Gold's spectacular rally in 2025 has captured the attention of traders, investors, and central banks worldwide. With prices breaking past $3,500 per ounce for the first time in history, many are asking: what comes next?

To answer this, it's crucial to examine the lessons from past gold surges, understand the key drivers behind the current rally, and see what history suggests about gold price predictions for 2025 and beyond.

Gold's Biggest Highs: What History Tells Us

Gold's journey as a safe haven asset has been marked by dramatic peaks during times of global turmoil:

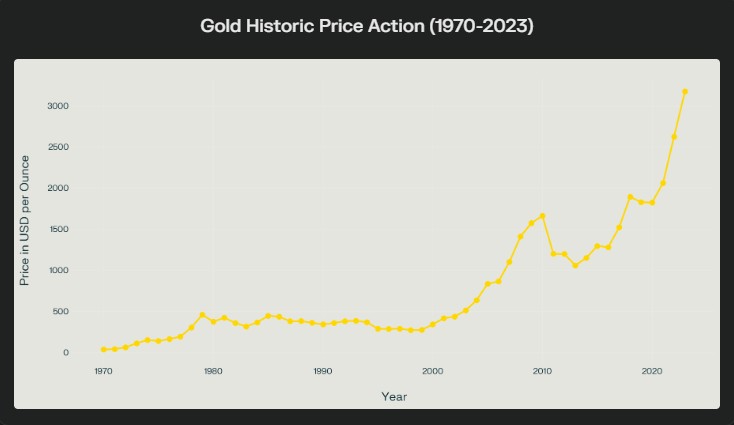

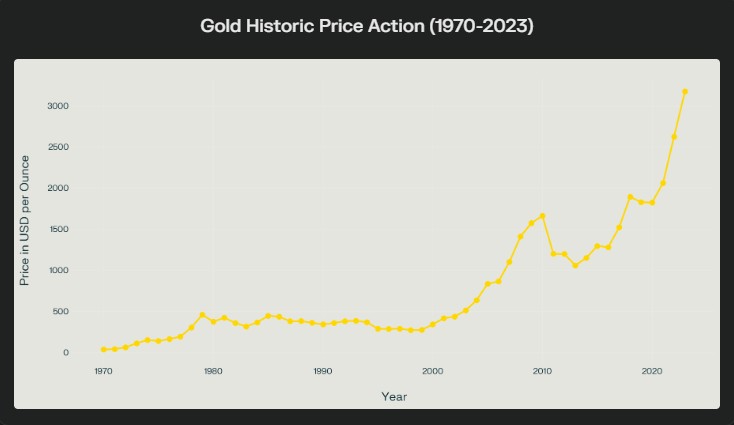

1970s stagflation and Bretton Woods Collapse: Gold prices soared after the US abandoned the gold standard in 1971, peaking at an inflation-adjusted equivalent of over $3,300 in 1980 amid rampant inflation and economic instability.

Great Recession (2008–2011): The 2008 financial crisis triggered a flight to safety, with gold rising from $730 to $1,300 in two years, and reaching $1,825 by mid-2011 as the European sovereign debt crisis unfolded.

Pandemic and Inflation (2020–2025): The COVID-19 pandemic and subsequent inflationary pressures drove gold to new highs, culminating in an all-time nominal peak of about $3,500 in April 2025, fuelled by trade tensions, central bank buying, and global uncertainty.

Key Drivers Behind Gold's 2025 Rally

1. Safe Haven Demand and Economic Uncertainty

Gold's reputation as a safe haven has been reaffirmed in 2025. Heightened geopolitical risks, trade wars (notably between the US and China), and volatile equity markets have all contributed to a rush for gold. When traditional assets like stocks and bonds become volatile or lose investor confidence, gold's appeal as a stable store of value rises sharply.

2. Central Bank Buying

Central banks have played a major role in the latest surge. Nations such as China, Russia, and Turkey have been aggressively increasing their gold reserves, seeking independence from the US dollar and hedging against the risk of sanctions or reserve freezes. In 2025, central bank demand reached record highs, removing substantial quantities of gold from circulation and underpinning the price rally.

3. Inflation and Real Interest Rates

Historically, gold thrives when inflation is high and real interest rates are low or negative. In 2025, even as inflation has moderated, real yields remain subdued, reducing the opportunity cost of holding non-yielding gold and keeping demand robust.

4. US Dollar Weakness

The US dollar's sharp decline in 2025-down 9% against a basket of major currencies-has made gold more attractive for non-dollar investors, further supporting the price surge.

5. Retail and Institutional Investment

Retail investors and exchange-traded funds (ETFs) have increased their gold holdings, seeking protection against portfolio drawdowns and speculating on further appreciation. Rising premiums for physical gold and higher trading volumes reflect this broad-based demand.

What Past Surges Reveal About Gold's Outlook

Surges Are Often Followed by Consolidation

History shows that after dramatic rallies, gold often enters a period of consolidation or even correction. For example, after peaking in 1980, gold entered a two-decade slump. Similarly, after the 2011 highs, prices retreated for several years. Current technical indicators suggest gold may be temporarily overbought, and some analysts anticipate a pause or short-term dip before further gains.

Long-Term Bullish Case Remains Intact

Despite the risk of short-term pullbacks, the long-term drivers-persistent geopolitical uncertainty, central bank demand, and a shift away from the US dollar-continue to support a bullish outlook for gold. Many analysts believe that even minor turbulence in larger financial markets could send gold prices higher, given the relatively small size of the gold market compared to global equities and bonds.

Goldman Sachs: Raised its year-end 2025 forecast to $3,700 per ounce, with an extreme scenario of $4,500 if recession or trade tensions escalate.

Reuters Analyst Poll: Median forecast of $3,065 per ounce for 2025, with continued volatility expected due to trade friction and de-dollarisation trends.

Technical Targets: Some analysts see $3,755 as the next technical upside, based on Fibonacci extensions of previous bull runs.

Lessons for Traders and Investors

Gold's Role as Insurance: Gold consistently proves its value as a hedge against uncertainty and inflation, but it may underperform during periods of stability and economic growth.

Central Bank Activity Is Key: Track central bank buying, as it can fundamentally alter market dynamics.

Don't Chase Parabolic Moves: After major surges, be prepared for consolidation or corrections.

Diversification Still Matters: While gold is a powerful diversifier, experts caution against overexposure-maintain a balanced portfolio.

Conclusion

Gold's 2025 surge is the latest chapter in a long history of dramatic rallies triggered by crisis, inflation, and shifting global power dynamics. While history suggests a pause or correction may follow such a rapid rise, the underlying drivers remain strong.

For traders and investors, the key lesson is clear: gold's value shines brightest in uncertain times, but prudent risk management and historical awareness are essential for navigating this volatile market.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.