Investing in the Dow Jones Industrial Average (DJIA) — often simply called "the Dow" — is a popular way to gain exposure to a basket of 30 of America's largest and most established companies. But since the Dow itself is an index (not a tradeable asset), you can't buy it directly. Instead, most investors go through ETFs or index funds that track the Dow.

In this article, we will explain how the Dow is performing now, why you can't buy it directly, and how to invest in it via funds such as ETFs — plus what you should consider when choosing.

Understanding the Dow Jones: The Latest Performance Snapshot

The Current Market State: A Recent Rally

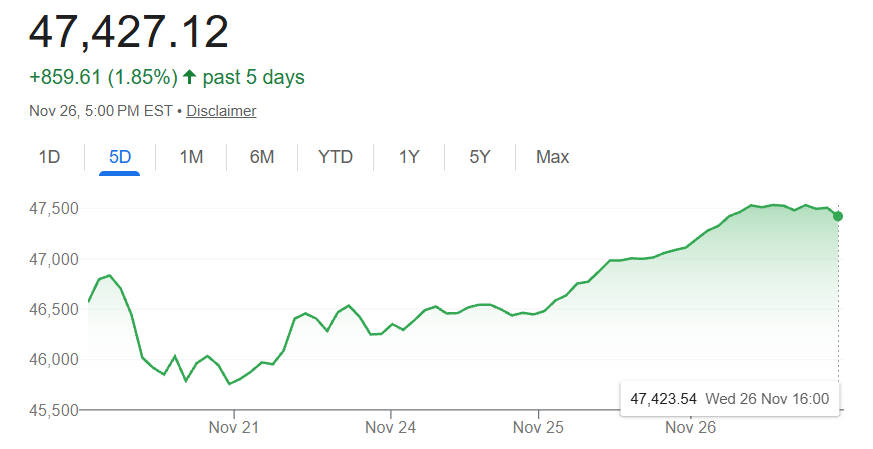

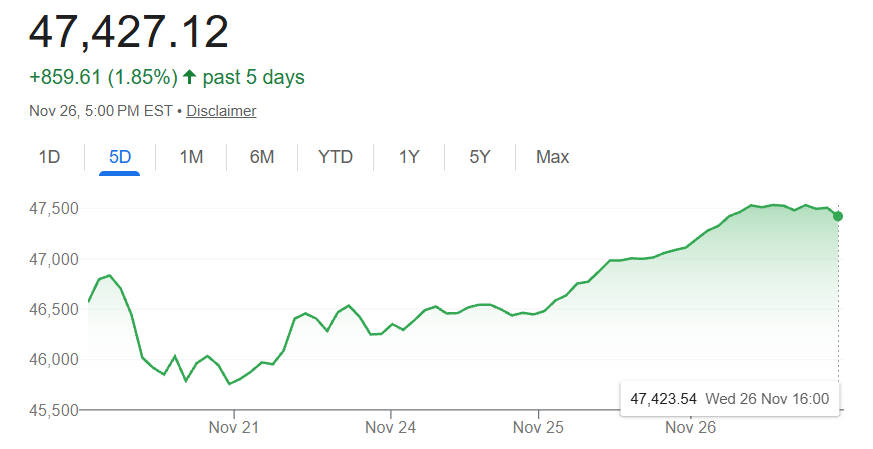

As of late November 2025. the U.S. stock market — including the Dow — has been in rally mode. The rally appears fuelled by growing optimism over a potential interest-rate cut by the Federal Reserve (the Fed), along with strength in big tech and "blue-chip" stocks.

Specifically, on 28 November 2025. the Dow closed strongly, extending a multi-day winning streak as part of a broader holiday-week rally.

Key Performance Metrics (as of 28 November 2025)

Closing Value:

The Dow Jones Industrial Average closed at 47.427.12 on 28 November 2025.

Recent Change:

That day the index gained roughly +314.67 points, representing about +0.67%.

Market Trend:

This rally marks at least a four-day consecutive gain for the Dow before the U.S. Thanksgiving holiday.

Overall, the bullish sentiment seems driven by a combination of strong blue-chip performance and rising expectations for monetary easing.

What Moves the Dow?

The DJIA is a price-weighted index, meaning each of its 30 component stocks contributes to the index in proportion to its share price (rather than market capitalisation).

Thus, high-priced stocks (regardless of their market cap) have a disproportionate impact on the daily movements of the index. The 30 stocks — widely considered U.S. "blue-chip" — include firms from industrials, financials, technology, healthcare and more. This structure means a large move in a high-priced component can sway the entire Dow substantially.

Why You Can't Invest in the DJIA Directly

Index vs. Asset

The Dow is an index — a statistical measure that reflects the aggregate performance of 30 large U.S. companies. It is not an asset that can be bought or sold directly. Instead, it serves as a benchmark or a snapshot of overall market (or blue-chip) performance.

The Cost of Buying All 30 Stocks

In principle, one could attempt to replicate the Dow's performance by manually purchasing shares of all 30 constituent companies. But this approach is often impractical:

You'd need substantial capital to buy meaningful positions across 30 large-cap stocks.

You'd have to regularly rebalance to reflect changes in the index (corporate actions, stock splits, changes in components, etc.).

Transaction costs and administrative burden can quickly erode returns.

The ETF and Index Fund Solution

To address these challenges, ETFs (Exchange-Traded Funds) and mutual funds that track the Dow provide a far more efficient, cost-effective and accessible way for ordinary investors to gain exposure.

These funds replicate the index either by holding the same stocks in the same proportions (or sometimes a reasonable approximation), thus giving you broad exposure with a single investment.

Primary Investment Vehicles for DJIA Exposure

1. Exchange-Traded Funds (ETFs) Tracking the DJI

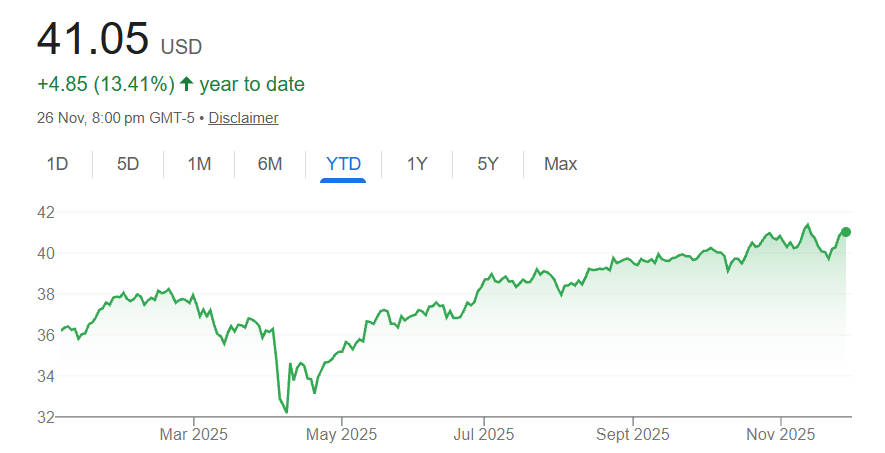

1) SPDR Dow Jones Industrial Average ETF Trust (Ticker: DIA)

This is the "plain-vanilla" and most widely used Dow ETF.

It directly tracks the price-weighted performance of the DJIA by holding the same 30 stocks in the same weightings.

Expense ratio is relatively low (as of recent data) — a key advantage for long-term investors.

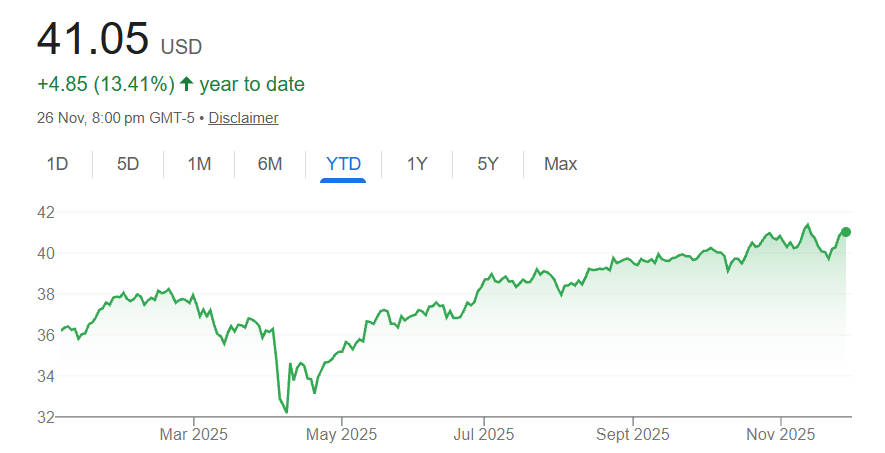

2) Invesco Dow Jones Industrial Average Dividend ETF (Ticker: DJD)

This ETF follows a dividend-focused strategy — often associated with the "Dogs of the Dow" approach, which emphasises high-yielding Dow stocks. (While specific 2025 dividend-yield stats fluctuate, the concept remains: higher income component than simply tracking price.)

For investors seeking income (dividends), DJD provides an alternative to pure price-return.

3) First Trust Dow 30 Equal Weight ETF (Ticker: EDOW)

Rather than replicating the price-weighted methodology, EDOW assigns equal weight to each of the Dow's 30 components.

This style may mitigate the price-weighted "bias" of the DJIA, giving smaller-price but high-quality companies a proportionally larger influence.

As of recent data: expense ratio is higher than DIA (reflecting the equal-weight structure), and dividend yield is modest.

2. Dow Jones Index Mutual Funds

While ETFs are the most common way to track the Dow, there are traditional mutual funds designed to replicate the DJIA (or a Dow-like portfolio). The trade-offs vs ETFs typically are:

Mutual funds price only at end-of-day (no intraday trading).

Minimum investment amounts may be higher.

Potentially less tax-efficient due to capital-gains distributions.

However, for long-term, buy-and-hold investors who prefer simplicity and automatic reinvestment, these can still be viable.

Selecting the Best DJI Fund for Your Portfolio

1. Expense Ratio

For index investing, the annual expense ratio is often the single most important cost factor. Lower fees help ensure that your returns are not eroded over time.

For example, DIA is known for a low expense ratio among Dow ETFs.

2. Tracking Error

This refers to how closely a fund’s performance mirrors the underlying index. A fund with minimal tracking error ensures you get returns close to the DJIA — deviations (positive or negative) are minimised. For a pure tracker like DIA, tracking error tends to be very low. For equal-weight or dividend-focused ETFs (like EDOW or DJD), tracking error vs the DJIA may be higher, but that comes with different risk/reward trade-offs.

3. Trading vs. Investing Style

If you want flexibility, the ability to trade intraday (buy or sell at any time), then ETFs are superior.

If you're a "set it and forget it" investor — contributing regularly, reinvesting dividends, and planning for the long haul — mutual funds may be simpler (though less tax-efficient).

4. Tax Efficiency

ETFs generally offer greater tax-efficiency than mutual funds. Because of their structure, ETFs often avoid capital-gains distributions (unless the fund manager sells holdings), which can reduce taxable events for investors.

Step-by-Step Guide: How to Buy Your First DJI ETF

1.Open a Brokerage Account:

If you don't already have a U.S.-market capable broker, you can open an account with EBC Financial Group. Their platform supports U.S.-listed ETF exposure (via ETF-CFDs), offers global access, and works across various assets, making it convenient for investors outside the United States.

2. Choose Your Ticker:

Decide your goal:

If you want pure Dow exposure and low cost, go for DIA.

If you prefer income, DJD.

If you like equal-weight diversification, EDOW.

3. Place the Order:

Use a market order (immediate execution) or limit order (buy at a set price).

4. Rebalance (Optional):

Periodically review your allocation; if you hold multiple funds or other assets, rebalance to maintain your target allocation. Also consider enrolling in automatic dividend reinvestment (DRIP) if your broker supports it.

Risks and Considerations When Investing in the Dow

1. Concentration Risk

The DJIA includes only 30 companies — all large-cap U.S. names. This gives limited diversification compared to broader indexes (e.g., those including hundreds of companies). If one or several of these firms suffer badly, the index (and your fund) could be disproportionately affected.

2. Price-Weighted Bias

Because the Dow is price-weighted, high-price stocks can dominate its movement — even if their market capitalisation or business size isn't the largest among components. This means the index may over-react to fluctuations in a few expensive stocks, skewing performance in ways that may not reflect the broader economy.

3. Economic or Market Downturns

Like any equity investment, Dow exposure is subject to macroeconomic risks: inflation spikes, interest-rate changes, recessions, geopolitical instability, or industry-specific headwinds (e.g., regulatory, supply chain, technological disruption). A downturn could lead to significant volatility in Dow-linked funds.

Conclusion: The Long-Term Outlook for Dow Jones Investing

The Dow Jones Industrial Average remains one of the most recognised barometers of U.S. market health — a stable collection of major, blue-chip companies across sectors.

By using ETFs or index funds such as DIA, DJD, or EDOW, individual investors can efficiently tap into the long-term growth potential of the Dow, without the complexity of managing 30 separate stock positions.

For many investors, a dollar-cost averaging strategy combined with a long-term holding horizon, can smooth out volatility and harness the well-established track record of U.S. large-cap equities.

If you prioritise low cost, tax efficiency, and flexibility, an ETF like DIA is hard to beat. If you favour income or want to avoid price-weight bias, alternatives like DJD or EDOW can also make sense.

Frequently Asked Questions

1. Can I invest directly in the Dow Jones Industrial Average?

No, the DJIA is a market index rather than a tradeable asset. Investors cannot buy it directly, but can access its performance through ETFs, index funds, or ETF-CFDs offered by regulated brokers.

2. What's the easiest way to invest in the DJIA as a beginner?

The simplest option is buying a DJIA-tracking ETF such as DIA through a reputable broker. ETFs provide diversified exposure, low fees, straightforward trading mechanics, and require far less capital than manually purchasing all 30 component stocks.

3. How does a DJIA ETF like DIA work?

A DJIA ETF replicates the index by holding the same 30 blue-chip companies in the same price-weighted structure. Its performance closely mirrors the Dow's movements, making it a convenient and cost-efficient investment vehicle.

4. What are the main risks of investing in the Dow Jones?

Risks include concentration in only 30 large-cap companies, the index's price-weighted bias, and potential volatility during economic downturns. High-priced components can overly influence movements, and sector exposure may be less diversified than broader indices.

5. Is EBC Financial Group a good option for trading DJIA-related products?

EBC Financial Group is a strong option for global investors, offering fast execution, multi-jurisdiction regulation, and access to U.S.-listed ETF CFDs. However, CFD trading carries leverage risks and may differ from owning ETFs directly.

6. Should I choose an ETF or an index mutual fund?

ETFs suit investors seeking low costs, higher tax efficiency, and intraday trading flexibility. Index mutual funds offer simplicity, automatic investment plans, and end-of-day pricing, making them more suitable for long-term, passive strategies.

7. How much money do I need to start investing in the Dow?

Entry requirements depend on your broker. With ETF investing, you can start by purchasing a single share or fractional share if available. CFD accounts may require specific minimum deposits, depending on the broker's account structure.

8. Is long-term investing in the DJIA still worthwhile?

Historically, the DJIA has demonstrated steady growth driven by strong blue-chip companies. Long-term investing remains appealing for stability, dividends, and resilience. Using ETFs and dollar-cost averaging can help smooth volatility over time.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.