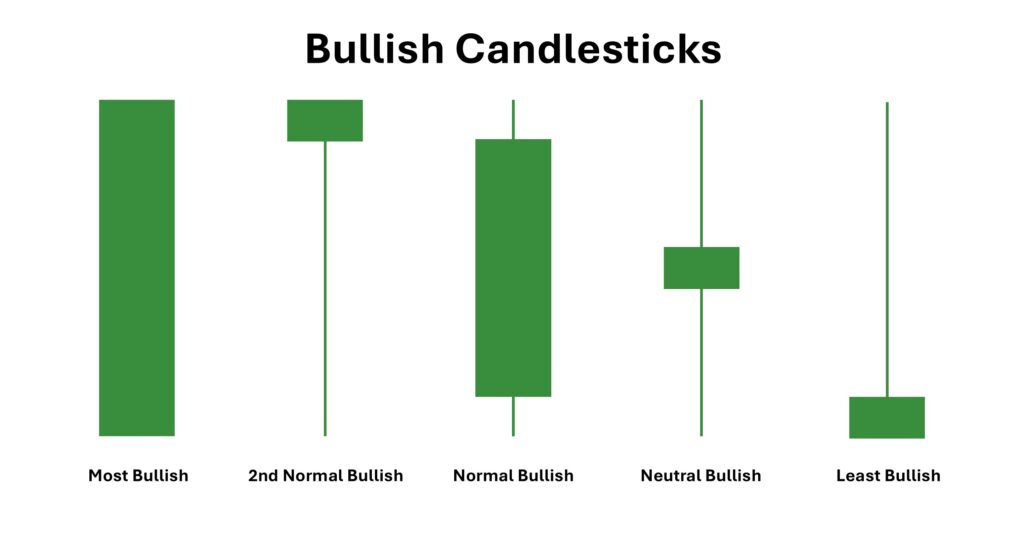

Candlestick patterns are powerful tools for traders looking to anticipate market movements. Among them, bullish candlestick patterns offer valuable insights into potential upward price reversals or continuations, making them essential for spotting buying opportunities.

Whether you're a beginner or a seasoned trader, mastering these candlestick formations can drastically improve your timing and accuracy. In this guide, we'll explore the top 10 bullish candlestick patterns, how to identify them, and how to use them effectively in your trading strategy.

What Are Bullish Candlestick Patterns?

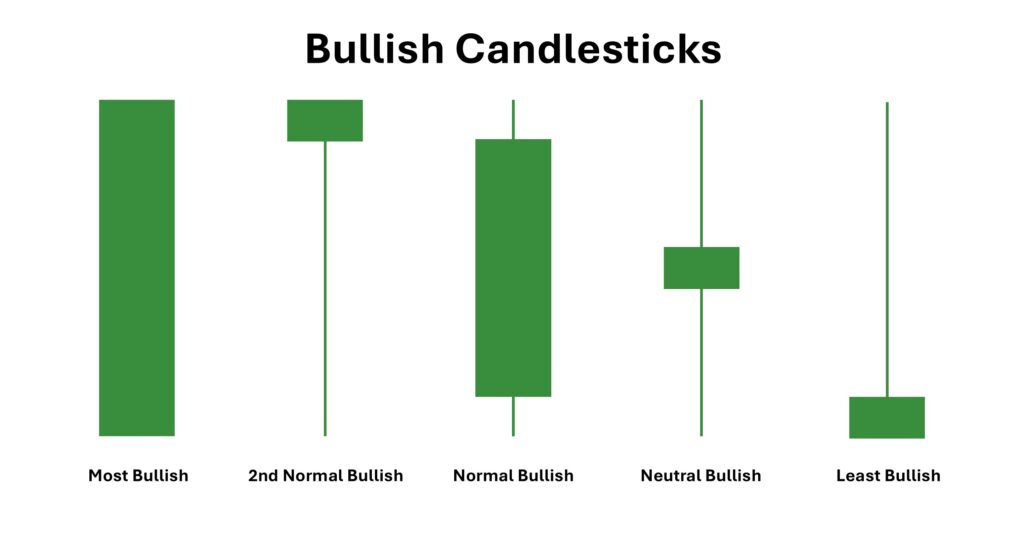

Bullish candlestick patterns are specific formations on price charts that signal a potential upward price movement. They typically appear at the end of a downtrend or during consolidation periods, indicating a possible reversal or continuation of bullish momentum.

These patterns are derived from Japanese candlestick charting techniques and represent the battle between buyers and sellers. Bullish patterns indicate buyers are gaining control, and prices may soon rise.

Why Does it Matter?

Understanding bullish candlestick patterns is vital for several reasons:

Early entry: Helps traders identify optimal buying points.

Trend reversal confirmation: Validates the end of a downtrend.

Risk management: Allows tight stop-loss placement.

Market psychology: Reflects the behaviour of institutional and retail traders.

In addition, bullish candlestick patterns become highly reliable when used with other tools like support/resistance, volume, or moving averages.

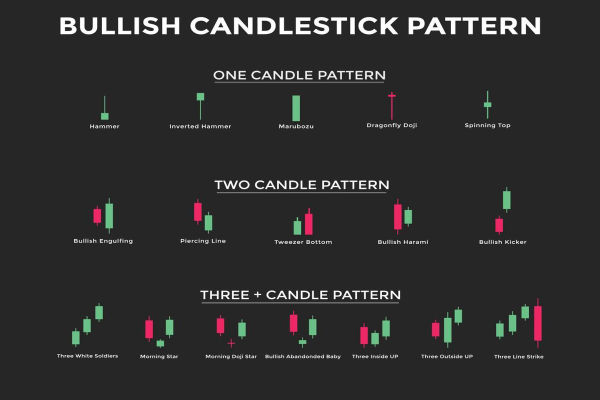

Top 10 Bullish Candlestick Patterns

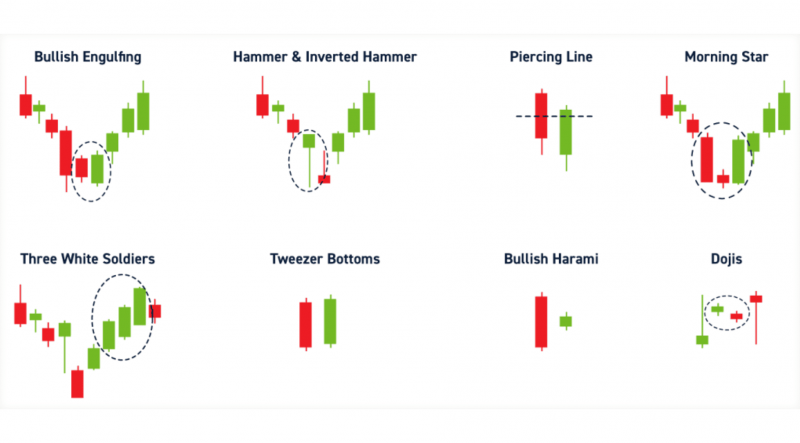

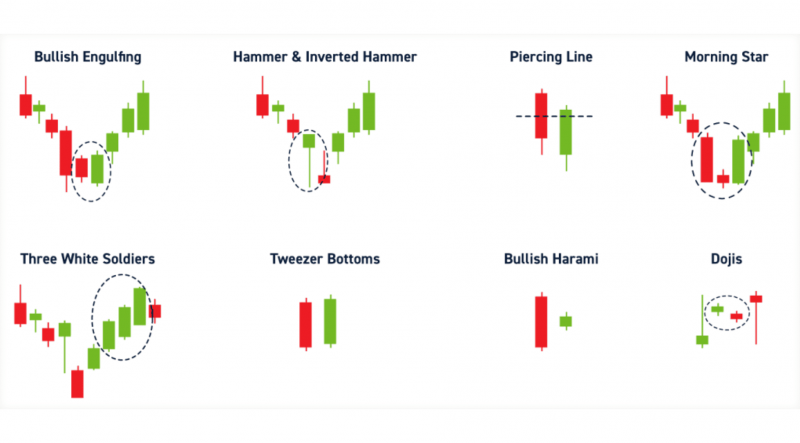

1. Bullish Engulfing Pattern

Structure: A small red (bearish) candle followed by a large green (bullish) candle that completely engulfs the previous one.

Meaning: Signals a strong shift in momentum from sellers to buyers.

Ideal Location: At the end of a downtrend or near support levels.

Trading Tip:

2. Hammer

Structure: A small body near the top of the candle with a long lower shadow (at least 2x the body length).

Meaning: Sellers pushed prices lower, but buyers regained control before the close.

Ideal Location: After a prolonged downtrend.

Trading Tip:

3. Morning Star

A three-candle pattern structure:

Trading Tip:

Wait for a break above the bullish candle for confirmation.

Best used on higher timeframes (4H, Daily).

4. Piercing Line

A two-candle pattern structure:

Trading Tip:

5. Inverted Hammer

Structure: Small body with a long upper wick and little or no lower wick.

Meaning: Sellers attempted to drive the price lower but failed.

Ideal Location: After a downtrend, often near support.

Trading Tip:

Requires bullish confirmation on the next candle.

Use tight stop-loss below the wick.

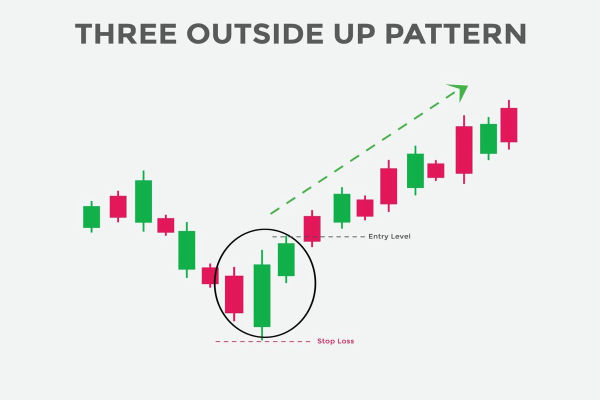

6. Three White Soldiers

Structure: Three consecutive large green candles with higher highs and higher closes.

Meaning: Strong bullish reversal with increasing momentum.

Ideal Location: After a strong downtrend or correction.

Trading Tip:

7. Tweezer Bottoms

Two candles with matching or near-matching lows structure:

Trading Tip:

8. Bullish Harami

Structure: A large bearish candle followed by a smaller bullish candle that fits within the body of the first.

Meaning: Shows a pause in selling pressure and potential reversal.

Ideal Location: At the bottom of a trend or during a pullback.

Trading Tip:

9. Rising Three Methods

Structure: A bullish candle followed by 3–4 small bearish candles and another bullish candle that closes above the first.

Meaning: A bullish continuation pattern during uptrends.

Ideal Location: During strong uptrend consolidations.

Trading Tip:

10. Dragonfly Doji

Structure: A doji with a long lower shadow and little to no upper shadow; open and close are at or near the high.

Meaning: Sellers pushed prices lower but were overwhelmed by buyers.

Ideal Location: Support levels or end of downtrends.

Trading Tip:

Tips to Know When Trading

Use Confluence: Combine candlestick patterns with support/resistance, Fibonacci levels, or trendlines.

Volume Confirmation: Strong patterns are usually backed by increasing volume.

Timeframe Matters: Patterns on higher timeframes (4H, Daily, Weekly) are more reliable than lower ones.

Risk Management: Always set stop-losses below pattern lows to limit the downside.

Avoid Overtrading: Wait for confirmation—don't act on every potential pattern.

Common Mistakes to Avoid

1) Trading Patterns in Isolation

Relying solely on candlestick patterns without context can lead to false signals.

2) Ignoring Market Structure

Bullish patterns in a strong downtrend often fail. Respect the overall trend.

3) Entering Without Confirmation

Jumping in without a confirming candle increases the risk of premature entries.

4) Using Too Low Timeframes

The 1-minute and 5-minute patterns often provide unreliable signals due to market noise.

5) Overleveraging on Patterns

Even strong patterns can fail. Use prudent position sizing.

Conclusion

In conclusion, Bullish candlestick patterns are indispensable tools for any trader's arsenal. By learning to identify and interpret these top 10 formations, traders can improve their decision-making and spot high-probability long setups.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.