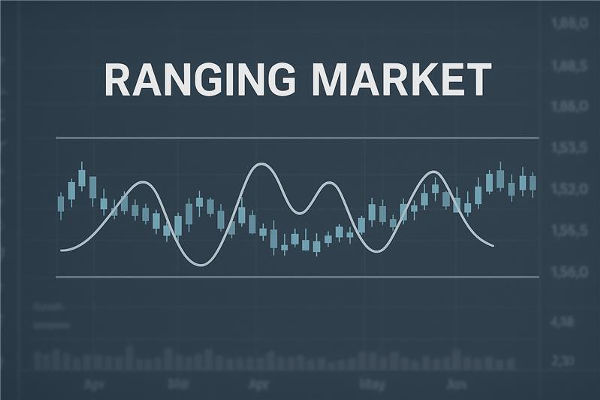

Most traders chase trends, hoping for big moves. Yet markets spend more time moving sideways than trending. A range-bound market occurs when price oscillates between a support floor and a resistance ceiling. While these periods may seem slow, they offer predictable and repeatable opportunities for disciplined traders.

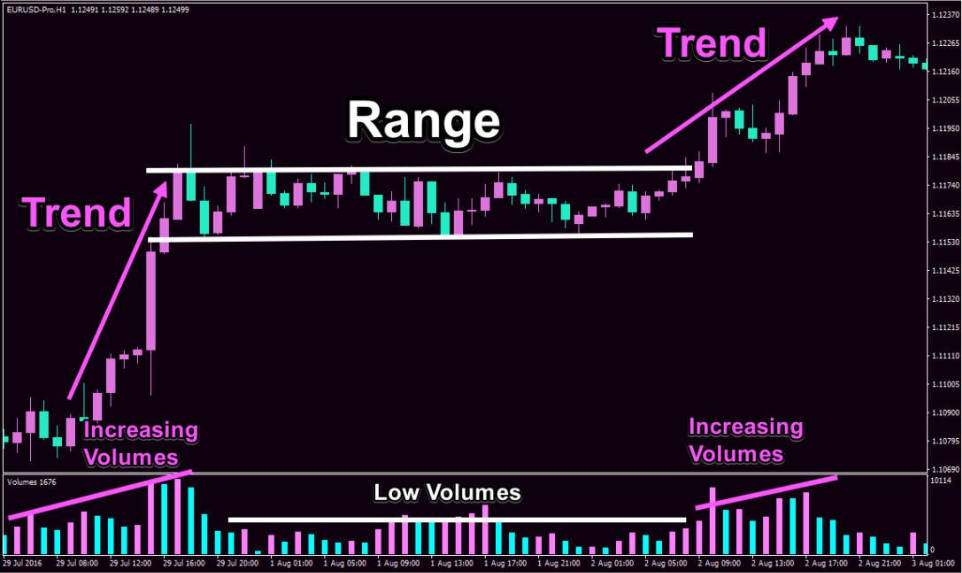

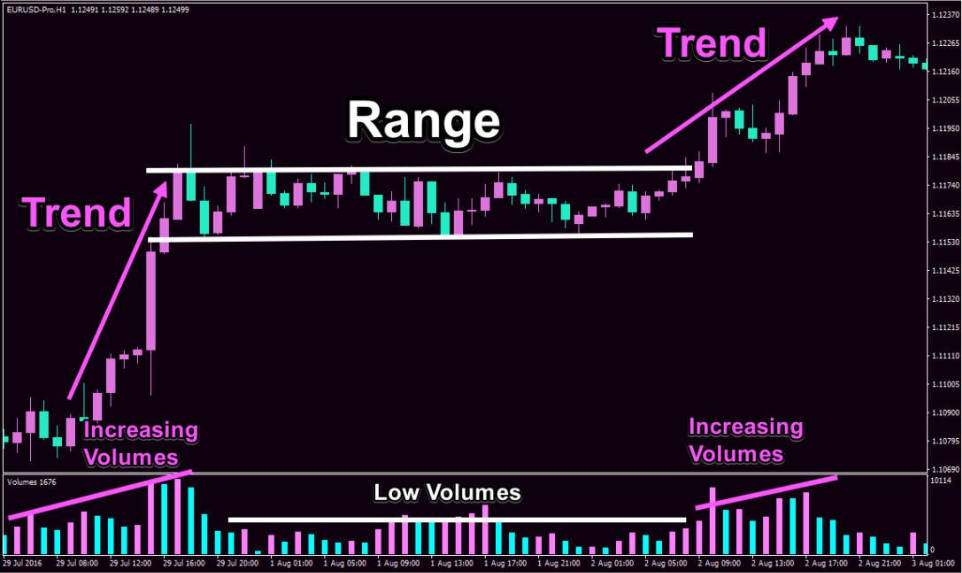

Sideways markets are pauses, not inactivity. Buyers and sellers reach a temporary balance, and volatility contracts. These phases often follow strong rallies or sell-offs, during uncertain economic conditions, or while traders wait for major news. While trends can bring large profits quickly, a range-bound market allows smaller but steadier gains with controlled risk.

Understanding Range-Bound Markets

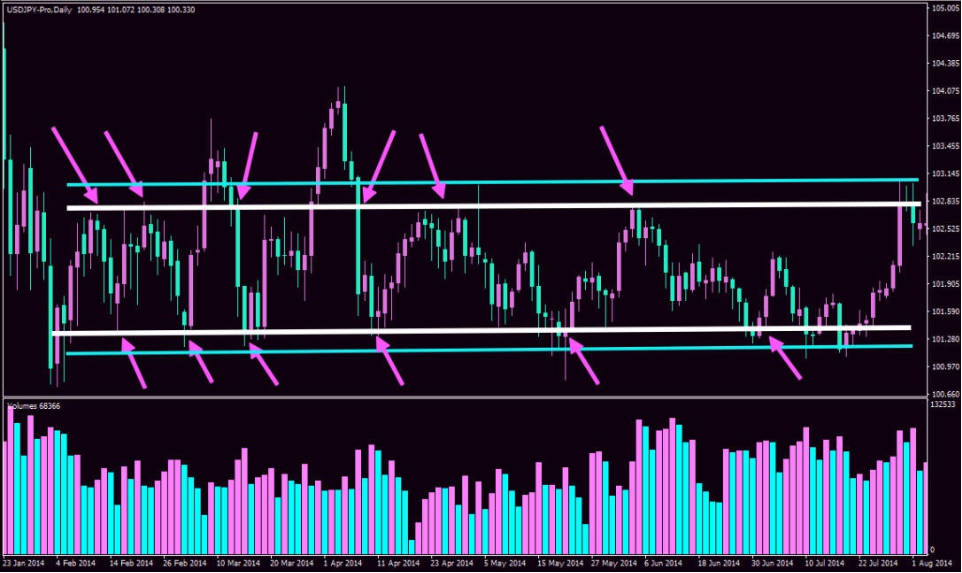

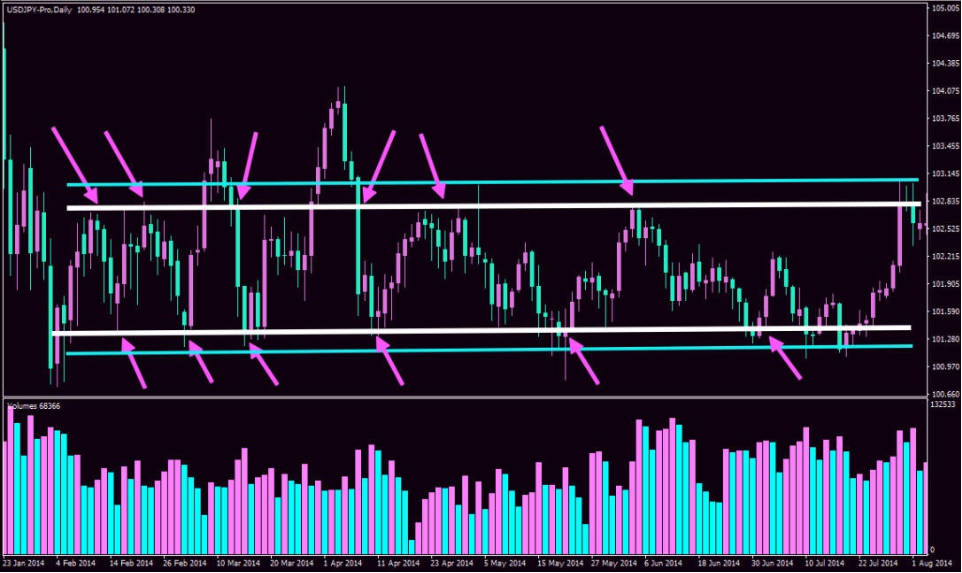

Price in a range-bound market repeatedly hits highs and lows without forming a trend. Think of a ball bouncing between two walls. Support acts as a floor, resistance as a ceiling. This predictable movement allows traders to plan entries and exits more accurately.

Key signs of a range-bound market:

Volatility shrinks: price moves are smaller and candles are compressed.

Volume declines: fewer traders commit to decisive moves.

Indicators like RSI or Stochastics hover near neutral, signaling low momentum.

Multiple timeframes confirm sideways action, reducing false assumptions.

Trading the Range: Bounce vs Breakout

Traders can profit in sideways markets mainly in two ways: bouncing within the range or trading breakouts.

1. Bounce Trading

Bounce trading involves buying near support and selling near resistance. Traders often look for reversal candlestick patterns like pin bars or engulfing candles. Discipline is critical: entering trades mid-range increases risk.

Stop-loss orders are placed just beyond boundaries to limit losses. Bounce trading works best in well-established ranges with low volume.

Tips for bounce trading:

Wait for price to approach support or resistance.

Use indicators (RSI, Stochastics) to confirm overbought/oversold conditions.

Avoid chasing trades when boundaries are weakening.

2. Breakout Trading

Breakout trading captures the move when price leaves the range. True breakouts are accompanied by strong momentum candles and rising volume.

Traders entering at breakout can place stop-loss orders near the middle of the previous range and use the range height to set profit targets. Retests of broken levels offer additional entries.

Tips for breakout trading:

Wait for volume confirmation.

Avoid impulsive entries; patience reduces false breakout risk.

Monitor retests of broken support/resistance for safer entries.

Tools and Indicators for Range-Bound Trading

The right tools improve timing and reduce risk:

Oscillators (RSI, Stochastics, CCI): Spot overbought/oversold zones near boundaries.

Volatility indicators (ATR, Bollinger Bands): Identify compression or expansion, signaling possible breakouts.

Support/resistance levels & pivot zones: Provide clear entry/exit points.

ADX (Average Directional Index): Confirms whether the market is truly sideways.

Pro Tip: Combine price action with indicators for best results. For example, a bounce trade is more reliable when reversal candles align with oversold RSI readings.

Risk Management and PsychologyforRange-Bound Trading

Even predictable markets require careful management. Profits per trade are smaller, tempting traders to overtrade. Moderate position sizes, thoughtful stops, and disciplined entries are essential.

Key risk management strategies:

Only trade clear boundary setups.

Avoid entering mid-range without confirmation.

Step aside when boundaries are weakening or upcoming news may disrupt the range.

Respect patience and avoid impulsive decisions.

Real-World ExamplesforRange-Bound Trading

1. Bounce Example:

EUR/USD between 1.0800 and 1.0900. Buying near 1.0800 and selling near 1.0900 over multiple swings can yield small but consistent profits.

2. Breakout Example:

S&P 500 futures consolidating between 4500 and 4600 for ten days. A strong candle breaks 4600 with high volume. Traders targeting the range height can profit, while cautious traders may wait for a retest.

Frequently Asked Questions

1. Why do markets often move sideways?

Markets consolidate when buyers and sellers are in balance or when traders are waiting for clarity from economic data. This pause allows the market to rest before deciding on the next directional move.

2. Which indicators are most useful in a range-bound market?

Oscillators like RSI, Stochastics, and CCI help spot overbought and oversold zones. Bollinger Bands, ATR, and clearly marked support/resistance levels indicate compression and potential entry points.

3. Is bounce trading safer than breakout trading?

Generally, yes. Bounce trading relies on established boundaries and lower risk, while breakouts offer higher potential rewards but require confirmation and discipline.

4. How do you avoid false breakouts?

Wait for a strong candle with rising volume breaking the boundary. Avoid chasing impulsive moves, and always place protective stop-loss orders.

5. How should traders manage risk in sideways markets?

Use moderate position sizes, place stops outside the range, and avoid mid-range entries. Patience and clear setups improve consistency and reduce losses.

Conclusion

Range-bound markets may appear slow compared to trending ones, but they offer consistent, low-risk trading opportunities for disciplined traders.

By understanding how to read support and resistance, trade bounces, prepare for breakouts, and manage risk effectively, traders can turn sideways movements into profitable, reliable opportunities. Patience, observation, and careful execution are the keys to mastering range-bound trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.