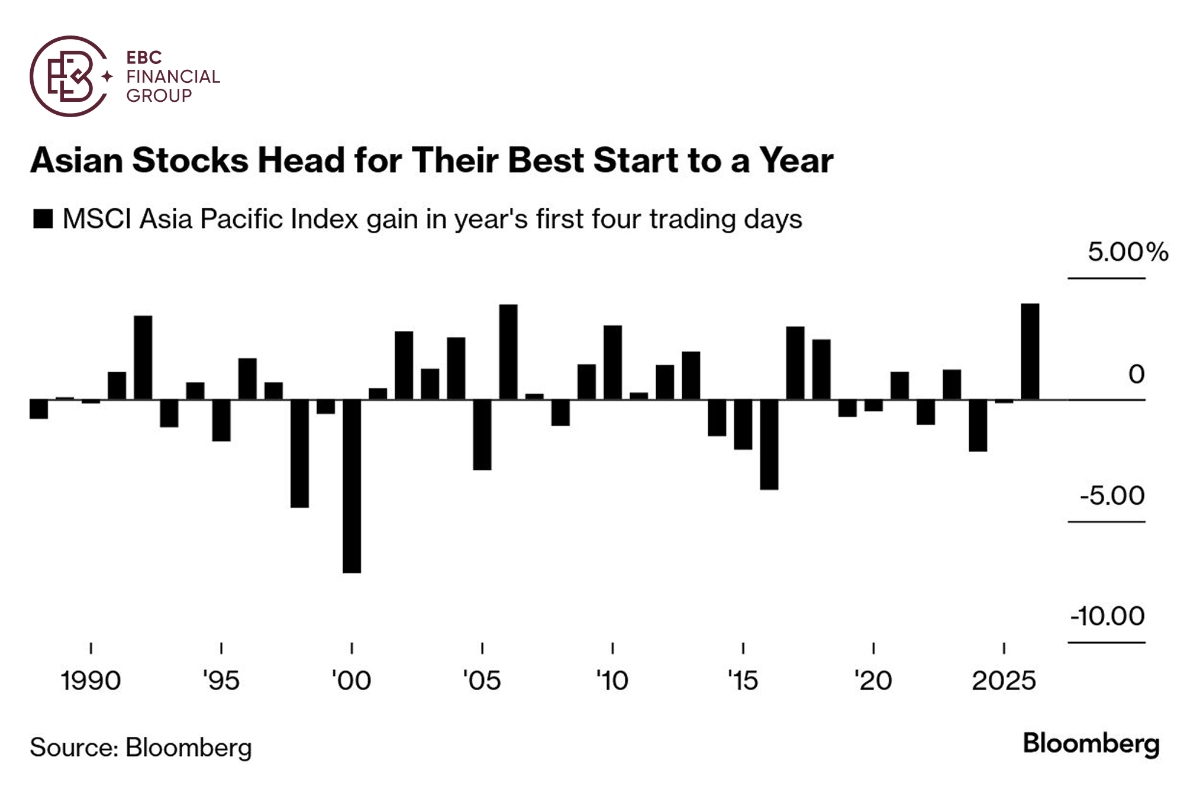

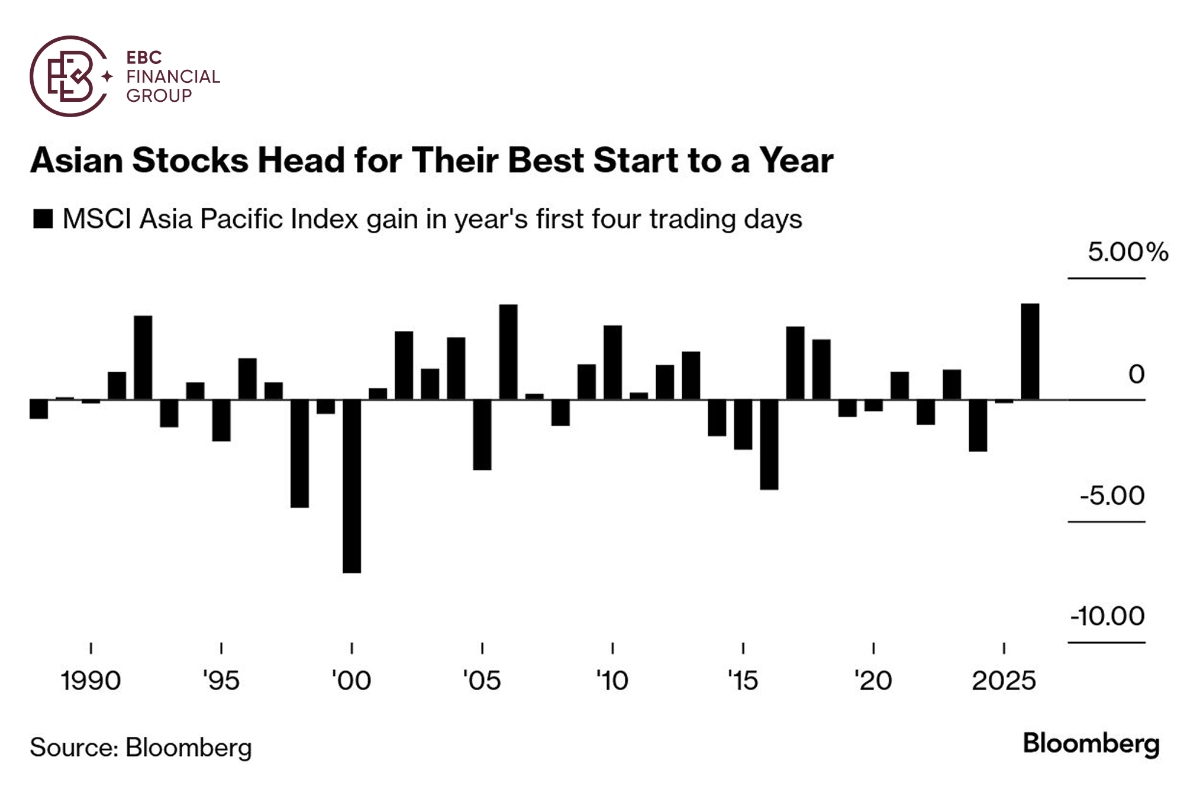

Asian stocks are having their best-ever start to a year, with South Korea and

Taiwan leading the gains. After a three consecutive years of rally, the region's

equities are still cheaper compared with US peers.

iShares MSCI South Korea ETF jumped 91% in 2025, the largest gain in 16

years. The strong momentum could carry over into the first quarter of this year

given prospect of the heavyweights.

At least six brokerages, including Goldman Sachs and Macquarie Group have

lifted projections on the TSMC, underscoring continued bullishness on the

chipmaking giant after its record surge.

The world's largest manufacturer of advanced AI chips, is expected to post a

27% jump in Q4 net profit. Analysts polled by Bloomberg expect operating margin

improving to a three-year high of over 50%.

Its major rival Samsung Electronics expects its profits to triple in Q4,

reaching a record high, as memory prices surge amid booming demand tied to AI.

That marks a significant improvement from a year earlier.

As memory companies prioritize capacity to meet AI application demand, it has

contributed to a shortage across the broader market, affecting chips used in

personal computers and mobile devices.

The market watcher estimates memory prices surged 40%-50% in the last

quarter, and expects similar gains in Q1. Both Samsung Electronics and SK Hynix

traded at a forward PE ratio of less than 10x.

Iran crisis

The Nasdaq 100 is trading well above long-term valuation averages, and there

are more downside risks to the market on top of that to spur outflows. Trade

tension readily rears its ugly head anytime.

Trump said Monday that the US will start charging a 25% tariff on imports

from countries that do business with Iran. The order is "effective immediately,"

he said in a Truth Social post.

It is unclear if he will finally stack the latest tariffs on top of existing

rates or announce carve-outs for China. Peter Navarro last August downplayed the

idea of hitting China over its buying of Russian oil.

Despite Khamenei's touch stance against talks with Washington, German

Chancellor Friedrich Merz on Tuesday said the embattled Iranian regime appears

to be finished as mass protests continue across the country.

Even the US respects is deal with China, Beijing would be agitated by a

repeat of Maduro's demise. Chinese refiners were expected to replace Venezuelan

oil with Iranian crude in the coming months.

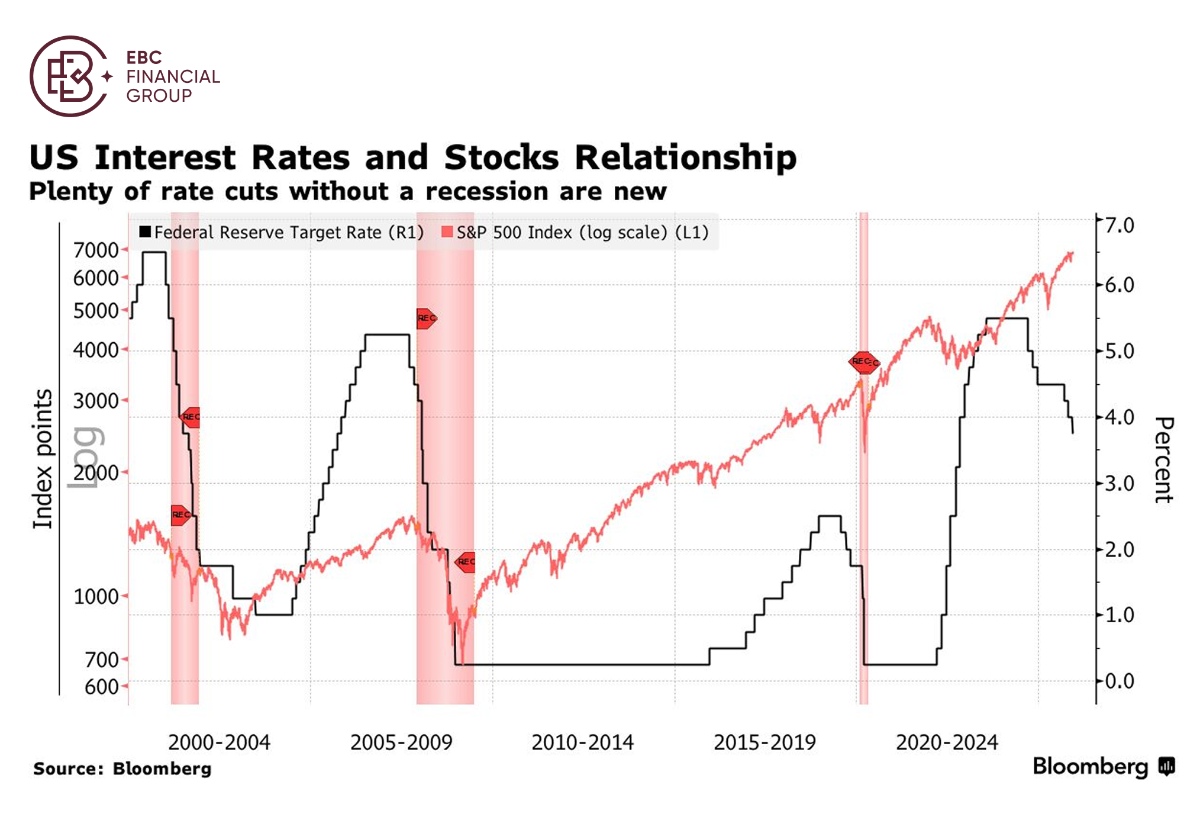

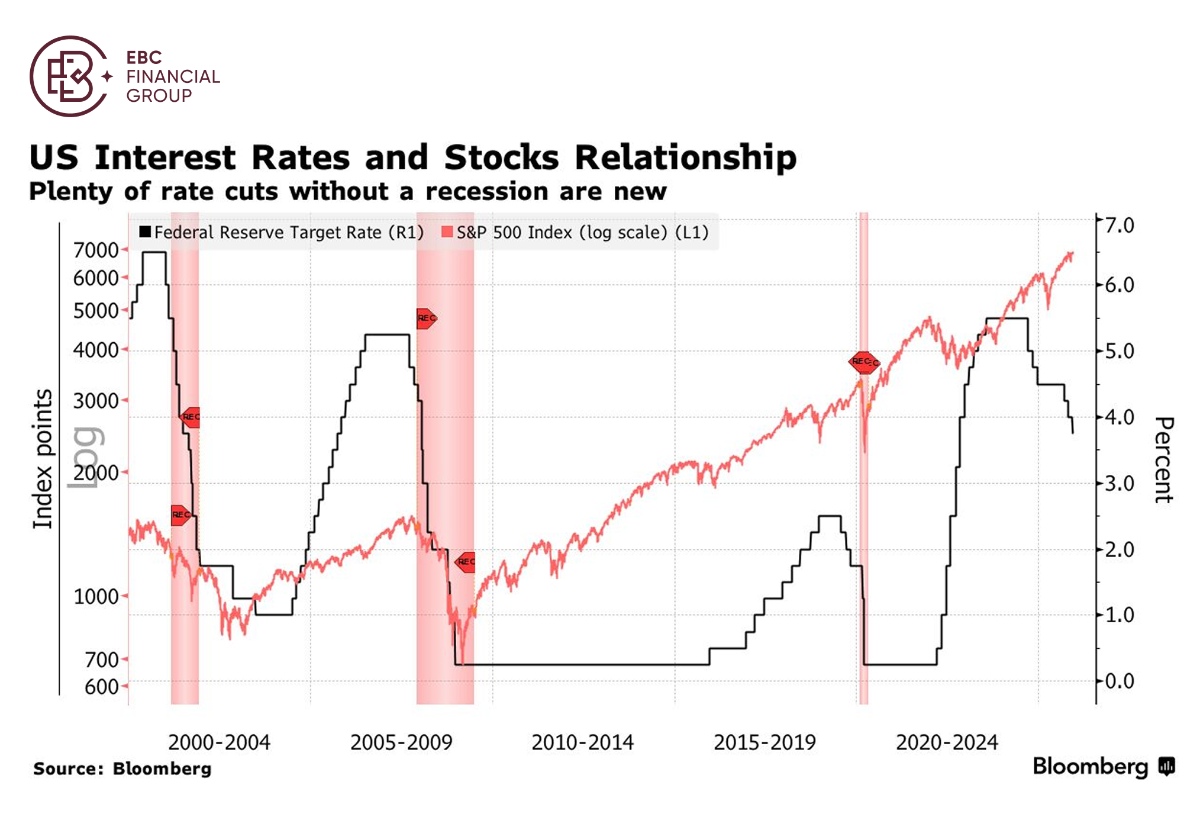

In the second place, markets are still anchored to the assumption that

inflation is cooling and policy rates will drift lower. The upshot would be the

Fed keeping rates higher for longer, or even tightening financial

conditions.

A forced slowdown in fiscal spending or dips in corporate hiring could

quickly translate into weaker earnings, particularly outside Big Tech. Any

downside revisions are critical when the FOMO rush remains prevalent.

Virtuous cycle

Bernstein, Societe Generale and Goldman Sachs were the latest additions to

the growing camp of Chinese equities bulls, with the former upgrading the

country's stocks to overweight last week.

Goldman boosted its forecast for Chinese earnings growth, expecting it to

accelerate to 14% in 2026 and 2027 from 4% in 2025, citing "artificial

intelligence monetization, policy stimulus, and liquidity overshoot."

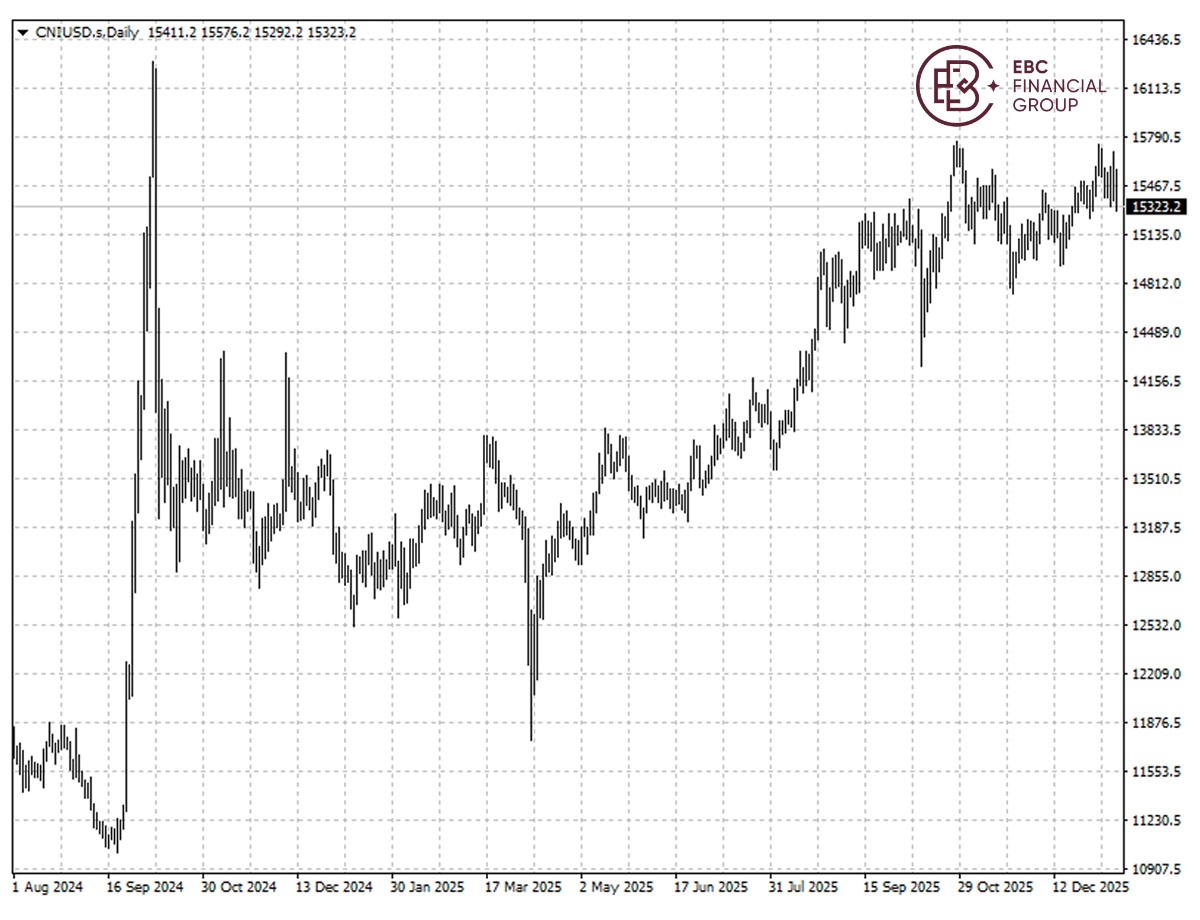

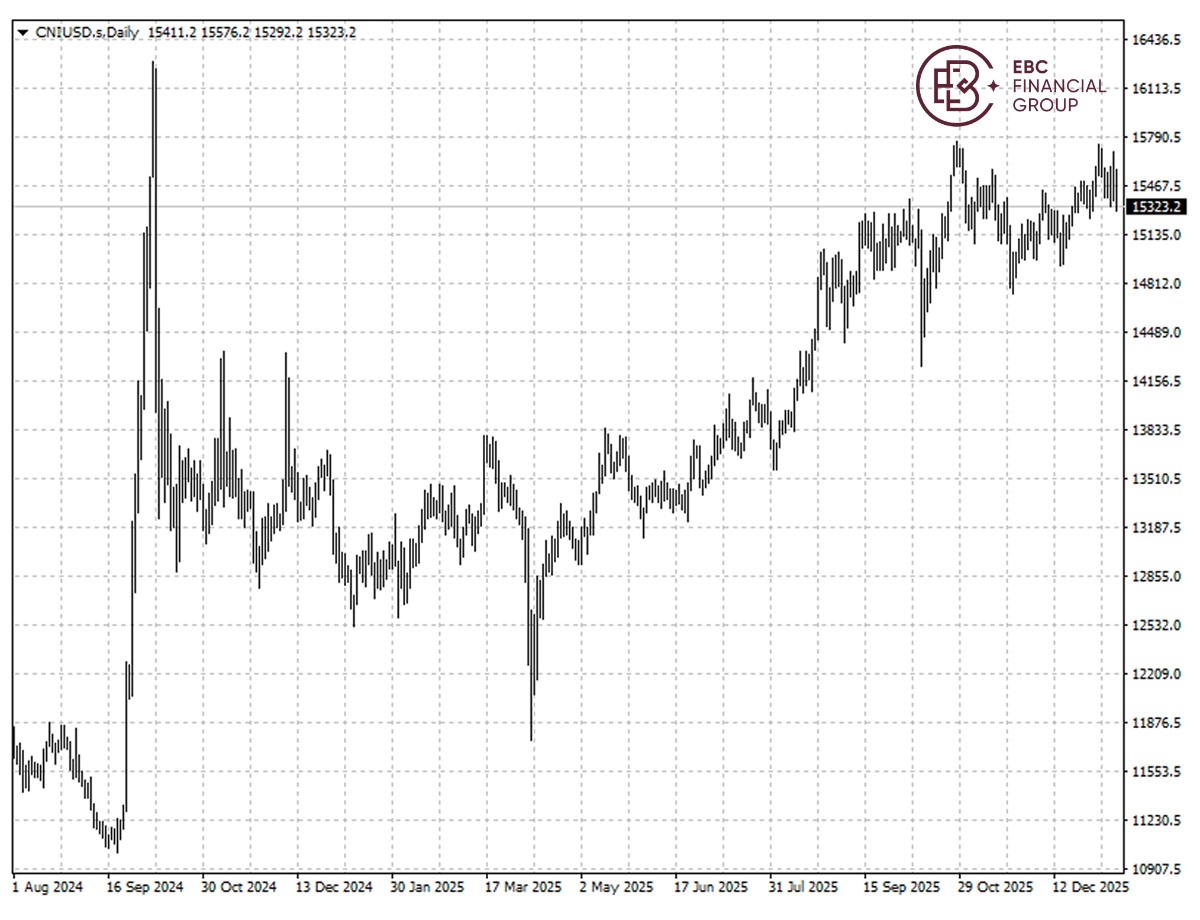

Market participants are also doubling down on the yuan, with some predicting

it to rise to as strong as 6.25 this year. Citigroup, Goldman Sachs and BofA are

among those favouring it, adding to appeal of the assets.

"A firmer yuan can help equities by improving dollar-based returns and risk

sentiment," said a strategist at the Franklin Templeton. "At the same time,

genuine equity inflows … can support the currency."

China's trade surplus came in at nearly $1.19 trillion for 2025 as producers

shifted their focus to emerging markets especially Southeast Asia. The car

industry saw overall exports jump 19.4%.

Economists expect the strong momentum to continue this year, helped by

Chinese firms setting up overseas production hubs, as well as by strong demand

for lower-grade chips and other electronics.

The latest decision to raise margin financing ratio from 80% to 100% could be

a game-changer. Money managers may be tempted to park more money into value

stocks rather than risk a bigger tech bubble.

Disclaimer: This material is for general information purposes only and is not

intended as (and should not be considered to be) financial, investment or other

advice on which reliance should be placed. No opinion given in the material

constitutes a recommendation by EBC or the author that any particular

investment, security, transaction or investment strategy is suitable for any

specific person.