The FTSE 100 soared to a historic high above 8,900 on 10 July 2025, buoyed by renewed optimism over global trade and a wave of buying in the defence and mining sectors.

The rally came as US President Donald Trump announced a temporary reprieve on new tariffs for several key trading partners, lifting sentiment across European markets and propelling London’s blue-chip index to fresh records.

FTSE 100 Hits Record High Above 8,900 on Tariff Relief

The FTSE 100 climbed as much as 1.1% in early trading, reaching an intraday high of 8,952 before settling near 8,920 by midday. This marks the first time the index has broken the 8,900 barrier, reflecting strong investor appetite for UK equities amid easing trade tensions and robust sectoral gains.

The move follows a week of volatile trading driven by shifting US tariff policy. The White House’s decision to delay the implementation of new tariffs for several European nations, including the UK, has been met with relief by investors concerned about the impact on global supply chains and export-driven sectors.

European Markets Rally as Tariff Fears Ease

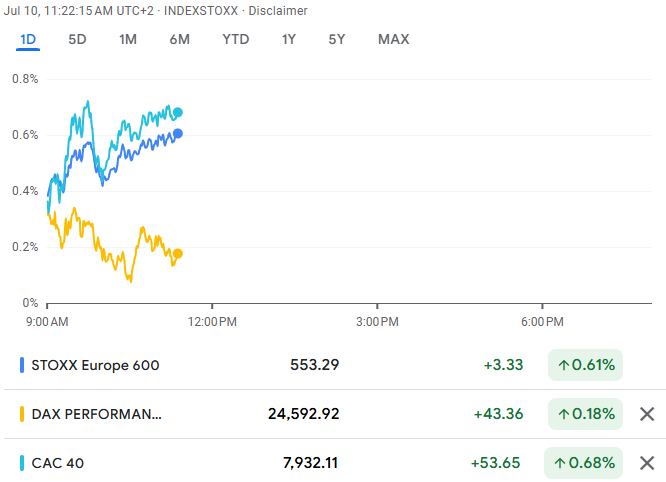

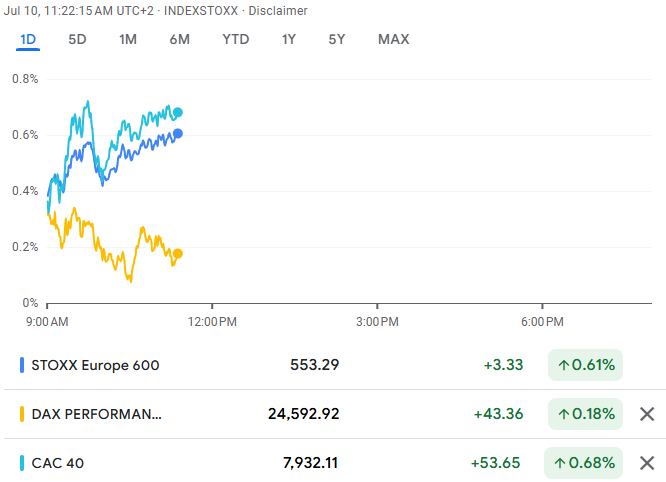

The positive momentum in London was mirrored across the continent. The pan-European Stoxx 600 index rose 0.5% to 540.25, while Germany’s DAX gained 0.7% to 24,206.91 and France’s CAC 40 advanced 0.6% to 7,766.71. European defence stocks, in particular, surged to new highs as investors sought safety amid ongoing geopolitical uncertainty.

The relief rally comes after President Trump confirmed that the 1 August tariff deadline would not be extended, but key US trading partners in Europe and Asia would be granted temporary exemptions. This shift has improved the outlook for multinational exporters and manufacturing firms, many of which are heavily represented in the FTSE 100.

Sector Highlights: Defence and Miners Lead Gains

Defence stocks were among the top performers, with BAE Systems and Rolls-Royce both advancing over 2% on the day. The sector benefited from increased investor demand for safe-haven assets amid continued geopolitical tensions and record defence spending across Europe.

Mining companies also posted strong gains, supported by a 10% surge in US copper futures after the announcement of a 50% tariff on copper imports. Rio Tinto and Glencore led the charge, each rising more than 1.5% as commodity prices rallied.

-

BAE Systems: +2.1%

-

Rolls-Royce: +2.3%

-

Rio Tinto: +1.7%

Glencore: +1.6%

Financials and consumer staples contributed to the advance, while pharmaceuticals and utilities lagged as investors rotated into more cyclical sectors.

Currency and Commodity Moves

The British pound traded steadily at $1.3613, little changed on the day, as the Bank of England maintained its cautious outlook on interest rates. Meanwhile, gold slipped 0.4% to $3,305 per ounce, and Brent crude hovered around $70 per barrel, reflecting stable commodity markets despite recent volatility.

Broader Market Context

The FTSE 100’s record-breaking run comes amid a backdrop of global economic uncertainty. While the US and China remain locked in a protracted trade dispute, the latest tariff relief has provided a temporary boost to risk assets. Investors are also closely watching the start of the Q2 earnings season, with Delta Air Lines and other major corporates set to report results this week.

Central banks remain in focus, with the Bank of England reiterating its commitment to data-dependent policy. The European Central Bank and US Federal Reserve are both expected to maintain accommodative stances as inflation pressures moderate and growth risks persist.

Analyst Perspectives and Outlook

Market analysts remain cautiously optimistic about the FTSE 100’s prospects. The index has gained more than 9% year-to-date, outpacing many global peers as UK equities benefit from attractive valuations and a weaker pound. However, risks remain, including the potential for renewed tariff escalation, slowing global growth, and political uncertainty ahead of upcoming elections in several major economies.

Looking forward, investors will be monitoring:

Further developments in US tariff policy and trade negotiations

Q2 corporate earnings, particularly from export-oriented sectors

Central bank communications and interest rate decisions

Commodity price trends, especially in metals and energy

The FTSE 100’s historic move above 8,900 underscores the resilience of UK equities in the face of global headwinds. While tariff relief has provided a welcome catalyst, the path ahead will depend on the interplay of trade policy, corporate performance, and macroeconomic conditions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.