The S&P/ASX 200 Index is Australia's premier stock market benchmark, widely followed by investors, analysts, and institutions both domestically and internationally.

It represents the performance of the top 200 companies listed on the Australian Securities Exchange (ASX) and acts as a barometer of the Australian economy.

Whether you're a retail investor diversifying your investments or a professional trader examining international indices, grasping the S&P/ASX 200 is crucial. This guide breaks down the index, its composition, performance, and how to invest in it in 2025.

What Is the S&P/ASX 200 Index?

The S&P/ASX 200 Index, commonly known as ASX 200, is an index weighted by market capitalisation. It includes the 200 largest stocks listed on the Australian Securities Exchange by float-adjusted market value.

It was launched on March 31, 2000, by S&P Dow Jones Indices and is now considered the benchmark for large-cap Australian equities. The index comprises firms from various industries, including finance, materials, healthcare, real estate, and consumer goods.

The ASX 200 is reviewed quarterly to ensure it reflects the evolving composition of the Australian equity market.

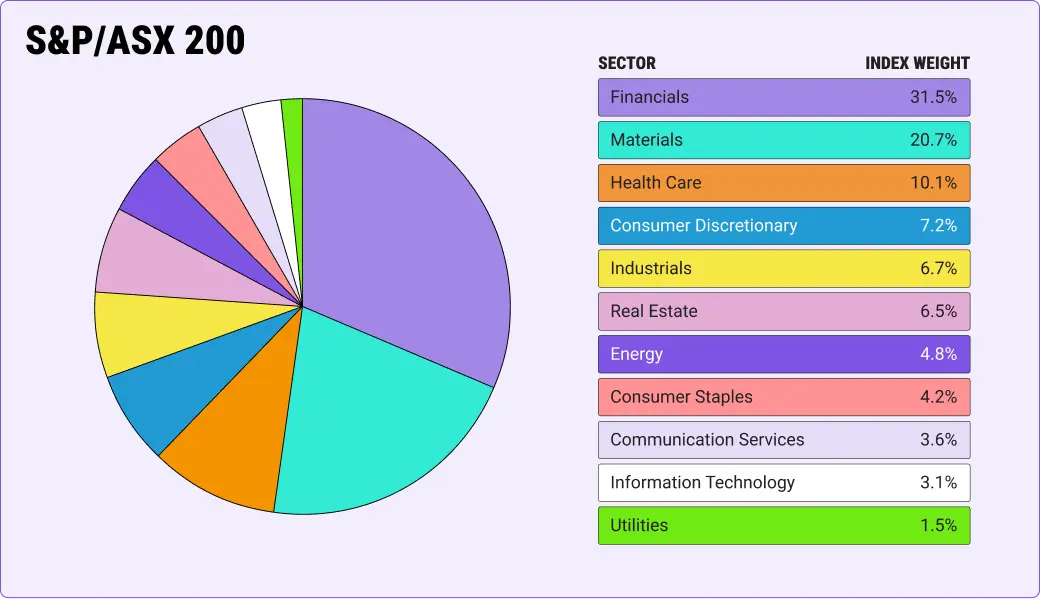

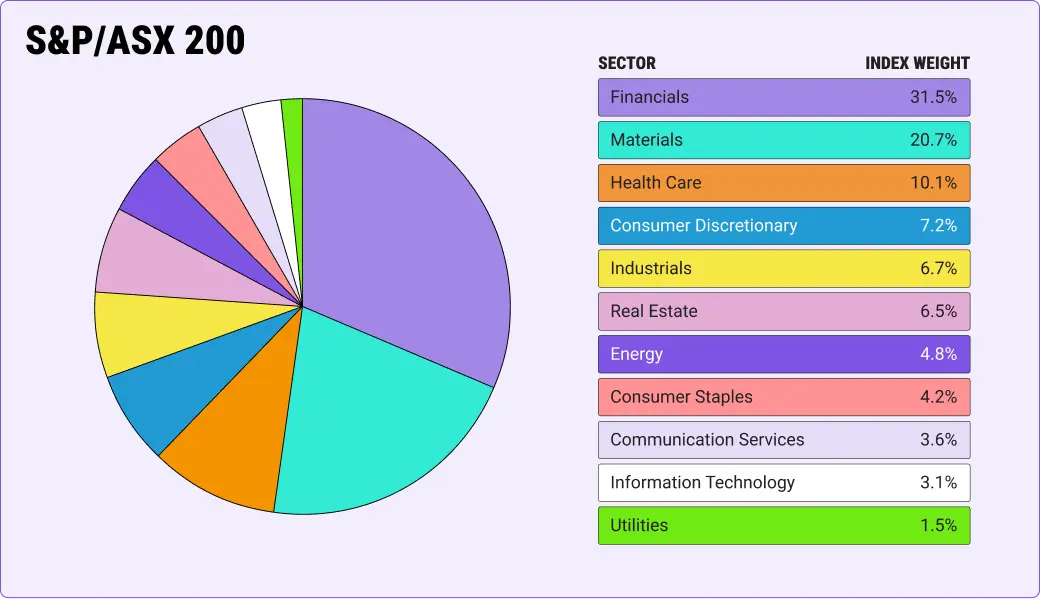

Key Sectors and Top Constituents

The ASX 200 is heavily weighted toward a few dominant sectors, making it unique compared to other indices such as the S&P 500 or FTSE 100.

As of 2025, the major sectors include:

Financials: This sector constitutes a massive portion of the index, with banks such as Commonwealth Bank, Westpac, NAB, and ANZ at the forefront.

Materials: Mining giants such as BHP, Rio Tinto, and Fortescue Metals play a large role in the index due to Australia's rich natural resources.

Healthcare: CSL Limited and ResMed rank among the leading healthcare firms, boasting worldwide presence and robust profits.

Consumer Staples: Woolworths and Coles are dominant retail brands included in the ASX 200.

These sectors make the ASX 200 both resource-driven and financially focused, which can impact its volatility and sensitivity to global commodity trends.

Historical Performance Overview

Over the past two decades, the ASX 200 has displayed steady growth, albeit with some periods of turbulence. The index recovered from the Global Financial Crisis in 2008 and showed strong performance throughout the 2010s.

In 2020, like many global indices, the ASX 200 saw a notable drop due to the COVID-19 pandemic, but rebounded quickly thanks to government support and improved company earnings.

From 2021 to 2024, the index saw mixed results due to global inflation, interest rate hikes, and geopolitical tensions. However, in early 2025, a rally in commodity prices and strong bank earnings helped push the index toward new highs.

How to Invest in the ASX 200 Index

Through Exchange-Traded Funds (ETFs)

One of the easiest ways to gain exposure to the index is through ETFs that mirror its performance. Popular ETFs like:

iShares Core S&P/ASX 200 ETF (IOZ)

SPDR S&P/ASX 200 Fund (STW)

Vanguard Australian Shares Index ETF (VAS)

These funds track the ASX 200 and can be bought through any online broker. They provide diversification, low management fees, and liquidity.

Direct Stock Investing

Advanced investors may choose to invest directly in several top ASX 200 companies to replicate the index manually. However, this approach requires more capital and involves monitoring individual stocks.

CFDs and Derivatives

Traders interested in short-term movements can use Contracts for Difference (CFDs), futures, or options based on the ASX 200. These provide leverage and flexibility, yet also involve greater risk.

Platforms such as EBC Financial Group provide traders with access to ASX 200 CFDs to speculate on market movements without possessing the underlying assets.

Factors That Influence the ASX 200

Interest Rates

The Reserve Bank of Australia (RBA) plays a critical role in shaping the direction of the ASX 200. Generally, rate reductions bolster stock values, particularly in financial and real estate sectors, while rate increases can diminish valuations.

Commodity Prices

Because of the significant influence of mining and energy firms, fluctuations in commodity prices—especially iron ore, coal, and gold—can lead to a disproportionate effect.

Global Economic Conditions

As a trade-dependent nation, Australia's stock market is sensitive to conditions in major economies, especially China, the U.S., and Europe. Investors closely monitor trade tensions, GDP growth, and manufacturing statistics.

Domestic Policies

Government spending, infrastructure projects, taxation changes, and corporate regulation also affect business performance and investor confidence.

S&P/ASX 200 Index in 2025: What's the Outlook?

| Timeframe |

Target Range |

Key Drivers |

| Q3–Q4 2025 |

8,400–8,600 |

RBA rate cuts, mining strength, earnings revisions |

| End‑2025 |

~8,500 |

Chinese stimulus, stable commodity prices, dividends |

| Mid‑2026 |

~8,500–8,800 |

Earnings recovery (~11%), global yield tailwinds |

The S&P/ASX 200 surged approximately 10.2% over the 2024‑25 financial year—its strongest year since 2021—despite global geopolitical uncertainties.

From about 7,750 early in FY25, the index climbed to just over 8,540 by June 30. Major contributors included tech, banking, gold miners, and defence stocks, which helped offset pressure on energy and mining sector valuations.

Analysts believe the ASX 200 could continue rising if inflation is managed well and international demand remains robust. Nonetheless, geopolitical uncertainties and fluctuations in interest rates might pose difficulties.

Tips for New Investors

New to the ASX 200? Here are a few steps to get started in 2025:

Start with ETFs: If you lack confidence in selecting individual stocks, select an ETF that tracks the ASX 200 for extensive exposure.

Understand the Sectors: Learn which sectors dominate the index and how they respond to economic events.

Follow Economic Data: Pay attention to RBA decisions, trade balances, and commodity prices.

Use a Regulated Broker: Hand-picked a reputable platform such as EBC Financial Group for dependable market access, risk management tools, and customer help.

Think Long Term: Despite short-term volatility, the ASX 200 has historically rewarded long-term investors.

Conclusion

In conclusion, the S&P/ASX 200 Index remains a key investment vehicle for those tapping into Australia's corporate strength and resource-rich economy. With a diversified portfolio of large-cap companies across banking, mining, healthcare, and consumer goods, it offers both growth and income potential.

While the ASX 200 carries some concentration risks, especially in commodities and finance, it also provides unique exposure compared to other global indices. Whether through ETFs, individual stocks, or derivatives, investors have multiple ways to participate.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.