ETF cfd trading is a method of gaining exposure to exchange-traded funds without owning the underlying assets. It combines the concept of ETFs, which are diversified baskets of securities traded like stocks, with CFDs, or Contracts for Difference, which are financial derivatives allowing traders to speculate on price movements.

This approach enables individuals to trade on both rising and falling prices, offering flexibility that traditional investing might not provide. Instead of buying an ETF directly, a trader uses a CFD to speculate on its price changes. If they believe the price will rise, they go long. If they anticipate a drop, they can go short.

Since no ownership of the ETF occurs, traders can enter and exit positions quickly, often with lower capital requirements. This has made ETF CFD trading an appealing strategy for short-term traders and investors seeking to manage risk in volatile markets.

How Does ETF CFD Trading Differ from Standard Investing?

Traditional ETF investing typically involves purchasing units in a fund that tracks a sector, index, commodity, or collection of assets. This approach is usually long-term in nature, focusing on the gradual accumulation of value and dividends over time. In contrast, ETF CFD trading is more dynamic. It allows for leveraged positions, meaning traders can control a larger market exposure with a smaller deposit. However, leverage increases both potential profits and potential losses.

Another major difference lies in ownership. With ETF CFD trading, the investor does not actually own any part of the underlying fund. This means no entitlement to dividends unless specified by the CFD provider and no voting rights in the ETF itself. For some investors, this is acceptable given the flexibility and speculative opportunities provided. For others, particularly long-term investors, the absence of ownership may be a disadvantage.

The cost structure is also distinct. While ETF investments may involve fund management fees and brokerage charges, CFD trading includes spreads, overnight financing costs, and sometimes commission depending on the broker. These differences highlight the importance of understanding one's investment goals before choosing between ETF investing and ETF CFD trading.

Benefits of ETF CFD Trading

ETF CFD trading offers several advantages that attract both beginner and experienced traders. One of the key benefits is the ability to trade in either direction. In uncertain markets, having the option to profit from falling prices is valuable. For investors who want to hedge existing positions, trading CFDs on ETFs can provide a quick and cost-effective solution.

Access to a wide range of markets is another strength of ETF CFD trading. Traders can choose from a variety of sectors and regions without needing to purchase multiple individual stocks. This makes diversification more accessible, even with limited capital. The availability of leverage also allows for potentially amplified returns, though it is essential to use this feature responsibly.

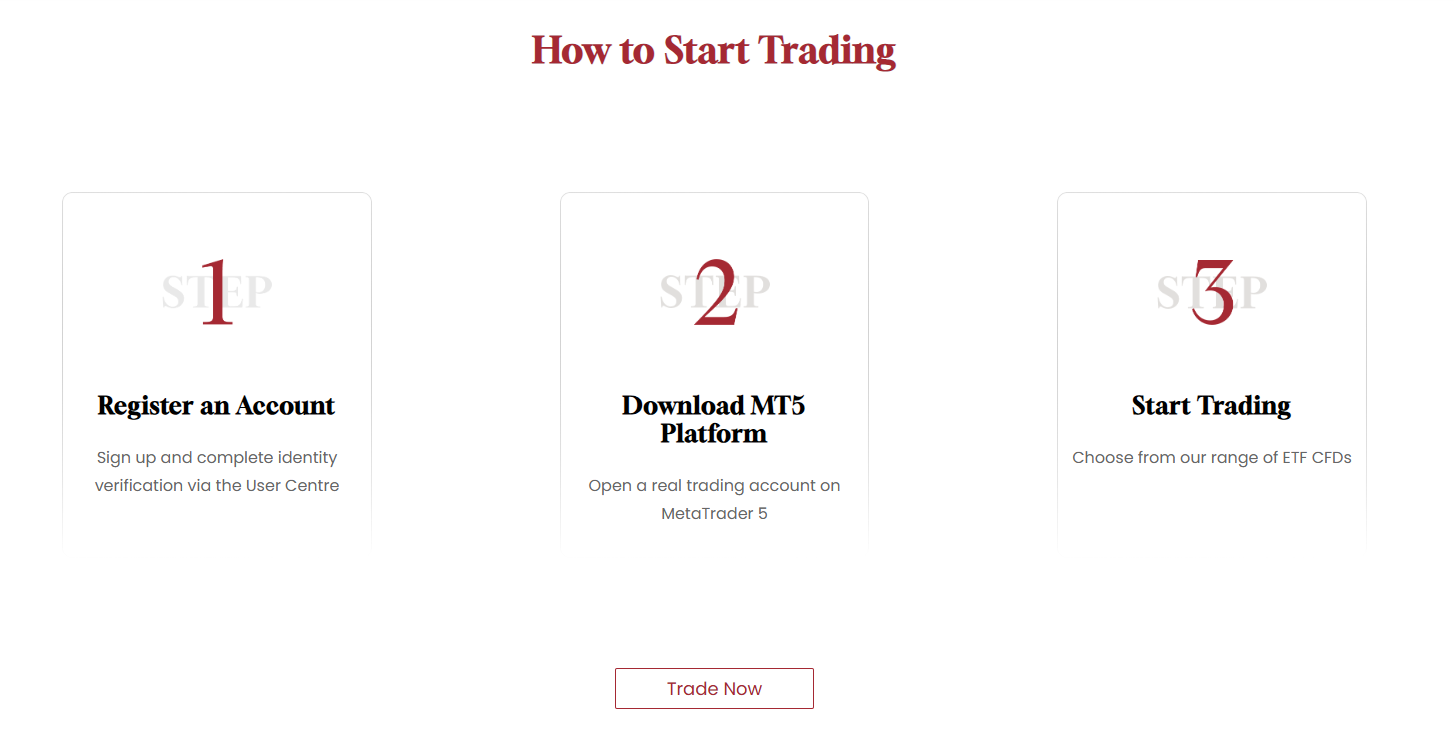

Another attraction is the ease of access. Many online trading platforms offer ETF CFD trading with user-friendly interfaces, real-time data, and advanced charting tools. This has helped open the market to retail investors who may not have considered trading ETFs through traditional means.

Risks and Considerations

Despite the benefits, ETF CFD trading involves significant risks. Leverage, while potentially profitable, can lead to substantial losses if the market moves against the trader. It is possible to lose more than the initial deposit if positions are not managed carefully. This risk makes it essential to use risk management tools such as stop-loss orders and to monitor positions closely.

Market volatility also presents a challenge. Because ETFs can be influenced by many external factors such as economic reports, global events, and changes in market sentiment, prices can move rapidly. For traders using leverage, even small price swings can have large impacts on their account balance. Understanding the underlying assets and how they react to different market conditions is crucial.

Costs associated with holding CFD positions overnight should not be ignored. If a position is kept open beyond the trading day, overnight financing charges may apply. These can accumulate quickly and affect profitability, especially for positions held over long periods. Traders need to be aware of the terms and conditions offered by their broker and consider how these fees align with their trading strategy.

Is ETF CFD Trading Suitable for Everyone?

ETF CFD trading may not be suitable for every investor. It is most appropriate for those who understand financial markets, are comfortable with the risks of leverage, and prefer short to medium-term trading strategies. For individuals seeking passive income, capital growth through dividends, or long-term wealth accumulation, traditional ETF investing might be a better fit.

However, for active traders who want the ability to respond quickly to market movements and who are confident in using trading tools and analysis, ETF CFD trading can be a valuable part of their strategy. It offers more control, more trading opportunities, and access to a wider variety of sectors and global trends without the need to tie up large amounts of capital.

Traders should consider their personal financial goals, experience level, and risk tolerance before entering the ETF cfd market. It may also be wise to practise on a demo account or consult with a financial adviser before committing real funds to this type of trading.

Final Thoughts

ETF CFD trading provides a powerful tool for investors who want to take advantage of market movements with speed and flexibility. By combining the diversification of ETFs with the speculative nature of CFDs, it creates opportunities for both growth and hedging. However, this strategy is not without its challenges. Leverage, market volatility, and the lack of ownership mean that traders must stay alert, informed, and disciplined.

For the right type of investor, ETF CFD trading can be a strategic way to diversify and engage with the markets more actively. It requires an understanding of the instruments involved, a clear plan, and the ability to manage risk effectively. While it is not a guaranteed path to profit, it remains a compelling choice for those seeking alternatives to traditional investing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.