A Stock Market Correction is a normal and recurring phase of market cycles. It represents a significant decline from recent highs that, while unsettling, often serves to realign valuations and clear excess optimism.

Understanding corrections helps investors remain composed and make measured decisions rather than reacting emotionally to short term price moves.

What Is a Stock Market Correction?

A Stock Market Correction occurs when the price level of a broad index or market falls by about 10 per cent or more from a recent peak. This threshold is not a legally defined rule, but it is the commonly accepted standard used by market analysts and major financial firms.

Corrections should be distinguished from pullbacks, which are smaller declines, and from bear markets, which are deeper falls of roughly 20 per cent or more.

Historical Frequency and Typical Patterns of Stock Market Corrections

Corrections occur regularly over long periods. Historical studies show that while small pullbacks happen quite often, full corrections of 10 per cent or more take place with less frequency but are nonetheless common over decades.

For example, research into long term market behaviour finds that corrections have appeared many times since the early 20th century, and only a subset of those corrections later deepen into bear markets.

Historical Snapshot: Corrections versus Bear Markets

| Measure |

Typical Threshold |

Historical Frequency (approx.) |

Typical Outcome |

| Correction |

10% decline from peak |

Occurs regularly; roughly once every 1–2 years for notable drawdowns |

Often resolves within weeks to months; many do not become bear markets. |

| Bear Market |

20% decline from peak |

Much less frequent than corrections |

Tends to last longer and correspond with deeper economic stress. |

Why Stock Market Corrections Happen

Corrections are driven by a mixture of fundamentals and sentiment. Economic surprises such as weaker GDP numbers, rising inflation or disappointing corporate earnings can trigger reassessments of value.

Market structure elements such as stretched valuations, high margin use or reduced liquidity can amplify declines. Investor psychology, including a shift from fear of missing out to profit taking, completes the mix.

External shocks such as geopolitical events or policy surprises can also precipitate swift corrections. Each correction is different in its proximate cause, but the pattern of valuation reassessment and sentiment change is common to most episodes.

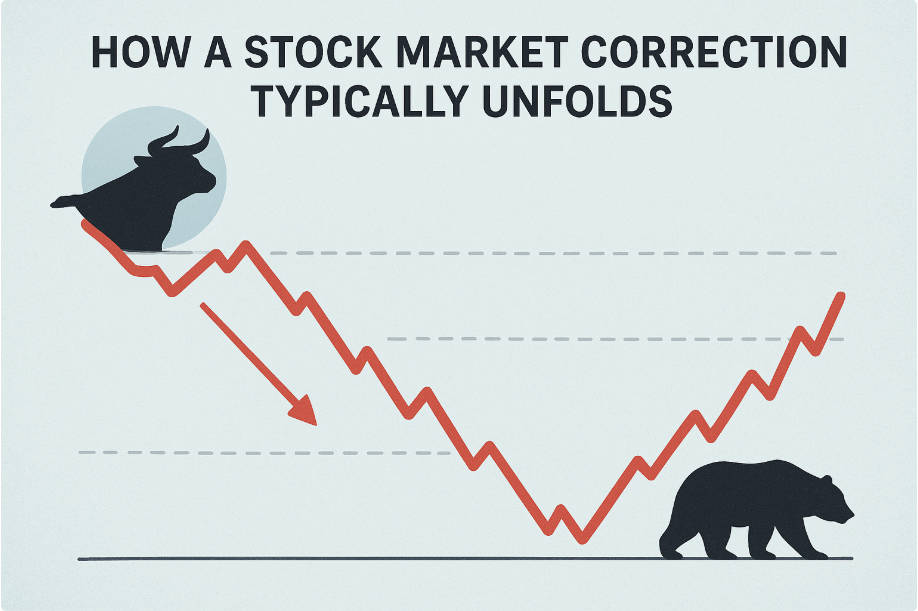

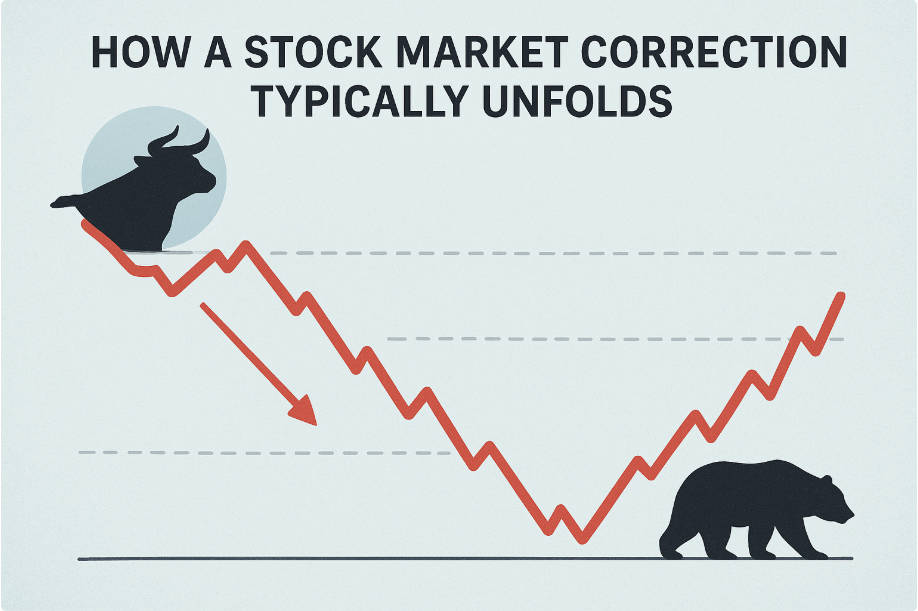

How a Stock Market Correction Typically Unfolds

A correction usually follows a market peak and begins as a steady series of down days or a sharper move triggered by news.

Technical levels, such as prior support zones and moving averages, often shape the course of the decline. Algorithmic trading and stop loss orders can magnify the descent, creating faster drops than fundamentals alone would justify.

Many corrections reach a trough and then recover as buyers step in and valuations become more attractive. Only when negative feedback loops deepen does a correction risk evolving into a bear market.

Practical Implications for Investors

A correction can cause significant short term portfolio volatility.

For investors with long time horizons, corrections are not necessarily a disaster; they can provide buying opportunities to acquire quality assets at lower valuations.

For near term savers or those with immediate liabilities, corrections emphasise the importance of liquidity and suitable asset allocation.

Behavioural risks include panic selling and abandoning a well considered plan. Maintaining discipline, reviewing asset allocation and ensuring an emergency cash buffer are practical measures to mitigate harm.

What Investors Can Do During a Stock Market Correction

Investors should consider several measured responses rather than seeking immediate market timing.

First, review and confirm whether asset allocation still matches financial goals and risk tolerance.

Second, consider opportunistic investing through dollar cost averaging if additional capital is available.

Third, rebalance portfolios to maintain intended risk exposures.

Fourth, maintain liquidity to avoid forced selling.

Finally, avoid emotional decisions and seek clarity from reliable research rather than headlines.

These steps do not promise outperformance, but they help preserve long term objectives and reduce the risk of costly reactionary moves.

Practical Checklist During a Correction

| Action |

Rationale |

| Reconfirm asset allocation |

Ensures portfolio aligns with goals and risk tolerance. |

| Avoid panic selling |

Historical patterns show many corrections recover; selling locks in losses. |

| Use dollar cost averaging |

Spreads purchase price and reduces timing risk. |

| Maintain emergency cash |

Prevents forced liquidation at depressed prices. |

| Rebalance if necessary |

Keeps portfolio risk profile intact. |

Common Myths and Misconceptions

There are several persistent misconceptions about corrections.

First, a correction does not automatically mean an impending recession.

Second, not all sectors fall equally; defensive sectors often outperform during declines.

Third, corrections are not a sign of market failure but are usually part of normal price discovery.

Recognising these myths helps investors interpret corrections more calmly and rationally.

The Bigger Picture: Corrections Within Market Cycles

Over decades, markets have trended upward despite periodic corrections and even deeper bear markets. Corrections serve as pauses in that climb. For long term investors, the reality is that short term volatility is inevitable and that disciplined investment practices typically matter more than attempts to precisely time market turns. Past recoveries from major corrections and crashes illustrate the market's capacity to rebound given time and economic recovery.

Frequently Asked Questions

Q1: What exactly counts as a Stock Market Correction?

A correction is generally a decline of around 10 per cent or more from a recent high, as commonly used by market commentators and analysts.

Q2: How often do corrections occur?

Corrections occur with some regularity. Small pullbacks are very frequent and corrections of 10 per cent or more appear every few years, depending on the measurement period and the index used. Studies show a wide historical record of such episodes.

Q3: Does a correction mean a bear market is coming?

Not necessarily. Only a portion of corrections deepen into bear markets. A correction becomes a bear market if losses expand to approximately 20 per cent or greater and are often accompanied by broader economic deterioration.

Q4: Is a correction a good time to buy?

For disciplined long term investors, corrections can offer opportunities to buy quality assets at lower valuations. Any buying should be done with a clear plan and within the context of one's overall financial objectives.

Conclusion

A Stock Market Correction is a routine, if unwelcome, part of investing. It tests investor temperament and planning. The best response is to rely on a thoughtfully designed plan, to ensure cash and allocation discipline, and to see corrections as part of the market's mechanism for renewing itself rather than as a cause for panic.

Historical evidence supports the view that, for patient investors, corrections are more often a temporary interruption than a permanent setback.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.