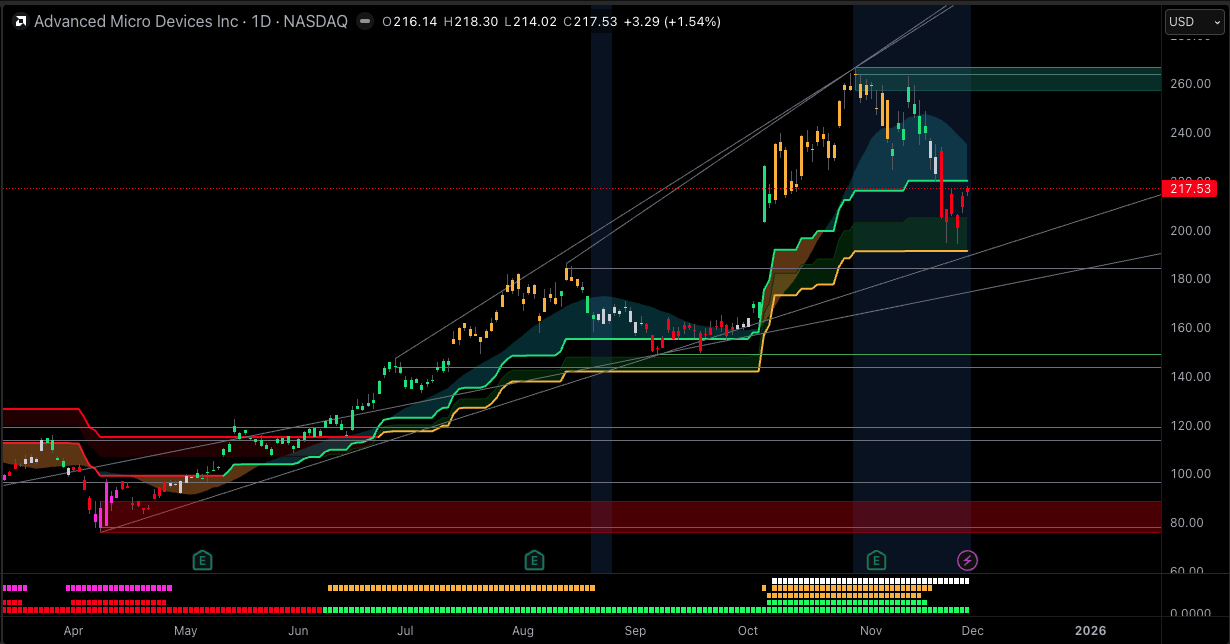

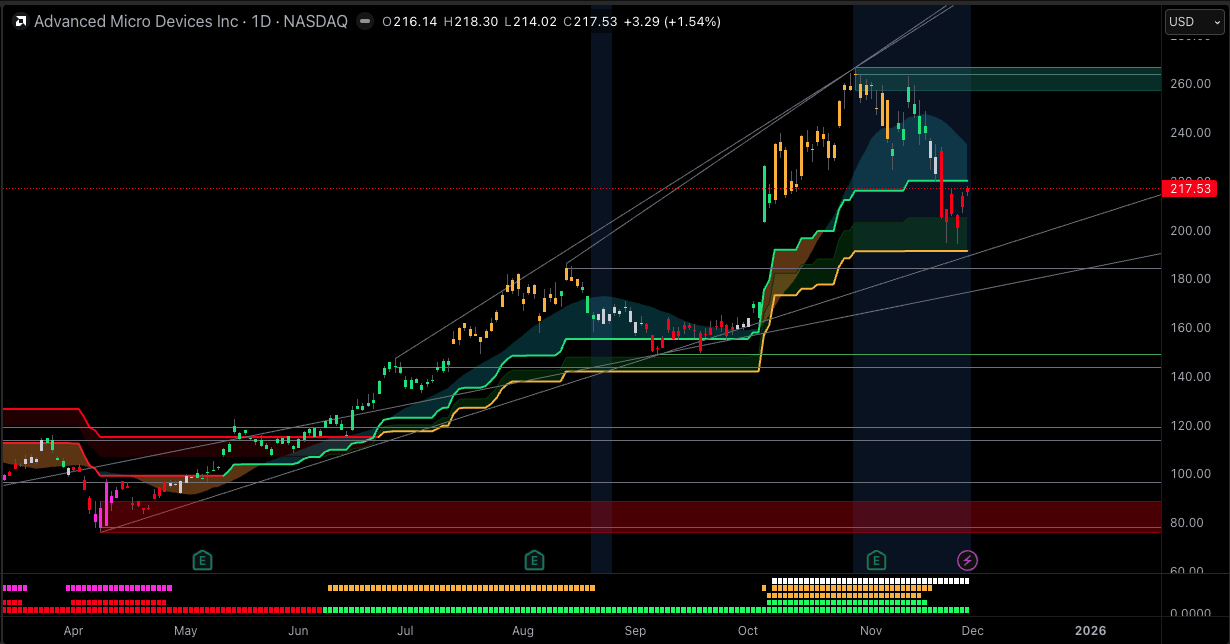

AMD has had an incredible run in 2025, but the last few weeks have been painful for anyone who bought near the highs. After hitting a 52-week and all-time high around $267.08 on 29 October 2025, the share price has pulled back to about $217.5, roughly 18% below the peak.

Even with that drop, AMD is still up about 93% over the last six months and around 80% year-to-date, so this is a sharp correction inside a strong uptrend rather than a collapse.

This article looks at why AMD stock is dropping now, what the fundamental story looks like, and how the technical picture sets key support and resistance levels traders are watching.

Where AMD Stock Stands Right Now?

Recent performance highlights:

Last close: about $217.5

1-month move: down roughly 16% from late October

6-month move: up around 93%

52-week range: $76.48 – $267.08

Last 10 trading days: price down on 7 of 10 sessions, about -12% over that stretch

If you want to understand the recent drop in AMD, you have to look at the run that came before it. The share price almost tripled from its 52-week low, then slipped quickly as traders locked in profits and sentiment cooled.

For a fast-moving growth stock tied to AI and priced for very strong results, sharp pullbacks after big rallies are common. They often reflect positioning and expectations catching up with reality, not a sudden collapse in the company’s long-term story.

Why Is AMD Stock Dropping Now?

Here are the main drivers behind the recent AMD stock drop.

1. Profit-Taking After a Huge AI Rally

From late May to late October 2025, AMD rallied from around $108.6 to $267.08, a gain of more than 100% in six months.

After that kind of move, short-term traders and some funds naturally lock in profits. When profit-taking starts in a crowded trade, it can cascade:

A MarketWatch report noted that AMD’s November decline was close to 23%, making it the stock’s worst month in about three years, even as the longer-term uptrend stayed in place.

2. “Great” Earnings, but Expectations Were Even Higher

AMD’s Q3 2025 numbers were objectively strong:

Revenue: $9.25 billion, up about 36% year-on-year

Non-GAAP EPS: $1.20, up around 30% YoY and slightly ahead of consensus

GAAP gross margin: 52%; non-GAAP gross margin: 54%

Data Center revenue: about $4.3 billion, up 22% YoY

Client & Gaming revenue: around $4 billion, up 73% YoY

Management also guided Q4 2025 revenue to around $9.6 billion at the midpoint, implying roughly 25% YoY growth. So why did the stock fall after such numbers?

Because expectations were extremely high. After a huge AI-driven rally, the market was pricing in not just strong growth, but almost flawless execution and upside surprises every quarter. When results are “very good” but not wildly ahead of the hype, the short-term reaction can be a sell-off rather than a celebration.

3. Valuation Still Looks Stretched

Recent valuation metrics show how richly AMD trades:

P/E ratio: about 118x trailing earnings

PEG ratio: around 2.4

Market cap: roughly $335–350 billion

Beta: near 1.9 (high volatility)

These are growth-stock numbers. When yields move higher or sentiment cools, high-multiple names sell off first. The November pullback is partly the market re-rating AMD from “AI darling at any price” to “great business, but price still matters.”

4. AI Competition and Spending Questions

AI is still the core long-term story for AMD, but investors are now thinking more carefully about:

How fast cloud and enterprise customers will grow AI spending from here.

How AI budgets will be split across different GPU and CPU suppliers.

Whether AMD can keep growing data center AI revenue fast enough to justify its valuation premium.

Recent coverage highlighted these concerns as a key reason behind the November slide, even though AMD’s own AI roadmap and customer wins remain strong.

5. Cost Pressures and GPU Pricing Headlines

Recent reports pointed out that AMD plans to raise GPU prices in 2026, partly due to rising memory and component costs.

For traders, that raises two questions:

Will higher GPU prices hurt demand in gaming and workstation markets?

Will margin gains offset any volume softness, or will it create a headwind?

These are not fatal issues for the business, but they add one more reason for short-term caution when the stock is already expensive.

6. Technical Break Below Key Moving Averages

Technicals have clearly shifted from “overheated uptrend” to “correcting within a trend”:

AMD briefly broke below its 50-day moving average in late November on heavy volume.

Several technical services now flag AMD as a short-term sell candidate, with a 3-month MACD sell signal and a pivot top in late October.

Once price drops under key moving averages, systematic and technical traders often reduce exposure, which adds to the downside pressure.

Fundamental Picture: Strong Business, Higher Risk Price

Despite the drop, the underlying business looks strong:

Revenue and earnings are growing 30-40% YoY.

Margins have recovered sharply from export-related charges in early 2025.

The balance sheet is clean, with low debt (debt-to-equity around 0.05) and strong liquidity (current ratio about 2.5).

Analysts, as a group, still call it a “Moderate Buy” with an average price target near $280.

The real tension is between excellent fundamentals and a high valuation. If growth slows even slightly, the market can knock 15–25% off the share price very quickly, as we just saw.

AMD Technical Analysis: Key Levels & Indicators

Based on multiple independent data sources updated through 30 November 2025, here is a summary of the current AMD technical picture.

AMD Technical Snapshot (Daily Chart)

| Indicator / Level |

Latest Value* |

Signal / Comment |

| Last Close |

$217.53 |

Sharp correction from highs but still in a long-term uptrend |

| 52-Week High / Low |

$267.08 / $76.48 |

~18% below high and >180% above low; high-beta growth profile |

| 8-day SMA |

$214.57 |

Price slightly above very short-term average; mild bounce |

| 20-day SMA |

$234.28 |

Price below this level; short-term trend still weak |

| 50-day SMA |

$218.80 |

Just below 50-day; reclaiming it would be an early positive sign |

| 200-day SMA |

$150.51–$172 |

Price well above 200-day; long-term trend remains bullish |

| RSI (14) |

~45–46 |

Neutral to slightly weak; not overbought/oversold |

| MACD (12,26) |

-4.5 to -6.3 |

Negative MACD confirms bearish momentum post-October peak |

| Bollinger Bands (25) |

$220.06 – $257.98 |

Price near lower band—common bounce zone but still shows pressure |

| ATR (14) |

~$14 (≈6–7% of price)** |

High volatility; position sizing important |

*Values rounded; all as of the last trading session in November 2025 based on multiple independent data providers.

Important Support and Resistance Zones

Combining Fibonacci levels, volume-based levels and moving averages:

Immediate support:

Deeper support:

Resistance above:

Bullish scenario: Price holds above $209–$215, reclaims the 50-day SMA, and RSI moves back above 50. That would suggest the correction is fading and buyers are regaining control.

Bearish scenario: A clean break below $194, followed by a move toward $172, would mark a deeper re-rating and a test of the longer-term trend.

What This Means for Traders?

For traders asking “why is AMD stock dropping?”, the answer is a combination of:

Profit-taking after a huge AI-driven rally

Very high expectations around earnings and AI demand

Rich valuation that magnifies every headline

Technical signals flipping from strong bullish to corrective

The business trend is still positive, but the price is now in a higher-risk zone. Short-term traders will focus on levels like $215, $194 and $235, plus RSI and MACD shifts.

Longer-term investors will care more about whether AMD can keep growing data center and AI revenue, maintain margins near the mid-50s, and turn that into sustainably higher earnings per share.

Frequently Asked Questions (FAQ)

1. Why is AMD stock dropping right now?

Because the stock ran very hard into late October, expectations for AI and earnings were extremely high, and valuation is rich. When Q3 results were “only” very strong instead of spectacular, profit-taking, AI competition worries, and technical sell signals all combined to push the share price down from the highs.

2. Is AMD stock a buy, hold or sell after this pullback?

Different traders will answer that differently. Fundamentals are strong and analysts still see upside from current levels, but the valuation is still high and technical momentum is weak. That mix makes AMD attractive for active trading, but risky for anyone who cannot handle volatility.

3. What are the key price levels to watch for AMD in 2025?

For now, traders are watching $214–$215 as near-term support, $194 and $172 as deeper support zones, and $235 and $264–$267 as important resistance areas. Breaks of these levels often trigger fresh momentum in either direction.

4. Does AMD pay a dividend?

AMD does not pay a regular dividend today. Historical data shows only small payments from the mid-1990s. The story is almost entirely about growth and capital gains, not income.

5. Is AMD suitable for beginners?

AMD can be suitable if beginners keep positions small and focus on risk first. The share price is volatile and very sensitive to AI headlines and macro conditions, so it is not a “set and forget” stock. Many new traders use AMD to learn how to apply support/resistance, RSI, MACD and moving averages with strict risk management.

Conclusion

AMD’s pullback is not a mystery once you put the pieces together. A huge AI rally, very high expectations, rich valuation and a few cautious headlines all hit at the same time. That is why AMD stock is dropping even though revenue, earnings and the long-term AI story are still moving in the right direction. Price simply ran ahead of what the market was comfortable paying, and now it is resetting.

For traders, this phase is about levels and discipline. As long as AMD holds key support zones around the low $200s and then $194 and $172, the longer-term uptrend stays alive, even if the ride is rough. A move back above the 50-day average and stronger RSI and MACD readings would hint that buyers are stepping back in.

Whether you trade short swings or think in years, the main task is the same: respect the volatility, know your levels, and let your own risk limits decide what this pullback means for you.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.