ETF CFDs are gaining popularity among traders looking for flexibility, leverage, and access to a wide range of markets. But what exactly is an ETF CFD, and how does it work?

This guide breaks down the essentials, so you can decide if ETF CFDs fit your trading strategy.

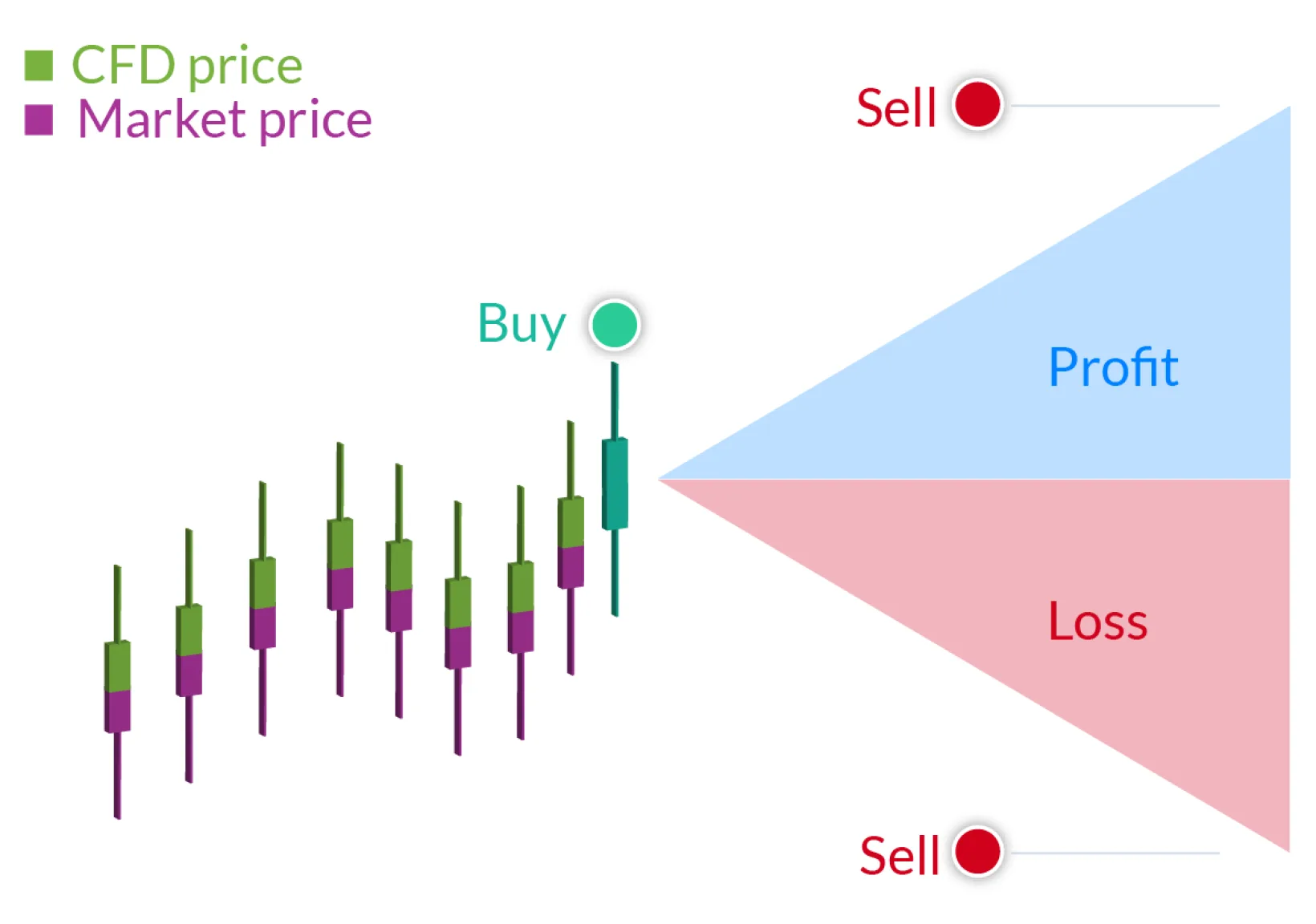

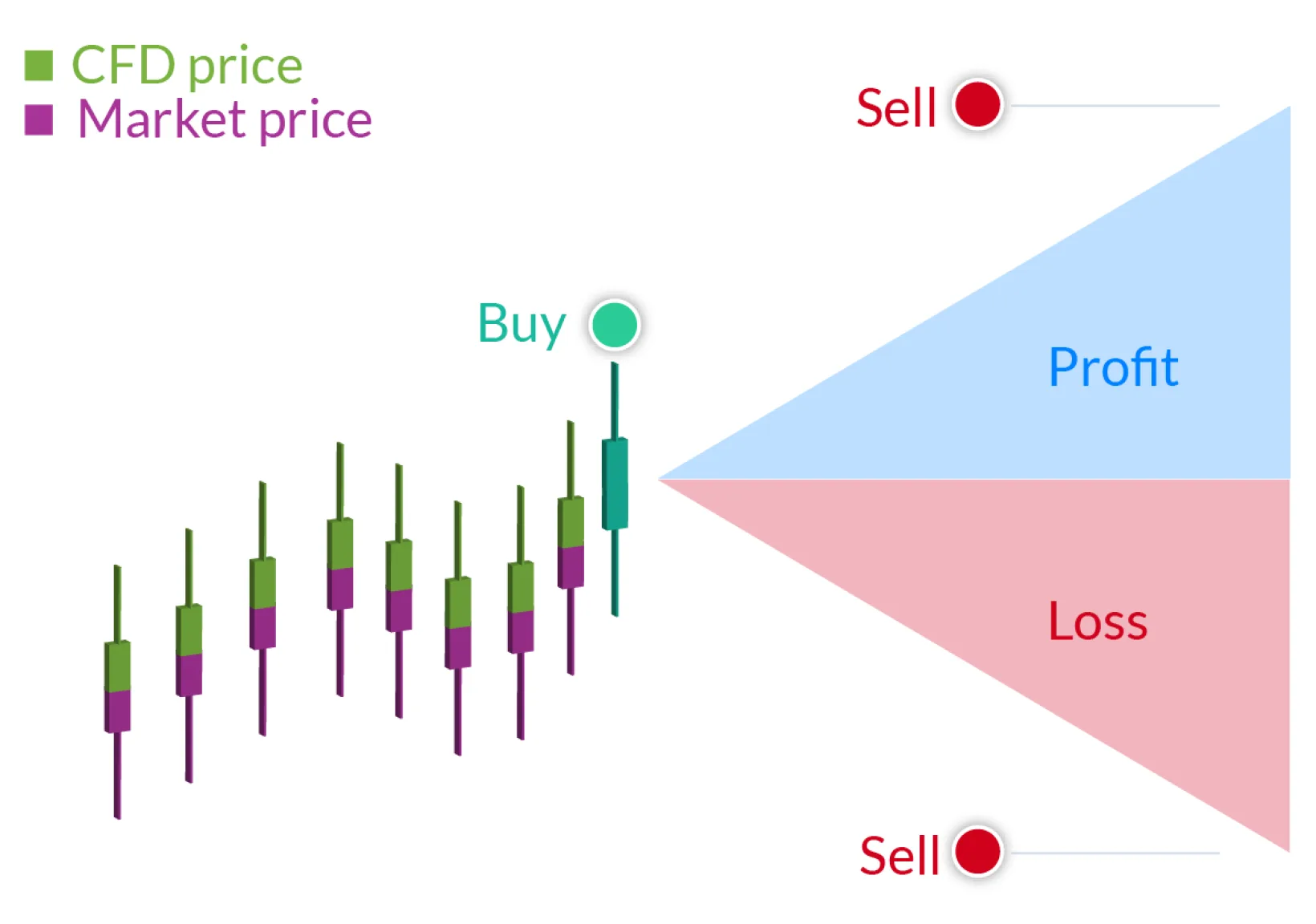

An ETF CFD (Exchange-Traded Fund Contract for Difference) is a derivative product that allows traders to speculate on the price movements of an ETF without owning the underlying fund or its assets. Instead, you enter into a contract with a broker to exchange the difference in the ETF's price between the time you open and close your position.

Key points:

You do not own the ETF or its underlying assets.

Profits and losses are based on the price difference during your trade.

ETF CFDs can be traded long (buy) or short (sell), giving you the opportunity to profit from both rising and falling markets.

How Does An ETF CFD Work?

When you trade an ETF CFD, you are speculating on the price of an ETF, such as those tracking the S&P 500, technology sectors, commodities, or bonds. You choose your position size, decide whether to go long or short, and use margin to control a larger trade with a smaller deposit.

Example:

Suppose you believe the price of the SPDR S&P 500 ETF (SPY) will rise. You open a long ETF CFD position. If the price increases, you profit from the difference. If the price falls, you incur a loss. The reverse is true if you open a short position.

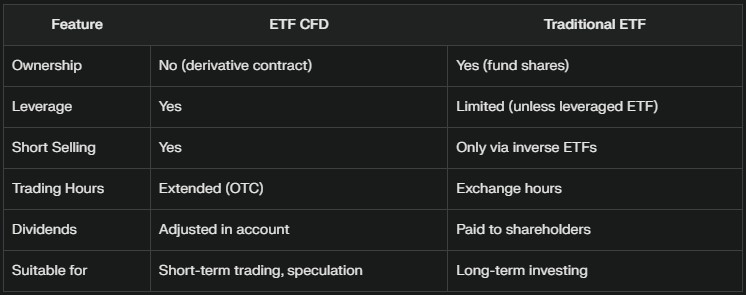

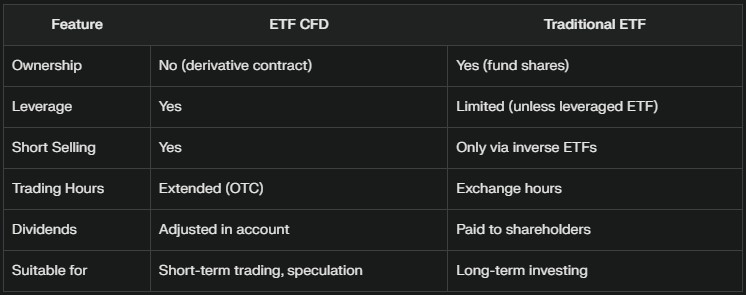

ETF CFD vs Traditional ETF: Key Differences

Main Features and Benefits of ETF CFDs

Leverage: ETF CFDs allow you to trade with leverage, meaning you only need to deposit a fraction of the trade's total value. This can magnify both gains and losses.

Access and Flexibility: Trade a wide range of ETFs from global markets, including stock, bond, commodity, sector, and currency ETFs.

Short and Long Trading: Easily take positions on both rising and falling prices, unlike traditional ETFs which are typically long-only.

Lower Capital Requirement: ETF CFDs can be traded with less capital compared to buying the actual ETF, making them accessible for more traders.

Extended Trading Hours: Many brokers offer ETF cfd trading beyond regular exchange hours, providing more flexibility.

Risks and Considerations

Leverage Risk: While leverage can boost profits, it also increases the risk of significant losses. Losses can exceed your initial margin if the market moves against you.

No Ownership: You do not receive dividends directly or have voting rights, though some brokers may adjust your account for dividend payments.

Overnight Fees: Holding ETF CFD positions overnight usually incurs additional costs, making them less suitable for long-term investing.

Market Volatility: ETF CFDs can be highly volatile, especially during major news events or economic releases.

Types of ETF CFDs

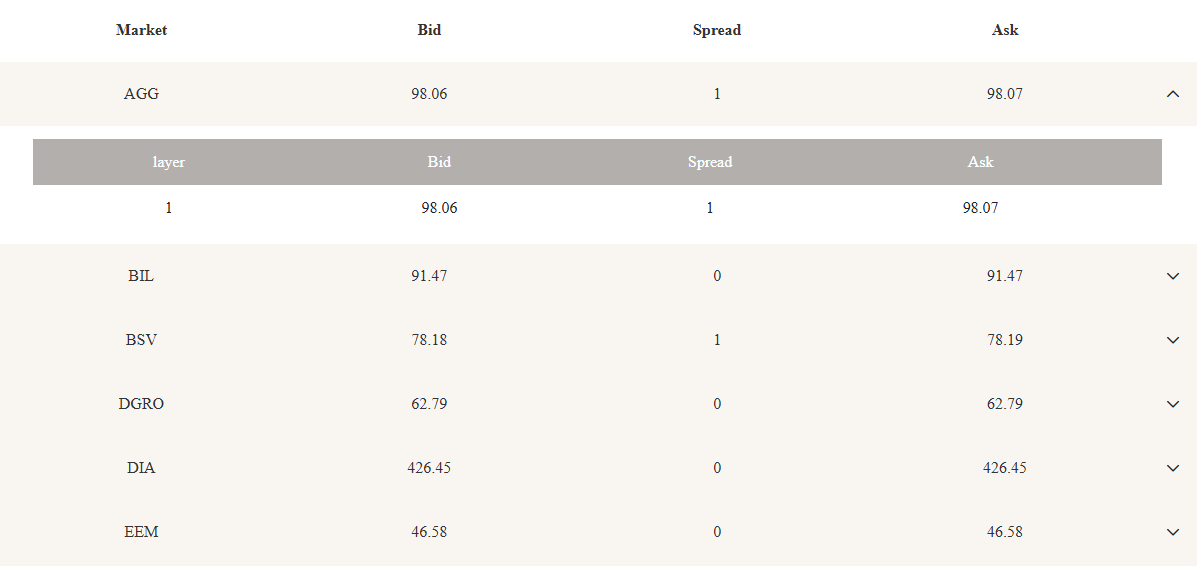

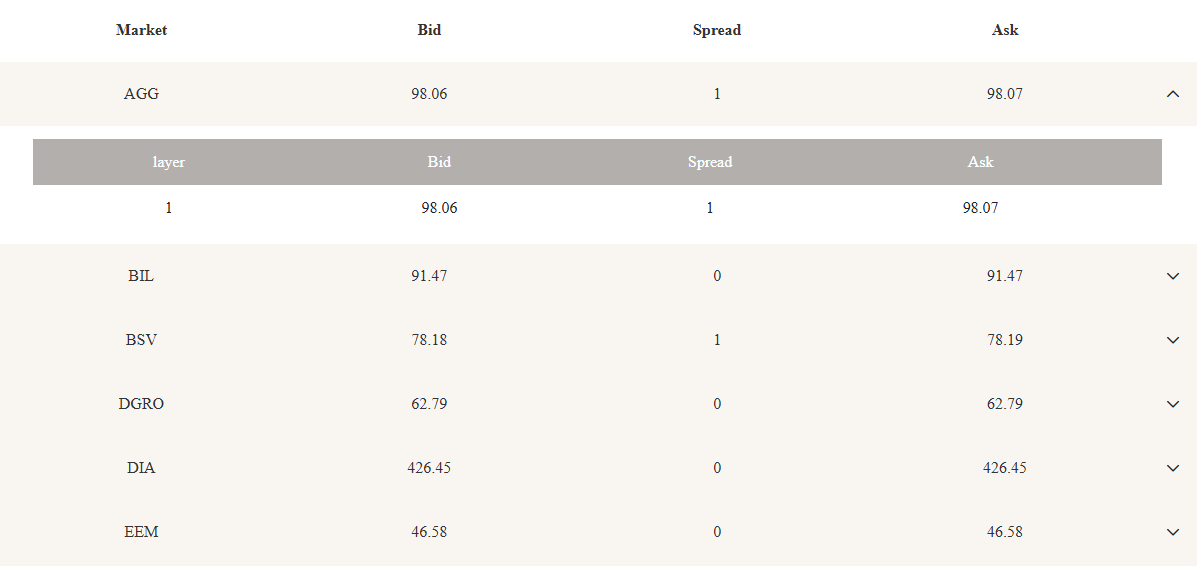

ETF CFDs are available on a wide variety of underlying ETFs, including:

Stock ETFs: Track baskets of shares from specific sectors or indices.

Bond ETFs: Provide exposure to government or corporate bonds.

Commodity ETFs: Track commodities like gold, oil, or agricultural products.

Sector and Thematic ETFs: Focus on industries like technology, healthcare, or green energy.

Currency ETFs: Offer exposure to forex markets.

ETF CFD Trading Strategies

Diversification: Use ETF CFDs on broad-market ETFs to spread risk across multiple assets.

Short-Term Trading: Take advantage of short-term price moves, news events, or market volatility.

Hedging: Hedge existing ETF or stock positions by taking an opposite position using ETF CFDs.

Range and Trend Trading: Apply technical analysis to identify trends or ranges in ETF prices and trade accordingly.

Conclusion

ETF CFDs offer a flexible and accessible way to trade the price movements of popular ETFs without owning the underlying assets. They provide opportunities for leverage, short selling, and global diversification—but also come with higher risk, especially for inexperienced traders.

Always use sound risk management and consider your trading goals before diving into ETF CFD trading.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.