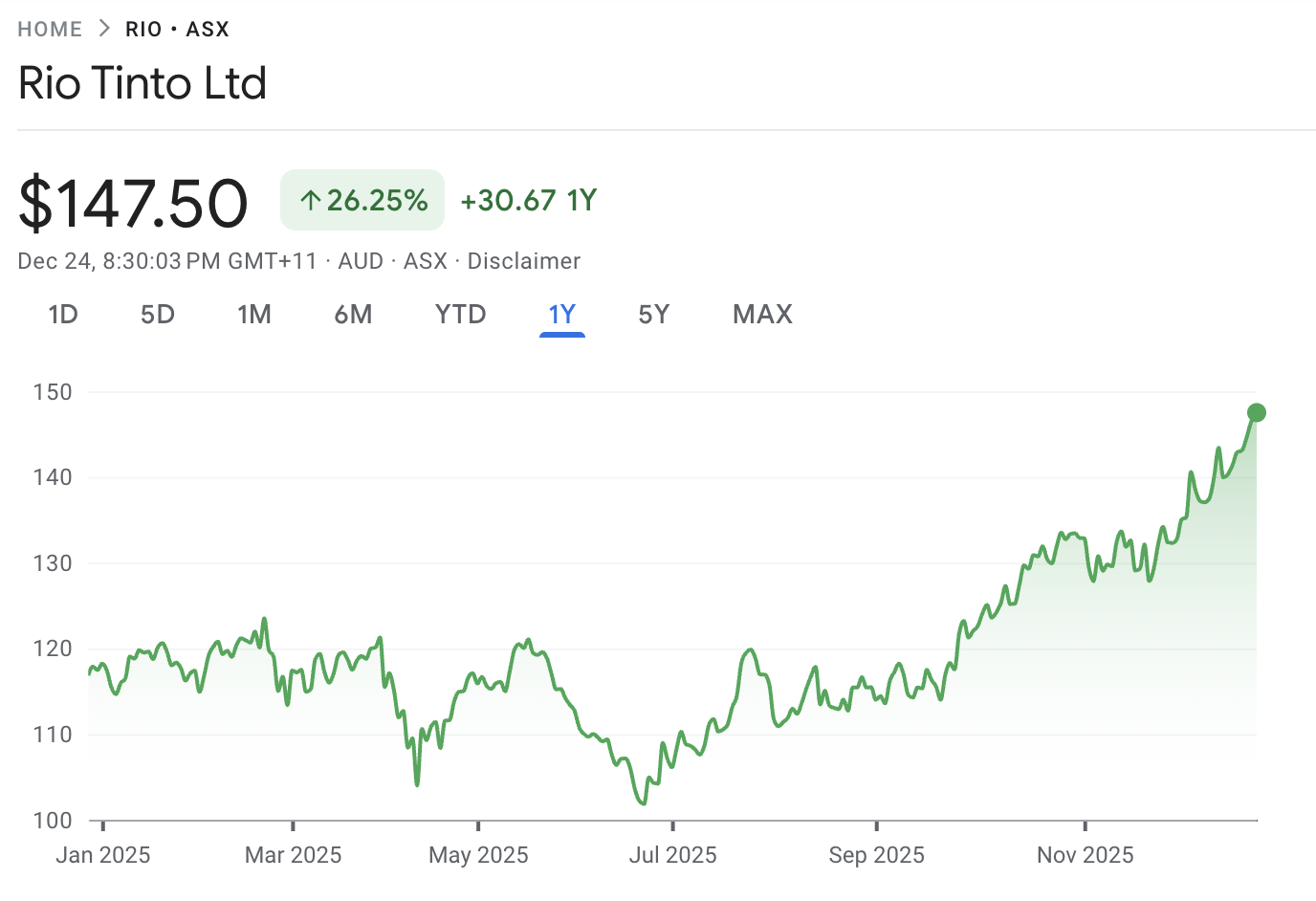

Rio Tinto Stock (NYSE: RIO) is priced near $80.97 per ADR (American Depositary Receipt) and remains one of the market’s most liquid ways to gain exposure to iron ore cash flows while adding meaningful upside to copper, aluminium, and emerging lithium volumes.

The buy case for 2026 depends on whether Rio can hold Pilbara iron ore volumes, convert higher copper production into free cash flow, and keep shareholder returns durable after a step-up in net debt. The company has already published 2026 production and capex guidance, including copper at 800-870 kt, Simandou sales at 5-10 Mt (100% basis), and capex up to ~$11bn.

2026 Setup For RIO Stock

2026 Guidance Points To A Broader Earnings Mix

Rio is entering 2026 with a clearer “mix shift” than it had in past cycles. Guidance shows Pilbara shipments steady at 323-338 Mt (100% basis) while total iron ore sales rise to 343-366 Mt with new contributions from Simandou (5-10 Mt) and higher IOC volumes.

Copper is guided at 800-870 kt, and lithium appears for the first time in the 2026 outlook at 61–64 kt LCE.

This mix matters because Rio’s earnings profile becomes less tied to a single commodity price and more tied to execution across several large systems: Pilbara replacement mines, underground ramp-up in Mongolia, and the early-stage logistics-heavy Simandou build-out. Investors should treat 2026 as an “execution year” more than a “single-price-call year.”

Dividend Strength Is Policy-Driven, Not Promise-Driven

Rio’s dividend framework targets 40-60% of underlying earnings through the cycle. That policy has produced large payouts in strong price environments and smaller payouts when commodity prices or volumes weaken.

For context, Rio reported a $6.5bn full-year ordinary dividend at a 60% payout for its 2024 results. In the first half of 2025, Rio declared an interim ordinary dividend of $2.4bn at a 50% payout. The practical implication for a 2026 “buy” debate is simple: investors should model dividends off earnings power and balance sheet capacity, not off trailing yield alone.

Net Debt Is Higher, So Cash Conversion Matters More

Rio ended the first half of 2025 with net debt of $14.6bn, up from year-end 2024, with the company citing the completion of the Arcadium acquisition as a key driver. Higher net debt does not automatically weaken the thesis for Rio Tinto Stock, but it changes what the market rewards.

When leverage is moving higher, the market typically focuses more on: (1) unit costs, (2) working capital discipline, and (3) whether growth capex stays within the stated envelope. Rio’s 2026 capex guide is up to ~$11bn, with a mid-term (2028+) ambition of up to $10bn as major builds mature.

Iron Ore Still Sets The Floor For Rio Tinto Stock

Even with a broader portfolio, iron ore remains the largest single earnings driver. In H1 2025, Rio reported an average realised Pilbara iron ore price (FOB) of $89.7/dmt, down 15% year on year, and explicitly linked the period’s earnings headwind to a lower iron ore price environment.

The demand side still maps closely to global steel consumption. The World Steel Association projects global steel demand at about 1,749 Mt in 2025 (flat vs 2024) and a 1.3% rebound to about 1,773 Mt in 2026. (worldsteel.org) A modest demand recovery is helpful, but it is not a guarantee of higher ore prices if supply growth outpaces it.

Copper Is The 2026 Differentiator

Copper is increasingly the “swing factor” in the Rio Stock outlook. Rio upgraded 2025 copper guidance to 860-875 kt and cut copper unit cost guidance to 80–100 c/lb, then set 2026 copper guidance at 800-870 kt.

This is the distinct analytical angle for 2026: Rio does not need a perfect iron ore tape to work if copper volumes hold and unit costs stay controlled. A miner that can grow copper output while keeping capex capped tends to earn a higher-quality multiple than a miner that only rides iron ore price momentum.

Rio Tinto Stock Fundamentals Investors Track

Segment Mix Shows Why The Story Has Changed

Rio’s first-half 2025 performance illustrates the portfolio shift. The company reported an underlying EBITDA split that showed Iron Ore $6.7bn, Aluminium $2.4bn, Copper $3.1bn, and Minerals $0.3bn for the half. [1] This matters for valuation because it reduces the probability that a single commodity downturn wipes out the entire year’s cash generation.

The same release highlights that copper-equivalent production growth supported volumes and mix, offsetting weaker iron ore price realisations. For a 2026 buy decision, investors should watch whether this “offset effect” persists in a normalised weather year in the Pilbara.

Capex Discipline Is The Hidden Driver Of Per-Share Returns

Rio’s guidance suggests capex remains heavy in 2026, with major projects still in flight. The key is whether that spending is translating into higher, lower-cost volumes rather than simply replacing depleted pits.

The company’s December 2025 investor update explicitly frames mid-term capex falling below prior levels as major builds complete (including Oyu Tolgoi underground, Simandou, and lithium projects). If Rio meets that path, the market typically rewards the combination of stabilising capex and rising production with stronger cash returns.

Commodity Drivers Into 2026

Steel Demand Is Expected To Improve Modestly

The most useful public demand baseline for iron ore is steel consumption. The World Steel Association’s outlook for 2026 implies a mild recovery rather than a boom. That points to a 2026 tape where price is likely to be driven as much by supply additions and restocking cycles as by demand growth.

For Rio Tinto Stock, the investment question becomes: can Pilbara shipments stay reliable, and can Rio avoid cost creep during replacement mine transitions? Stable volumes at stable unit costs can protect margins even when ore prices are not rising.

Base Metals Pricing Has Structural Support

The World Bank’s late-2025 analysis points to base metals firming in 2026–2027, with its base metal price index expected to rise by almost 2% over that period, and copper expected to be among the stronger performers. [2]

This is relevant because Rio’s copper guidance is now large enough to matter to consolidated earnings, while aluminium and bauxite provide additional ballast. A 2026 environment with steady steel demand but firm base metals would typically be constructive for diversified miners versus pure-play iron ore producers.

Lithium Is Optionality, Not The Core Valuation Anchor Yet

Rio’s 2026 guidance includes 61-64 kt LCE. [3] That is meaningful operationally, but lithium is still unlikely to dominate group earnings in 2026 unless prices surge or margins beat expectations.

The more realistic way to treat lithium in a RIO stock forecast is as a “future growth lever” that can improve the market’s view of Rio’s long-duration relevance, especially if execution is clean and capital intensity stays controlled.

Rio Stock Forecast: Three Scenarios For 2026

Forecasting Rio Stock is best done with scenarios tied to commodity prices, volumes, and costs rather than a single-point target.

| 2026 Scenario |

Operating Backdrop |

What Usually Happens To RIO Stock |

| Bull Case |

Iron ore stable-to-firm, copper stays strong, Pilbara shipments hit the upper half of guidance, costs stay controlled |

Higher earnings quality plus dividend confidence typically supports a re-rating and stronger total return |

| Base Case |

Iron ore range-bound, copper supportive but volatile, volumes near midpoints, capex within guidance |

Returns tend to track dividends plus modest price gains; valuation stays anchored to cash flow durability |

| Bear Case |

Iron ore weak, copper pullback, weather or operational disruptions cut volumes, unit costs rise |

Dividends usually compress with earnings; the stock often derates until margins and volumes stabilise |

A practical takeaway: 2026 looks less like a “make-or-break iron ore year” and more like a year where copper execution and capex discipline can protect the equity even if iron ore is not leading.

Risks That Can Break The Buy Thesis

Rio Tinto Stock carries real cyclicality and project risk. The highest-impact risks for 2026 typically include:

Iron Ore Price Downshift: A sharp fall in realised prices can overwhelm diversification.

China-Linked Volatility: Steel demand and restocking cycles can swing quickly, impacting seaborne ore pricing.

Execution Risk On Growth Projects: Logistics and commissioning delays can push capex higher or delay volumes.

Cost Inflation: Labour, diesel, and contractor pricing can lift unit costs, especially during replacement mine builds.

Balance Sheet Sensitivity: Higher net debt increases the market’s focus on cash conversion and funding discipline.

How Investors Judge Whether Rio Tinto Stock Is A Buy In 2026

A disciplined “buy” decision is usually based on a short checklist:

Compare guidance to delivery: watch quarterly shipment and cost trends versus the stated 2026 ranges.

Track dividend capacity: link expected payouts to the 40–60% framework and the balance sheet, not just trailing yield.

Stress-test the iron ore floor: assume a weaker ore environment and check whether copper and aluminium can keep free cash flow positive.

Watch capex creep: the upside case strengthens if capex stays within guidance while volumes rise.

Frequently Asked Questions (FAQ)

1. Is Rio Tinto stock a good long-term investment for dividends?

Rio Tinto Stock is often viewed as a dividend name because it targets total cash returns of 40–60% of underlying earnings through the cycle. The dividend can be large in strong commodity years and smaller in weaker years, so income investors must accept variability.

2. What is the Rio Stock forecast for 2026?

A useful rio stock forecast is scenario-based. If iron ore is stable and copper volumes deliver within guidance, dividends and valuation support can remain firm. If iron ore weakens sharply or costs rise, payouts typically compress and the stock can derate.

3. Why does copper matter so nuch for RIO stock now?

Rio has published large copper guidance for 2025 and 2026 and is targeting lower unit costs, making copper a bigger contributor to group earnings quality. A supportive copper environment can offset weaker iron ore conditions, especially when volumes rise and costs fall.

4. How important is Simandou to Rio Tinto Stock in 2026?

Simandou appears in Rio’s 2026 guidance at 5-10 Mt (100% basis), making it more relevant than in prior years. In 2026, the project is more about execution and ramp discipline than immediate earnings dominance, but it can influence sentiment.

5. Does higher net debt change the RIO investment case?

Higher net debt does not automatically weaken the case, but it raises the bar for execution. Investors tend to demand tighter capex control, steady unit costs, and strong operating cash flow when leverage rises. Rio reported $14.6bn net debt at mid-2025.

Conclusion

Rio Tinto Stock in 2026 sits at the intersection of steady iron ore scale and rising copper influence. The company’s published 2026 guidance makes the story more measurable: investors can track volumes, capex, and mix quarter by quarter rather than relying on a single macro call.

A “buy” view is strongest when iron ore is stable, copper volumes and costs improve, and capex stays within guidance, because that combination supports both dividends and valuation. A cautious view is warranted if iron ore weakens sharply, costs climb, or execution slips on major projects, especially with net debt elevated versus prior years.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources:

[1] https://announcements.asx.com.au/asxpdf/20250730/pdf/06mb398zs47x5w.pdf

[2] https://blogs.worldbank.org/en/opendata/metal-prices-poised-to-strengthen-further

[3] https://www.riotinto.com/en/news/releases/2025/stronger-sharper-and-simpler-rio-tinto-to-deliver-leading-returns