In forex trading, the price does not always move in a smooth and balanced way. At times, the market experiences imbalances, sudden surges where buying or selling pressure dominates, leaving "unfilled orders".

These imbalances often appear as sharp price moves with little retracement, creating zones that traders can later use as reference points for future trades. If you've ever seen a candlestick chart where price shoots up in a vertical move or drops aggressively before pausing, you've witnessed an imbalance.

This guide explains the concept of imbalance in forex, offers examples, and presents a detailed strategy for trading it successfully.

What Does Imbalance Mean in Forex?

An imbalance in the FX market occurs when there is a significant difference between buying and selling orders.

If buyers significantly outweigh sellers, price rallies sharply, creating an upward imbalance.

If sellers dominate buyers, price falls rapidly, forming a downward imbalance.

These moves are often linked to large institutional orders, which overwhelm available liquidity and leave behind a "gap" in the order book.

Retail traders who can identify these zones can anticipate where prices might return in the future to "rebalance."

Why Do Imbalances Happen?

Several factors create imbalances in forex markets:

Institutional Orders: Banks or funds execute massive buy/sell orders, causing strong price displacement.

News Events: NFP, CPI, or interest rate decisions create sudden surges in one direction.

Liquidity Gaps: During periods of low liquidity, even moderate-sized orders can lead to significant price fluctuations.

Stop-Loss Hunting: Big players push prices to sweep liquidity, leaving behind imbalance zones.

These factors suggest that discrepancies stem mainly from institutional operations rather than from retail-driven behaviours.

How to Identify Imbalance on a Chart

Traders usually look for imbalance zones, which appear as:

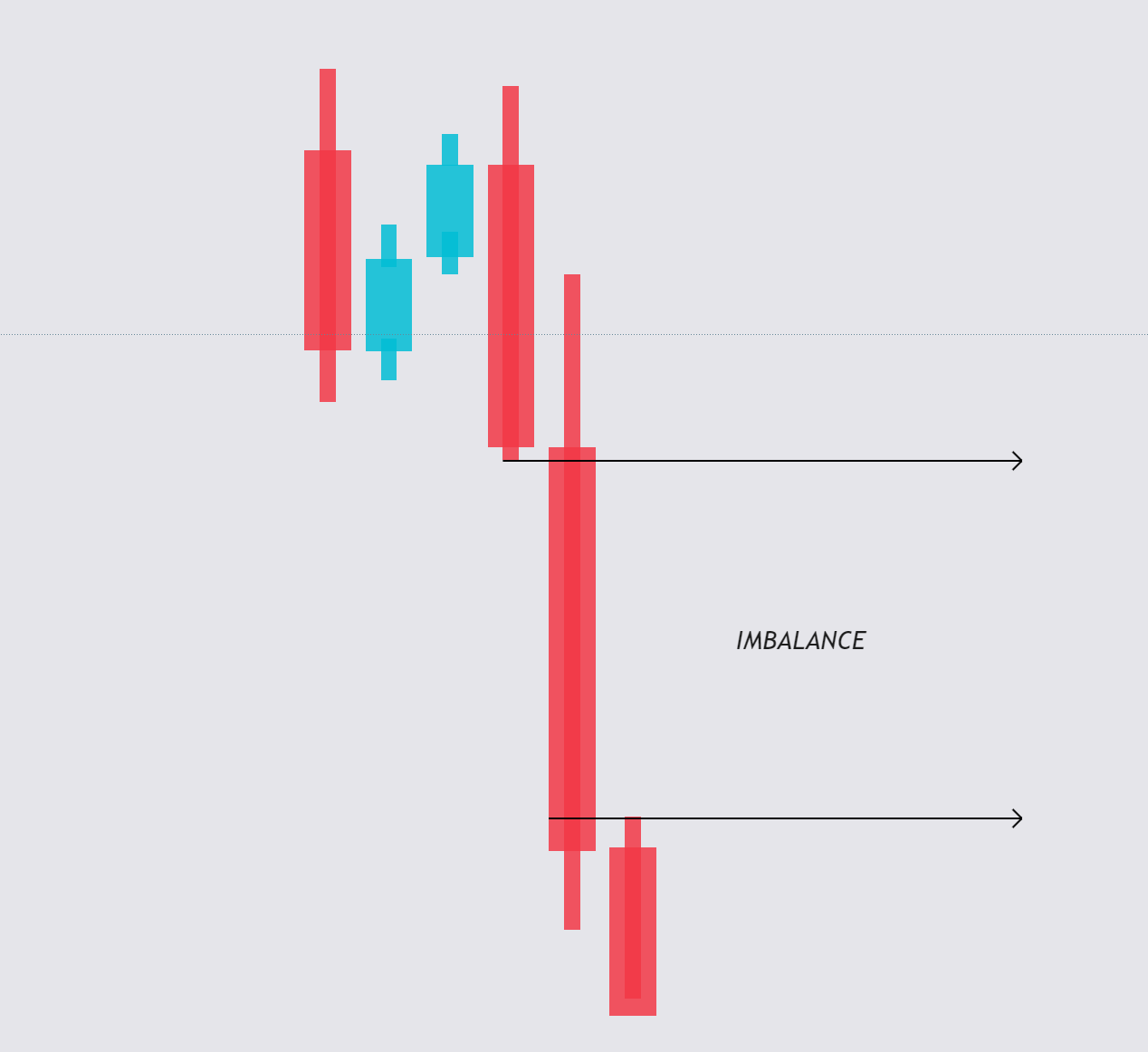

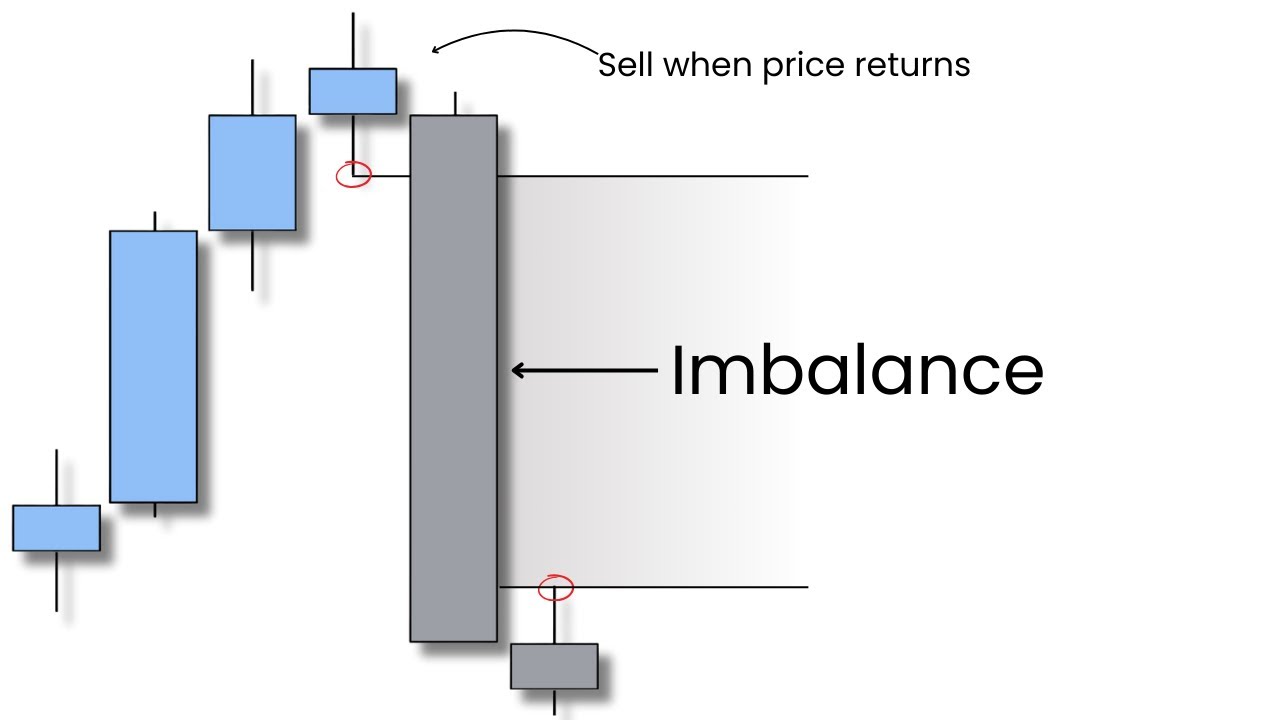

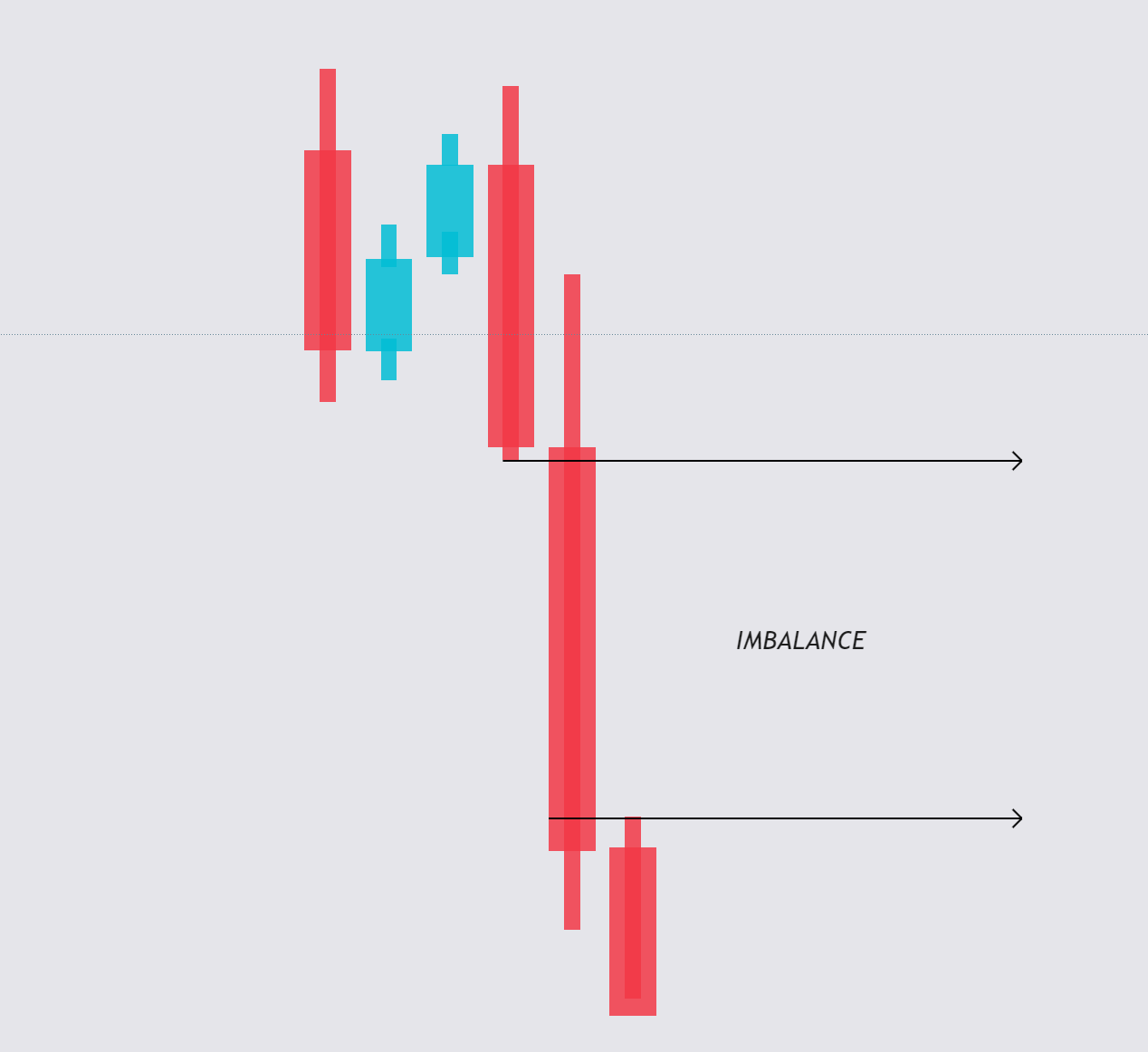

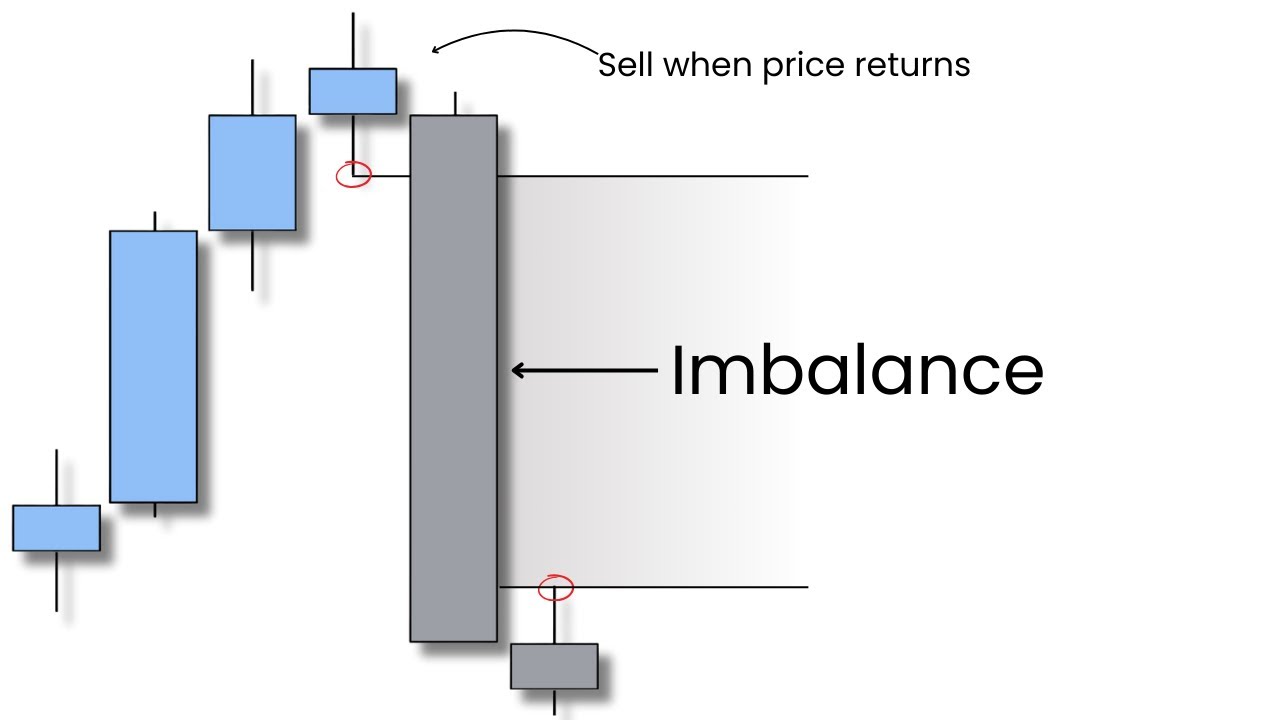

Three-candle patterns: A long, strong candle sandwiched between two smaller candles.

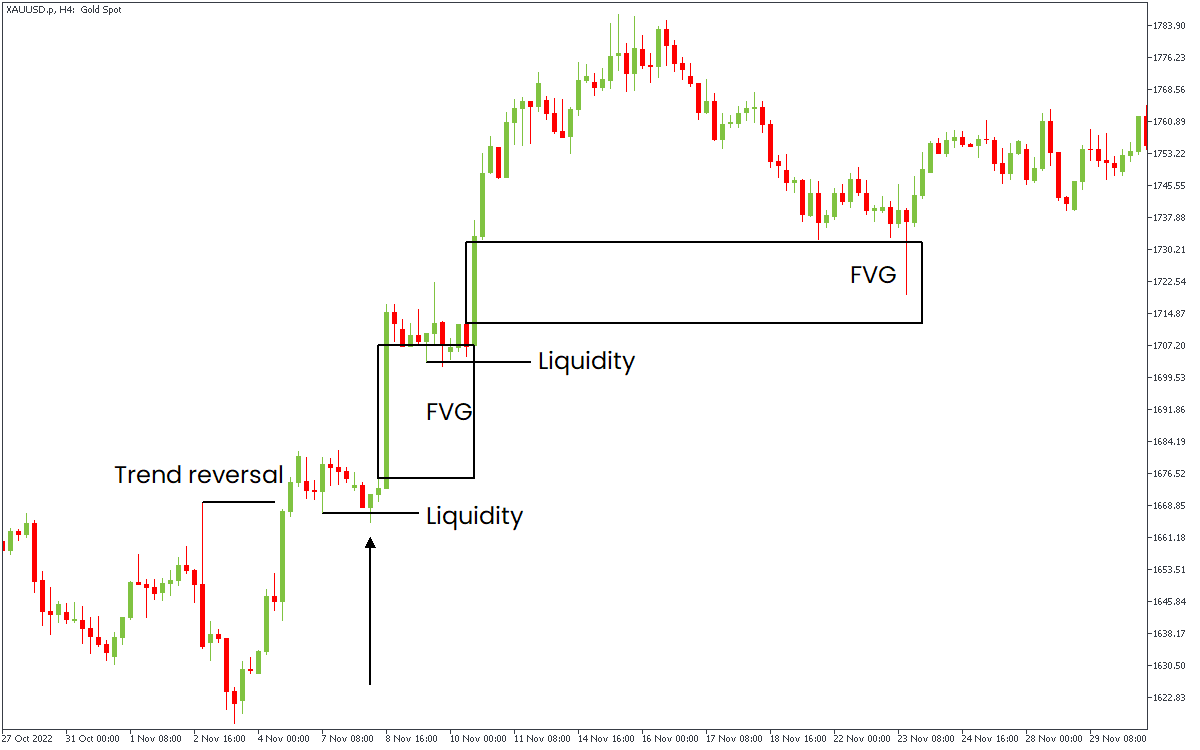

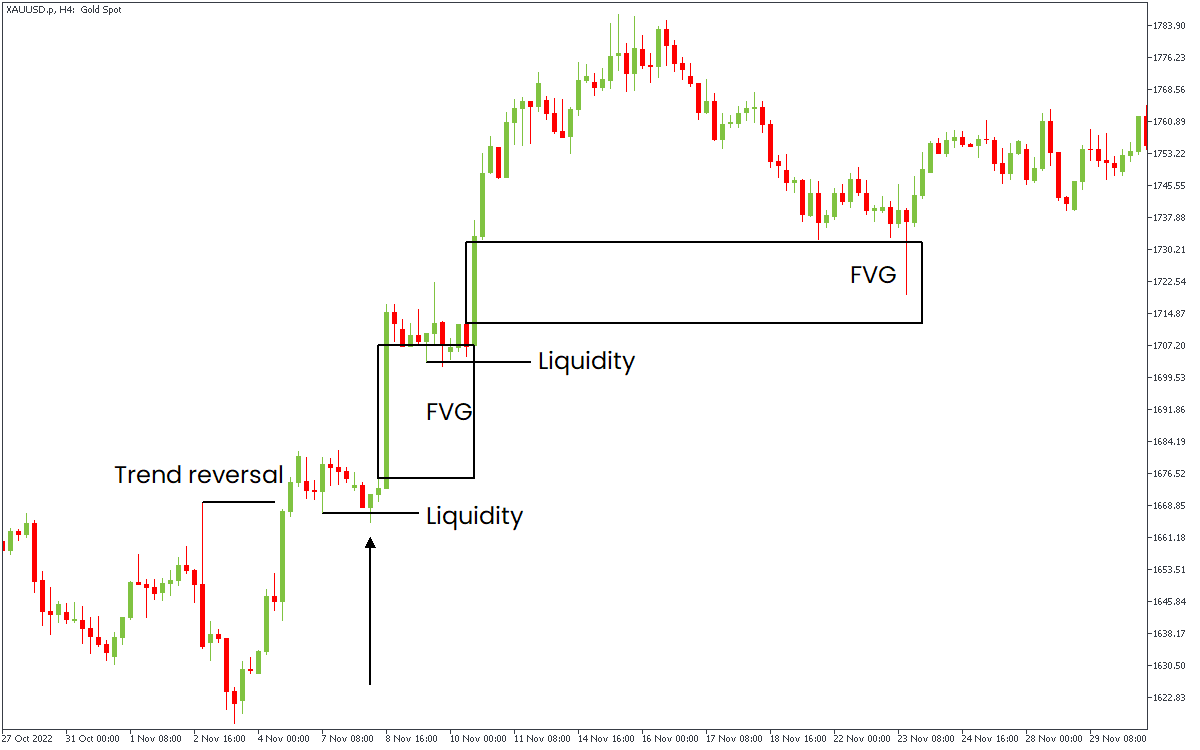

Fair Value Gaps (FVGs): A concept popularised by ICT (Inner Circle Trader), where the market skips price levels without trading much volume there.

Large impulsive moves: Sharp, extended moves with little to no pullback.

For instance, on a candlestick chart, if you observe a bullish candle that is significantly larger than the surrounding candles and the price does not retrace back into the body, that area indicates an imbalance.

Types of Imbalances in Forex

1. Bullish Imbalance

Occurs when aggressive buying overwhelms selling. Seen as sharp upward moves with little retracement.

2. Bearish Imbalance

Created when strong selling pressure dominates, pushing prices downward rapidly.

3. Liquidity Void

A zone where the price moved too quickly, leaving behind very little traded volume.

4. Fair Value Gap (FVG)

A gap between three consecutive candles where the middle candle doesn't overlap the wicks of the first and third.

5. Order Block Imbalance

Linked to institutional order blocks, where one strong candle represents a bulk order that caused displacement.

How to Trade Imbalances in Forex

Trading imbalances is all about waiting for the price to revisit those zones. Here's a structured approach:

Step 1: Identify Imbalance Zones

Look for strong, impulsive candles that left gaps or fair value areas. Mark them on your chart.

Step 2: Wait for Retracement

Avoid chasing the imbalance when it first forms. Instead, wait for the price to retrace into the zone.

Step 3: Enter the Direction of the Original Move

When price revisits the imbalance zone, look for confirmation signals (candlestick patterns, lower timeframe entries, or order flow analysis) to enter a trade in the direction of the imbalance.

Step 4: Set Stop Loss Below/Above the Zone

To manage risk, place a stop loss just outside the imbalance area.

Step 5: Target Previous Highs/Lows or Key Liquidity Levels

Exit trades at logical levels where price might reverse again.

Risk Management in Imbalance Trading

Trading imbalances can be highly rewarding but also risky.

Risks:

False imbalances that retrace fully.

High slippage during volatile events.

Wrong entries when zones are invalidated.

Risk Management Tips:

Never risk more than 1–2% of the account per trade.

Use stop-losses outside the imbalance zone.

Wait for confirmation before entering.

Frequently Asked Questions

1. What Does Imbalance Mean in Forex Trading?

Imbalance in forex refers to a situation where either buying or selling pressure dominates the market.

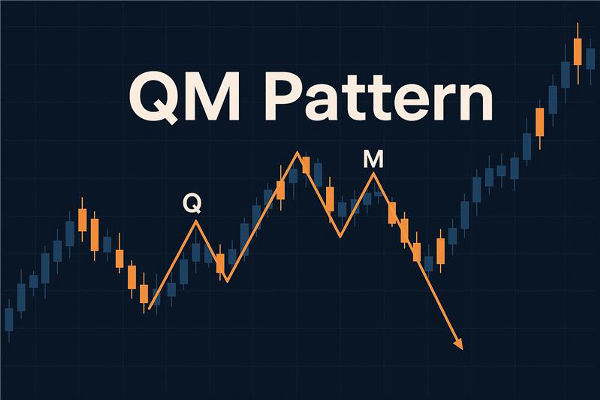

2. Can Imbalance Trading Be Used With Other Forex Strategies?

Yes, imbalance trading is often combined with other strategies such as support and resistance, Fibonacci retracements, and order block trading. This increases accuracy and helps filter out false signals.

3. Is Trading Forex Imbalances Risky?

Yes, imbalance trading can be risky if not effectively managed. To reduce risk, traders should wait for confirmation signals, use stop losses, and avoid over-leveraging.

Conclusion

In conclusion, an imbalance in FX markets is a clear indicator of institutional activity. By identifying these zones, traders can align with smart money, anticipate retracements, and enter high-probability trades.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.