TSMC dominates advanced chip manufacturing, which makes TSM a good stock to buy if you seek exposure to AI and semiconductors. However, technical leadership brings high capital intensity, and Taiwan/US policy risk means investors must balance upside with possible shocks.

Why TSMC Matters to Investors

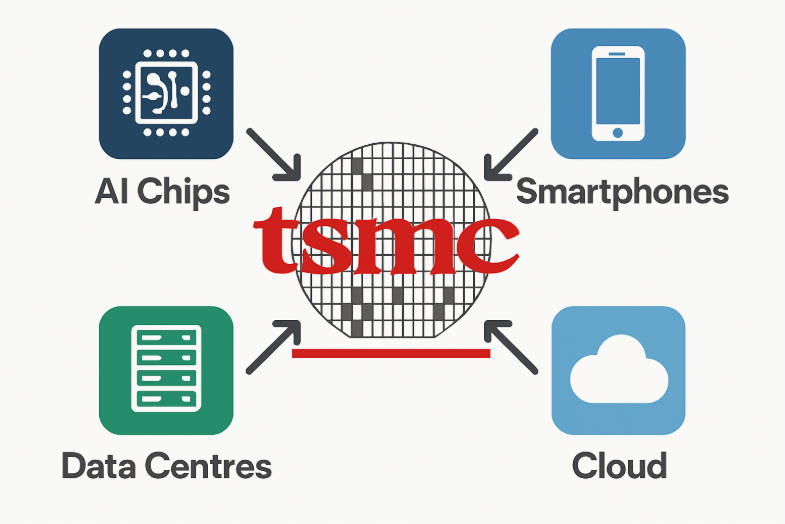

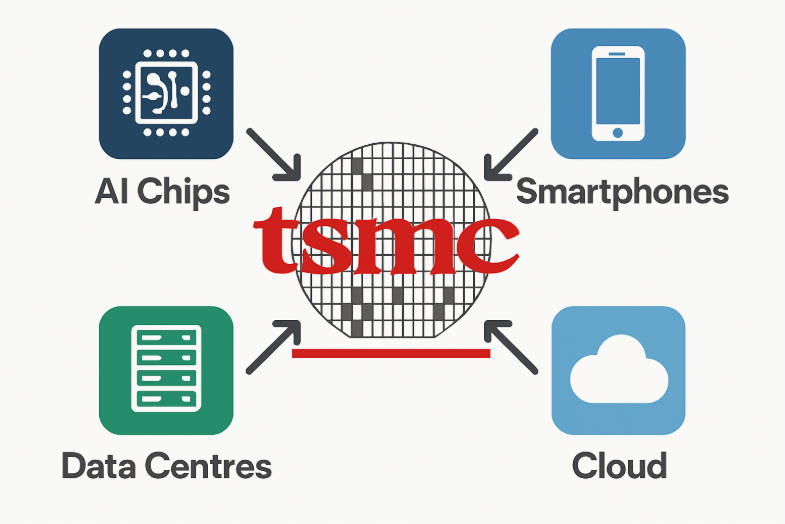

Taiwan Semiconductor Manufacturing Company (TSMC) is at the centre of the global semiconductor supply chain. Its advanced foundries power smartphones, AI accelerators, and data centres worldwide. This unique position makes TSM a top question for investors looking to gain AI exposure without picking individual chip designers.

TSMC's strategic importance goes beyond tech—it reflects global demand trends in AI, cloud computing, and next-generation chips. Understanding its growth drivers and risks is critical before investing.

What Gives TSMC Its Edge

1. Advanced Node Leadership

TSMC leads the semiconductor industry with cutting-edge process nodes (4nm, 3nm). Advanced technology allows higher margins, better yields, and strong demand from top clients like Apple, Nvidia, and AMD. This technological moat supports a long-term "buy" thesis.

2. Strong Customer Contracts

Large, long-term contracts with global tech leaders provide revenue visibility and protect against cyclical downturns. Customers depend on TSMC for mission-critical chips, reinforcing TSM's market position.

3. AI and Cloud-Driven Demand

The rapid growth of AI infrastructure—GPUs, AI accelerators, and data centres—has become a major revenue driver. As AI models scale, demand for TSMC's advanced nodes is expected to grow further.

TSMC Fundamentals and 2025 Guidance

Revenue growth: Mid-30% YoY in USD, driven by AI and advanced chip demand.

Capex commitment: Large investments in fabs and process technology to sustain leadership.

Global expansion: New fabs in the U.S., Japan, and elsewhere reduce concentration risk and meet diversified demand.

These factors show strong demand, technological leadership, and continued reinvestment—key fundamentals for a long-term buy.

Key Risks That Make TSM a More Cautious Buy

1. Geopolitical Concentration

Despite overseas fabs, most advanced production remains in Taiwan. Cross-strait tensions and global power dynamics could disrupt operations and trigger market volatility.

2. Capital Intensity

TSMC's leading-edge fabs require massive investment. Heavy capex years can pressure free cash flow even as they protect the company's competitive moat.

3. Semiconductor Cyclicality and Valuation

Semiconductor demand is cyclical, and AI hype may already be priced into the stock. Buying at elevated valuations increases the risk of short-term losses if demand softens.

How TSMC Rewards Shareholders: Dividends and Buybacks

TSMC prioritises growth over high income. It pays a modest quarterly dividend and occasionally issues special dividends when cash flow allows. While it does return some capital to shareholders, its main focus is reinvesting in advanced fabs and technology.

Key points for investors:

Dividend yield is low compared to income-focused stocks.

Expect growth-first, income-second strategy.

Check TSMC's investor relations page for the latest dividend announcements and payout history.

In short, TSMC rewards shareholders modestly today while investing heavily for future growth, making it more suitable for long-term growth investors than income seekers.

How TSMC's U.S. Fabs Affect Stock Risk and Growth

TSMC's expansion in Arizona and other overseas locations is long-term strategic. While this reduces risk exposure over time, Taiwan remains the centre of advanced production. Investors should view U.S. fabs as risk mitigation, not complete de-risking.

Who Should Buy TSMC? Who Should Avoid

Consider buying if you:

Seek long-term AI and advanced semiconductor exposure.

Can tolerate geopolitical and cyclical risk.

Have a multi-year investment horizon.

Avoid or be cautious if you:

Need capital soon or have short-term liquidity needs.

Already have concentrated Taiwan or semiconductor exposure.

Are uncomfortable with stock volatility.

How to Value and Time Buying TSMC Stock

Investing in TSMC requires careful attention to valuation, guidance, and risk management. Here's a practical approach for long-term investors:

1. Compare Stock Multiples:

Evaluate TSMC's trailing and forward P/E relative to peers like Intel, Samsung, and Nvidia, as well as its historical ranges. This helps determine if the stock is fairly valued or overbought.

2. Monitor Capex and Margin Guidance:

TSMC's large capital expenditures and margin projections significantly impact its fair value. Upward or downward revisions can materially change the investment case.

3. Use Dollar-Cost Averaging:

Semiconductor demand can be cyclical, and AI hype may inflate short-term valuations. Spreading purchases over time reduces the risk of poor entry points.

4. Limit Position Size:

Due to geopolitical exposure and cyclical volatility, many investors consider allocating 3–7% of a diversified portfolio to TSMC. Adjust based on personal risk tolerance.

In essence, valuation, timing, and disciplined buying are crucial for TSMC stock. Following these practical rules helps manage risk while staying positioned for long-term AI and semiconductor growth.

Conclusion: Is TSM a Good Stock to Buy?

TSMC offers world-class technology, strong customer relationships, and direct AI exposure. For long-term investors willing to accept geopolitical and cyclical risks, TSM is a core growth stock. Timing and valuation matter—investors should stagger purchases, monitor guidance, and hold through volatility.

Frequently Asked Questions

1: What makes TSM a good stock to buy?

TSMC dominates advanced semiconductor nodes, supplies major AI and cloud clients, and benefits from long-term contracts. Its leadership in cutting-edge technology offers strong growth potential, making it attractive for investors seeking exposure to the semiconductor sector.

2: Is TSMC safe given geopolitical risks?

Concentration in Taiwan introduces geopolitical risk. While overseas fabs help mitigate exposure, investors should expect some operational and market volatility. Risk-aware investors can balance potential growth against geopolitical uncertainties when considering TSMC in their portfolios.

3: How much TSM should I own in a portfolio?

Typical allocations range from 3–7% of a diversified portfolio, depending on individual risk tolerance. This balances TSMC's growth potential with geopolitical and cyclical risks, allowing investors to gain semiconductor exposure without overconcentration in a single stock.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.