Are you asking which trading style is most profitable when the market is this manic?

Every successful trading manual emphasizes the necessity of a defined trading strategy. A profitable strategy serves as your essential guide, especially in the volatile Forex market, providing the clarity needed to successfully manage risk.

The truth is, there's no "one-size-fits-all" answer. Some strategies thrive in high-volatility environments, while others work better in stable conditions. What's important is matching the strategy to your capital, skill level, and risk tolerance.

We have compiled the 10 most profitable types of trading today. These strategies, ranging from hyper-automated AI-driven methods to high-stakes Meme Stock speculation, are optimized for the speed and uncertainty of the current market.

10 Most Profitable Types of Trading

To help you navigate today’s unpredictable markets, we’ve analyzed the most profitable trading styles, complete with real-world insights and practical expectations to guide your next move.

| # |

Type of Trading |

Why It's Profitable in 2025 |

Risks |

Typical Returns |

| 1 |

Swing Trading |

Exploits brief market corrections in stocks, forex, commodities |

Requires patience; late entries erode gains |

5–15% per trade |

| 2 |

Day Trading |

High market swings from inflation, central bank decisions, earnings reports |

Time-intensive; transaction costs; overtrading |

10–20% monthly for disciplined traders |

| 3 |

Algorithmic & AI Trading |

Handles repetitive setups efficiently; reduces emotional bias |

High setup costs; coding expertise needed; backtests may not match live |

–10% to +25% annually (hedge fund data) |

| 4 |

Options Trading |

Hedging + earning premiums; protection against volatility |

Options may expire worthless; leverage magnifies losses |

10–20% yearly (conservative), higher if speculative |

| 5 |

Quantitative Trading |

Exploits market inefficiencies in high liquidity assets |

Model breakdowns; over-optimization |

5–20% historically, strategy-dependent |

| 6 |

News-Based (Event) Trading |

Capitalizes on sharp moves from global uncertainties |

Requires fast execution; spreads widen |

3–10% per trade, higher variance |

| 7 |

Discretionary Macro Trading |

Human judgment adapts better than AI in volatile markets |

Expertise-dependent; narratives can shift unexpectedly |

15–25% (top funds), individual results vary |

| 8 |

Copy Trading |

Accessible via social trading platforms; bypasses steep learning curve |

Depends on copied trader; past performance |

10–20%+ annually, results vary depending on copied trader |

| 9 |

Momentum Trading |

Captures rallies in volatile news-driven markets |

Sudden reversals can lead to losses; requires strict stop-loss |

10–25% on successful trades, high risk |

| 10 |

Scalping |

Thrives on high market liquidity (Forex, futures) |

Extremely time-intensive; high risk if stop-loss rules broken |

5–15% but consistent for disciplined traders |

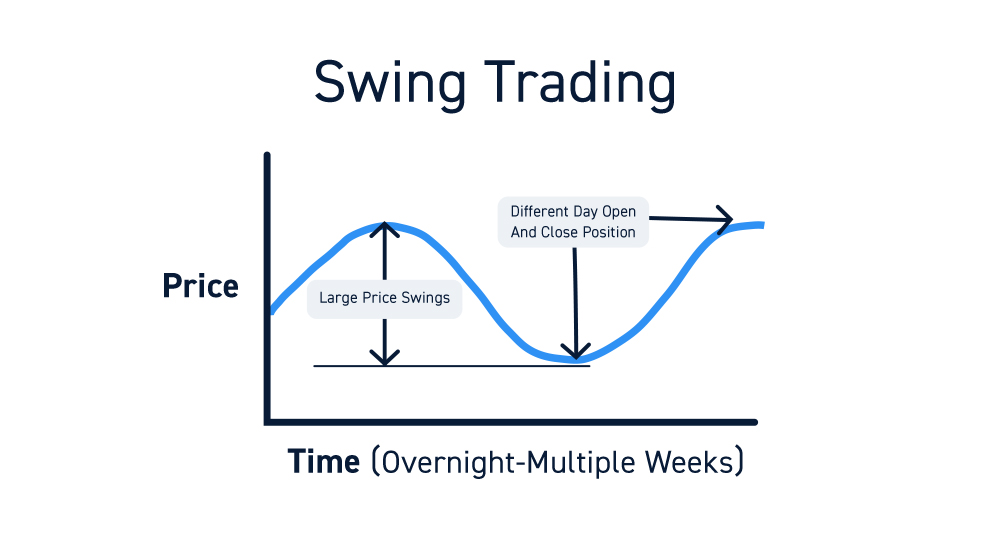

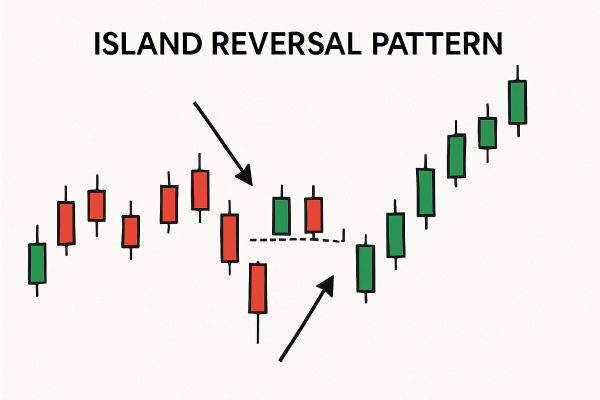

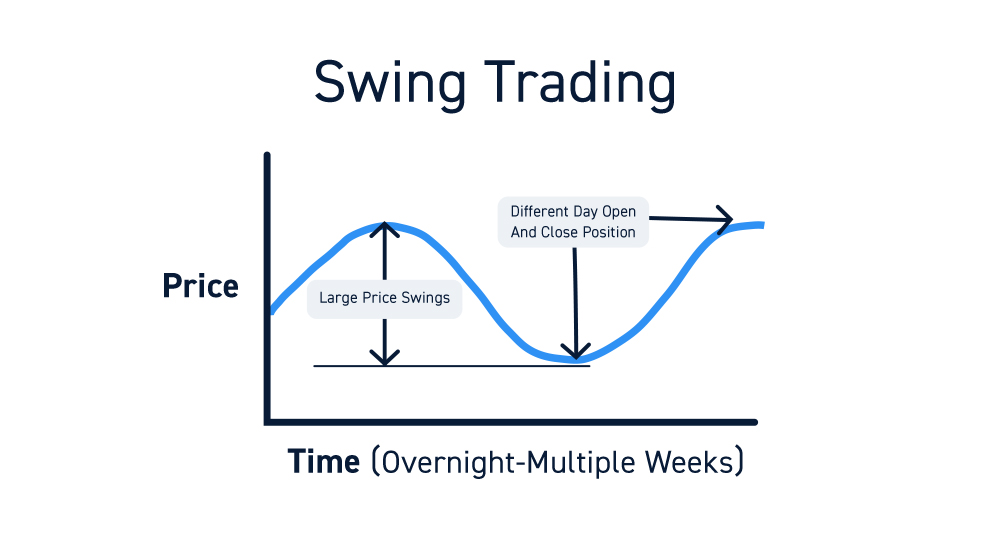

1. Swing Trading

Swing trading aims to capture medium-term moves lasting days to weeks by analyzing price momentum and technical patterns.

Why It's Profitable: Markets continue to be unstable, yet they're not in a perpetual decline. Swing traders can take advantage of brief corrections in stocks, forex, and commodities.

For example, tech stocks influenced by AI and energy sectors have experienced fluctuations of 10–20% in only a few weeks.

Risks: Requires patience and discipline as late entries can erode gains.

Typical Returns: Historically, successful traders profited 5–15% per trade, although results differ.

2. Day Trading

Buying and selling on the same day, often capitalizing on intraday volatility.

Why It's Profitable: High market swings from inflation reports, central bank decisions, and corporate earnings create multiple daily setups.

Risks: Extremely time-intensive; transaction costs and overtrading can eat into profits.

Typical Returns: Ranges widely as some disciplined traders make 10–20% monthly, but many fail without strict risk controls.

3. Algorithmic & AI Trading

Using computer programs or AI to automate trade execution based on pre-set strategies.

Why It's Profitable: AI tools have advanced, making automation accessible beyond institutions. Algorithms excel at handling repetitive setups in forex, equities, and crypto.

New Trend: Hedge funds increasingly combine human discretion with algorithms to capture both macro shifts and micro signals.

Risks: High setup costs, requires coding/technical expertise, and backtest results don't always match live performance.

Typical Returns: Hedge fund data suggests wide ranges (-10% to +25% annually, depending on volatility).

4. Options Trading

Trading contracts that give the right, but not the obligation, to buy/sell an asset at a specific price before expiry.

Why It's Profitable: Options strategies such as covered calls or protective puts allow traders to hedge against volatility while earning premiums. Demand has surged as investors seek protection from uncertain equity markets.

Risks: Options can expire worthless; leverage magnifies losses.

Typical Returns: Conservative income approaches can generate 10–20% yearly, while speculative methods may surpass that figure but involve significant risk.

5. Quantitative Trading

This is data-driven trading using mathematical models, often executed automatically.

Why It's Profitable: Quant trading thrives on market inefficiencies. Pairs trading, mean reversion, and statistical arbitrage remain profitable where liquidity is high.

Reality Check: In 2025, many quant-only funds underperformed compared to human macro traders, showing the limits of purely model-based approaches.

Risks: Over-optimisation and model breakdown during regime shifts.

Typical Returns: 5–20% historically, but highly strategy-dependent.

6. News-Based (Event) Trading

Trading based on market-moving news like earnings, Fed announcements, or geopolitical events.

Why It's Profitable: Global uncertainties (interest rate cuts, oil supply concerns, geopolitical tensions) drive sharp moves that event traders can capitalize on.

Risks: Requires lightning-fast execution; spreads widen during announcements.

Typical Returns: Can deliver 3–10% on single trades but with higher variance.

7. Discretionary Macro Trading

Human-led decision-making based on global macroeconomic trends (currencies, commodities, equities).

Why It's Profitable: Hedge funds report discretionary macro strategies outperforming AI quants in volatile markets, as human judgment adapts to unexpected shocks.

Risks: Relies on trader expertise and can be wrong if narratives shift.

Typical Returns: Top funds delivered 15-25% in early 2025; individual returns vary widely.

8. Copy Trading

Trading: Automatically replicating the trades (both entry and exit) made by an established, often high-performing, professional trader or trading system.

Why It's Profitable: The growth of user-friendly social trading platforms and brokerages has made this strategy highly accessible.

It allows beginners or time-constrained traders to participate in complex markets (like forex or crypto) by leveraging the expertise of proven performers, bypassing the steep learning curve.

Risks: You assume the risk of the copied trader; past performance is not a guarantee of future results. It requires careful selection of the master trader and monitoring to ensure their strategy aligns with your risk tolerance.

Typical Returns: Highly variable, directly reflecting the performance of the copied trader. Successful strategies can often yield 10-20%+ annually, but this depends entirely on the master trader's strategy and risk management.

9. Momentum Trading

Trading: Trades in the direction of strong price moves and exits when momentum fades, often using technical indicators to confirm strength and timing.

Why It's Profitable: In volatile, news-driven markets, certain assets (like AI stocks or specific commodities) can experience sharp, sustained rallies. Momentum traders capitalize on the herd mentality and rapid influx of capital into these high-performing areas before the trend reverses.

Risks: High risk if timing is off. A sudden reversal or "whipsaw" event can lead to significant losses, as these trades rely heavily on rapid, continuous price movement. It requires strict stop-loss management.

Typical Returns: Can yield high rewards, often aiming for 10-25% on successful trades within short periods, but this comes with a high potential for losses on failed trades.

10. Scalping

Trading: Executing dozens of trades per day to profit from tiny, frequent price movements, holding positions for seconds or minutes.

Why It’s Profitable: It thrives on high market liquidity (like Forex or futures), minimizing exposure to major market swings. Small, consistent gains from high-volume execution compound rapidly, often using automation for speed.

Risks: Extremely time-intensive (constant monitoring required); high risk of compounding losses if strict stop-loss rules are broken; profitability easily eroded by high commissions/slippage.

Typical Returns: Aim for a high volume of small wins that can compound to strong monthly returns for disciplined, high-frequency traders.

Key Components of a Trading Strategy

A successful trading strategy requires a structured plan built on discipline and consistency:

Market Selection: Choose markets (like Forex or stocks) that match your expertise and available time.

Trading Timeframe: Decide whether you want quick, intraday moves or long-term trends.

Entry & Exit Criteria: Set clear, objective rules (technical signals, events) for opening and closing trades.

Risk Management: Strictly define how you protect capital using stop-loss orders and proper position sizing.

Performance Evaluation: Track and analyze every trade to measure profitability and consistency.

Adaptation: Be flexible and adjust your plan as market conditions evolve.

Frequently Asked Questions

1. What Type of Trading Is Best for Beginners?

Swing trading and simple options strategies (like covered calls) are considered beginner-friendly as they require less screen time than day trading and allow for more structured decision-making.

2. Which Type of Trading Has the Least Risk?

No trading style is risk-free. However, long-term swing trading and conservative options strategies (like protective puts or covered calls) typically carry lower risks than high-frequency day trading or speculative options.

3. What's the Most Profitable Type of Trading Overall?

In 2025, discretionary macro trading has delivered strong institutional returns, while swing trading and options income strategies are popular among retail traders.

Conclusion

In conclusion, trading in 2025 is shaped by volatility, AI tools, and shifting market cycles. Beginners may find swing trading and simple options strategies more approachable, while experienced traders can explore algorithmic or macro-driven styles.

Important reminder: Historical returns don't guarantee future success. Managing risk and avoiding the pursuit of maximum profit strategies distinguish winners from losers.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.