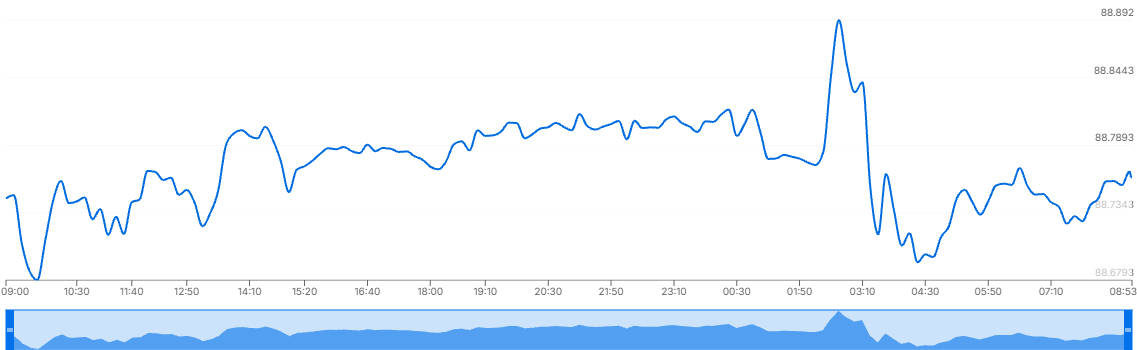

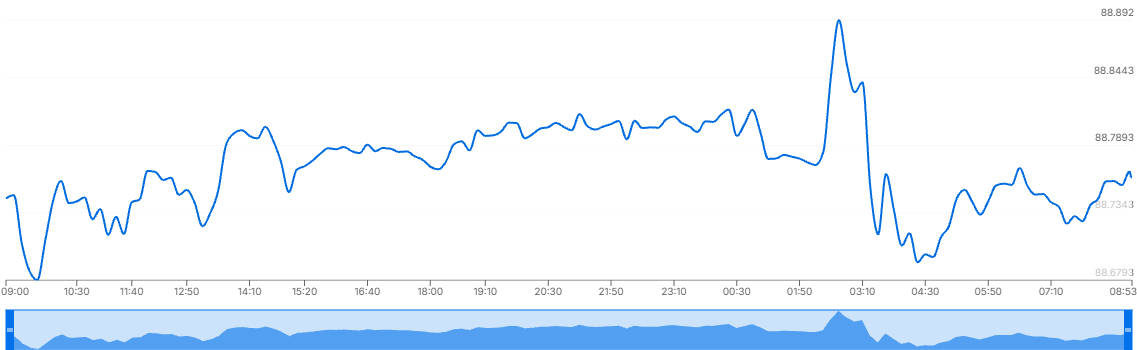

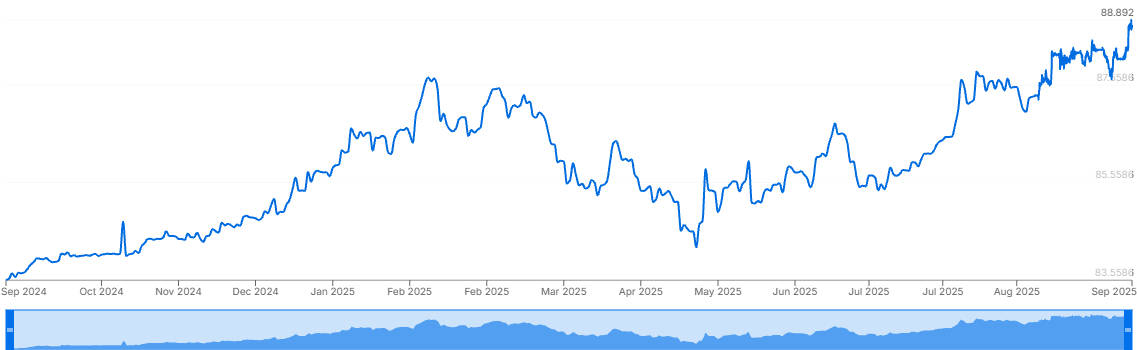

As of late September 2025. the Indian rupee has tumbled to fresh all-time lows against the U.S. dollar, with the USD/INR rate pushing past ₹88.79 at intraday extremes before settling around ₹88.7550.

The depreciation reflects mounting pressures from multiple fronts — U.S. trade policy, surging visa costs, capital flight, and shifting global risk sentiment.

Given the rupee's centrality to India's trade, inflation and external stability, this slide merits close attention.

Why the Rupee Is Weak Even as the Dollar Index Pulls Back

The Indian rupee is under pressure despite the recent retreat in the U.S. dollar index, largely because its weakness is being driven by India-specific shocks — steep U.S. visa fee hikes, new tariffs, seasonal import demand, and persistent capital outflows.

While the dollar has softened globally, these domestic and bilateral challenges are weighing disproportionately on the rupee.

This contrast highlights how currency performance often depends not just on global dollar trends but also on country-level fundamentals and policy shocks.

In this article, we will examine the rupee's latest record lows, break down the key drivers behind USD/INR's divergence from the dollar index, and explore what this means for trade, markets and policy in the months ahead.

The Latest Moves & Key Statistical Milestones

1) Record low levels:

On 23 September 2025. the rupee hit ₹88.7975 per dollar before ending the day near ₹88.7550.

2) Daily decline:

That drop was about 0.5 %, the steepest one-day fall in nearly a month.

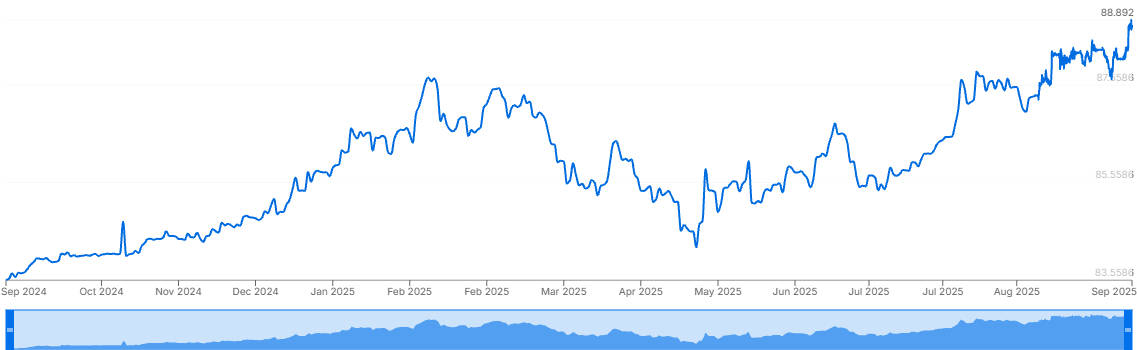

3) YTD depreciation:

Over the year, the rupee has weakened more than 3.5 %, making it one of the worst performers among major Asian currencies.

4) Subdued volatility:

Paradoxically, implied volatility in the rupee options market has remained muted — three-month implied volatility is at six-month lows, while one-year implied volatility is at its year-to-date bottom.

5) Options market behaviour:

Corporate hedging volumes have surged — between January and August 2025. the notional value of dollar/rupee options rose ~70 % to about USD 73 billion (compared with the same period in 2024).

These figures point to a currency under sustained pressure, yet not triggering panic in volatility markets — a telling sign of how structural hedging and central bank tactics are altering market dynamics.

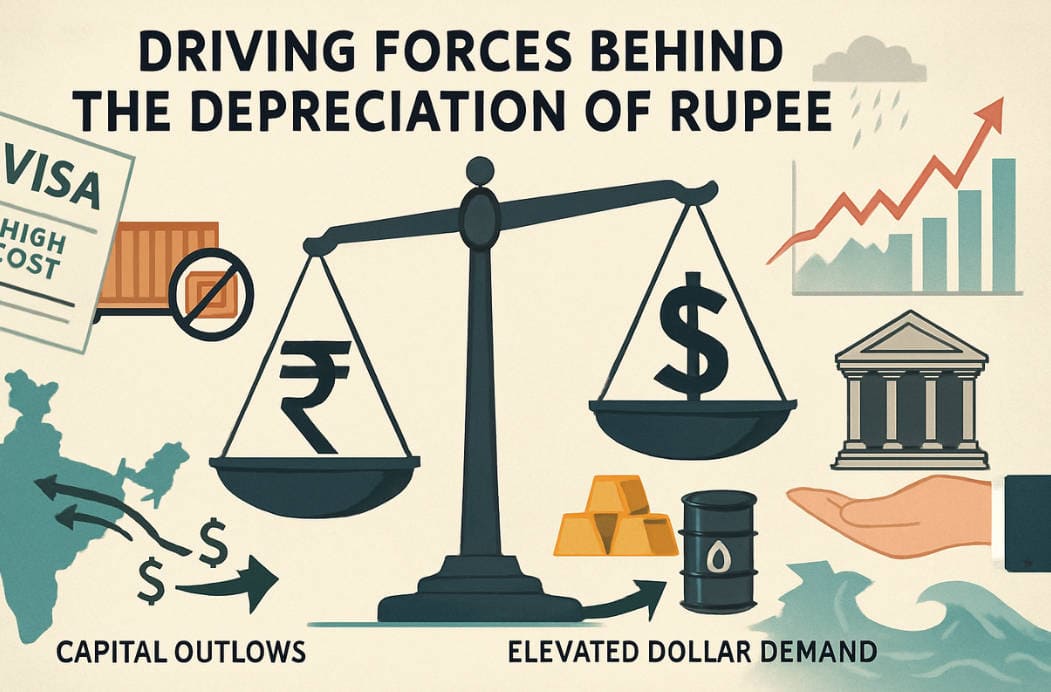

Driving Forces Behind the Depreciation

A. U.S. Policy Shocks: Visa Costs & Tariffs

a) H-1B visa fee hike:

The United States has introduced a sharply increased visa cost (reportedly USD 100.000 for certain applications), triggering fears that fewer Indian professionals will deploy to the U.S.

b) Impact on IT exports and remittances:

Indian IT firms rely heavily on U.S. contracts, and curtailment of assignment mobility could depress growth. HSBC estimates that remittances from Indians in the U.S. total about USD 33 billion annually; if new visa policies deter travel, remittance inflows could shrink by approximately USD 500 million.

c) Steep U.S. tariffs: The United States has imposed 50 % tariffs on selected Indian goods — among the harshest in Asia — exerting stress on India's export competitiveness.

B. Capital Outflows and Portfolio Tilting

a) Foreign institutional investor (FII) outflows:

The rupee is feeling pressure from sustained foreign selling of equities and bonds.

b) Reduced sentiments:

The combination of trade policy uncertainty and global risk aversion is making international investors cautious about Indian assets.

C. Elevated Dollar Demand & Seasonal Impulses

a) Gold import surge:

Ahead of festivals like Diwali, Indian jewellers and traders have frontloaded gold imports, sharply increasing demand for U.S. dollars. Reuters notes that dollar demand from gold imports has nearly tripled in some stretches.

b) Other import bills:

India remains a net importer of oil and many raw materials — as the rupee weakens, import costs rise, further feeding demand for dollars.

D. Central Bank Strategy & Forward Market Dynamics

a) RBI / central bank intervention:

The Reserve Bank of India is believed to have sold dollars in both onshore spot and non-deliverable forward (NDF) markets to limit disorderly movement.

b) Widened trading band / controlled depreciation:

Rather than defending a specific level, the RBI appears comfortable allowing a gradual rupee depreciation, intervening only to smooth sharp swings.

c) Forward positioning & hedging:

As corporates hedge aggressively, forward markets absorb more of the volatility pressure, shifting some stress away from spot.

E. Global Monetary Trends & Risk Aversion

a) Dollar strength & Fed dynamics:

A rebound in U.S. Treasury yields and cautious signals from the Federal Reserve have bolstered the dollar broadly, reducing headroom for emerging currencies.

b) Global risk-off sentiment: Markets are jittery about external shocks, and capital tends to flow toward safe havens — working against vulnerable emerging market currencies like the rupee.

Market Sentiment & Derivatives Signals

Despite the rupee's slide to historical lows, the options market has remained unusually calm. Volatility remains subdued, possibly because:

1) Corporate hedging dominance:

Many Indian firms are actively hedging dollar exposures, effectively supplying volatility to banks and stabilising implied volatility levels.

2) Lack of aggressive bets offshore:

Institutional speculators overseas appear reluctant to place large directional bets on further rupee weakness, likely mindful of central bank interventions and past sharp reversals.

3) Central bank credibility & smoothing:

With the RBI intervening in forward markets and signalling a preference for orderly moves, traders may feel less need to "price in" high volatility.

On charts, key technical watchers will be observing support zones around ₹88.40–₹88.50 and resistance near ₹89.00. Breach of either side could trigger further momentum.

Possible Trajectories: Forecast & Scenarios

Base Case: Gradual Depreciation

The rupee may continue a slow slide, perhaps inching toward ₹89.00–₹89.50. unless new policy relief or capital inflows emerge. The RBI is likely to keep intervening tactically to avoid disorder.

Bear Case: Sharp Weakening

If U.S. policy shocks intensify (more tariffs, further visa clampdowns), or if global risk sentiment sours sharply, the rupee could weaken more rapidly toward ₹90.00 or beyond.

Bull Case: Partial Recovery

A negotiated de-escalation (e.g. tariff rollback, visa reforms), combined with a return of foreign capital and stronger remittances, could arrest the decline and push the rupee upward toward ₹88.00 or better.

Buffers to watch:

India's foreign exchange reserves, which give some breathing room

Current account status (if trade balance improves)

Foreign debt servicing requirements

Broader Implications for India

A. Trade & Export Dynamics

A weaker rupee gives Indian exporters more pricing advantage abroad, but rising input costs (for imported raw materials) can erode margins.

B. Remittances & Inward Flows

While a weaker rupee boosts remittance value in rupee terms, decline in remittances due to visa restrictions could offset the gain.

C. Inflation, Debt & Borrowing Costs

Depreciation adds pressure to inflation via higher import costs (particularly oil). For entities with foreign currency liabilities, debt servicing burdens will rise.

D. Sectoral Impact

IT & services: Heavily exposed to U.S. demand and visa mobility

Import-intensive sectors: More vulnerable to cost escalation

Consumer inflation exposure: Electronics, fuel, raw materials

Policy Responses & Risks to Monitor

RBI strategy shifts: More aggressive intervention if rupee volatility threatens market stability

Monetary/fiscal alignment: Steps to mitigate imported inflation

U.S. trade & immigration developments: Tariff reforms, visa regulation changes

Global shocks: Oil prices, macro slowdowns, geopolitical events

Conclusion

The Indian rupee is navigating a storm of external pressures. Steep U.S. tariffs, visa policy shifts, capital outflows and global volatility are combining to push USD/INR toward uncharted levels.

While the RBI is playing a delicate balancing act, the currency is unlikely to stabilise fully unless some of the underlying policy headwinds ease.

Going forward, key indicators to watch include FII flow data, remittance trends, India–U.S. negotiations, and U.S. rate / yield dynamics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.