Semrush Holdings, Inc. (NYSE: SEMR) has seen its stock price soar following a landmark announcement: Adobe Inc. will acquire Semrush in an all‑cash deal valued at approximately US$1.9 billion, or US$12.00 per share, according to both companies.[1]

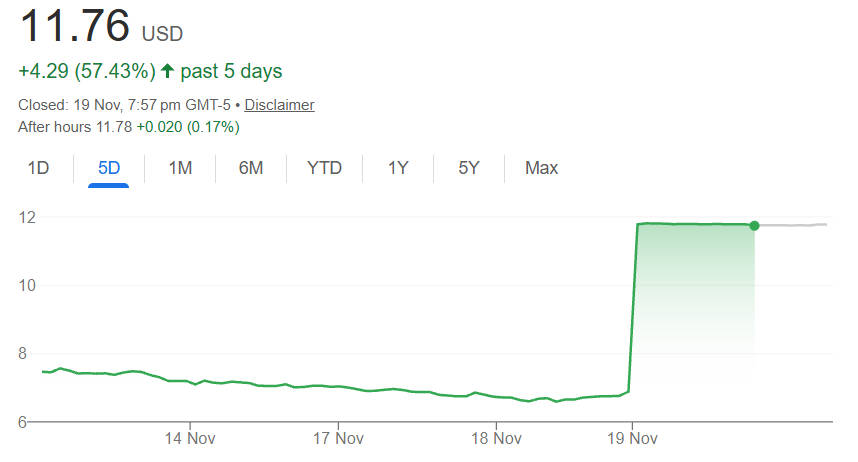

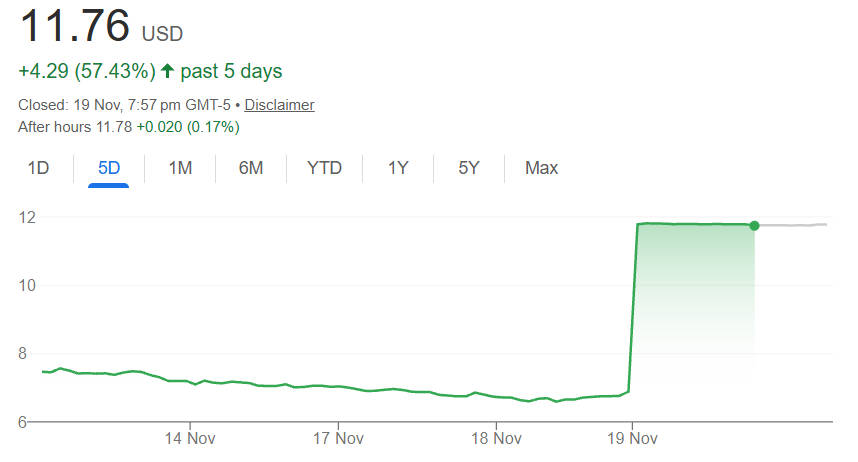

Semrush Stock Price Reaction to the Adobe Acquisition

When Adobe confirmed the deal, Semrush's stock jumped sharply, reflecting the substantial premium embedded in the offer. The US$12 per share price represents a premium of more than 50 per cent over its recent trading levels. Market response was immediate, with shares surging in pre‑market trading.

This price acts as a de facto floor for Semrush shareholders, assuming the deal closes. Given the scale of the premium, many investors may view this as a highly attractive exit opportunity.

Strategic Rationale: Why Adobe Wants Semrush

Adobe's acquisition of Semrush is more than a mere financial transaction. The deal aligns with Adobe's broader strategy to deepen its AI‑powered marketing capabilities and extend its reach into brand visibility across both traditional and generative AI search environments.

Semrush is known for its SEO (search engine optimisation) tools, but increasingly its GEO (generative engine optimisation) solutions are attracting enterprise customers. These tools help brands understand how they appear not only in web search but also in responses generated by large language models (LLMs) such as ChatGPT and Google's Gemini.

By combining with Adobe, Semrush's data-driven visibility capabilities can be fused with Adobe Experience Cloud, potentially giving marketers a more holistic understanding of brand presence across owned channels, AI-driven search, and the wider web.

Semrush Financial Performance in Context of Stock Price

To understand Semrush's valuation, it is essential to review its recent financial performance.

1. Third Quarter 2025 Highlights

Semrush reported US$112.1 million in revenue for Q3 2025. representing a 15 per cent year-on-year increase.

The company recorded a GAAP operational loss of US$4.5 million, yielding an operating margin of –4.0 per cent.

On a non-GAAP basis, it generated US$14.1 million of operating income, giving a non-GAAP margin of 12.6 per cent.

Semrush delivered strong cash flow, with US$21.9 million of cash from operations, translating to a cash flow margin of 19.5 per cent.

At the end of the quarter, Annual Recurring Revenue (ARR) was US$455.4 million, a 14 per cent increase year on year.

The company maintained a dollar-based net revenue retention rate of 105 per cent, indicating that existing customers are expanding their usage.

2. Full Year 2024 Results

For the full year 2024. Semrush reported US$376.8 million in revenue, up 22 per cent year on year.

ARR at the end of 2024 stood at US$411.6 million, also up 22 per cent.

The company generated US$47.0 million in operating cash flow for the year.

3. First Quarter 2025

Semrush reported strong uptick in enterprise: customers paying more than US$50.000 annually grew by 86 per cent year on year.

Non‑GAAP operating margin in Q1 was 11.6 per cent, and cash flow from operations was US$22.1 million.

The company reaffirmed its full-year 2025 guidance with expected healthy profitability and free cash flow. [2]

Taken together, these performance metrics illustrate that Semrush is not just growing in top-line ARR, but also translating that into solid cash‐flow generation, providing a solid basis for its valuation in the acquisition.

Analyst Perspectives on Semrush Stock Price After the News

Analysts have viewed Adobe's offer for Semrush as a strong validation of Semrush's strategic importance. The all‑cash deal at US$12 per share implies a high valuation multiple relative to current SaaS benchmarks, but the premium suggests that Adobe anticipates meaningful synergies, especially in AI and enterprise adoption.

Many market commentators believe that the acquisition provides a clear path to liquidity for long‑term Semrush investors. On the other hand, because the deal sets a fixed price, the upside from further stock appreciation may be limited unless another bidder emerges.

In short, the offer price of US$12 helps anchor Semrush's stock, but future valuation upside appears contingent on deal execution or competing offers.

Risks and Key Considerations for Semrush Stock Price

Although the transaction offers significant value, there are several risks and considerations that investors should closely monitor:

1.Regulatory and Shareholder Approval

The deal is subject to regulatory clearance and requires Semrush shareholder approval. Any delay or rejection could jeopardise the acquisition, potentially causing the stock to retreat.

2.Integration Risk

Merging Semrush's technology and operations into Adobe's broader marketing ecosystem is complex. Poor integration could limit the realisation of expected synergies, reducing the long‑term value of the deal.

3. Shifting Business Focus

Semrush's shift toward enterprise customers and AI-driven products is promising but represents a departure from its traditional SEO base. Execution missteps in this transformation could lead to margin pressure or slowed growth.

4. Competitive Pressures

The market for digital marketing and AI-driven visibility tools is highly competitive. Semrush competes against other SEO platforms, data aggregators, and emergent AI-native analytics providers.

5. Deal Execution Timing

Although the acquisition is expected to close in the first half of 2026. any delay could expose Semrush's stock to volatility and reacquire deal risk.

Potential Catalysts for Semrush Stock Price Pre‑and Post‑Deal

Several catalysts could influence the stock price of Semrush before and after the transaction closes:

1. Proxy Statement Release and Shareholder Vote

The filing of the SEC proxy statement and the eventual shareholder vote will be critical milestones to watch.

2. Regulatory Approvals

Approval from relevant regulators (e.g., competition authorities) is essential. Any red flags could delay or block the deal.

3. Product Innovation and AI Acceleration

Semrush's continued innovation, particularly in its AI portfolio (GEO tools, enterprise AI), could justify the premium and drive further adoption. Their Q3 results already show ARR growth in AI.

4. Customer Expansion

Increased uptake from enterprise customers, especially those paying more than US$50.000 annually, could reinforce the strategic rationale.

5. Macro Trends

Broader trends in digital advertising, SEO demand, and the evolution of generative AI as a search interface may further support Semrush's value.

Impact on Semrush Stock Price Outlook

With the acquisition, Semrush's valuation now depends heavily on deal completion and integration execution, rather than purely on organic growth. The US$12 per share offer provides significant near-term value for shareholders, but the long-term upside will hinge on whether Adobe can successfully merge Semrush's tools, realise synergies, and scale its AI‑driven visibility products.

Scenarios for Semrush Stock Price

1. Base Case:

The deal closes as agreed, Semrush's technology integrates well, and the stock trades close to US$12 until closing.

2. Bull Case:

A competing bid emerges that drives up the offer; or Adobe over-delivers on synergy projections, re‑rating Semrush's value.

3. Bear Case:

Regulatory hurdles or shareholder rejection delay or kill the deal, causing Semrush's stock to fall back significantly from current levels.

Conclusion

Adobe's decision to acquire Semrush at US$12 per share and for a total of approximately US$1.9 billion shows how highly it values Semrush's SEO, generative engine optimisation, and AI-driven visibility tools. For Semrush investors, this deal offers a compelling liquidity event at a generous premium.

However, risks remain, especially around regulatory approval, integration, and execution of Semrush's growth strategy under Adobe's umbrella. As momentum shifts from organic growth to M&A value realisation, investors will need to track closing milestones, product adoption, and any competing bids.

In essence, the Semrush stock price story has evolved from "growth play" to "deal play," and whether it remains attractive will depend on whether that transaction can be carried out smoothly and deliver the synergies that Adobe expects.

Frequently Asked Questions

Q: What price is Adobe offering for Semrush shares?

Adobe is offering US$12.00 per share in an all‑cash deal to acquire Semrush.

Q: When is the Semrush‑Adobe deal expected to close?

The transaction is expected to close in the first half of 2026. subject to regulatory and shareholder approval.

Q: How much Annual Recurring Revenue (ARR) does Semrush currently have?

As of the end of Q3 2025. Semrush reported ARR of US$455.4 million, up 14 per cent year on year.

Q: Is Semrush profitable?

In Q3 2025. Semrush recorded a GAAP operating loss of US$4.5 million, but on a non‑GAAP basis it had operating income of US$14.1 million with a 12.6 per cent margin.

Q: What are the main risks for Semrush shareholders in this deal?

Key risks include regulatory approval, integration challenges, changing business focus, and possible competition affecting long‑term value.

Sources:

[1] https://news.adobe.com/news/2025/11/adobe-to-acquire-semrush

[2] https://investors.semrush.com/financials/quarterly-results/default.aspx

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.