If you've seen headlines like "CAC 40 rises after banks rally" and wondered which country's stock market that is, you're not alone.

The CAC is the leading stock-market index in France, and it holds significance for global investors, including those seeking opportunities in European blue-chip companies.

This guide explains what the CAC Index is, how it's built and calculated, the factors influencing it in 2025, and actionable methods for traders to gain exposure.

What Is the CAC Index and Which Country Represents It?

The CAC 40 (often shortened to "CAC"), which translates roughly as "continuous assisted quotation", was introduced in 1987 with a base value of 1,000.

It has evolved into a free-float market-capitalisation weighted index, emerging as the primary benchmark index for French stocks listed on Euronext Paris.

Today, it measures the performance of top French companies across the luxury goods, energy, finance, aerospace, and pharmaceuticals sectors.

For example:

Luxury & Consumer Goods: LVMH and L'Oréal often rank among the largest constituents; these companies drive performance when global consumer demand is strong.

Energy & Utilities: Major energy companies (e.g., TotalEnergies) add cyclical exposure.

Banking & Financials: BNP Paribas, Société Générale, and Crédit Agricole bring sensitivity to interest-rate and credit cycles.

Aerospace & Industrials: Airbus and major industrial groups reflect European manufacturing strength.

Healthcare & Pharma: Sanofi and other biotech/pharma firms provide defensive balance.

Additionally, because many CAC firms are multinational, the index also serves as a proxy for broader European and global corporate trends. Think of it as the French equivalent of India's Nifty 50 or the U.S. S&P 500 (but focused on 40 major French firms). [1]

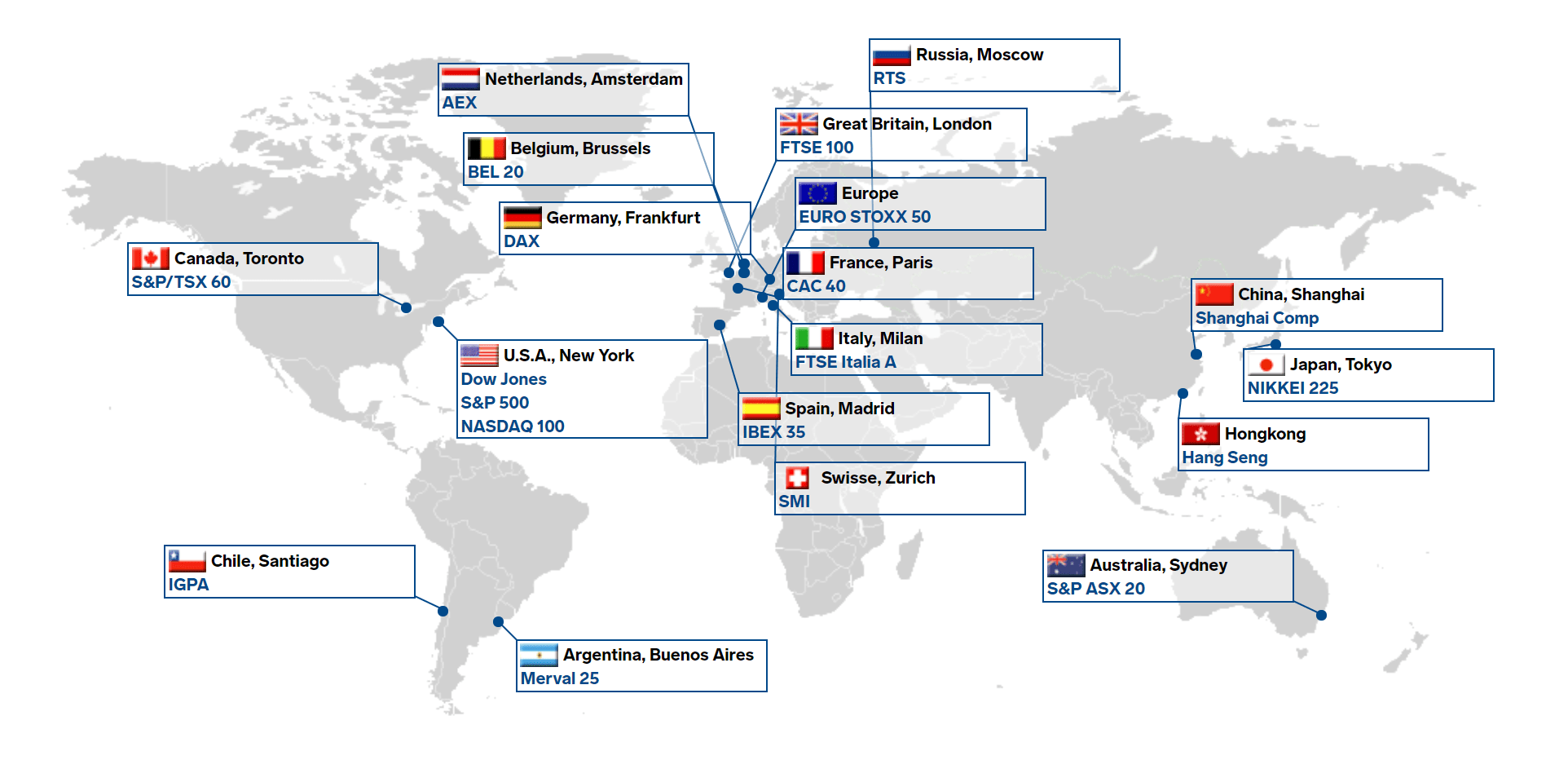

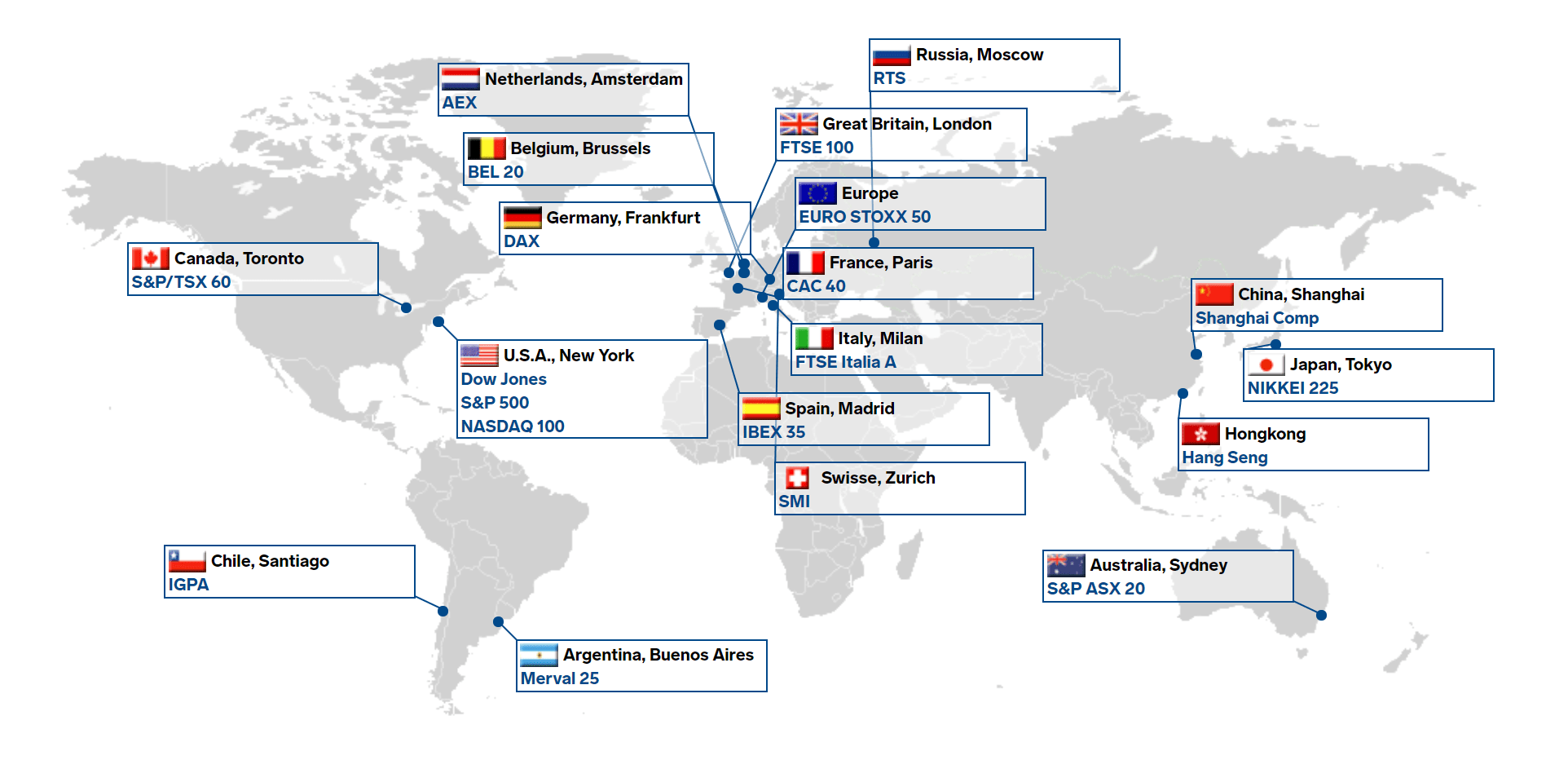

How the CAC Compares With Other Major Indices (Nifty, S&P 500, DAX)?

1) Nifty 50

Nifty is India-centric with heavyweights in IT, financials, and energy. CAC is concentrated in consumer luxury, energy, industrials and banks, a different exposure that complements an India portfolio.

2) S&P 500

S&P has broader tech exposure and more US-centric growth firms. CAC gives more European cyclical and value exposure.

3) DAX (Germany)

DAX includes heavy industrial and auto names; CAC arguably has stronger representation in luxury and consumer brands.

How Is the CAC Index Constructed and Calculated?

As mentioned above, the CAC 40 is a free-float adjusted, market-cap weighted index:

Free-float adjustment means only shares available to public investors count toward weighting.

Market-cap weighting means larger companies (by market value of available shares) have more influence on index moves than smaller ones.

Periodic review: the index composition is reviewed regularly (typically quarterly) to add new leaders and remove companies that no longer meet liquidity or size thresholds.

This design ensures that the CAC represents the genuine, tradable French market rather than abstract or illiquid capital.

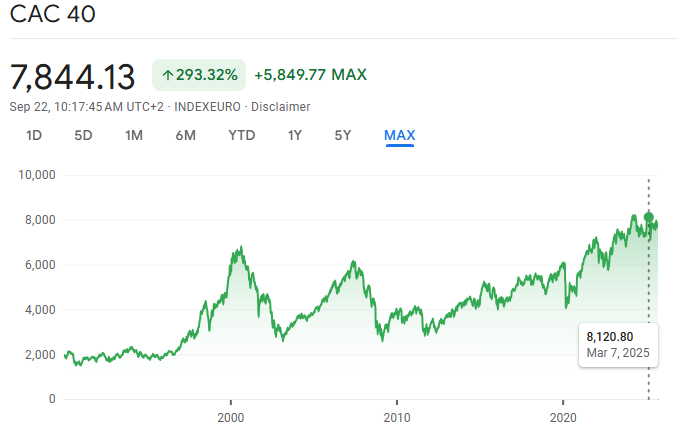

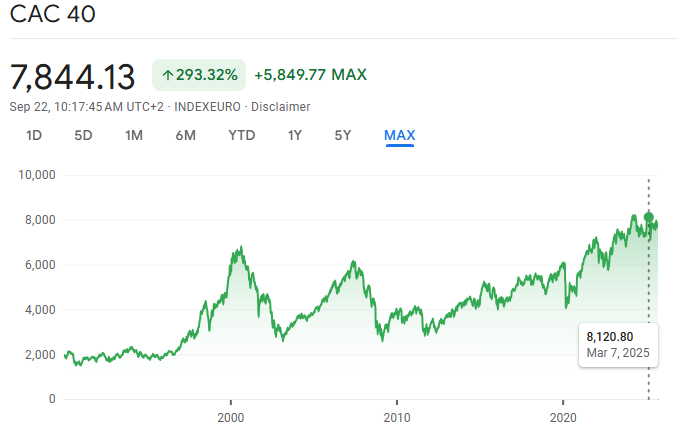

How Has the CAC 40 Performed in 2025?

As of September 2025, the CAC 40 has been trading in the ~7,700–7,900 range and recently pushed toward the high 7,800s on bouts of optimism about central bank policy and corporate earnings.

European markets, especially the CAC, have reacted to interest rate forecasts, geopolitical events, and significant corporate announcements. Recent reporting highlights both short-term rallies and the usual seasonal pressure in September.

Why the CAC Matters to Investors?

You may ask: "Why should I, based in other continents, care about a French index?" Here are key reasons:

Global diversification: holding assets tied to the CAC adds exposure to European growth cycles, currencies (EUR), and industries that are under-represented in domestic markets, such as luxury brands and aerospace.

Blue-chip multinational exposure: Investing in the CAC gives access to global consumer demand, not just domestic French consumption.

Portfolio risk management: when domestic or U.S. markets are weak, European stocks may perform differently, which can reduce overall portfolio volatility.

International diversification is a commonly recommended way to smooth returns and capture growth beyond the domestic economy.

How Can Investors Gain Exposure to the CAC 40 Index?

You don't need to open a Paris trading account to invest in the CAC. Here are practical routes many Indian investors use:

1. ETFs That Track the CAC Index

Several UCITS ETFs track the CAC 40 total return index (Amundi and Lyxor are notable providers). These ETFs are listed on European exchanges and can be bought through international brokerage accounts.

Examples include the Amundi CAC 40 UCITS ETF and Lyxor CAC 40 UCITS ETF. They replicate the index and usually have modest expense ratios around 0.20–0.30%.

2. International Brokerages

Many investors use brokers such as EBC Financial Group that offer access to foreign exchanges. If you have an account with a broker that provides global equities/ETF/CFD trading, you can buy index CFDs directly.

Dividends, Sector Bias and What to Watch in 2025

In 2025, watch for:

1) Earnings Season:

Results from major CAC companies (LVMH, L'Oréal, TotalEnergies, BNP Paribas) can influence the index. Recent coverage by Reuters suggests that L'Oréal and banking news are affecting sentiment. [2]

2) Interest-Rate Expectations:

Cues from the European Central Bank and signals from the U.S. Fed influence capital movements toward or away from equities.

3) Geopolitical and Commodity Shocks:

Energy firms adjust to fluctuations in oil prices, while industrial sectors respond to trade dynamics.

4) Seasonality:

September is historically weaker for European markets. Thus, keep that in mind for timing. [3]

Risks to Remember Before Investing in a Foreign Index

1. Currency risk: returns in INR depend on both the index movement and EUR/INR fluctuations.

2. Regulatory & tax risk: different jurisdictions mean different tax and reporting rules. Always check the tax treatment of dividends and capital gains.

3. Concentration risk: the CAC's top names can dominate performance; a handful of large companies can move the index.

4. Liquidity & fees: depending on route (ETF share class and domicile), trading costs and spreads vary.

Frequently Asked Questions

1. Which Country Does the CAC Index Represent?

The CAC 40 Index is the benchmark stock market index of France, tracking the performance of 40 of the largest and most liquid companies listed on the Euronext Paris.

2. Is the CAC 40 Only About France's Economy?

Not entirely. While it is France's benchmark, many CAC companies are multinational firms earning most of their revenues abroad. For example, LVMH and Airbus derive a large share from global markets.

3. How Is the CAC 40 Performing in 2025?

As of September 2025, the CAC 40 trades around 7,700–7,900 points, near its record highs, supported by strong earnings from luxury, banking, and energy companies.

4. Can Investors Invest in the CAC Index?

Yes. Investors can access the CAC through international brokerages or ETFs such as Amundi CAC 40 UCITS ETF and Lyxor CAC 40 UCITS ETF.

Conclusion

In conclusion, the CAC 40 index is an established, liquid benchmark for French and broader European corporate performance.

For investors seeking diversification, exposure to global consumer luxury brands, and a play on European cyclical and financial sectors, the CAC offers a concise package.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://companiesmarketcap.com/cac-40/largest-companies-by-market-cap/

[2] https://www.reuters.com/business/finance/european-shares-end-higher-amid-all-eyes-french-no-confidence-vote-2025-09-08/

[3] https://www.euronews.com/business/2025/09/05/why-september-tends-to-spook-european-equity-markets