The question of whether VNQ is a good investment depends on the interaction among interest rates, property cash flows, and credit conditions in 2026. Publicly traded real estate typically behaves similarly to long-duration equities. When discount rates increase, valuations tend to compress rapidly. Conversely, when rates decline, valuation multiples can recover even if rental income growth is gradual.

As of January 2026, the US 10-year Treasury yield remains in the mid-4 percent range. This elevated hurdle rate for property valuations is significantly higher than in the previous decade, continuing to pressure the entire real estate investment trust (REIT) sector.

Key Takeaways:

Interest rates remain the primary driver: With the 10-year Treasury yield at approximately 4.25 percent in January 2026 and policy rates remaining restrictive, VNQ’s valuation is largely determined by the trajectory of long-term yields and credit spreads.

Portfolio concentration is notable: The top ten holdings account for approximately 52 percent of assets, indicating that a small number of large REITs and platforms significantly influence overall performance.

Income is substantial but not assured: VNQ’s yield, which is approximately 3.9 to 4.0 percent, contributes to total return; however, distributions may vary depending on operating conditions and refinancing expenses.

Office-sector challenges do not define the entire portfolio: Although US office vacancy rates remain elevated, VNQ’s primary allocations are in subsectors such as logistics, data infrastructure, and demographic trends, rather than traditional office properties.

Expect equity-like volatility: VNQ’s multi-year volatility profile has historically been closer to equities than bonds, including periods of sharp drawdowns during macro shocks.

How VNQ Behaves As An Investment

VNQ, the Vanguard Real Estate ETF, provides broad and cost-effective exposure to US-listed real estate, eliminating the need to select specific subsectors or individual REITs. It tracks the MSCI US Investable Market Real Estate 25/50 Index, includes over 150 holdings, charges a 0.13 percent expense ratio, and distributes income quarterly with an indicated yield of approximately 4 percent.

| Key detail |

Information |

| Issuer |

Vanguard |

| Ticker |

VNQ |

| Type |

Real Estate sector ETF (exchange-traded fund) |

| Assets |

Invests in US-listed real estate companies and REITs |

| Expense ratio |

0.13% |

| Exchange |

NYSE Arca |

| Dividend |

Pays quarterly; yield often around 3.8%–4.0% |

| Risk |

Vanguard risk rating: 4 (higher risk/reward) |

| AUM |

Around $64 billion (early 2026) |

Portfolio composition is significant. VNQ’s largest allocations are in industrial logistics, digital infrastructure, healthcare real estate, and large diversified platforms, rather than traditional office properties. In 2026, this diversification may distinguish a balanced cash-flow allocation from a concentrated thematic investment.

What VNQ Owns and Why the Benchmark Matters

VNQ aims to replicate the MSCI US Investable Market Real Estate 25/50 Index using a predominantly full-replication strategy. As a result, VNQ is not limited to REITs; it also includes real estate management and development companies, thereby broadening the range of return drivers beyond rental income.

The portfolio’s largest holdings offer a clear representation of its actual market exposure. A significant share is allocated to specialized, scalable business models, which generally have greater capital-raising efficiency than smaller, niche landlords.

| Top VNQ holdings |

Approx. weight |

| Vanguard Real Estate II Index Fund |

14.5% |

| Welltower |

7.1% |

| Prologis |

6.9% |

| American Tower |

4.8% |

| Equinix |

4.4% |

| Simon Property Group |

3.5% |

| Digital Realty |

3.1% |

| Realty Income |

3.0% |

| CBRE Group |

2.8% |

| Public Storage |

2.4% |

Collectively, the top ten positions comprise approximately 52 percent of assets. While VNQ maintains a broad roster of REITs, the portfolio is not equally weighted. A limited number of dominant franchises exert a disproportionate influence on overall performance.

The Rate Regime in 2026: The Hidden Engine Behind REIT Pricing

If you want to know whether VNQ is a good investment, start with the discount rate. Real estate

valuation is built on a familiar relationship:

Property value is roughly NOI ÷ cap rate.

Cap rates typically track the risk-free rate plus a risk premium.

REIT share prices adjust quickly because markets reprice them in real time.

When long-term yields are in the 4 percent range rather than 2 percent, the market assigns a lower value to each dollar of property cash flow unless growth is sufficient to offset the higher discount rate. As a result, VNQ may exhibit fundamental stability at the property level while remaining volatile in market pricing.

When long-term yields are in the 4 percent range rather than 2 percent, the market assigns a lower value to each dollar of property cash flow unless growth is sufficient to offset the higher discount rate. As a result, VNQ may exhibit fundamental stability at the property level while remaining volatile in market pricing.

A scenario framework helps anchor expectations:

| 2026 scenario |

Rates backdrop |

What it usually means for VNQ |

| Disinflation, yields drift lower |

10-year declines gradually; credit spreads stable |

Multiple expansion becomes more plausible; total returns improve |

| Soft landing, yields sideways |

10-year range-bound |

Returns skew toward yield plus modest cash-flow growth |

| Sticky inflation or reflation |

10-year rises; spreads widen |

Valuation pressure; refinancing headwinds intensify |

This framework is not a forecast but rather a decision-making tool. VNQ’s prospective returns depend less on short-term rent increases and more on changes in the market’s required return over the next 12 to 24 months.

Cash Flow Reality: What Actually Funds VNQ’s Distributions

VNQ’s long-run return comes from three sources:

Starting yield (cash distributed),

Growth in cash flows (FFO, NOI),

Valuation changes (the multiple the market assigns to those cash flows).

The current yield provides a tangible income component, but it does not make VNQ comparable to a bond. REIT distributions fluctuate with occupancy rates, rent spreads, operating expenses, and interest costs. In a higher-interest-rate environment, a critical consideration is whether same-store net operating income growth keeps pace with the rising cost of capital.

A common principle explains the divergence in REIT performance: external growth is effective when a REIT can invest at returns exceeding its total financing cost. When this spread narrows, acquisition activity slows, development becomes more selective, and management prioritizes balance sheet strength over expansion.

Subsector Crosscurrents: VNQ’s Built-In Tilt in 2026

VNQ’s largest allocations are concentrated in sectors with more robust secular demand compared to the most challenged segments of commercial real estate.

Industrial logistics: Prologis represents modern distribution footprints tied to e-commerce, inventory optimization, and regional delivery density. Demand is cyclical, but the asset type has generally enjoyed better structural support than older retail formats.

Digital infrastructure: Equinix and Digital Realty reflect data centers, which behave like “real estate plus power and connectivity.” Lease terms can be sticky, yet the subsector is not immune to supply cycles, power constraints, or shifting customer demand.

Wireless infrastructure: American Tower adds a contracted infrastructure profile tied to network usage. It is still rate-sensitive, but the underlying revenue model differs from traditional leasing.

Healthcare real estate: Welltower acquires senior housing and medical-related assets in markets with strong demographics supporting demand. Performance tends to hinge on operating costs, labor availability, and the dynamics of occupancy recovery.

Retail and net lease: Simon Property Group and Realty Income reflect two distinct models: high-quality malls with strong tenant sales metrics versus diversified net lease portfolios built on long leases.

The office sector remains the primary risk within commercial real estate. National vacancy rates are still elevated, despite some early signs of stabilization. For VNQ, this results in diluted exposure to office-related risks, as the ETF’s largest allocations are in other sectors.

Valuation and Return Expectations: Translating History Into a 2026 Decision

VNQ is best evaluated as an equity allocation that provides income, rather than as a fixed-income substitute. Historical data support this perspective: long-term holding periods have produced respectable returns, while shorter periods are more susceptible to interest rate shocks and risk-off events.

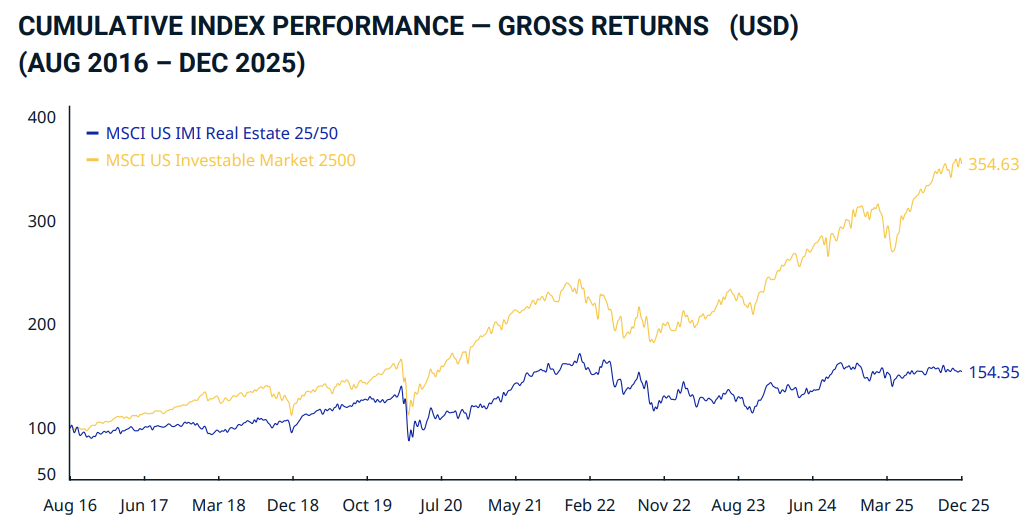

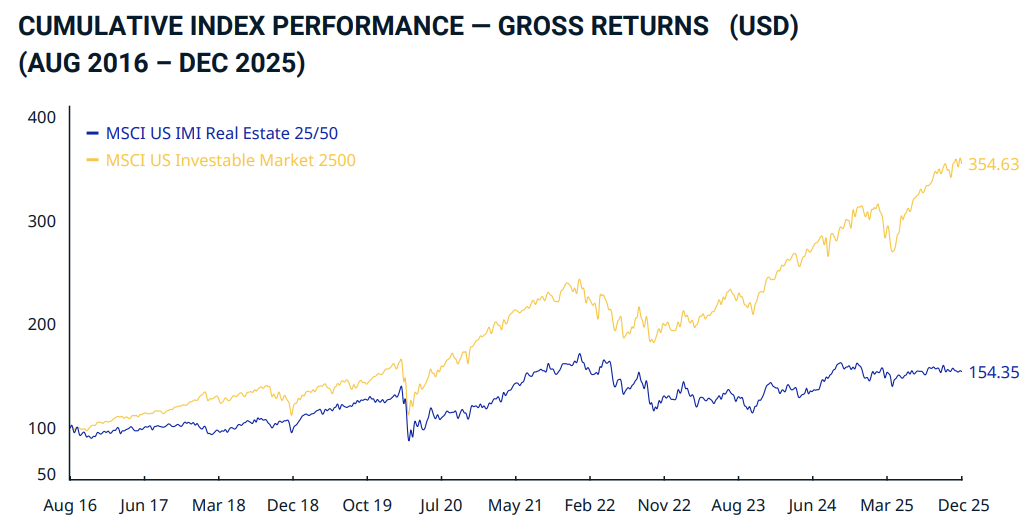

By late 2025, VNQ’s annualized total returns over five- and ten-year periods were in the mid-single digits, with even stronger performance since inception. These results align with a portfolio in which dividends provide consistent income and valuations fluctuate with interest rate cycles.

By late 2025, VNQ’s annualized total returns over five- and ten-year periods were in the mid-single digits, with even stronger performance since inception. These results align with a portfolio in which dividends provide consistent income and valuations fluctuate with interest rate cycles.

A realistic set of expectations for 2026 includes the following scenarios:

If long rates fall gradually, VNQ’s total return can benefit from both yield and valuation normalization.

If long rates remain range-bound, the base case leans toward yield plus modest cash flow growth.

If long rates rise or credit tightens, price pressure can overwhelm income for extended periods.

This framework underpins the central question of whether VNQ is a suitable investment beyond 2026. The answer depends equally on an investor’s tolerance for interest rate-driven volatility and the underlying strength of real estate fundamentals.

Taxes and Account Placement: The Quiet Factor That Changes the Math

In a US taxable account, REIT distributions are commonly taxed as ordinary income rather than at qualified dividend rates. That can reduce after-tax yield relative to many dividend-heavy equity strategies.

However, qualified REIT dividends have historically been eligible for the Section 199A deduction (up to 20 percent for eligible taxpayers), which can partially offset the difference depending on personal circumstances.

Generally, REIT-heavy allocations are well-suited to tax-advantaged accounts, where ordinary income treatment is less detrimental. In taxable accounts, after-tax yield is influenced by the composition of distributions such as ordinary income, return of capital, and other elements, as well as eligibility for deductions.

Given the personal and jurisdiction-specific nature of tax outcomes, this consideration should inform portfolio design rather than serve as a universal guideline.

So, Is The VNQ A Good Investment In 2026?

You can use this checklist to reach a clear, self-determined conclusion to determine if VNQ is a good ETF investment for your portfolio in 2026.

VNQ tends to fit when:

The goal is broad US-listed real estate exposure with low fees and high liquidity.

A multi-year holding period is realistic, ideally five years or longer.

Portfolio construction benefits from an income component that can diversify equity cash flows.

The macro view leans toward stable-to-lower long-term yields rather than a renewed inflation shock.

A diversified basket across subsectors feels preferable to making a single-property-type call.

VNQ tends to be a weaker fit when:

Capital stability is required over the next 12–24 months.

The portfolio is already heavily exposed to rate-sensitive assets and credit beta.

The intent is to express a concentrated thesis (such as a dedicated office rebound), since VNQ’s diversification will dilute single-theme outcomes.

In summary, VNQ is most effective as a strategic component within a diversified portfolio, rather than as a replacement for cash, short-term bonds, or guaranteed income instruments.

Frequently Asked Questions (FAQ)

1. What is VNQ, and what does it track?

VNQ is the Vanguard Real Estate ETF. It aims to track the MSCI US Investable Market Real Estate 25/50 Index, providing broad exposure to US-listed real estate companies, including REITs and select real estate operating businesses.

2. Is VNQ a good investment for income in 2026?

VNQ’s yield of around 4 percent can make it attractive as an income-oriented equity allocation. The key trade-off is variability: distributions can change, and the ETF price can move sharply with interest-rate expectations. It works best when income is part of a longer-term total-return plan.

3. How sensitive is VNQ to interest rates?

VNQ is materially rate-sensitive because real estate valuation depends on discount rates and cap rates. When long-term yields rise, REIT multiples often compress; when yields fall, the opposite can occur. The higher the starting rate level, the more the market focuses on refinancing costs and required returns.

4. Does VNQ have heavy office exposure?

VNQ has some office-related holdings, but its larger weights sit in industrial logistics, healthcare real estate, digital infrastructure, retail leaders, and diversified platforms. Office headlines can still influence sentiment, yet the portfolio is not built as an office-centric strategy.

5. Is VNQ safer than owning individual REITs?

Diversification reduces single-name risk, but it does not remove rate sensitivity or sector-wide drawdowns. VNQ can be less fragile than a concentrated REIT position, yet it will still fall when real estate equities reprice lower across the board.

Conclusion

A disciplined approach to evaluating VNQ as an investment in 2026 is to consider it a rate-sensitive equity portfolio supported by rental income streams, rather than a stable-income product. Its value proposition includes diversified US-listed real estate exposure, a low expense ratio, and a meaningful yield.

The principal risks are also evident: exposure to long-term interest rates, refinancing conditions, and subsector divergence, particularly in areas with structurally weak leasing demand. Over multi-year horizons, VNQ can function as a resilient allocation that combines income with inflation-linked cash flows.

However, for investors seeking short-term stability, the rate sensitivity that benefits VNQ during easing cycles may also result in significant headwinds.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources:

US 10 Year Treasury Yield

VNQ Annualized Returns