The financial markets operate in cycles of optimism and caution. Recognising whether the market is in a bullish phase or a bearish one is essential to making informed investment decisions.

Below is a comprehensive exploration of Bullish vs Bearish market regimes—covering sentiment, economics, technical traits, strategy, transitions, and practical assessment.

Introduction to Bullish vs Bearish

1. Defining "Bullish" and "Bearish" in investment parlance

In market terminology, a bull market is a period in which asset prices are rising and investors expect the up‑trend to continue. A bear market, by contrast, is a period in which asset prices are falling for a sustained span and investor expectation is for further decline.

2. Why the distinction matters for investors and traders

The difference between bullish and bearish regimes affects portfolio construction, risk appetite, asset allocation, trading strategy, and investor behaviour. Recognising the prevailing market orientation helps align decisions with momentum and guard against unexpected reversals.

3. Preview of key differences to come

We will analyse sentiment and psychology, underlying economic conditions, technical and price‑behaviour traits, strategies for each regime, how transitions occur, assessment tools, and summarise key take‑aways.

Bullish vs Bearish Market Psychology

1. Investor attitude and behavioural drivers in a bullish market

In a bullish regime, investor confidence is high, expectations of future growth are optimistic, and many market participants expect gains. More capital flows into equities or growth assets; fear of missing out may drive participation.

2. Psychological dynamics in a bearish environment

In a bearish market investors tend to be cautious or fearful. Expectations of decline dominate. Some may exit risk assets, shift to safety, or hedge. The mood drives behaviour, which in turn can exacerbate declines.

3. How sentiment feeds into price movements and market momentum

Sentiment is self‑reinforcing: in a bull phase positive outlook brings purchases, which push prices higher, which reinforce optimism. In a bear phase negative outlook triggers selling, driving down prices and deepening pessimism.

Fundamental Economic Conditions Behind Bullish vs Bearish Regimes

1. Macro‑economic indicators favouring a bullish stance

Typical signs favouring a bullish market include: strong GDP growth, low or falling unemployment, rising corporate earnings, stable or falling interest rates, moderate inflation, favourable global trade conditions. These support rising asset prices.

2. Economic warning signs that usher in bearish phases

Conversely, bearish markets often accompany economic contraction, rising unemployment, falling earnings, higher inflation, increasing interest rates, geopolitical or trade stress. These weaken the outlook for future growth and asset valuations.

3. The role of policy, interest rates and global trade in flipping between bullish and bearish

Monetary policy (e.g., interest rate decisions), fiscal stimulus or austerity, and global trade disruptions can act as triggers of regime shifts. For example, tightening rates can dampen growth and move sentiment from bullish to bearish.

Price Behaviour and Technical Characteristics in Bullish vs Bearish Markets

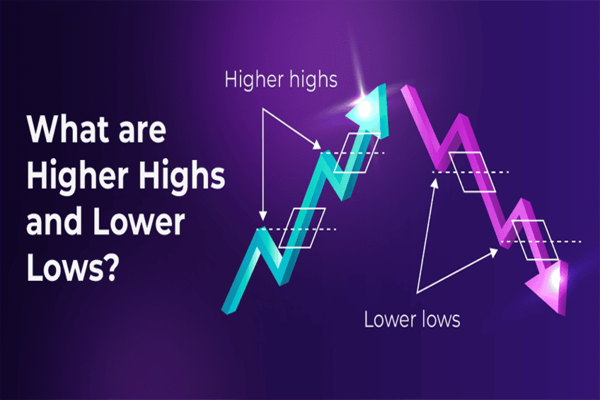

1. Typical price patterns and trend behaviour in a bullish market

In a bullish market one often sees rising asset price levels over time, a series of higher highs and higher lows, market breadth improving, and pull‑backs treated as buying opportunities.

2. Characteristic price action in a bearish market

In a bearish regime one sees falling price levels, lower lows and lower highs, narrowing breadth, rallies that fail to attract follow‑through, and corrections that turn into sustained declines.

3. Liquidity, volume and market breadth differences during bullish vs bearish phases

Volume and liquidity tend to be stronger in bullish phases as more participants engage, whereas in bearish conditions liquidity can dry up or trading may be dominated by sellers. Market breadth (percentage of stocks advancing) tends to narrow in bearish times.

Bullish Market VS Bearish Market

| Feature |

Bullish Market |

Bearish Market |

| Price Trend |

Rising steadily with upward momentum |

Declining with downward momentum |

| Investor Sentiment |

Optimistic, confident |

Pessimistic, fearful |

| Breadth & Participation |

Broad participation; many stocks rising |

Narrow participation; many stocks falling |

| Corrections / Pull‑backs |

Viewed as buying opportunities |

Viewed as selling opportunities |

| Liquidity |

Generally strong |

May weaken; selling pressure dominates |

Investment and Trading Strategies for Bullish vs Bearish Markets

1. Recommended portfolio approaches when the market is bullish

In bullish markets investors might favour growth assets, longer equity exposure, smaller hedges, possibly higher‑risk but higher‑return assets. The philosophy might lean toward buy and hold, riding momentum, seeking capital appreciation.

2. Defensive and opportunistic tactics for bearish environments

In a bear regime the focus often shifts to capital preservation: defensive stocks, fixed income, hedges, possibly short positions or inverse‑exposure. Opportunistic investors might look for oversold assets or value plays but must manage risk carefully.

3. Timing challenges and myths: why trying to "time the top" or "pick the bottom" is fraught

Switching strategies based on market regime can be challenging because regime shifts are hard to detect in real time. Many investors mistime transitions and incur losses. A disciplined approach and diversified framework are often preferable to trying to perfectly time entry or exit.

Recognising the Switch from Bullish to Bearish and Vice Versa

1. Indicators signalling a transition

Transitions may be signalled by divergence between fundamentals and prices, extreme sentiment (either exuberance or despair), technical breakdowns (e.g., major index falling 20 %), macro‑economic shocks, or sudden liquidity events.

2. Common pitfalls investors face during transitions

Pitfalls include mistaking a temporary correction for a full regime shift, exiting too early or too late, overreacting to short‑term noise, or shifting strategy based purely on emotion rather than signal.

3. Historical examples of major bullish‑to‑bearish and bearish‑to‑bullish shifts

Historical data show bull markets tend to last longer than bear markets. Examining past transitions helps investors understand the dynamics and prepare for future shifts.

How to Assess Whether You Are in a Bullish or Bearish Market

1. Checklist of signals (economic, technical, sentiment)

Has the major market index risen or fallen by roughly 20 % from recent low/high?

Are fundamentals (earnings, GDP, employment) improving or deteriorating?

Is investor sentiment optimistic or fearful?

Are price patterns showing higher highs/higher lows or the opposite?

Are breadth and liquidity favourable or narrowing?

2. Case study walkthroughs (select past periods)

For example the 2009–2019 US stock market bull run, followed by the 2020 abrupt bear event after global pandemic, illustrate how quickly transitions can occur and the importance of structural versus cyclical context.

3. How to align your portfolio with the prevailing regime while preserving flexibility

While aligning strategy with the prevailing regime is sensible, maintaining flexibility (e.g., staying diversified, holding some liquid reserves, employing risk controls) is vital since no regime lasts forever and reversal can be swift.

Conclusion

Briefly: Bullish markets equal rising prices, optimism, broad participation, while bearish markets equal falling prices, pessimism, narrow market action.

In bullish times emphasise growth, momentum, participation; in bearish times emphasise defence, risk reduction, selective opportunity.

Regardless of whether the market is bullish or bearish, staying disciplined, aligned with long‑term objectives, and sticking to a structured plan often trumps reactive moves.

Frequently Asked Questions

Q1. What exactly constitutes a"bear market"versus simply a correction?

A bear market is often defined as a decline of about 20 % or more from a recent high in a broad market index. A correction is typically a smaller fall, often 10‑20 %.

Q2. Can both bullish and bearish markets last indefinitely?

No. Historically bullish phases tend to last longer than bearish ones, but both eventually end and reverse.

Q3. Should I change my investment strategy when the market is bearish?

It depends on your objectives and risk tolerance. Some strategic shifts (greater defence, more liquidity) may be appropriate in bearish regimes, but frequent tactical changes can increase risk.

Q4. Are there opportunities in bearish markets?

Yes. Bearish markets can offer opportunities to buy undervalued assets, use hedging tools, or profit from declines (for experienced investors). But they typically involve higher risk and require disciplined risk management.

Q5. How reliable are sentiment indicators in detecting bullish vs bearish phases?

Sentiment indicators are helpful but not sufficient on their own. They must be combined with fundamental and technical indicators. Sentiment may change rapidly or be initially misleading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.