, understanding how the US30 operates can open up diverse opportunities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.