What Is an Option Spread?

An option spread is a strategy that involves buying and selling options on the same underlying asset, usually with different strike prices or expiration dates. Instead of taking on the full risk and potential reward of a single call or put option, spreads allow traders to create defined pay-off profiles.

At their core, spreads are about trade-offs: the trader accepts limited profit in exchange for reduced risk or reduced upfront cost. This makes them popular tools not only for speculative traders but also for hedgers who want precise control over their exposure.

By combining long and short positions, option spreads sit at the heart of professional options trading—striking a balance between cost efficiency, risk containment, and directional or volatility-based market views.

Types of Option Spreads

Vertical Spreads

A vertical spread involves buying and selling options of the same type (calls or puts) and the same expiration date, but with different strike prices.

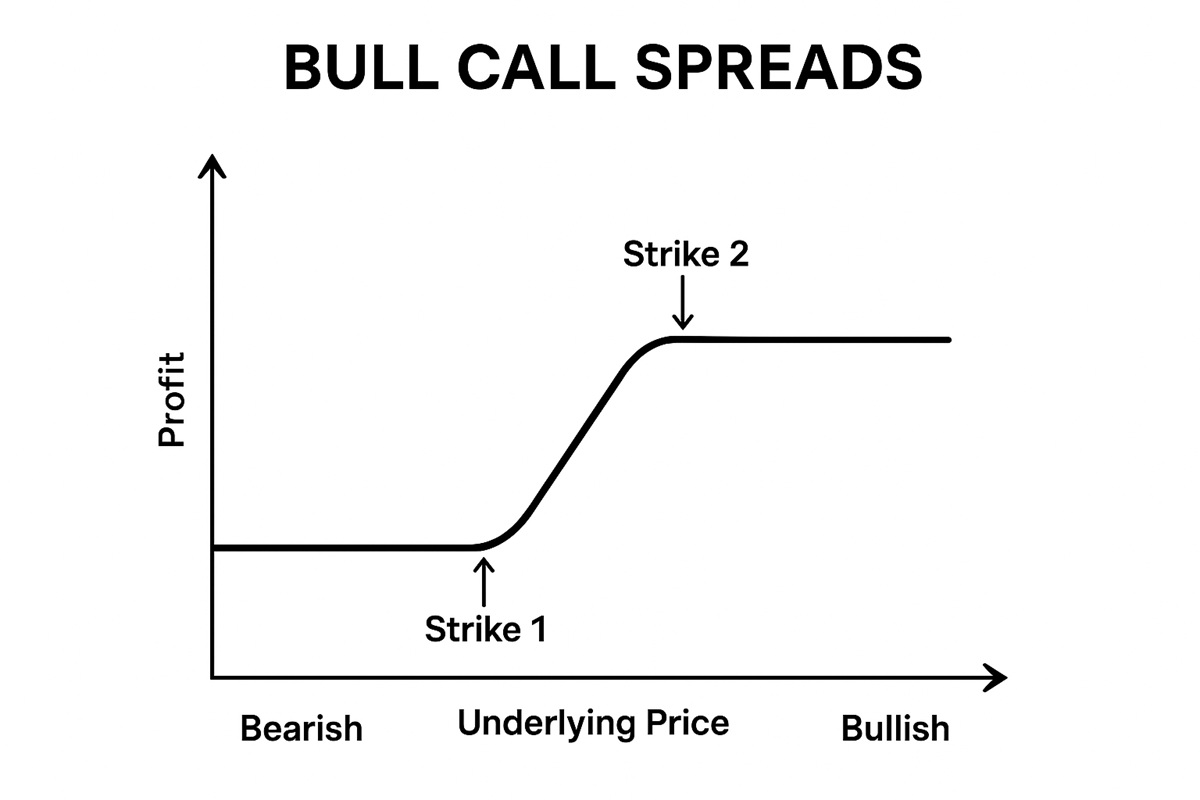

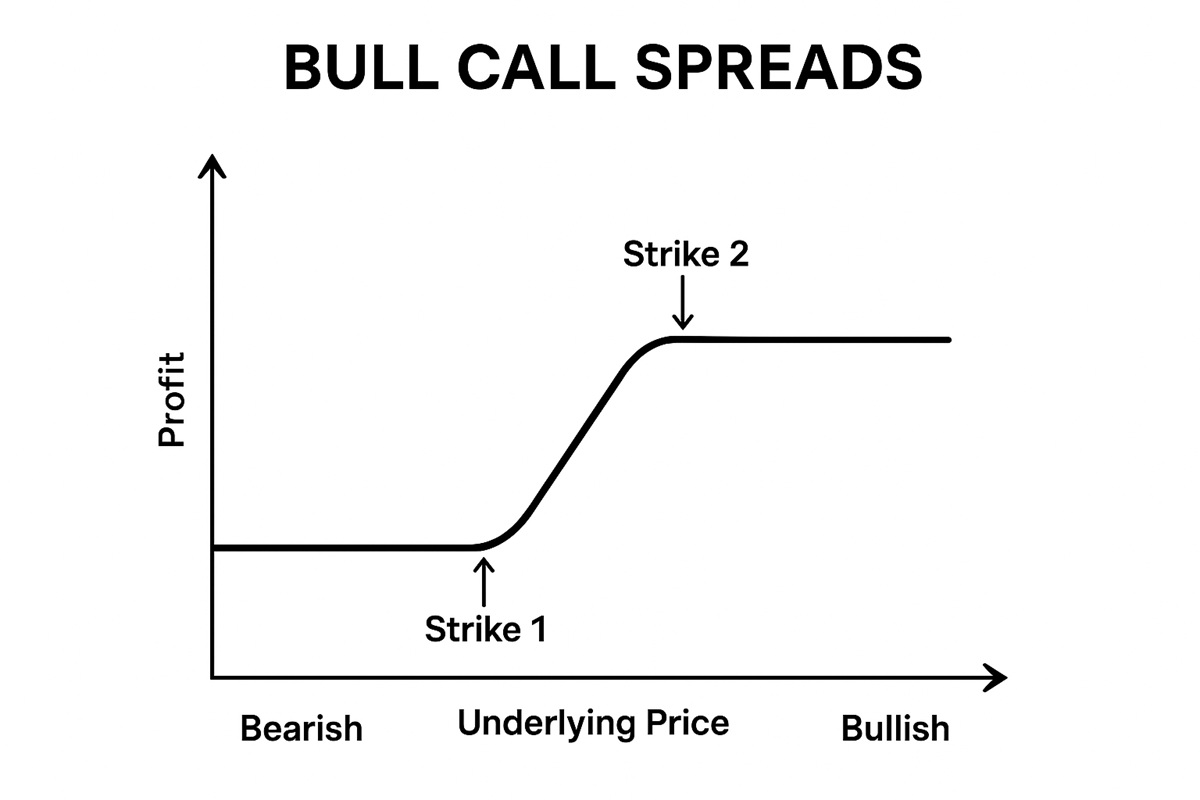

Bull Call Spread: Buy a call at a lower strike, sell another at a higher strike. Designed to profit from a moderate rise in the underlying asset.

Bear Put Spread: Buy a put at a higher strike, sell another at a lower strike. Intended for markets expected to decline modestly.

Vertical spreads cap both upside and downside, making them straightforward, cost-efficient plays for directional traders.

Horizontal (Calendar) Spreads

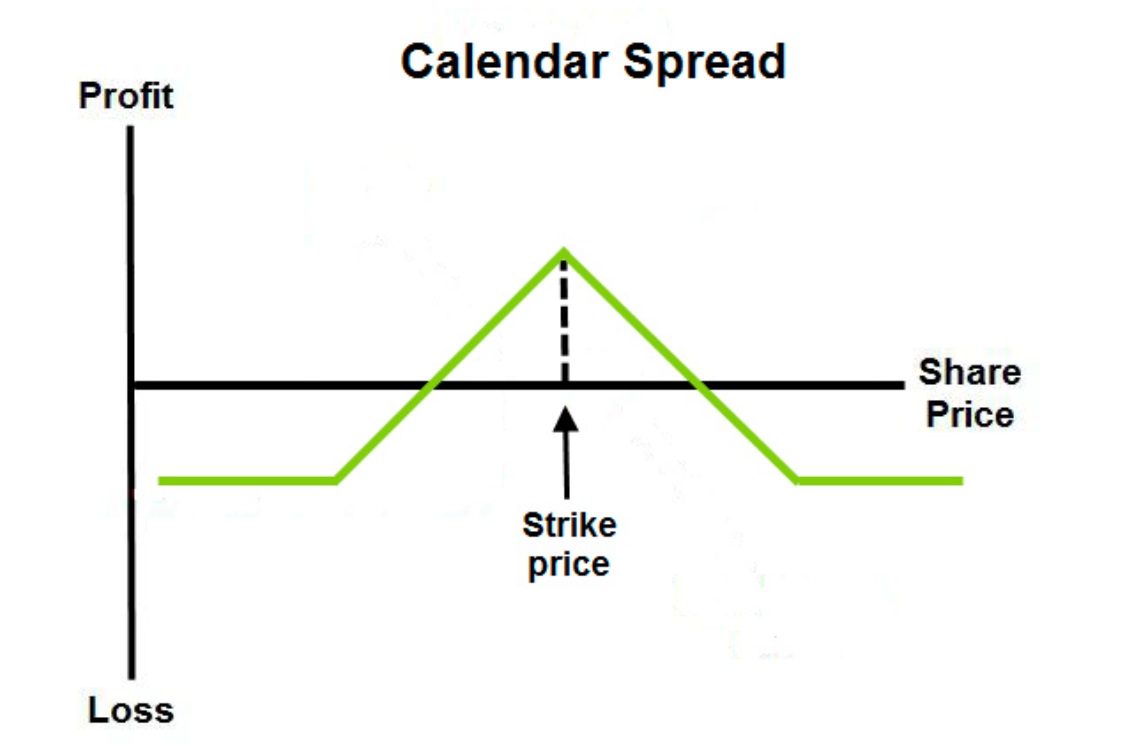

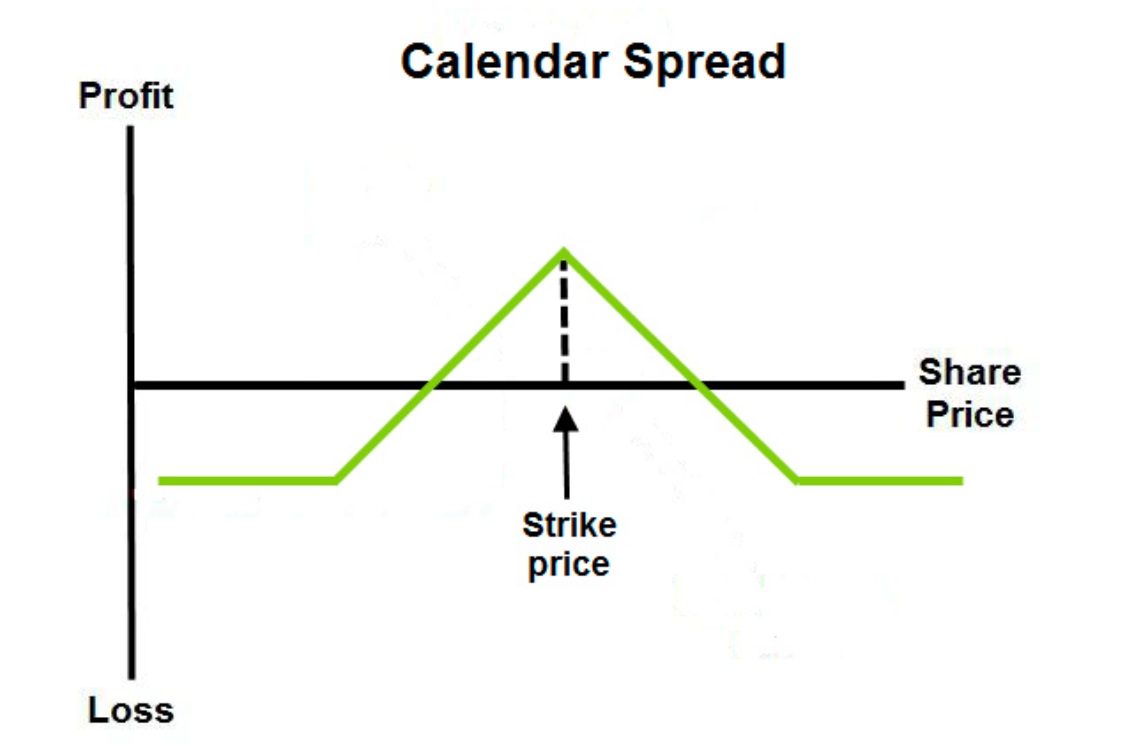

A calendar spread (or time spread) involves buying and selling options with the same strike price but different expiration dates.

The trader typically sells the near-term option to capture faster time decay (theta) while holding the longer-term option as protection. The payoff benefits if the underlying stays near the strike while short-term time decay accelerates.

Calendar spreads are widely used for neutral strategies and for trading differences in implied volatility across maturities.

Diagonal Spreads

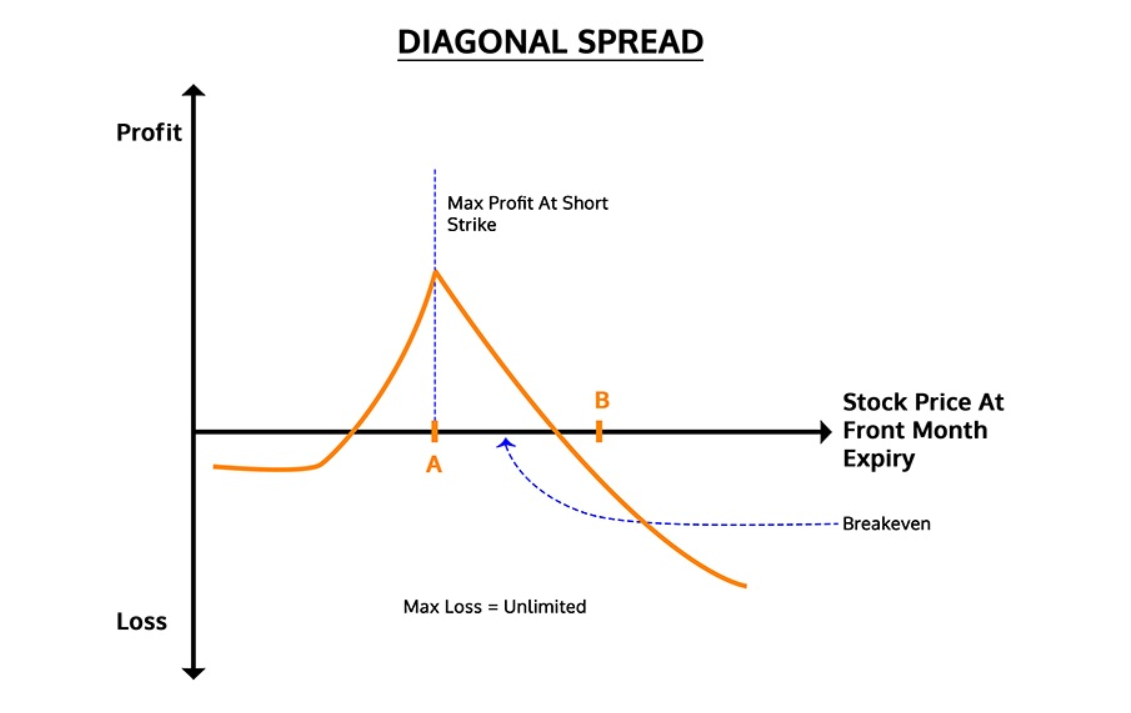

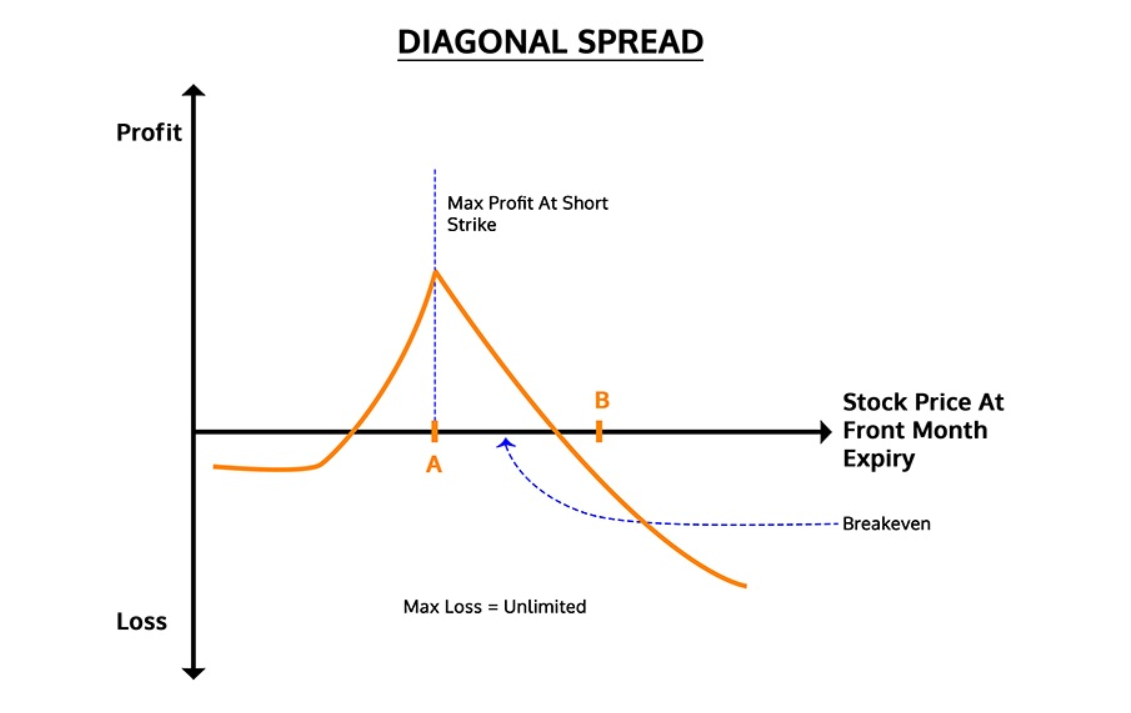

A diagonal spread is a hybrid between vertical and calendar spreads, combining different strikes and different expirations.

This gives traders more flexibility: they can express a view on both direction and time. For example, a trader might sell a near-term call at one strike while buying a longer-term call at a different strike, aligning the spread with a more nuanced outlook on market movement.

Why Use Option Spreads?

By construction, spreads cap both maximum profit and maximum loss. For traders who want controlled exposure, this is a major advantage over naked options.

Selling one leg of the spread offsets part of the premium paid for the other, reducing upfront capital outlay. This makes spreads particularly attractive when volatility is elevated, as option premiums become expensive.

Spreads can be tailored for different outlooks:

Bullish (e.g. bull call spread)

Bearish (e.g. bear put spread)

Neutral (e.g. calendar or butterfly spreads)

Volatility-driven (e.g. long straddles vs. condors, though technically outside simple spreads)

Whether markets are trending strongly or range-bound, there exists a spread strategy designed to take advantage of the conditions.

Core Principles to Understand

The Greeks

The success of an option spread depends heavily on how it responds to the Greeks:

Delta: Measures sensitivity to underlying price moves. Vertical spreads are typically constructed with a directional delta bias.

Theta: Reflects time decay. Calendar spreads are designed to benefit from theta differences between near and long expiries.

Vega: Shows exposure to volatility. Diagonal and calendar spreads can either profit from rising implied volatility or suffer when it collapses.

The Trade-Off

Every spread is a compromise. By reducing upfront cost and risk, traders give up unlimited profit potential. This is not necessarily a weakness—many successful strategies rely on consistency and risk control rather than maximum upside.

For example, a bull call spread might generate less profit than a single long call if the asset rallies strongly, but it also costs less to enter and loses less if the rally never materialises.

Conclusion

Option spreads are among the most versatile and powerful strategies available to options traders. By blending long and short positions, they create defined risk-reward scenarios suited to different market conditions—whether trending, range-bound, or volatile.

The key lies in understanding their structure, limitations, and sensitivity to the Greeks. For traders who approach them thoughtfully, spreads can transform options trading from a risky speculative endeavour into a disciplined, structured pursuit of opportunity.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.