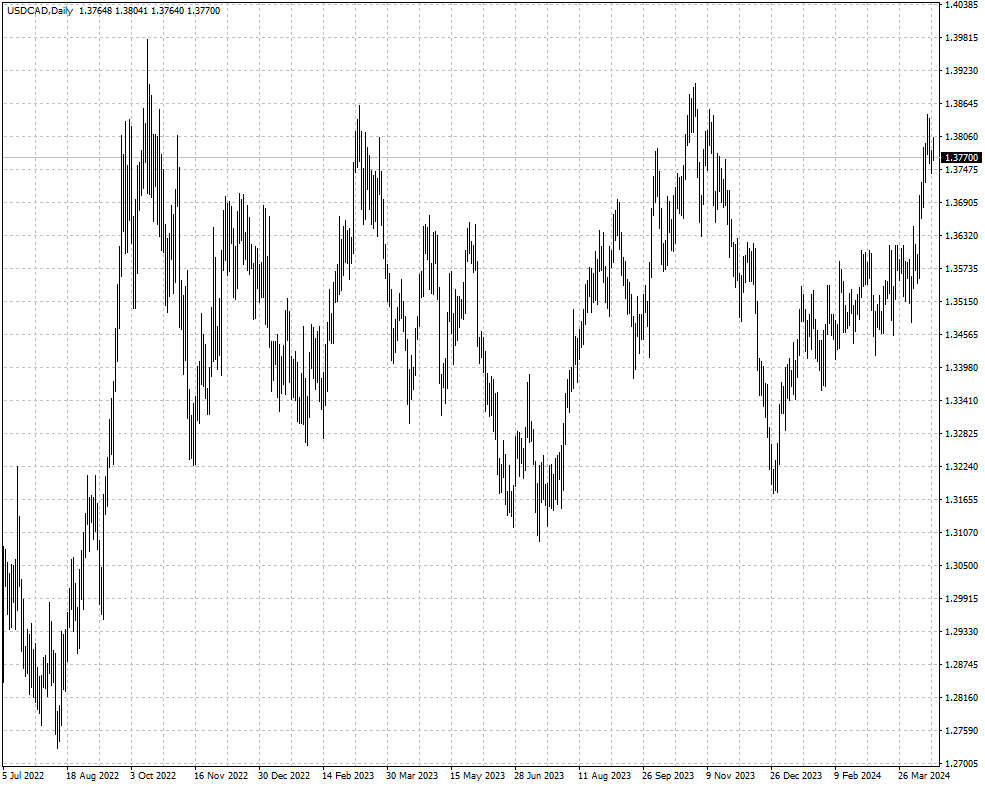

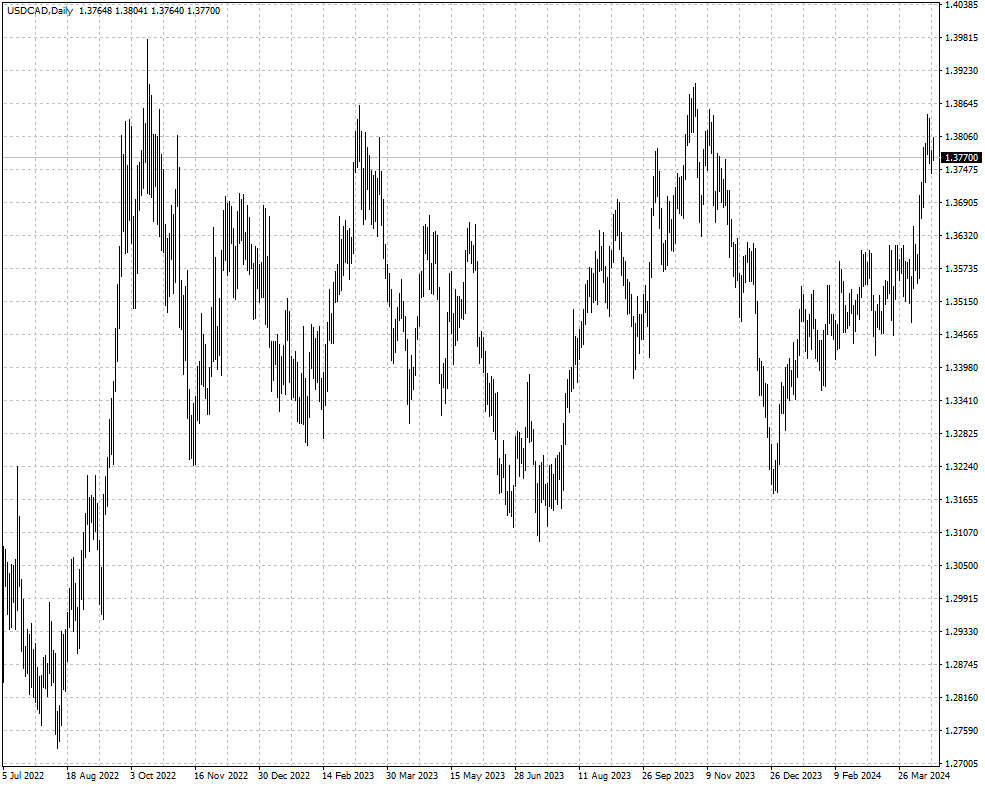

The canadian dollar continues to limp along after the BOC held its rate

steady as expected and signalled they could get closer to monetary loosening at

its meeting earlier this month.

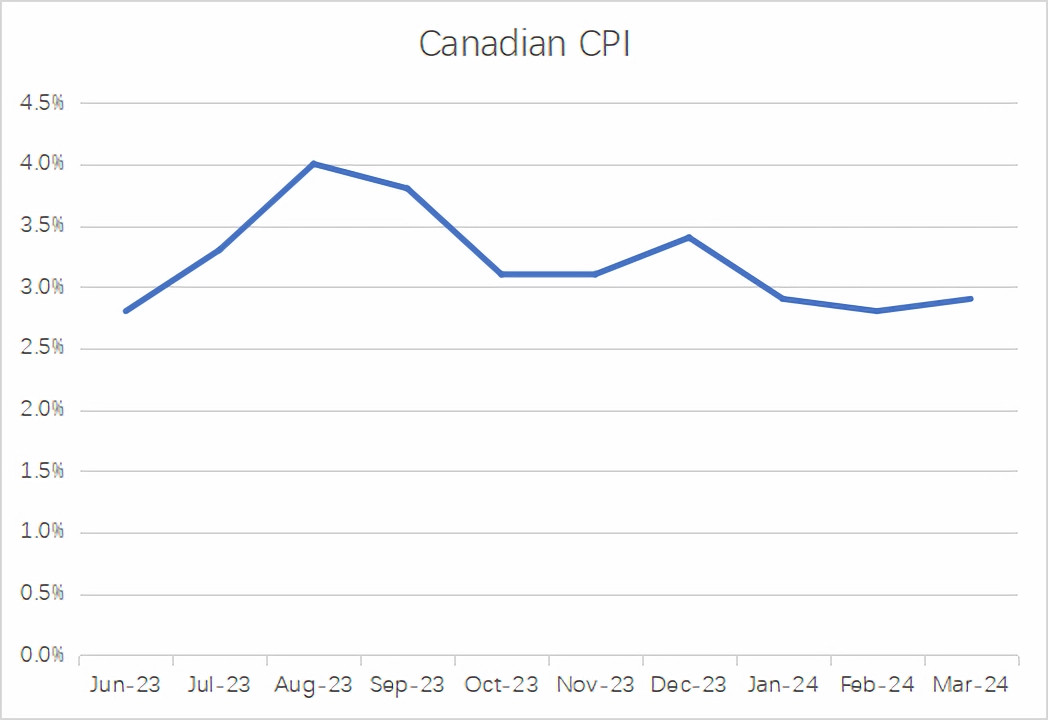

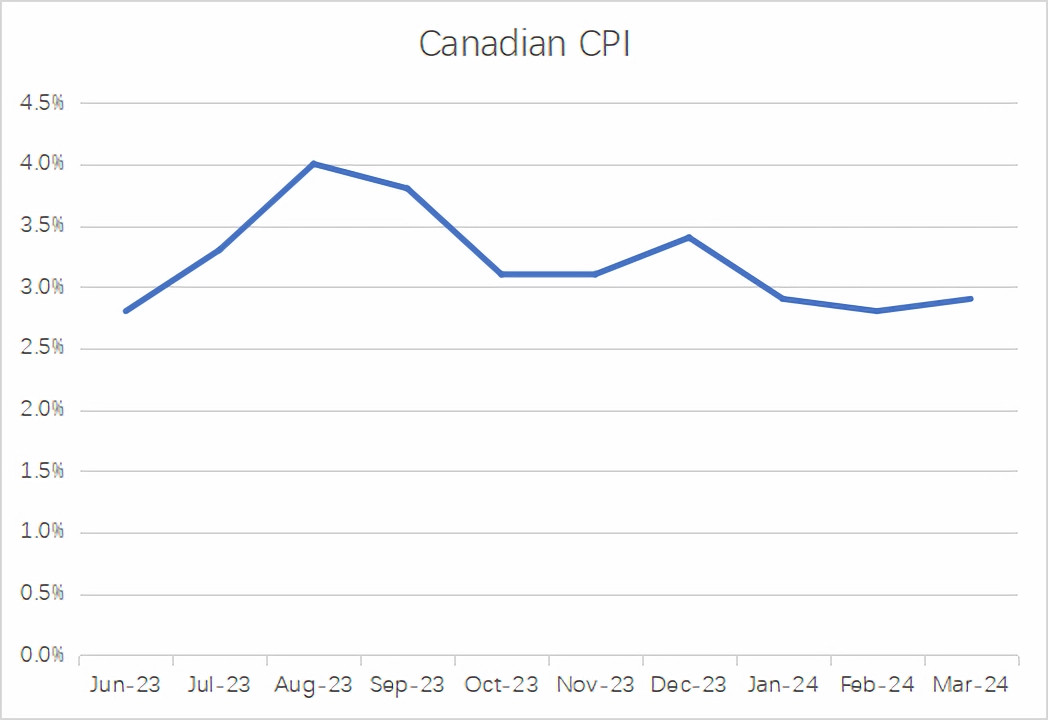

Governor Tiff Macklem Governor Tiff Macklem called further declines in core

inflation “very recent” and said policymakers want to be “assured this is not

just a temporary dip.”

“Sustained downward momentum in core inflation within the next CPI print will

be key in determining whether than process can start at the next meeting in

June,” said Andrew Grantham, an economist at CIBC.

Policymakers now see inflation falling to 2.2% by the end of this year, a

slightly faster deceleration than was previously expected, and officials

continue to see inflation hitting 2% in 2025.

The country’s annual Inflation rate ticked up to 2.9% in March thanks to

higher energy costs, while the core figure continued easing for a third

consecutive month and came in lower than Street expectations.

The SNB surprised investors with a rate cut in March - the first mover of the

developed market easing cycle. That may help bolster its peers’ courage to act

amid signs of resurgence in price growth.

Wide gap

Canada's economy expanded by 0.6% more than expected in January, its fastest

growth rate in a year, data showed. February's GDP is also likely to have grown

by 0.4%.

"The surprisingly healthy start to 2024 points to above-potential growth in

Q1, which could make the BOC a bit less comfortable with the inflation outlook,"

said BMO Capital Markets in a note.

Even so, those figures are overwhelmed by the expected annualised rate of

3.4% for Q1 in the US. The labour market also points to the wide gap with Canada

shedding 2,200 net jobs last month.

Wells Fargo, Monex Europe, RBC and BofA are pencilling in more weakness for

the currency in the coming months as they expect the BOC to turn more dovish

than the Fed this year.

Monex Europe said that the pair will likely touch 1.39 by June, while RBC

expects it to trade at 1.3750. One-week risk reversals showed last week traders

were the most bearish on the currency in a year.

There is still some light at the end of the tunnel. Traders in the SOFR

futures market are piling into a contrarian bet against the US dollar, as

opposed to the current consensus on Wall Street.

Scenarios in which the trade stands to gain include the Fed front-loading

interest-rate cuts before the presidential election in November, and being more

aggressive than believed.

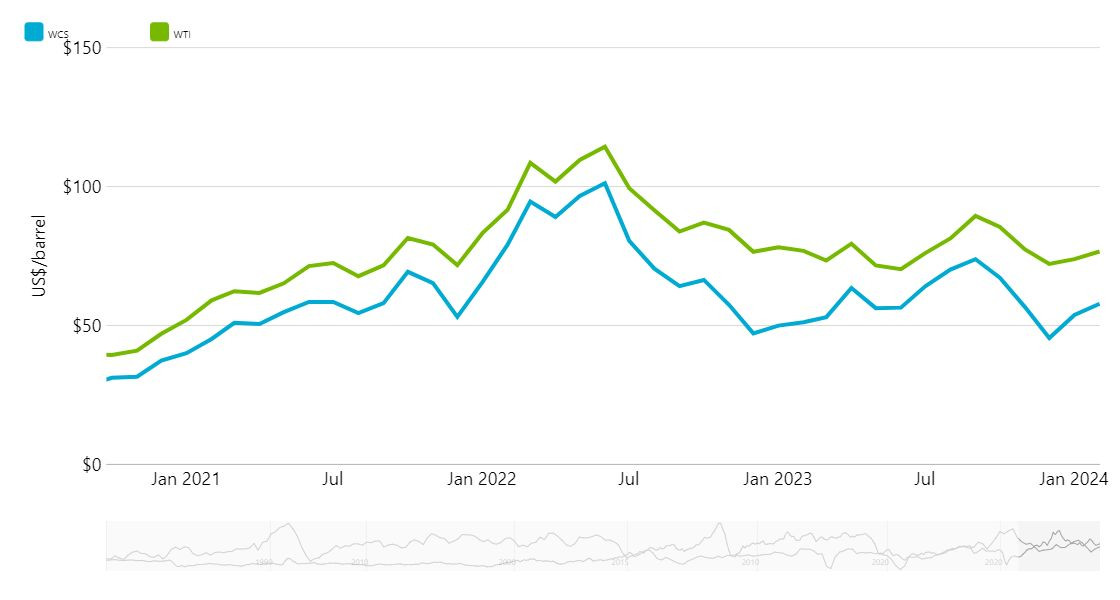

Oil on fire

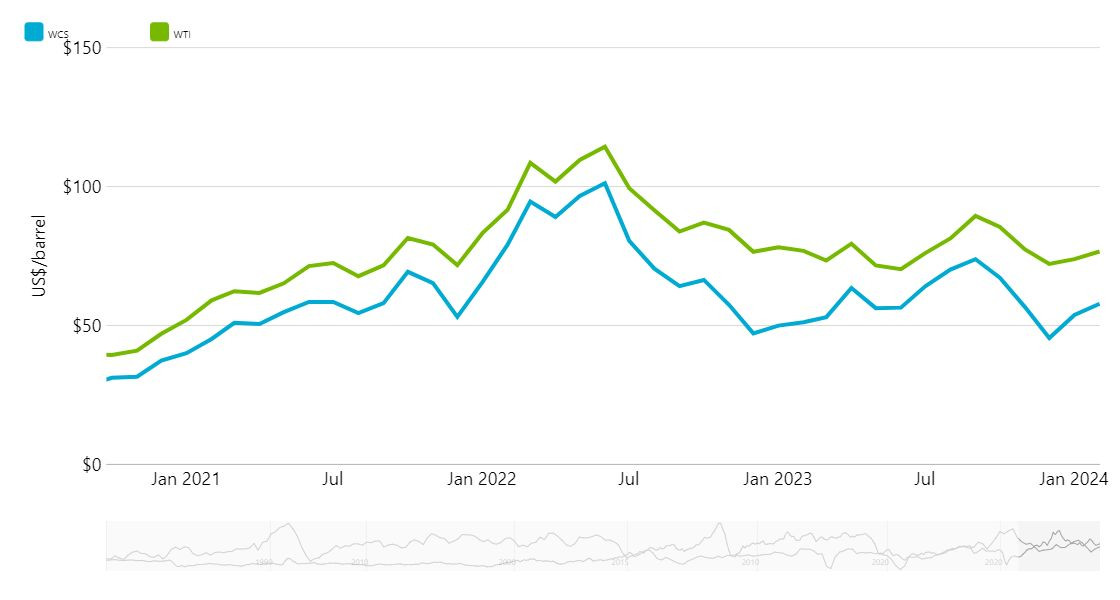

An X-factor in the exchange rate is energy. Benchmark oil price has soared

more than 15% year-to-date as Iran and its proxies in the Middle East are

intensifying their attacks on Israel.

Iran’s United Nations mission warned that its response would be more severe

should there be further Israeli retaliation. Britain’s foreign secretary

acknowledged that an Israeli reprisal seemed inevitable.

Oil prices, trading around $90, could soar to $100 per barrel and beyond,

said market watchers. The buoyant US economy and better-than-expected China Q1

growth may portend robust demand.

Meanwhile, oil faces a sizable natural decline in output. The decline rate

for a conventional oil well is around 15%, absent any capital expenditure,

according to Morgan Stanley’s estimates.

The IEA downgraded its forecast for 2024 oil demand growth last week though,

citing “exceptionally weak” OECD deliveries, a largely complete post-Covid-19

rebound and an EV boom.

WCS has been trading in discount to WTI for many years due to pipeline

shortages and other costs, but completion of the Trans Mountain Pipeline due

later this year should narrow, TD Economics noted.

On an industry-level basis, the oil and gas sector accounts for 4% of total

GDP. The potential annual production growth between 6-10% may translate to a 0.2

– 0.4% increase in Canada’s economy.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.