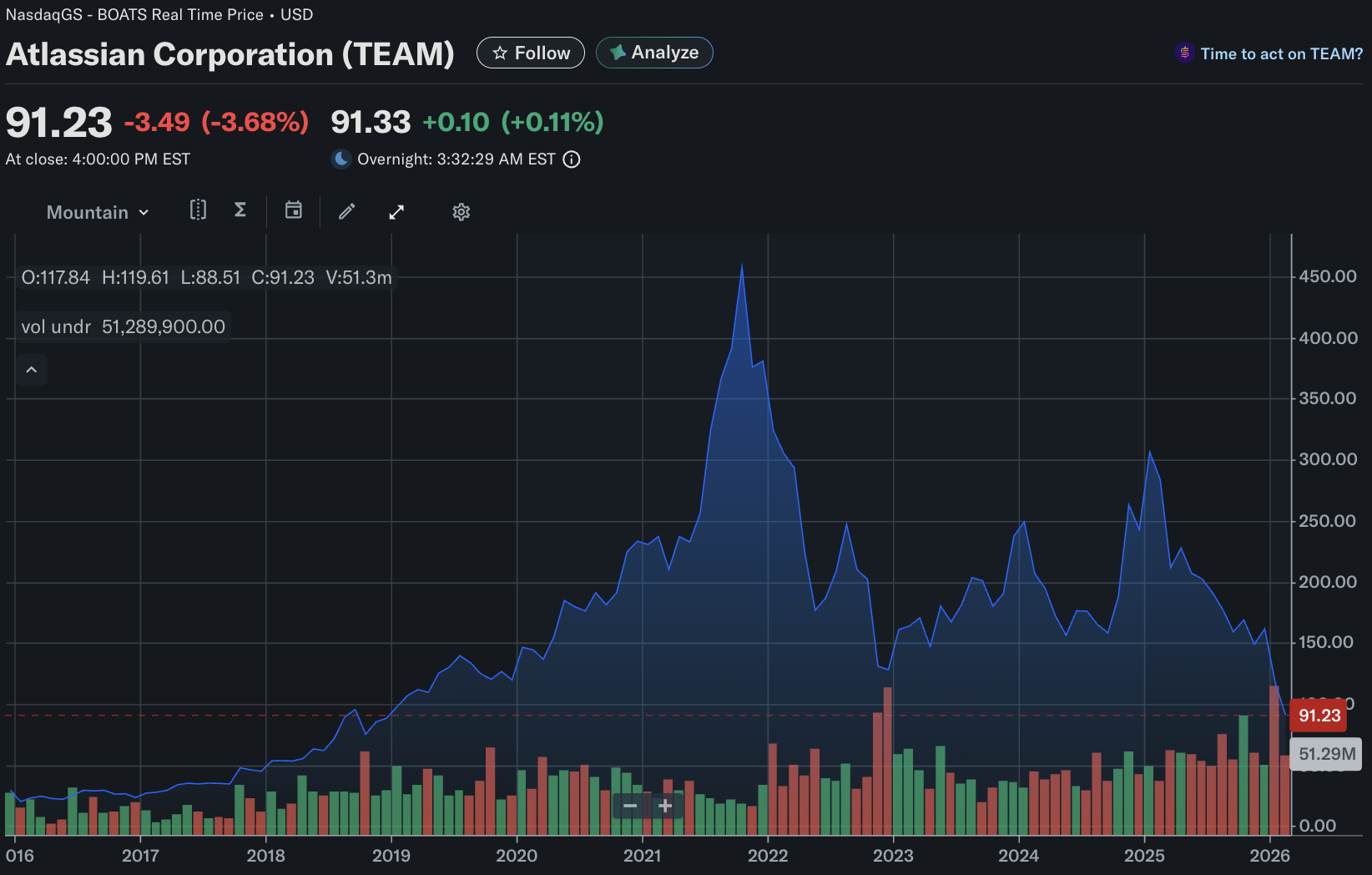

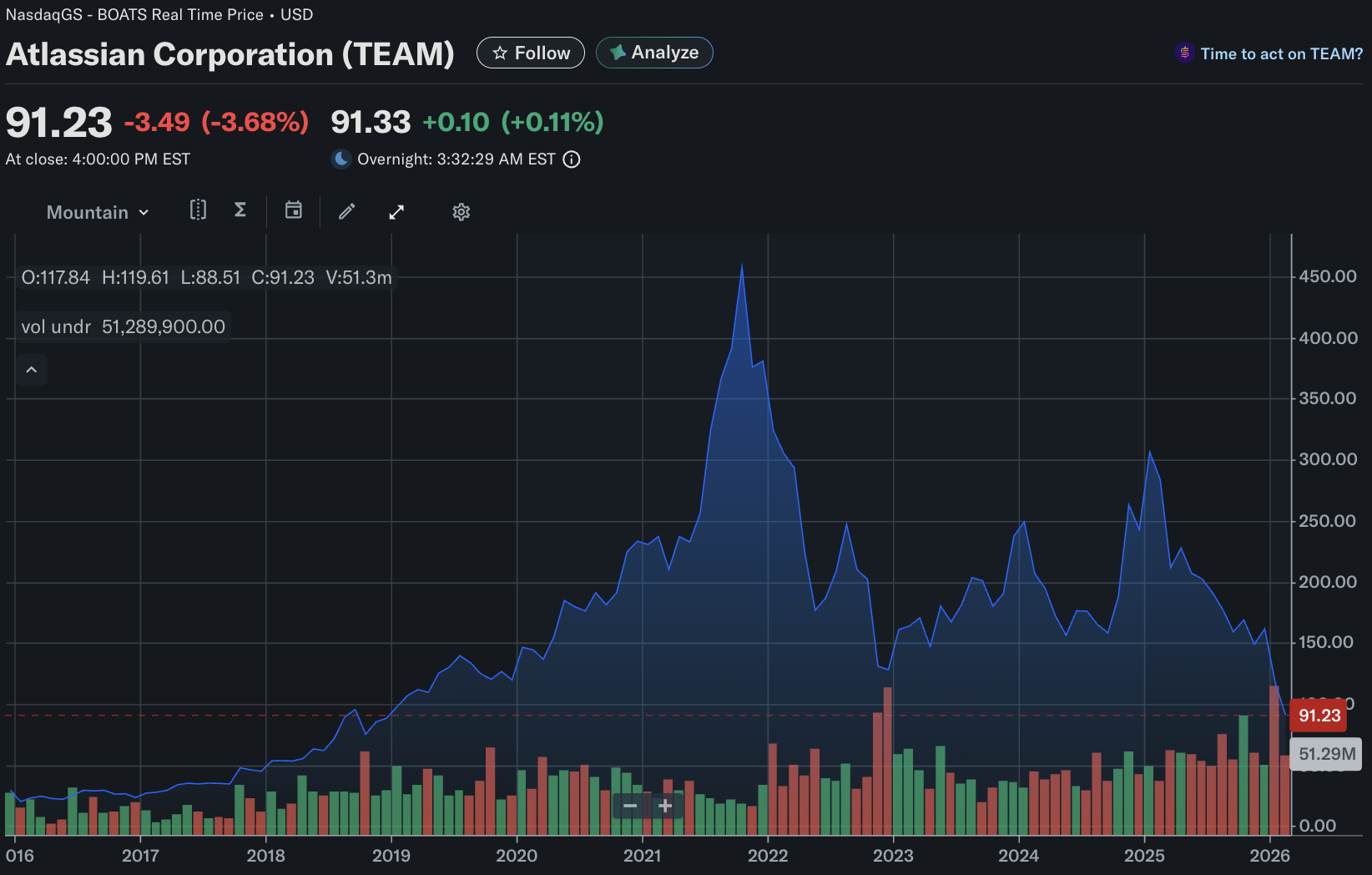

Atlassian stock has returned to a price range not seen in several years, despite the company's expansion into a significantly larger, more resilient recurring-revenue platform. With $TEAM stock closing at $91.23 on February 9, 2026, the market appears to be pricing Atlassian as though its growth prospects have diminished considerably and its competitive advantages are facing substantial challenges.

The timing is significant. Atlassian recently reported a quarter in which revenue exceeded a $6 billion annual run rate, with cloud revenue surpassing $1.0 billion. This combination of expanding product breadth alongside a rapidly declining equity multiple is uncommon in the software sector. Such a scenario typically indicates either a genuine impairment of the business franchise or a valuation adjustment that has outpaced underlying fundamentals.

Atlassian ($TEAM) Stock Performance (1W, 1M, 6M)

The decline in stock prices has been abrupt, characterised by a series of sharp downward movements that have driven momentum indicators to historically stressed levels.

Stock performance table (as of Feb 9, 2026, close)

| Period |

Performance |

Reference date |

| 1W (5-day) |

-19.76% |

since 02/02/26 |

| 1M |

-37.69% |

since 01/09/26 |

| 6M |

-45.72% |

since 08/08/25 |

Atlassian Stock’s Paradox: Bigger Business, Smaller Multiple

Atlassian’s market narrative has flipped. In the 2020-2021 cycle, investors paid for duration: high gross margins, expanding TAM, and the assumption that collaboration and workflow software would compound at premium growth rates for a decade. In 2025-2026, the same attributes are being discounted because the market is no longer debating whether Atlassian can grow. It is debated how defensible that growth is in an AI-native workflow world, and how much of it is price, packaging, and migration rather than organic seat expansion.

The result is that Atlassian stock now trades like a maturing software utility. That is a stark framing for a company that just demonstrated ongoing cloud acceleration and enterprise contract expansion. Q2 FY2026 revenue rose 23% year over year to $1.586 billion, with non-GAAP operating margin at 27% and RPO at $3.814 billion. Those are not the metrics of a franchise in operational decline.

The result is that Atlassian stock now trades like a maturing software utility. That is a stark framing for a company that just demonstrated ongoing cloud acceleration and enterprise contract expansion. Q2 FY2026 revenue rose 23% year over year to $1.586 billion, with non-GAAP operating margin at 27% and RPO at $3.814 billion. Those are not the metrics of a franchise in operational decline.

Revenue Is About Six Times The FY2018 Base, But The Market Cares About The Mix

The headline claim in $TEAM stock’s current debate is simple: revenue has multiplied, while the share price has retraced. On a clean reference point, Atlassian generated $874.0 million of revenue in FY2018. In FY2025, total revenue rose to $5.215 billion, roughly six times the FY2018 base. By Q2 FY2026, Atlassian reported $1.586 billionin quarterly revenue, and management noted it had surpassed a $6 billion annual run-rate.

On a simple arithmetic run-rate basis (Q2 revenue multiplied by four, not company guidance), that implies roughly $6.34 billion, or just over seven times the FY2018 level. The market’s concern is not the magnitude of revenue growth, but rather the composition and defensibility of that revenue as artificial intelligence transforms knowledge work.

Revenue scaling snapshot

Cloud revenue and RPO figures are reported for Q2 FY2026; annualized values are simple arithmetic run-rates (quarter multiplied by four) and are not company guidance.

The strategic implication is that Atlassian is no longer a single-product story. It is a platform that migrates customers to the cloud, expands into service management, and uses AI features to increase engagement. That is the bull case. The bear case is that the same AI features are table stakes that compress pricing power over time.

| Metric |

FY2018 |

FY2025 |

Q2 FY2026 (Quarter) |

FY2026 Run-rate (Annualized) |

| Total revenue |

$0.874B |

$5.215B |

$1.586B |

~$6.34B |

| Cloud revenue |

N/A |

N/A |

$1.067B |

~$4.27B |

| RPO |

N/A |

N/A |

$3.814B |

N/A |

Cloud revenue and RPO figures are reported for Q2 FY2026; annualized values are simple arithmetic run-rates (quarter multiplied by four) and are not company guidance.

Cloud Transition: Stronger Stickiness, New Execution Risk

Atlassian’s cloud mix is important because cloud revenue is more recurring, easier to bundle, and typically supports higher long-term lifetime value. In Q2 FY2026, cloud revenue rose 26% to $1.067 billion, while total revenue rose 23%. That spread suggests cloud is still outgrowing the aggregate, which is what investors want to see during a migration cycle.

RPO growth is even more revealing. Remaining performance obligations rose 44% year over year to $3.814 billion. For enterprise software, RPO is a proxy for contracted backlog and duration. Rapid RPO growth alongside mid-20s revenue growth often indicates that the enterprise motion is expanding and deal terms are lengthening.

Yet, cloud transition poses a structural risk: it creates a window during which customers reassess their tooling. Migration projects are moments of scrutiny. In a world where AI copilots can route work across tools, and where developer teams increasingly automate workflows, Atlassian must prove it remains the system of record for work, not merely an interface for tickets and pages.

The AI Question: Moat Extension or Workflow Disintermediation

The market’s sharp repricing of Atlassian stock is best understood as an AI anxiety premium being subtracted from the multiple. Atlassian is leaning into AI as a distribution advantage, highlighting that Rovo exceeded 5 million monthly active users and that the platform surpassed 350,000 customers.

That is not a defensive posture. It is an attempt to make Atlassian the orchestration layer that enables humans and AI agents to coordinate tasks, knowledge, and approvals.

The opposing perspective suggests that AI-native tools may reduce switching costs. As work becomes increasingly mediated by intelligent agents, users may prioritize interoperability, search capabilities, and outcomes over specific interfaces. In such a context, ticketing and documentation could become commoditized features within larger software suites. Atlassian’s strategy must therefore emphasize product-led differentiation, rather than relying solely on pricing and bundling.

Technical Picture: Key Support Levels and What The Tape is Signaling

Key support levels (practical, price-based)

$88.50–$89.00 (primary support): This zone aligns with the $88.51 52-week low and the recent period low shown on the performance dashboard. It is the nearest “must-hold” level because it is where buyers have already defended price.

$80 (secondary, psychological support): A round-number magnet that often attracts bids after capitulation-style moves. It matters less as a “technical level” and more as a liquidity and positioning checkpoint.

$70 (tertiary, extreme downside marker): Not a forecast, but a stress-test level that frames what a deeper derating could look like if the market concludes AI materially erodes Atlassian’s pricing power.

Trend and Momentum Markers (what traders will watch)

Barchart’s technical dashboard shows the magnitude of trend damage through moving averages and RSI:

| Signal |

Value |

Interpretation |

| 5-day moving average |

91.97 |

Price is below short-term mean |

| 10-day moving average |

92.42 |

Downtrend still intact |

| 20-day moving average |

95.82 |

Short-term trend remains bearish |

| 50-day moving average |

105.05 |

Medium-term downtrend is entrenched |

| 100-day moving average |

116.92 |

Longer-term pressure persists |

| 200-day moving average |

132.13 |

Long-term trend reversal not in place |

| RSI (14-day) |

32.481 |

Weak momentum, near oversold threshold (30) |

Technical indicators show the magnitude of trend damage through moving averages and RSI (14-day). As of the Feb 9, 2026 close, the price remains below key moving averages, and momentum remains weak.

The signal set is consistent with a heavy downtrend. RSI is in the low-30s, near the commonly watched oversold threshold (30). Reflex rallies can still occur within a bear trend, but the higher-probability question is whether price can reclaim broken moving averages, starting with the 20-day and then the 50-day.

What Would Make The Valuation “Make Sense” Again?

Atlassian’s Q2 FY2026 results show a business that is still scaling: $1.586 billion of quarterly revenue, 27% non-GAAP operating margin, and expanding RPO. If the stock is behaving as if growth durability is impaired, the burden of proof is now product and competitive, not purely financial.

Three signposts matter most:

Net retention quality in the cloud: The market will reward evidence that cloud growth is driven by usage and expansion, not just by migration timing.

AI attach and monetization path: If Rovo and related AI capabilities increase adoption and reduce churn, they support the moat. If they become undifferentiated, they compress the multiple.

Operating leverage consistency: Non-GAAP margin at 27% is constructive, but investors will want confidence that AI investment does not permanently cap incremental margins.

Frequently Asked Questions (FAQ)

Is Atlassian stock oversold right now?

Technically, conditions are weak but not deeply oversold: the 14-day RSI is around 32.5. RSI readings below 30 are often treated as oversold, but RSI can stay low for extended periods in a downtrend. RSI also does not define fundamental value, it only describes recent momentum.

What is the most important support level for $TEAM stock?

The market is anchored to $88.51, the recent low and the 52-week low, on the performance dashboard. A sustained break below that level typically shifts the discussion from “bounce” to “capitulation,” because recent buyers have failed to defend their reference point.

How fast is Atlassian growing in 2026?

In Q2 FY2026, total revenue rose 23% year over year to $1.586 billion. Cloud revenue rose 26% to $1.067 billion, and RPO rose 44% to $3.814 billion, showing both growth and improving contract duration.

Has Atlassian’s revenue really increased about six times since 2018?

FY2018 revenue was $874.0 million, and FY2025 revenue was $5.215 billion, which is roughly six times higher. Q2 FY2026 revenue of $1.586 billion implies a simple annualized run-rate of about $6.34 billion (not guidance), which is just over seven times FY2018.

Why is the Atlassian stock down so much if revenue and cloud are still growing?

The price action reflects multiple compressions and a market reassessment of durability. Investors are discounting AI-driven workflow disruption risk and treating Atlassian less like a long-duration compounder and more like a mature platform facing new competitive vectors, even as current-quarter results remain strong.

Conclusion

Atlassian stock reflects a clear market message: growth alone is no longer sufficient to command a premium valuation. With $TEAM stock at $91.23, down 45.72% over six months, investors are increasingly factoring in the likelihood that artificial intelligence will alter the economics of collaboration and work management software.

Nevertheless, operational data indicate that Atlassian remains a high-quality, evolving platform. In Q2 FY2026, the company reported $1.586 billion in revenue, $1.067 billion in cloud revenue, and $3.814 billion in remaining performance obligations, with a non-GAAP operating margin of 27%.

The immediate decision point is both technical and fundamental: the $88.51 support level is critical. If this level holds, the market may shift from a liquidation phase to a recovery phase. If it fails, the discussion may move from a valuation reset to more profound concerns regarding the company’s long-term prospects.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

Atlassian FY2018 total revenue (annual report)

Atlassian FY2025 total revenue (Form 10-K)

The result is that Atlassian stock now trades like a maturing software utility. That is a stark framing for a company that just demonstrated ongoing cloud acceleration and enterprise contract expansion. Q2 FY2026 revenue rose 23% year over year to $1.586 billion, with non-GAAP operating margin at 27% and RPO at $3.814 billion. Those are not the metrics of a franchise in operational decline.

The result is that Atlassian stock now trades like a maturing software utility. That is a stark framing for a company that just demonstrated ongoing cloud acceleration and enterprise contract expansion. Q2 FY2026 revenue rose 23% year over year to $1.586 billion, with non-GAAP operating margin at 27% and RPO at $3.814 billion. Those are not the metrics of a franchise in operational decline.