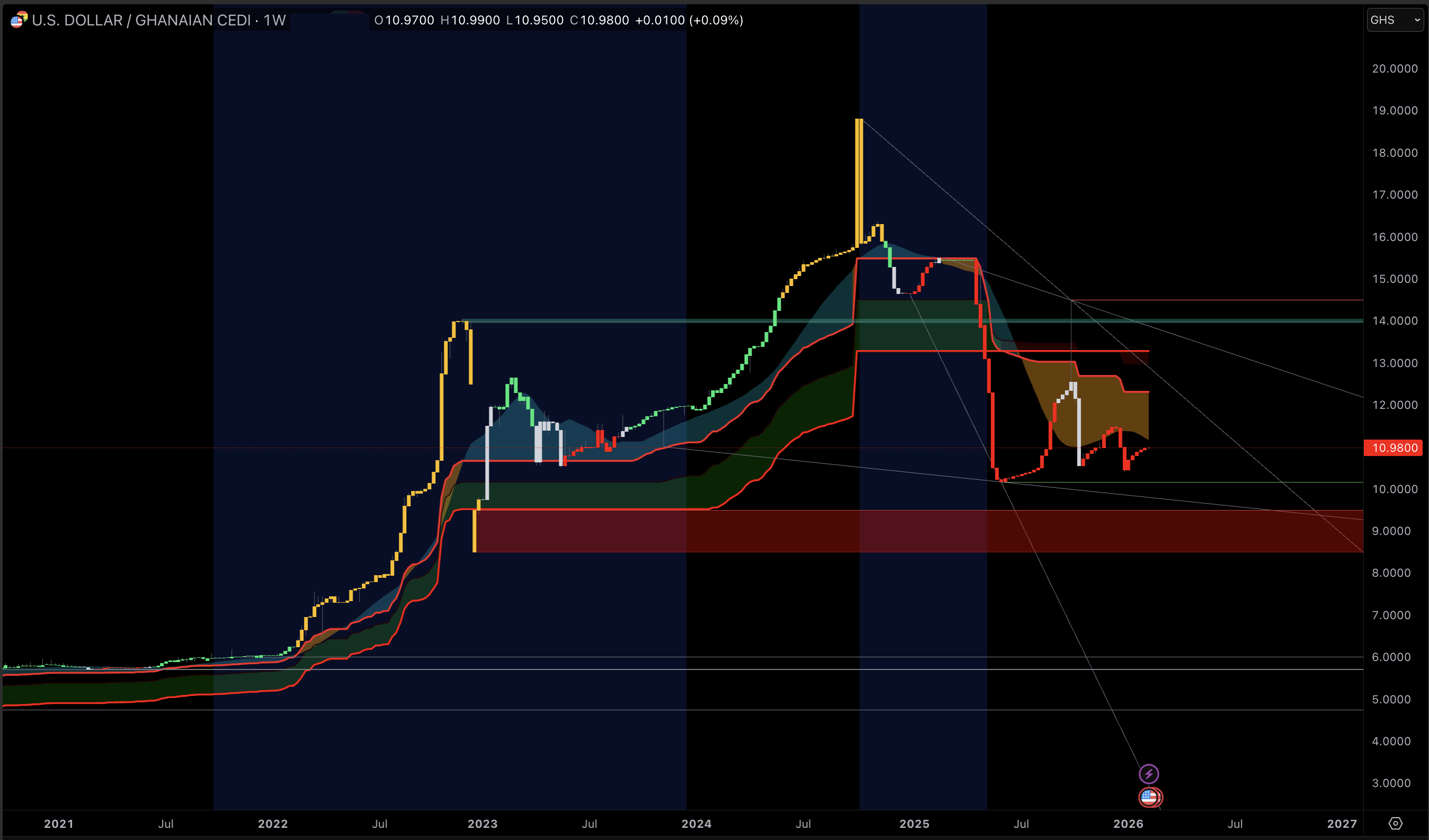

The Dollar to Cedi exchange rate began in 2026 under more stable conditions than in previous years. The official interbank reference rate remains near GHS 11 per $1, supported by disinflation, a stronger external position, and credible reserve rebuilding.

This stability is the result of deliberate policy. In 2025, the cedi appreciated due to tighter monetary and fiscal policies, increased FX supply from exports and transfers, and improved external buffers. The key question for 2026 is whether Ghana can maintain these supports as the Bank of Ghana moves toward lower rates and growth-oriented policies.

Dollar To Cedi Forecast Key Takeaways For 2026

Spot Level Sets The Near-Term Anchor. The Bank of Ghana’s interbank USD/GHS mid rate was 10.9985 on 13 Feb 2026, placing the market’s working reference close to GHS 11 per $1.

Ghana’s current macroeconomic environment supports a stronger cedi than historical trends indicate. Inflation has declined significantly, with January 2026 inflation at 3.8% and month-over-month price growth at only 0.2%.

Real yield support remains strong despite recent rate cuts. The Bank of Ghana reduced the policy rate to 15.50% in late January, yet real yields remain high relative to current inflation and US rates.

External buffers are central to Ghana’s currency stability. At the end of 2025, gross international reserves reached $13.8 billion (5.7 months of import cover), and the provisional current account surplus was $9.1 billion, significantly reducing the risk of forced depreciation.

The base case for 2026 is broad stability with occasional volatility, influenced by USD risk sentiment, commodity price fluctuations, and domestic liquidity cycles.

Where USD/GHS Stands Today

The Bank of Ghana publishes a market reference closing rate, calculated as a weighted median of reported spot US$/GHS transactions, including interbank trades and qualifying client transactions of $10,000 or more, typically recorded before the daily cut-off. This rate serves as a reliable benchmark for trend analysis and for comparing bank spreads and retail quotes.

As of 13 Feb 2026, the official interbank reference showed USD/GHS buying at 10.9930, selling at 11.0040, and the mid rate at 10.9985. In practical terms, the “Dollar to Cedi” rate is sitting near GHS 11 per $1.

Cedi To Dollar Conversion

The Cedi to Dollar exchange rate is simply the inverse. Using the same reference mid rate:

1 GHS ≈ $0.0909

GHS 1,000 ≈ $90.92

Retail conversion rates can differ significantly from the interbank reference rate due to margins, cash-handling costs, and liquidity conditions. The interbank rate should be viewed as the primary directional benchmark.

The Ghana Side Of The USD/GHS Equation

Disinflation Has Changed The FX Math

Currency markets reflect the credibility of domestic monetary policy. Ghana’s rapid disinflation has shifted expectations. Official CPI data shows January 2026 inflation at 3.8%, declining steadily through 2025, with a 0.2% month-over-month change. The Bank of Ghana also reported a decrease in headline inflation to 5.4% in December 2025, attributing this to currency appreciation and tight policy.

Lower inflation reduces the structural pressure for the cedi to depreciate over time. When inflation declines and expectations are stable, local investors seek fewer dollars as a hedge, and foreign investors require a smaller FX premium.

Policy Rates Still Offer A Large Cushion

The Bank of Ghana reduced the Monetary Policy Rate by 250 basis points to 15.50% on 28 January 2026. Despite this reduction, Ghana’s rate structure continues to offer significant carry support compared to much lower US policy rates. This spread encourages domestic savings in cedi assets and reduces the incentive to hold dollars locally.

The primary risk is not the policy rate level, but the speed of easing. If rate cuts outpace inflation and liquidity conditions, FX pressure may return quickly, particularly in less liquid markets.

The External Accounts Are Doing The Heavy Lifting

The cleanest way to forecast the Dollar to Cedi path is to track Ghana’s net FX supply. The Bank of Ghana’s January 2026 communication reported:

Provisional current account surplus: $9.1 billion in 2025 (vs $1.5 billion in 2024)

Provisional balance of payments surplus: $3.98 billion

Gross international reserves: $13.8 billion, equivalent to 5.7 months of import cover

These are substantive improvements. A sustained current account surplus indicates the economy is generating more dollars through trade and transfers than it is spending. Growing reserves enhance credibility by giving policymakers flexibility to manage volatility without depleting buffers.

Fiscal Consolidation Supports FX Confidence

FX markets punish fiscal slippage because it often ends with monetary financing and higher inflation. The Bank of Ghana flagged continued consolidation through November 2025, including an overall fiscal deficit of 0.5% of GDP (commitment basis), a 2.8% of GDP primary surplus, and a decline in public debt to 45.5% of GDP.

For USD/GHS, this is the “quiet driver” behind stability. Stronger fiscal numbers reduce rollover anxiety, improve the capital account, and lower the probability of a sudden FX funding gap.

The US Dollar Side Of The Equation

The US dollar influences the USD/GHS exchange rate through global risk appetite and interest rate differentials. The Federal Reserve’s policy stance is important not because Ghana is directly pegged to the Fed, but because it affects global capital flows and the cost of holding dollars.

The Federal Reserve maintained the federal funds target range at 3.50% to 3.75% as of 28 January 2026.

US CPI inflation was 2.4% year-over-year in January 2026, with core inflation at 2.5%.

A stable or easing US inflation profile generally lowers the likelihood of a significantly stronger dollar. However, USD strength can still emerge during risk-off periods. When global investors reduce exposure to emerging markets, the USD/GHS exchange rate may rise even if Ghana’s fundamentals remain strong.

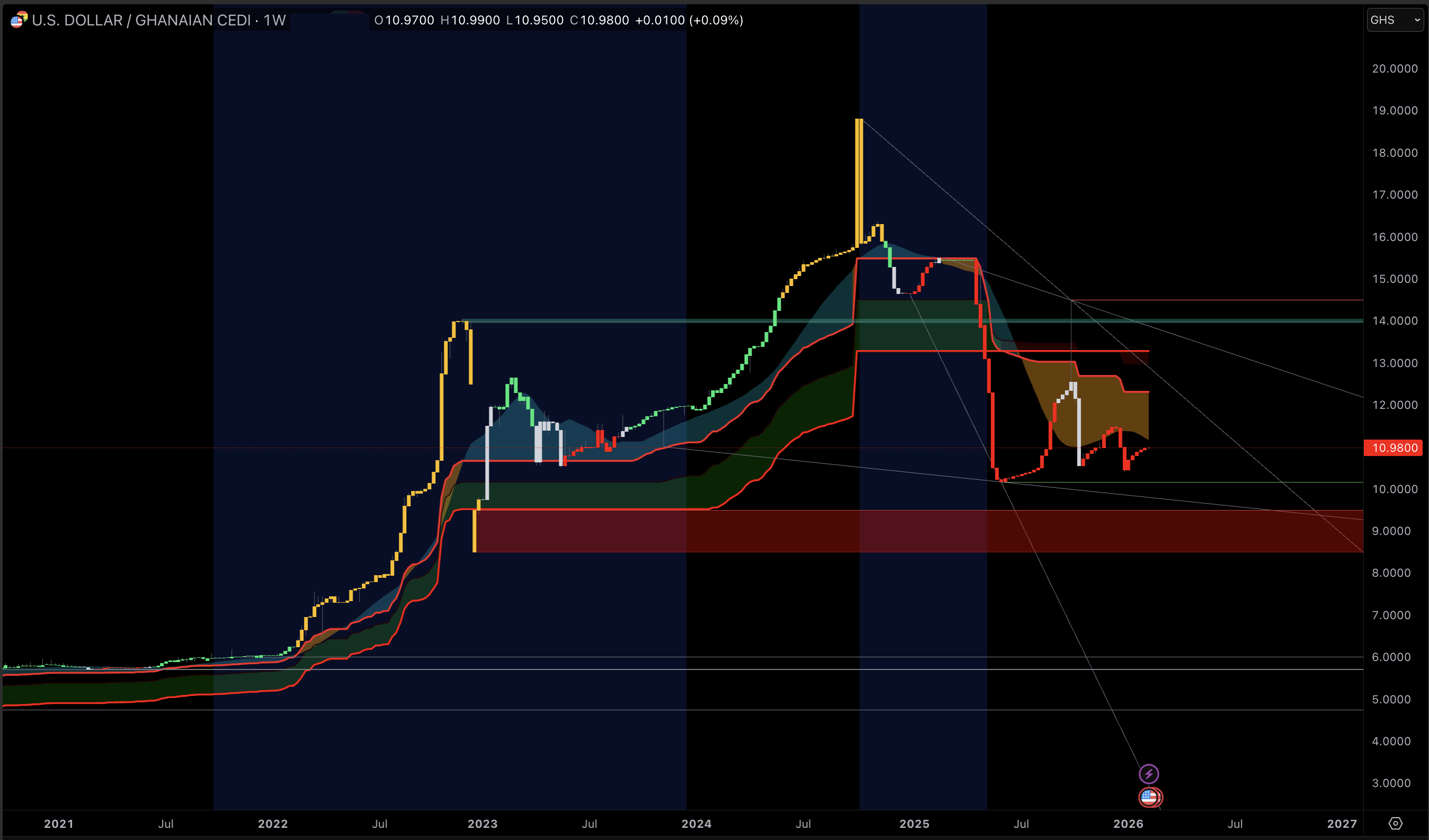

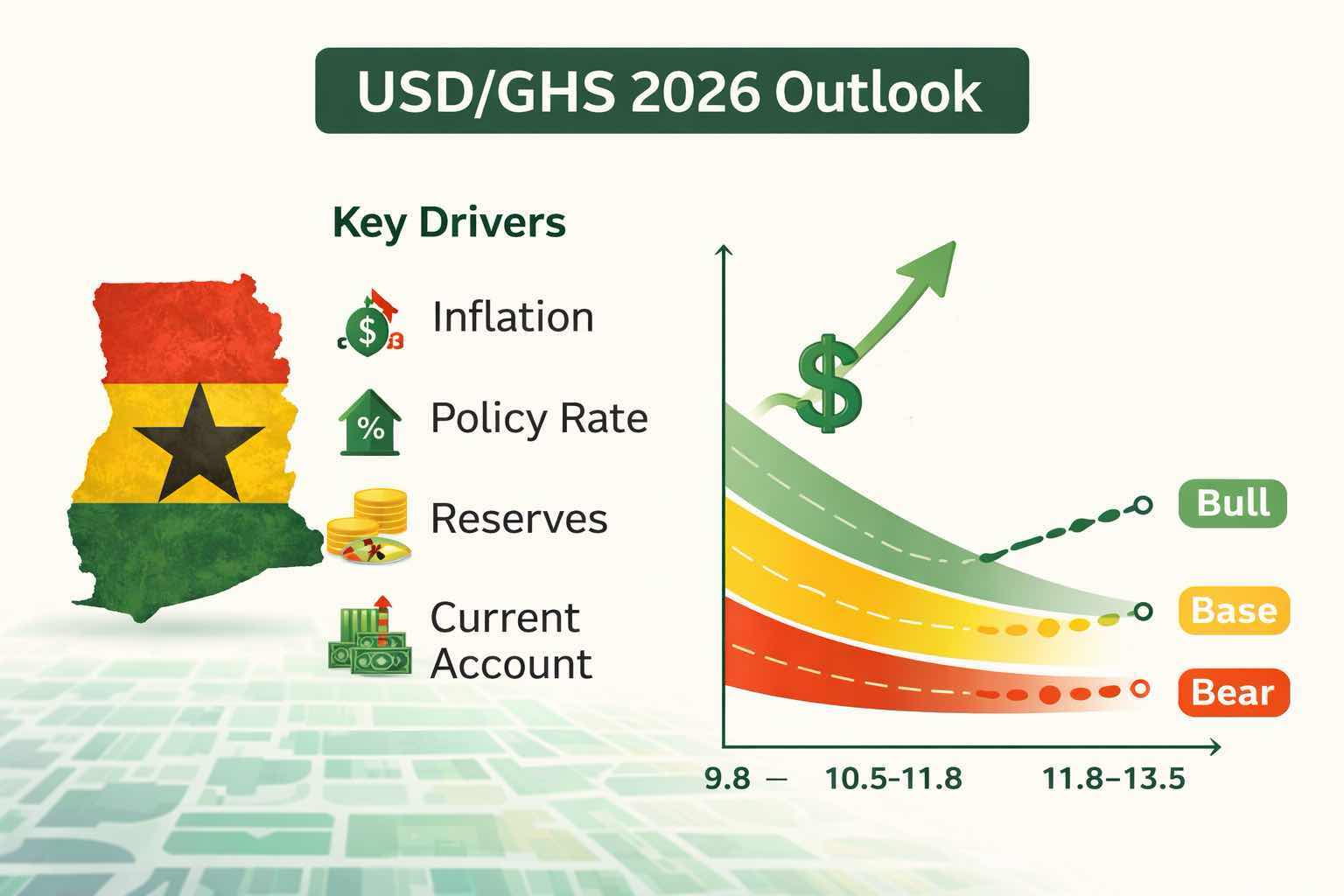

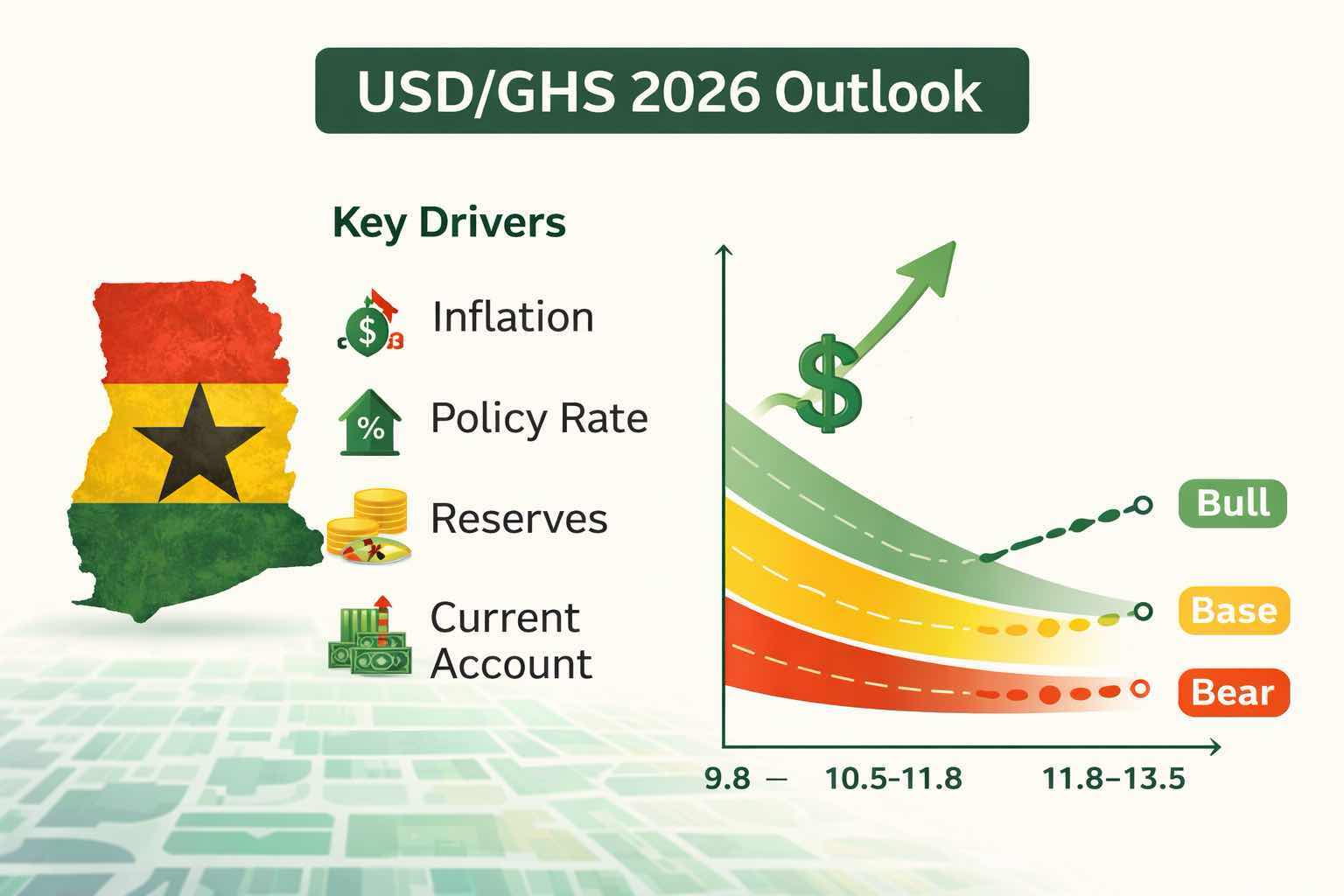

USD/GHS Forecast Scenarios For 2026

Forecasting a frontier-market currency involves assessing probabilities rather than predicting a single value. The most effective method is to define ranges based on identifiable catalysts.

Base Case: Stability With Mild Two-Way Volatility (Most Likely)

Range: GHS 10.5 to GHS 11.8 per $1

This scenario assumes Ghana maintains ample reserves, contained inflation, and gradual rate cuts. Under these conditions, the cedi is likely to trade within a managed stability framework, with brief periods of pressure offset by increased FX supply and credible policy actions.

Bull Case: Cedi Strength Extends (Lower USD/GHS)

Range: GHS 9.8 to GHS 10.8 per $1

This outcome depends on continued strong export receipts, steady private transfers, sustained fiscal discipline, and a softer global dollar environment. When FX inflows outpace import demand, dealers compete to sell dollars, driving USD/GHS lower.

Bear Case: Repricing Higher On Policy Or External Shock

Range: GHS 11.8 to GHS 13.5 per $1

This scenario is driven by balance-sheet fundamentals rather than by negative news. It may occur if rate cuts exceed inflation improvements, reserves stagnate, or export earnings weaken while import demand rises. A sharp global risk-off event can intensify the adjustment, especially if corporates quickly seek to cover dollar liabilities.

What To Watch If You Trade Or Hedge USD/GHS

Reserve Momentum, Not Just The Level. A high reserve stock helps, but the market reacts more quickly to month-to-month changes in reserves.

The relationship between inflation trends and policy cuts is critical. With inflation at 3.8% in January, aggressive rate cuts would test market confidence in the Fed's policy credibility.

Local interest rates signal liquidity conditions. The Bank of Ghana noted a sharp decline in the 91-day Treasury bill rate to 11.08% in December 2025, indicating easier domestic financial conditions. A renewed increase would typically signal tighter liquidity and stronger support for the Cedi.

A widening gap between official reference and retail rates often signals localized dollar scarcity rather than a fundamental shift in equilibrium pricing.

Frequently Asked Questions for USDGHS

What Is The Dollar To Cedi Rate Today?

The official interbank reference rate is published by the Bank of Ghana as a weighted median of qualifying market transactions. On 13 Feb 2026, the interbank USD/GHS mid rate was 10.9985, close to GHS 11 per $1.

Why Did The Cedi Strengthen So Much In 2025?

The Bank of Ghana attributed cedi strength to tighter policy, fiscal consolidation, and a major reserve rebuild. Official communication recorded a 40.7% appreciation against the US dollar in 2025, alongside a strong external position and rising reserves.

Is The 2026 Dollar To Cedi Forecast Bullish Or Bearish For GHS?

The balance of evidence favors a stable-to-firm cedi bias, but not a straight line. High reserves, a current account surplus, and lower inflation support GHS, while rate cuts and global risk-off episodes can still temporarily push USD/GHS higher.

How Do I Convert Cedi To Dollar Correctly?

Use the most accurate reference rate and invert it. At an interbank mid rate of approximately 10.9985, 1 GHS equals about $0.0909 and GHS 1,000 equals about $90.92. Retail rates may be lower after fees and spreads.

Does The Bank Of Ghana Set A Fixed Exchange Rate?

No. The Bank of Ghana publishes a daily market reference rate based on reported transactions, designed to reflect prevailing market conditions. The currency can still move, but stronger reserves and liquidity management can reduce disorderly volatility.

What Could Push USD/GHS Sharply Higher?

The most immediate triggers are a sudden USD liquidity shortage, a decline in net FX inflows, or a loss of policy credibility. In practice, this could result from weaker reserve momentum, rapid policy easing, or a global risk-off event that increases dollar demand.

Conclusion

The 2026 Dollar to Cedi outlook is based on Ghana’s improved inflation dynamics, stronger external balances, and higher-than-expected reserves. This combination supports a forecast of stability near GHS 11 per $1, with volatility driven primarily by timing, liquidity, and global risk sentiment rather than persistent macroeconomic weaknesses.

The cedi’s stability depends on continuity rather than perfection. Sustained fiscal discipline, gradual monetary easing, and the maintenance of external buffers have transformed USD/GHS from a one-way trade to a two-way market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

(Bank of Ghana)(Federal Reserve)(Bureau of Labor Statistics)