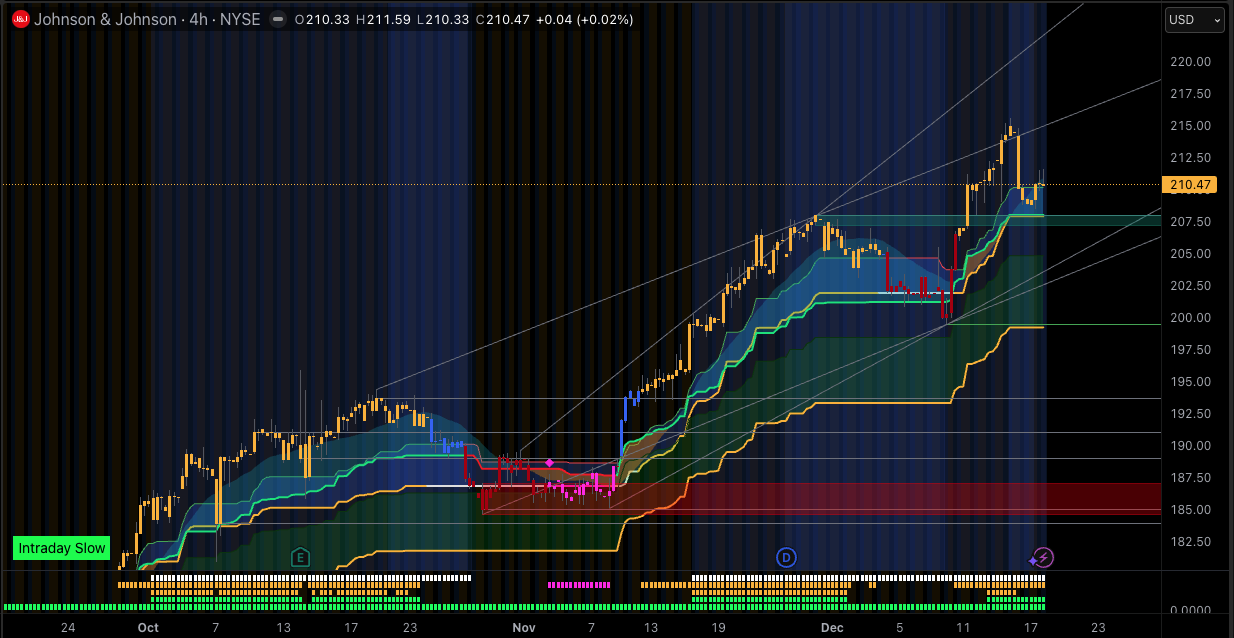

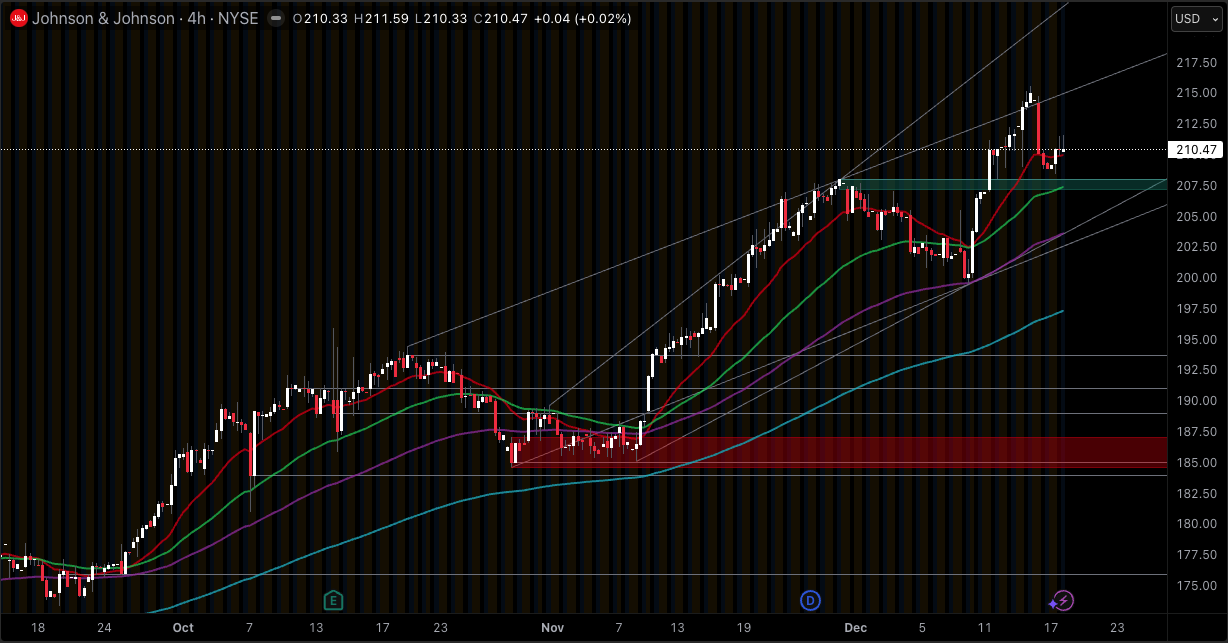

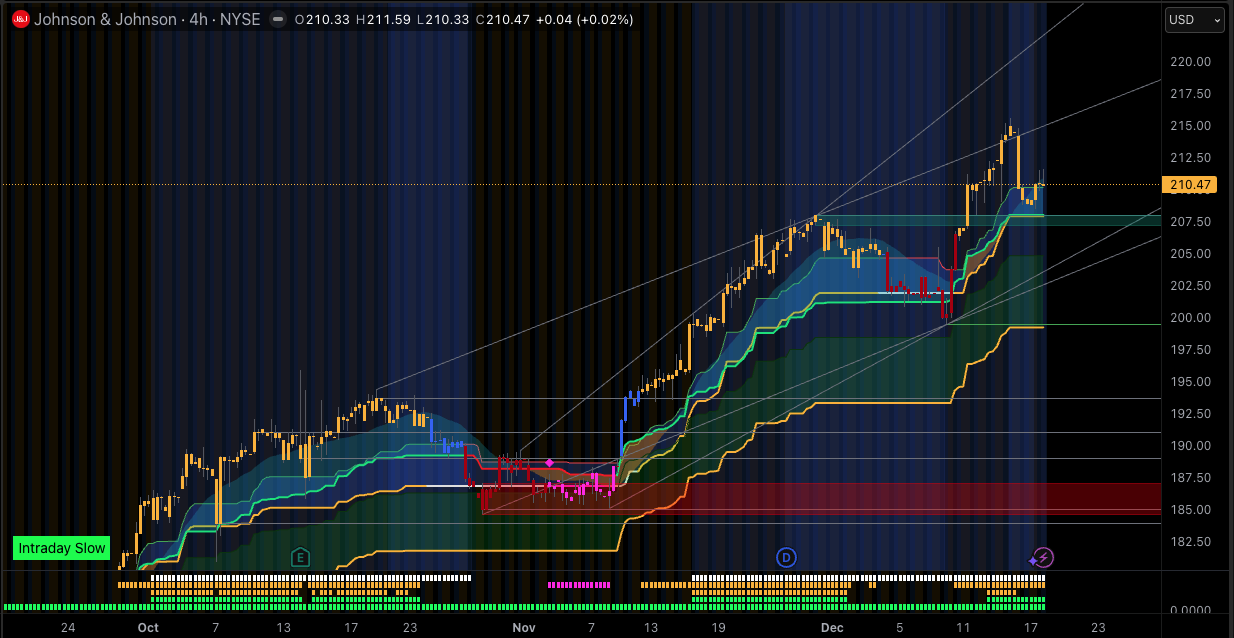

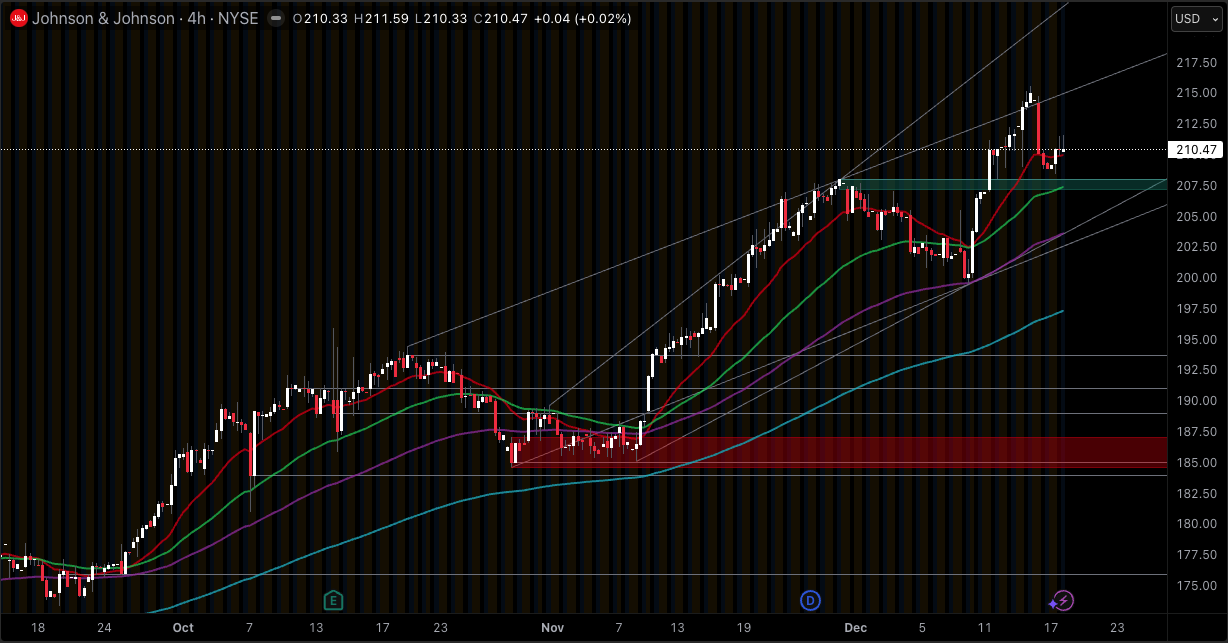

Johnson & Johnson (JNJ) stock is in a pullback within a broader uptrend on the H4 view, with price still holding well above its larger trend references after a strong 2025 run.

The latest regular-session close sits at $210.33, keeping the stock pinned near the upper end of its 52-week range ($140.68 to $215.19).

The one level that matters most right now is the $208.46 to $211.52 band. That band defines the most recent session’s full range and is effectively the near-term battlefield for whether this pullback stays orderly or turns into a deeper unwind.

Conditional bias: Bullish above $212.80, Bearish below $208.46, Neutral inside.

Key Levels Around The $211 Retest Band

| Level |

Price |

Why It Matters |

| Resistance 2 |

$215.19 |

Upper supply zone near the 52-week high, where breakouts can stall first. |

| Resistance 1 |

$212.80 |

Near-term ceiling where multi-hour closes need to stick to confirm continuation (range cap behavior). |

| Pivot Zone |

$210.80 to $211.50 |

Retest band around the mid-to-upper part of the current range, where acceptance or rejection often decides the next impulse. |

| Support 1 |

$208.46 |

Session floor and first demand reference; losing it shifts control to sellers quickly. |

| Support 2 |

$206.50 |

Next structural “catch zone” aligned with the rising MA100 on the multi-hour dashboard read. |

Technical Dashboard

Price is sitting in a “decision pocket” where levels matter more than opinions. With volatility relatively contained on the multi-hour read, the market is more likely to reward clean triggers (H4 close through a level, then retest) than anticipation inside the middle of the range.

That makes the $210.80 to $211.50 area the practical filter: hold above it and dips tend to stay buyable; fail there repeatedly and upside attempts lose follow-through.

| Metric |

Current Value |

Signal |

Practical Read |

| Price (Close) |

$210.33 |

— |

Reference point for all levels (Dec 17, 2025). |

| RSI (14) |

50.58 |

Neutral |

Range-type momentum: neither strong trend pressure nor washout yet. |

| MACD (12,26,9) |

0.41 |

Bullish |

MACD bias is positive, but needs price to reclaim the upper band for momentum to matter. |

| ADX (14) |

27.35 |

Trending |

Trend strength is present, but continuation still requires acceptance above resistance (avoid chasing mid-range). |

| ATR (14) |

1.12 |

Low |

Expect tighter H4 swings; targets should be realistic, and stop placement must respect nearby levels. |

| Williams %R (14) |

-69.14 |

Neutral |

Not stretched; room exists for either a grind higher or another dip without forced bounces. |

| CCI (14) |

4.12 |

Neutral |

No strong impulse signal; price action at the band edges is the real trigger. |

| MA20 |

210.11 |

Above |

Fast trend guide is just below price and rising; supportive if $210 holds on retests. |

| MA50 |

209.86 |

Above |

Swing filter remains supportive; pullbacks that hold above it tend to stay constructive. |

| MA100 |

206.49 |

Above |

Mid-term structure reference; breaks below support likely pull toward this zone. |

| MA200 |

202.13 |

Above |

Long-term trend line; major reaction zone if the range breaks down. |

| Volume vs 20D Avg |

8.46M vs 8.97M |

Normal |

Slightly below typical activity; no panic selling or breakout urgency yet. |

| Earnings Window |

Jan 21, 2026 |

Not Near |

Several weeks out, reducing scheduled gap risk. |

| Gap Risk |

Medium |

Medium |

Legal and headline sensitivity can still gap price even without earnings nearby. |

Momentum And Structure: Uptrend, But With Mixed Follow-Through

RSI is neutral while MACD stays bullish, a mixed alignment that often translates into slower follow-through and more two-sided trade until a range edge breaks cleanly.

Structurally, the H4 picture remains constructive: price is still holding above its key moving-average stack, but it is also pressing into a zone where sellers have recently defended the upper band and buyers have defended the lows.

Structurally, the H4 picture remains constructive: price is still holding above its key moving-average stack, but it is also pressing into a zone where sellers have recently defended the upper band and buyers have defended the lows.

That is classic “trend pause” behavior: the next decisive move typically comes from acceptance above the range cap or failure through the range floor, not from the midpoint.

With ATR sitting near $1.12 on the multi-hour read, expectations should stay tight: this is not a tape that needs wide targets unless a breakout is confirmed. Preference stays with break-and-retest triggers rather than impulse entries inside the pivot band.

Lower Timeframes: Compression Under Resistance

On the lower timeframes, the most practical read is compression under nearby resistance, with repeated probing toward the upper band and quick returns to the pivot zone. That kind of action usually favors patient execution: wait for a level to hold on a retest rather than buying the first spike.

If lower timeframe bounces keep failing to build above the pivot band, it often signals distribution inside the range. Conversely, if pullbacks keep getting absorbed quickly above the pivot zone, it usually sets up a cleaner H4 continuation attempt into the next resistance layer.

Scenarios For The Next Few Sessions

| Scenario |

Trigger |

Invalidation |

Target 1 |

Target 2 |

| Base Case |

H4 acceptance back above $210.80–$211.50 |

H4 close below $208.46 |

$211.52 |

$212.80 |

| Bull Case |

H4 close above $212.80, then retest holds |

H4 close back below $210.80 |

$214.17 |

$215.19 |

| Bear Case |

H4 close below $208.46 |

H4 close back above $210.80 |

$206.50 |

$202.13 |

Risk Notes: Volatility Is Low, Headlines Are Not

With ATR near $1.12 on the multi-hour dashboard, stops that ignore structure tend to get tagged by normal noise. Targets should also be proportional: in low-ATR regimes, the market often requires a confirmed break before it pays larger extensions.

Event and headline risk still matters. Legal developments around talc litigation can override technicals quickly, and broader market risk appetite can shift fast when rates move or macro narratives change.

Frequently Asked Questions (FAQ)

1. Is JNJ bullish or bearish on the H4 chart?

Bullish bias overall, but currently in a pullback phase. Bullish confirmation improves on H4 strength above $212.80; risk increases below $208.46.

2. What are the key support and resistance levels for JNJ right now?

Support: $208.46 then $206.50. Resistance: $212.80 then $215.19.

3. What confirms an H4 breakout higher in JNJ?

An H4 close above $212.80 followed by a retest that holds, ideally with improving participation and less wick rejection.

4. What invalidates the bullish scenario?

A clean H4 close below $208.46 shifts the structure toward a deeper pullback path.

5. What do RSI and MACD suggest right now?

RSI is neutral while MACD remains bullish, which is typically a “mixed” setup that needs price confirmation at the range edges to avoid chop.

6. How volatile is JNJ right now based on ATR?

Multi-hour ATR is about $1.12, implying tighter swings and more importance on precise level-based execution.

7. When is the next earnings event, and does it matter for gap risk?

The next earnings call is scheduled for Jan 21, 2026. It is not immediate, but headline risk remains present due to legal and sector news flow.

Conclusion

JNJ is trading like a mature trend that is pausing under resistance, not breaking. The pivot band near $210.80 to $211.50 is the execution filter, and the range edges at $212.80 and $208.46 are the levels that will decide whether the next H4 leg is continuation or retracement.

As long as price holds above $208.46, the setup favors patience and confirmation: buyable pullbacks are more likely than clean breakdowns.

A confirmed H4 close above $212.80 shifts the tape back into continuation mode toward $214.17 and potentially $215.19, while losing $208.46 opens the door toward $206.50 and $202.13.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Structurally, the H4 picture remains constructive: price is still holding above its key moving-average stack, but it is also pressing into a zone where sellers have recently defended the upper band and buyers have defended the lows.

Structurally, the H4 picture remains constructive: price is still holding above its key moving-average stack, but it is also pressing into a zone where sellers have recently defended the upper band and buyers have defended the lows.