The covered call is one of the most popular options strategies for both new and experienced traders. It allows you to generate extra income from stocks you already own while managing risk in a straightforward way.

If you're new to options or looking for a practical, income-focused approach, this step-by-step guide will help you understand and implement covered calls with confidence.

What Is a Covered Call?

A covered call is an options trading strategy where you hold (or buy) shares of a stock and simultaneously sell a call option on those shares. By selling the call, you earn a premium, which is extra income, but you also agree to sell your shares at a specific price (the strike price) if the buyer exercises the option.

In simple terms:

You own 100 shares of a stock.

You sell a call option on those shares.

You keep the premium, but may have to sell your shares if the price rises above the strike price.

Why Use a Covered Call Strategy?

Income generation: Collect premiums for each call option sold.

Downside protection: The premium provides a buffer against small declines in the stock's price.

Simplicity: Covered calls are less risky than other options strategies because you already own the shares you're obligated to sell.

Step-by-Step Guide to Placing a Covered Call

1. Choose the Right Stock

Start with a stock you already own or are willing to buy in lots of 100 shares (since each options contract covers 100 shares). Look for stable, well-known companies that you wouldn't mind holding for the medium to long term.

2. Decide on the Call Option to Sell

Select a call option with:

Strike price: Usually above the current share price (out-of-the-money), so you keep your shares if the price doesn't rise too much.

Expiration date: Typically one to two months out, but this can vary based on your goals.

3. Place the Covered Call Trade

Your broker will guide you through the process, and you'll receive the option premium immediately.

4. Manage the Position

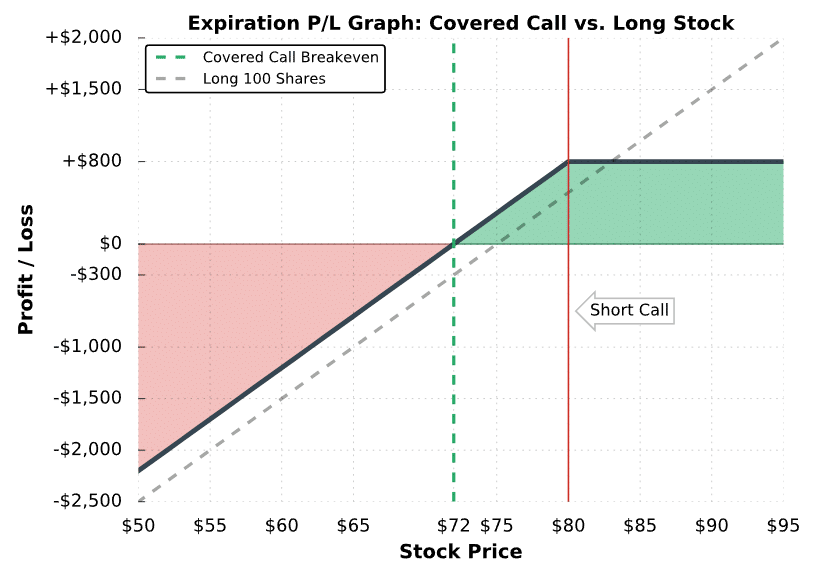

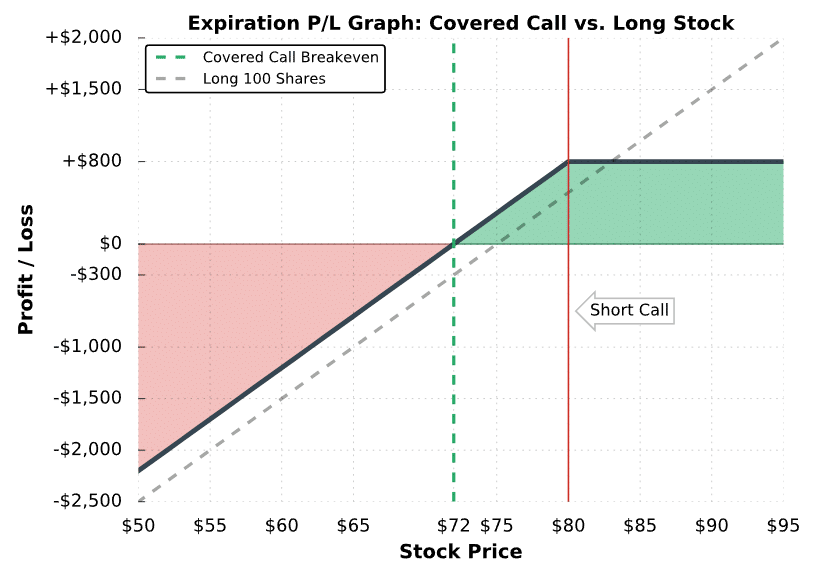

There are three possible outcomes before the option expires:

Stock stays below the strike price: The option expires worthless, you keep the premium and your shares.

Stock rises above the strike price: You may be required to sell your shares at the strike price, but you still keep the premium.

Stock falls in value: You keep the premium, which helps offset some of the loss, but you still hold the shares.

5. Repeat or Adjust

Once the option expires, you can repeat the process (sell another call) or adjust your strategy based on market conditions and your investment goals.

Example of a Covered Call

Suppose you own 100 shares of XYZ Corp at £50 each. You sell a one-month call option with a £55 strike price for a £2 premium per share.

If XYZ stays below £55: The option expires, you keep the £200 premium and your shares.

If XYZ rises above £55: Your shares are sold at £55, and you keep the £200 premium. You miss out on gains above £55 but still profit from the sale and the premium.

If XYZ falls: You keep the £200 premium, which cushions your loss.

Benefits of Covered Calls

Earn extra income on stocks you already own.

Reduce risk with the premium as a buffer.

Flexible: Can be repeated as long as you own the shares.

Risks and Considerations

Limited upside: If the stock price soars, your profit is capped at the strike price plus the premium.

Potential for loss: If the stock drops significantly, the premium only partially offsets your loss.

Requires 100 shares: You must own (or be willing to buy) at least 100 shares per contract.

Tips for New Traders

Start with stocks you know: Avoid volatile or speculative shares.

Choose reasonable strike prices: Slightly out-of-the-money strikes often offer a good balance of premium and upside.

Watch ex-dividend dates: Selling calls just before a dividend may result in your shares being called away.

Monitor your positions: Be ready to adjust or close your trade if market conditions change.

Conclusion

The covered call is a practical, beginner-friendly options strategy that can boost your portfolio's income and offer some downside protection. By following this step-by-step guide, new traders can confidently start using covered calls to enhance returns, manage risk, and gain valuable experience in the options market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.