Exchange-traded funds—commonly known as ETFs—have become one of the most talked-about investment products in recent years. If you've browsed a trading app, watched financial news, or even chatted with someone getting into investing, chances are ETFs have come up. But what exactly are they, and why are so many people adding them to their portfolios?

What Is an ETF?

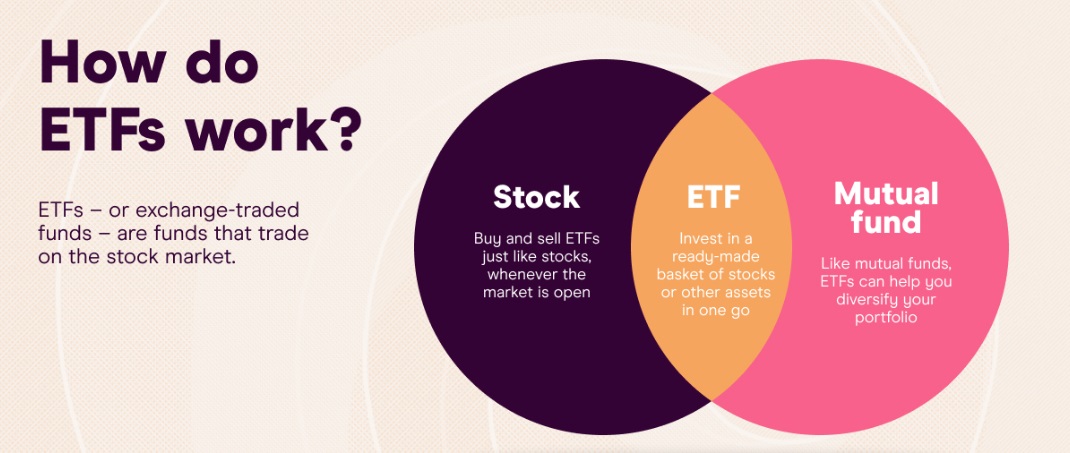

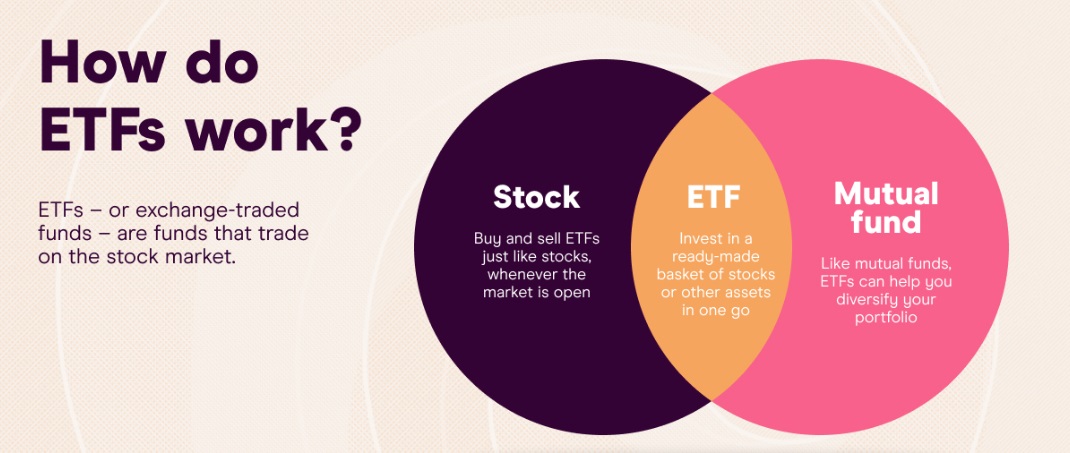

Let's start with the basics. ETF stands for exchange-traded fund. At its core, it's an investment fund that holds a collection of assets—these could be shares, bonds, commodities, or even a mix of different types. What makes an ETF different from other funds is that it's listed and traded on stock exchanges, just like individual company shares.

So when you buy an ETF, you're not buying a single stock—you're buying a small slice of a larger basket of investments. This gives you exposure to a whole market sector, index, or theme, without having to buy each asset individually. For example, one ETF might track the FTSE 100. giving you access to the performance of the UK's top 100 companies in one simple trade.

How ETFs Operate

ETFs are managed by fund providers who set them up with a specific goal in mind. Most aim to track the performance of a particular index, such as the S&P 500 or MSCI World. These are known as passive ETFs because they're not actively trying to beat the market—they're simply designed to match it.

Behind the scenes, a team of professionals handles the fund's mechanics. They make sure the ETF's holdings stay in line with its target index, adjusting things when necessary (like when companies are added or removed from the index). What's convenient for everyday investors is that you can buy and sell ETF shares throughout the trading day, just like any other stock. This gives you flexibility and real-time pricing, which you don't get with traditional mutual funds.

Not all ETFs are created equal. In fact, there's an impressive variety to choose from, each offering exposure to different parts of the market. Here are some of the most common types:

Equity ETFs – These track stock indices or sectors, such as technology, healthcare, or emerging markets.

Bond ETFs – These invest in fixed-income securities like government or corporate bonds, offering more stable returns.

Commodity ETFs – These focus on physical goods like gold, oil, or agricultural products.

Sector & Thematic ETFs – These target specific industries or trends, such as clean energy, AI, or electric vehicles.

Inverse & Leveraged ETFs – More advanced options designed to amplify gains (or losses), often used by experienced traders.

This variety means you can tailor your investment strategy to suit your risk tolerance, interests, and financial goals—all through ETFs.

Benefits of Investing in ETFs

ETFs are popular for a reason—they come with a range of advantages that appeal to both beginners and pros. One of the biggest draws is diversification. By investing in an ETF, you're spreading your money across many different companies or assets, which helps reduce risk. If one company in the fund performs poorly, it won't drag your whole investment down.

Another key benefit is cost-efficiency. Most ETFs have relatively low fees because they're passively managed. You're not paying a fund manager to constantly buy and sell holdings—you're just tracking the market.

ETFs also offer transparency and convenience. You can easily find out what an ETF holds, how it's performing, and what it costs. And because they trade like shares, you can buy or sell them any time during market hours, using a regular brokerage account.

Risks Associated with ETFs

While ETFs are generally considered a beginner-friendly option, that doesn't mean they're risk-free. Like any investment, their value can go up or down depending on market conditions. If the index or sector your ETF tracks takes a hit, your investment could suffer too.

Some ETFs, especially those focusing on niche markets or commodities, can be more volatile than others. There's also something called tracking error, which means the ETF might not perfectly mirror the performance of its benchmark index.

And while ETFs are usually quite liquid, some smaller or more specialised funds may not have a high volume of trades, which can affect how easily you can buy or sell them at a fair price.

Final Thoughts

ETFs offer a flexible, affordable, and accessible way to invest in a broad range of assets. Whether you want to track a major stock index, invest in government bonds, or bet on a fast-growing sector, there's likely an ETF for that. For beginners especially, ETFs can be a smart stepping stone into the world of investing—offering both diversification and simplicity.

As with any investment, the key is to understand what you're buying and how it fits into your overall financial plan. Once you've got that covered, ETFs can be a powerful tool in your investment toolkit.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.