Indices trading has gained massive popularity among retail and institutional traders in 2025. Whether you're tracking the S&P 500, the NASDAQ 100, or the FTSE 100, trading indices offer broad exposure to markets with fewer complexities than managing a basket of individual stocks.

However, with opportunity comes risk—especially when including margin and leverage. These two powerful tools can amplify profits, but they can also lead to significant losses if misunderstood or misused.

In this comprehensive guide, you'll learn what margin and leverage are, how they apply to indices trading, their pros and cons, key risk management practices and real-world examples.

What Is Indices Trading?

Before diving into margin and leverage, it's crucial to understand what indices trading entails. An index is a basket of stocks that represents a specific segment of the financial market. For example:

S&P 500 tracks 500 large-cap U.S. companies

NASDAQ 100 tracks top 100 non-financial stocks listed on NASDAQ

Dow Jones Industrial Average (DJIA) includes 30 blue-chip U.S. companies

FTSE 100 covers the 100 largest companies on the London Stock Exchange

Instead of buying all 500 stocks in the S&P 500, you can trade index derivatives like:

Many traders opt for CFDs and futures due to their flexibility and margin-based trading structure.

What Is Margin?

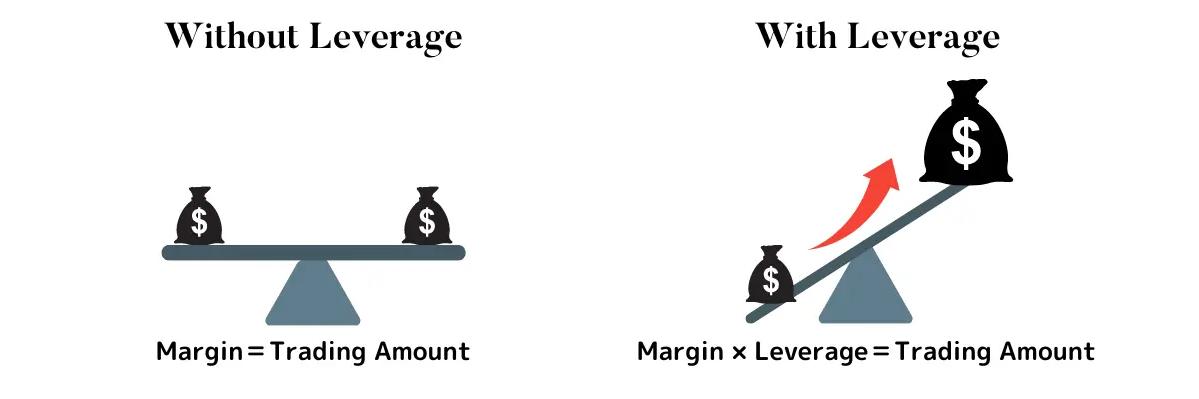

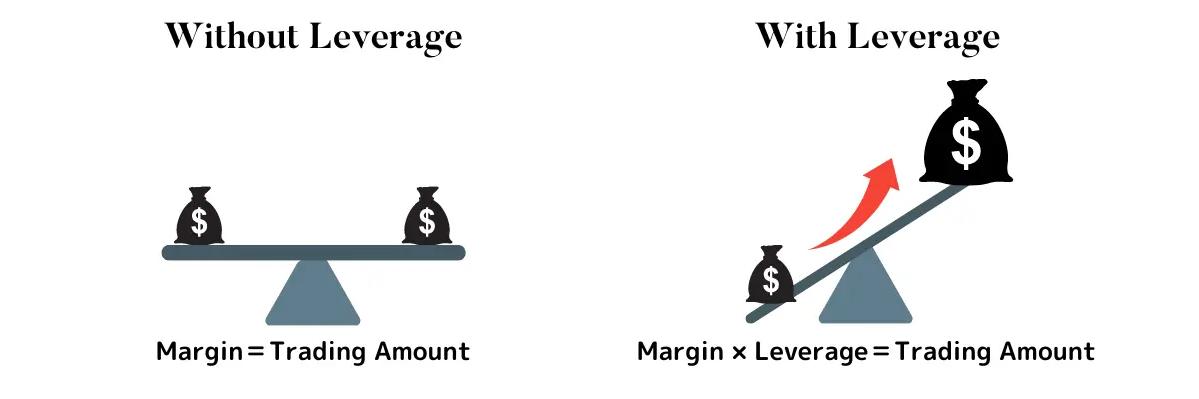

Margin is the amount of money a trader must deposit with a broker to open a leveraged position. It acts as collateral for the trade.

Types of Margin:

1) Initial Margin

The minimum deposit required to open a trade.

2) Maintenance Margin

The minimum equity required to keep your trade open. Falling below this level may trigger a margin call.

Example:

Suppose you're trading the S&P 500 index via CFDs. If the contract value is $10,000 and your broker requires a 5% margin, you'd need to deposit $500 to control a $10,000 position.

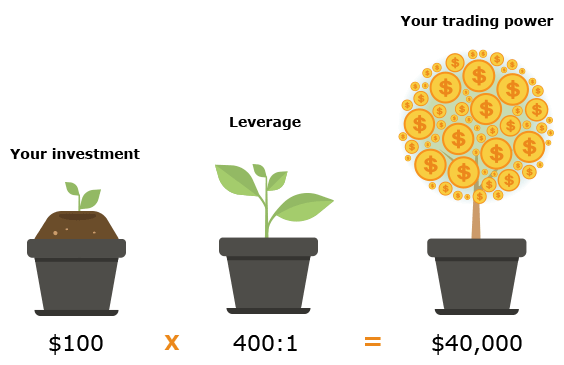

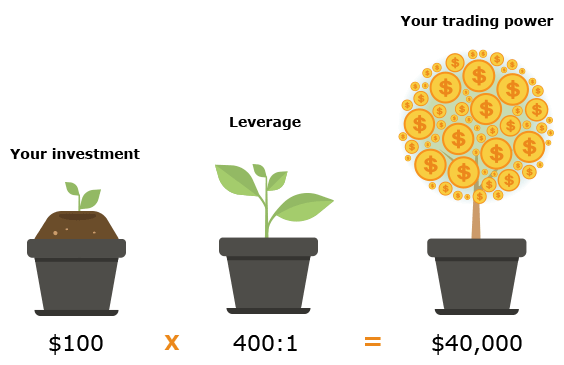

What Is Leverage?

Leverage allows you to control a large position with a relatively small amount of capital. It's expressed as a ratio, such as:

1:10 (10x leverage)

1:50 (50x leverage)

1:100 (100x leverage)

Using leverage can magnify both profits and losses. While it's a powerful tool, it must be used with extreme caution.

Leverage Formula:

Leverage = Total Position Size / Margin Used

Margin vs Leverage

| Feature |

Margin |

Leverage |

| Definition |

The amount of capital needed to open a trade |

The ratio of exposure to capital invested |

| Example |

$1,000 margin for a $20,000 position |

20:1 leverage |

| Trader Control |

Determines how much capital is tied up |

Determines exposure level |

How Margin and Leverage Work in Indices Trading

Let's break it down with an example:

With just $3,000, you're controlling a $150,000 position. A 1% move in the index (150 points) results in:

Profit/Loss = 150 x $10 = $1,500

A 1% move can yield a 50% return or loss on your margin. This example shows the amplifying effect of leverage.

Real-World Examples: Profit and Loss Scenarios

Example 1: Leveraged Profit

Index: S&P 500 rises from 4,000 to 4,050

Contract: $10 per point

Position: 2 contracts (4,000 = $80,000 exposure)

Margin: $2,000

Gain: 50 points x 2 contracts x $10 = $1,000

Return on Margin: 50%

Example 2: Leveraged Loss

Same scenario, but the index drops to 3,950

The key takeaway? Even a 1.25% move in the index caused a 50% swing in your margin-based return.

Best Practices for Trading Indices with Margin and Leverage

1. Use a Stop-Loss on Every Trade

Protect your downside by defining a stop-loss before entering the trade.

2. Start with Lower Leverage

Even if your broker provides a leverage of 1:100, it is advisable to use a lower leverage, such as 1:5 or 1:10, to minimise risk.

3. Calculate Position Size Carefully

Use risk management formulas to determine the amount of contracts to trade.

4. Monitor Margin Level Regularly

Avoid margin calls by maintaining your equity above maintenance levels.

5. Avoid Overexposure

Avoid using margin to open multiple trades simultaneously without adequate capital.

Risks of Margin and Leverage in Index Trading

1. Magnified Losses

Just as profits are amplified, so are losses. A small adverse move can wipe out your account.

2. Margin Calls

If your account equity falls below the maintenance margin, your broker may issue a margin call, requiring you to deposit more funds—or close your position at a loss.

3. Forced Liquidation

If you fail to meet a margin call, your broker may automatically close your position to prevent further losses.

4. Overtrading

Leverage can tempt traders to take more trades than their risk tolerance allows, leading to impulsive decisions.

Tools to Manage Leverage Risk

| Tool |

Purpose |

| Position Size Calculator |

Determines how many contracts you can afford |

| Margin Calculator |

Estimates required margin for each trade |

| Stop-Loss/Take-Profit |

Automates Exit Strategy

|

| Trading Journal |

Tracks performance and risk patterns |

Is Margin and Leverage Suitable for Beginners?

While leverage opens up exciting possibilities, it is generally not recommended for beginners without adequate knowledge and risk control skills.

Alternatives for Beginners:

Trade index ETFs without leverage

Use demo accounts to simulate leveraged trades

Start with small positions and low-leverage

Education, discipline, and risk management should precede profit-seeking.

Conclusion

In conclusion, margin and leverage are integral to modern indices trading, offering the ability to control large positions with minimal capital. When used wisely, they enable traders to amplify gains and seize short-term opportunities. But with great power comes great risk.

When trading the S&P 500, NASDAQ 100, or global indices, treat leverage as a tool rather than a shortcut. Utilising appropriate leverage levels and applying sound risk management are essential for long-term success.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.