Investing involves uncertainty; we rarely know what the economy will look like next month, let alone next year. That uncertainty is what motivated Ray Dalio, founder of Bridgewater Associates, to design a portfolio meant to "weather" all economic conditions.

To clear up any misunderstandings, Ray Dalio doesn't really sell "stock tips". What he sells is a way of looking at risk so you don't blow yourself up when the world changes on you. The All Weather portfolio and risk-parity framework sit right at the centre of that, and in a 2025 world of high debt, expensive equities, and $4,000+ gold, they're back in the spotlight.

If you strip away the mystique, Ray Dalio's strategy boils down to a few simple ideas: balance risk across economic environments, build 10–15 uncorrelated streams of return, and accept you don't know the future. The rest is just an implementation detail.

What Problem Was Ray Dalio Trying to Solve?

Ray Dalio founded Bridgewater Associates in 1975 and turned it into one of the world's biggest hedge funds, known for its macro research and systematic strategies.

By the early 1990s, he was looking for a way to make money for his family that didn't depend on calling the next recession or bull market. That led to:

All Weather: A portfolio designed to hold up across different "economic seasons".

Risk Parity: An approach that balances risk across asset classes instead of just splitting capital.

Traditional 60/40 portfolios are dominated by equity risk: roughly 90% of the volatility comes from stocks, even though only 60% of the capital is in equities. Dalio's view: that's not diversification, that's equity with a bond sidecar.

What Are the Core Ideas Behind the Ray Dalio Strategy?

1) Four Economic "Seasons"

Dalio starts from a basic macro grid:

That gives four regimes:

Rising growth, low/stable inflation (classic boom)

Falling growth, low inflation (recession/deflation scare)

Rising inflation, decent growth (overheating/reflation)

Falling growth, high inflation (stagflation)

No single asset does well in all four. The idea of All Weather is to own a mix that has something working in each box, such as growth assets, deflation hedges, and inflation hedges.

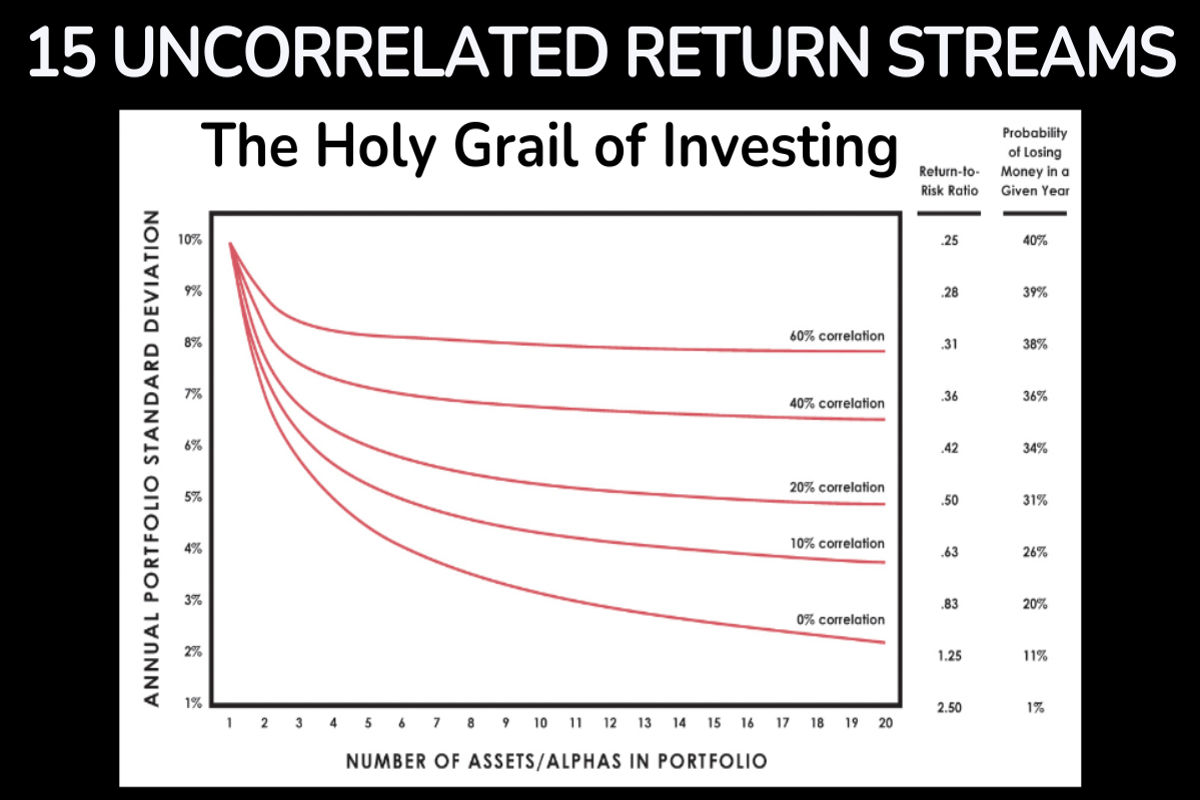

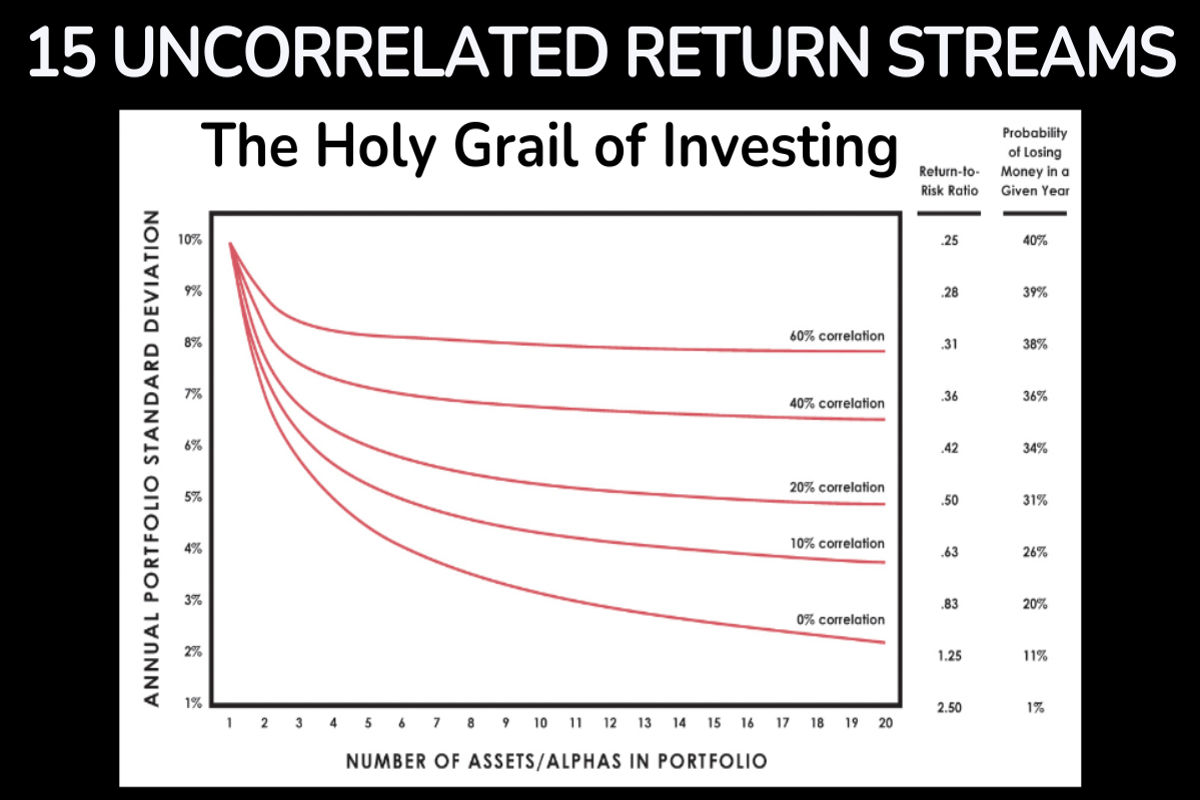

2) The "Holy Grail": 10–15 Uncorrelated Return Streams

Dalio's other big pillar is the so-called "Holy Grail of investing":

"My mantra of investing is 15 good uncorrelated return streams, risk-balanced… I can keep the same return as any one of those investments with up to an 80% reduction in risk."

The logic is straightforward:

If you combine 10–15 reasonably uncorrelated return streams, and you balance their risk, you achieve returns close to the average, while experiencing significantly reduced volatility and smaller drawdowns.

For him, the All Weather or risk-parity strategy embodies this concept by diversifying across major macro betas, including stocks, bonds, inflation hedges, and commodities.

What Is The Classic All-Weather Portfolio?

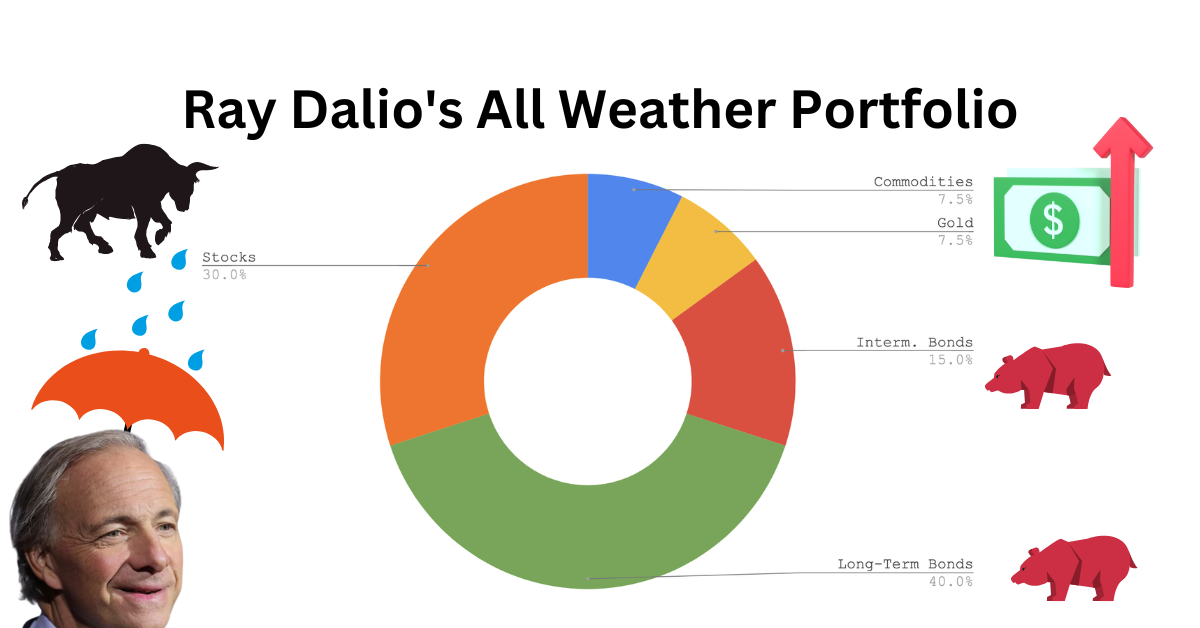

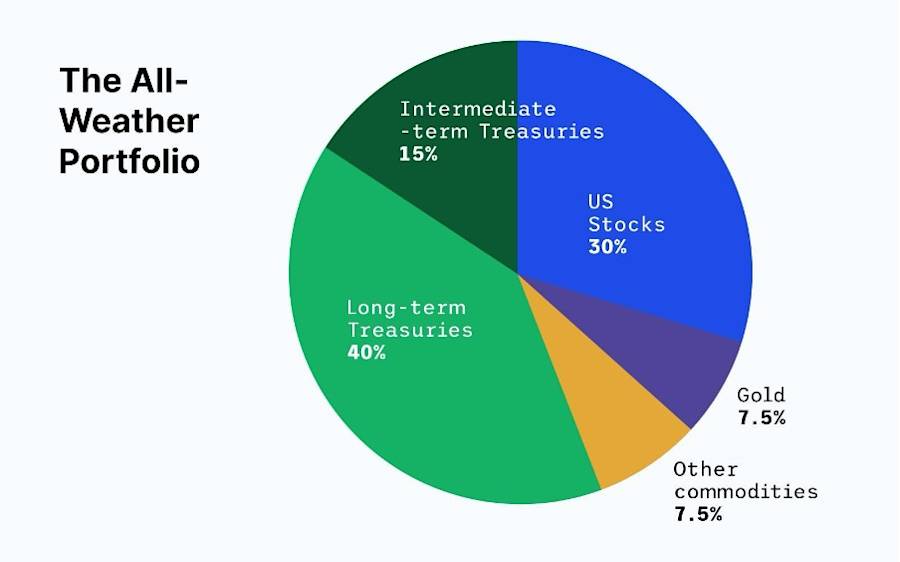

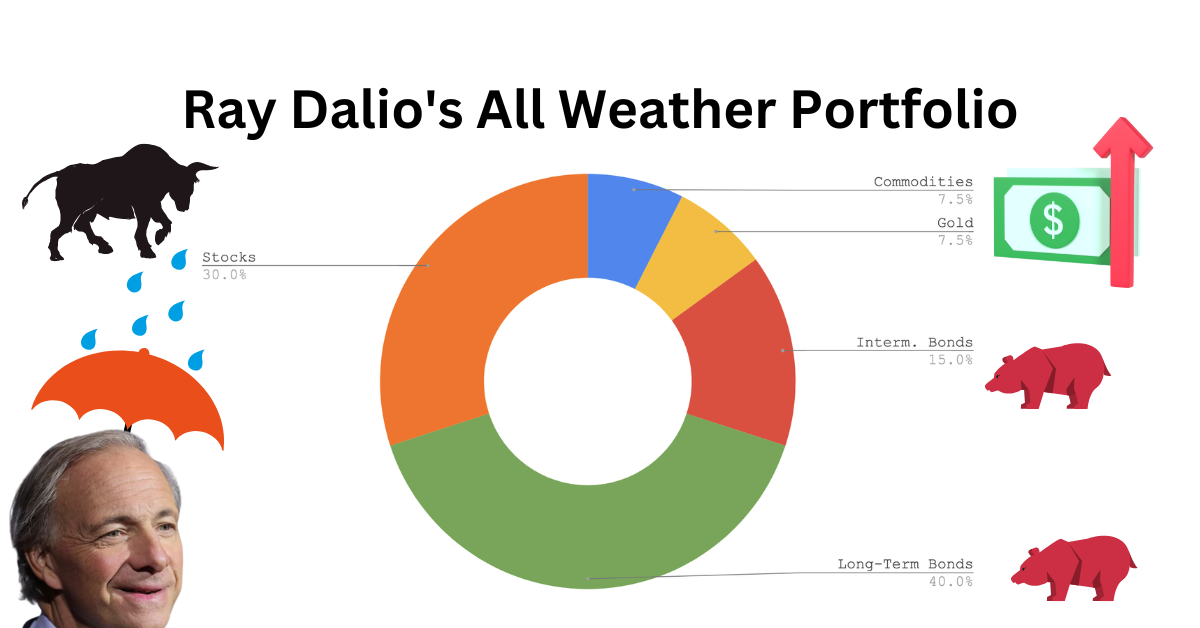

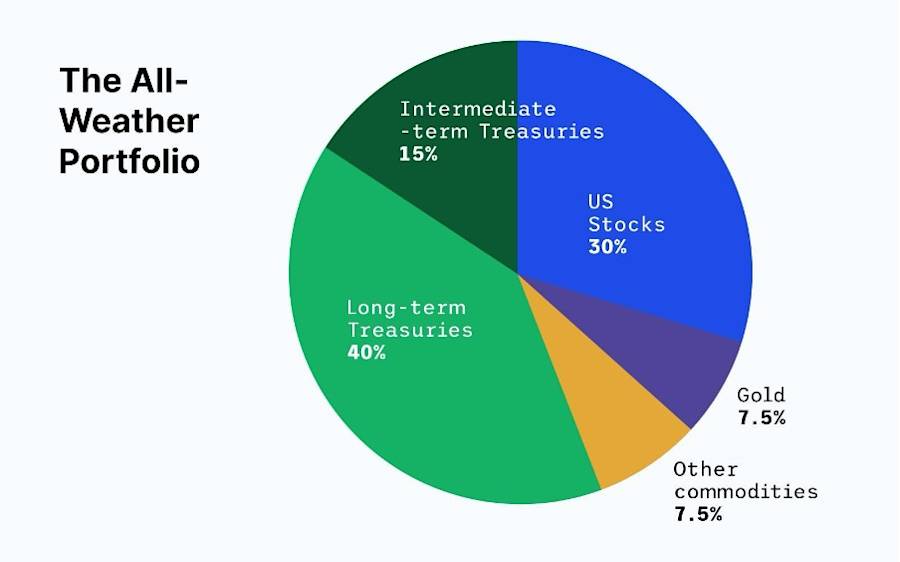

Bridgewater has never published an official retail recipe, but multiple sources and interviews converge on a widely used approximation:

This isn't random:

Bonds carry significant weight due to their lower volatility compared to stocks. In a risk parity framework, a higher notional exposure to low-volatility assets is required to balance their risk contribution.

Gold and commodities hedge inflation spikes and currency debasement, which Dalio worries about even more in the mid-2020s.

Equities are typically limited to around 30% of the portfolio, ensuring that the portfolio is not overly dependent on a single asset class.

Backtests show this mix historically delivered lower drawdowns than a 60/40 portfolio, at the cost of giving up some upside in roaring equity bulls.

How Each Bucket Fits Dalio's "Economic Seasons"

Equities (30%): Win in rising growth, subdued inflation. They suffer in recessions and hard inflation shocks.

Long-term bonds (40%): Excels in environments of declining growth and inflation, when bond yields decrease. They're the big losers in rapid rate shocks like 2022.

Intermediate bonds (15%): Reduce the portfolio's sensitivity to big rate moves, smoothing the ride.

Gold (7.5%): Historically does well in crises and debasement periods; Dalio sees it as protection against "a heart-attack-risk" U.S. financial system overloaded with debt.

Commodities (7.5%): Benefit when inflation runs hot and real assets reprice upward.

Put simply: you're never all-in on a single macro story.

What Is Risk Parity and How Does It Fit In?

Risk parity is a way of building portfolios so that each asset class contributes roughly the same amount of risk, usually measured by volatility, instead of allocating 60% to stocks and 40% to bonds and calling it "balanced".

In practice, that means:

Bridgewater's flagship All Weather Fund, launched in the mid-1990s, is the archetype of institutional risk parity.

60/40 vs Risk Parity?

Conceptually, the difference looks like this:

| Feature |

Classic 60/40 portfolio |

Risk-parity / All Weather style |

| Capital allocation |

60% stocks, 40% bonds (typical) |

30% stocks, ~55% bonds, ~15% inflation hedges |

| Risk concentration |

~90% of risk from equities |

Risk more evenly spread across assets |

| Use of leverage |

Usually low / none |

Often uses leverage to scale low-vol assets |

| Main vulnerability |

Equity bear markets |

Sharp, correlated sell-offs in stocks and bonds (e.g. 2022) |

| Objective |

Outperform stocks with some cushioning |

Smoother, "all-weather" return with smaller drawdowns |

Studies of hedge fund strategies indicate that high fees and leverage tend to erode realised returns compared to a low-cost 60/40 index portfolio over extended periods, particularly when the bond bull market wanes.

But the underlying risk-balancing logic, don't let one asset class dominate your risk budget, is sound.

How Dalio Is Updating the Message in Modern Trading?

Dalio is no longer overseeing Bridgewater daily, but he remains highly engaged in public discourse, and his latest remarks align perfectly with the All Weather approach.

1) "15 Uncorrelated Return Streams, Risk-Balanced"

In 2024–2025 interviews and posts, he keeps repeating the same mantra:

"5 good uncorrelated return streams, risk balanced… I won't lower my return, but I can lower my risk by up to 80%."

That's his shorthand for:

Stop betting the farm on any single theme (U.S. tech, long bonds, one country).

Build many different moderate bets whose risks don't move in lockstep.

Risk-balance them (All Weather style), instead of simply equal dollar weights.

2) Gold: Now Explicitly 10–15% of the Portfolio

In 2025, he's sharpened his guidance on gold to something very concrete:

Consistently recommends a 10–15% allocation to gold, or a combination of gold and some bitcoin, as a hedge against debt-driven fiat currency devaluation.

U.S. markets are at risk of a "heart attack" because of swelling debt and rising interest costs that "clog the system like plaque".

Highlights that gold carries no counterparty risk and has historically preserved value during periods of inflation and financial crises.

This is basically a more explicit version of the All Weather idea: hard assets as a hedge against monetary and fiscal excess.

3) Scepticism on Treasuries and "Pure Equity" Bets

Recently, he's also:

Warned that long-only Treasuries are less of a "safe haven" when governments are forced to print to fund debt.

Described speculative stock-picking as a kind of zero-sum game at this stage of the cycle, urging investors to avoid chasing hot names and instead hold more inflation-protected government bonds and diversifiers.

Again, that lines up with a risk-parity / All Weather tilt to real assets and inflation-linked bonds, rather than relying purely on nominal bonds and U.S. equities.

4) The Wew All Weather ETF (ALLW)

In March 2025, State Street and Bridgewater launched the SPDR Bridgewater All Weather ETF (ticker: ALLW), which pushes Dalio's institutional ideas into a listed product:

Current approximate exposure:

And it uses about 1.8x leverage via futures, so each $1 in the fund gives almost $2 of market exposure. The cost is around 0.85% annually, greater than standard index ETFs but notably less than hedge funds.

Bridgewater's strategy signals continued conviction in the core All Weather/risk-parity framework, with adjustments emphasising greater inflation protection over pure nominal duration exposure.

Is the Ray Dalio Strategy Suitable for You?

It makes sense for people who:

Care more about avoiding big drawdowns than beating the S&P every year.

Believe we're in a more volatile macro regime (debt, geopolitics, inflation all at once).

Are comfortable with a portfolio that can lag in roaring equity bull markets but holds up better in stress.

It is less suitable for people who:

Want to maximise long-run equity upside and don't mind big swings.

Can't or don't want to hold commodities, gold, or foreign bonds for regulatory/tax reasons.

Are trading hyper-actively; All Weather is meant as a strategic, long-horizon core, not a short-term trade.

Frequently Asked Questions

1. What Is Ray Dalio's All-Weather Portfolio?

A diversified mix of stocks, long and intermediate bonds, gold and commodities, aiming for smoother returns "in any weather".

2. Didn't Risk Parity Underperform Recently?

Yes. Risk-parity funds had a tough time in 2022, when both stocks and bonds sold off together, and bond yields surged from very low levels.

3. Is the Ray Dalio Strategy Guaranteed to Protect Me in a Crash?

No portfolio is bulletproof. All Weather and risk parity are designed to reduce drawdowns and smooth returns, not to eliminate risk.

Conclusion

In conclusion, the Ray Dalio strategy is less about a magic 30/40/15/7.5/7.5 recipe and more about how you think about risk.

Assume you don't know the future. Spread your bets across very different economic outcomes. Make sure no single asset or story can sink you. Balance the risk, not just the capital.

In a world of soaring U.S. debt, record-high gold prices, and the traditional 60/40 strategy disrupted by rate shocks, that mindset is arguably more relevant than ever.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.