The IEMG ETF is an exchange-traded fund that offers exposure to a wide range of emerging market equities. Designed to track the performance of companies in developing economies, it has become a popular choice for investors seeking to diversify beyond developed markets.

Emerging markets are known for their growth potential, but they also come with higher volatility and country-specific risks. The IEMG ETF aims to balance these factors by offering broad-based access to equities across Asia, Latin America, Eastern Europe, Africa, and the Middle East.

While there are several funds targeting this asset class, the IEMG ETF stands out in a few key areas. Understanding what makes it different can help investors decide whether it fits within their portfolio strategy.

Broader Coverage of Emerging Markets

One of the primary distinctions of the IEMG ETF is its comprehensive scope. Unlike some emerging market funds that limit their exposure to large-cap companies, the IEMG ETF includes small-cap and mid-cap equities as well. This results in a more diversified and representative view of emerging economies.

By including companies of various sizes, the IEMG ETF captures a wider range of growth opportunities. Smaller firms often have more room to expand in their local markets and may benefit from rising domestic demand, innovation, or regional reforms. At the same time, the inclusion of large, well-established firms provides stability and liquidity.

This multi-cap approach makes the IEMG ETF suitable for those seeking both depth and breadth in their emerging market allocation.

High Stock Count and Diversification

Another way the IEMG ETF differentiates itself is through the number of holdings. The fund typically includes thousands of companies, offering greater diversification than funds that focus on a narrower selection. This lowers the risk associated with individual company exposure and reduces the impact of volatility in any single country.

For investors who prefer a passive strategy, the broad diversification of the IEMG ETF makes it an efficient tool for capturing the overall performance of emerging markets without the need to analyse and select individual stocks or regions.

Inclusion of Frontier-Market Transition Economies

A notable feature of the IEMG ETF is its exposure to companies from markets that are sometimes classified between emerging and frontier. These are economies that may not yet meet the full criteria of established emerging markets but are on the path toward greater financial integration.

This inclusion means that the IEMG ETF offers access to fast-changing markets with strong demographic growth, rising consumer classes, and evolving infrastructure. For long-term investors, this exposure provides an added layer of growth potential that might not be present in more narrowly focused EM funds.

Efficient Cost Structure

Another factor that sets the IEMG ETF apart is its cost structure. Many investors look to ETFs for their affordability, and the IEMG ETF has been recognised for maintaining low annual expenses compared to some actively managed or region-specific emerging market funds.

While lower costs do not guarantee better performance, they can make a significant difference over time, especially in long-term portfolios. For those aiming to gain emerging market exposure without eroding returns through high fees, the IEMG ETF offers a relatively cost-effective solution.

Accessibility and Simplicity

For retail investors, accessibility matters. The IEMG ETF is structured in a way that makes it easy to trade, monitor, and integrate into a broader investment strategy. It avoids complex derivatives or illiquid assets, favouring transparency and simplicity.

This straightforward structure benefits both new and experienced investors who want to gain emerging market exposure without the administrative burden or complexity of direct international stock picking.

Strategic Fit in Long-Term Portfolios

The IEMG ETF also differs from more tactical or niche emerging market funds in its long-term suitability. Some EM products are designed to capitalise on specific regional themes or sector booms, which can lead to higher short-term volatility. The IEMG ETF, by contrast, offers more consistent exposure to long-term growth drivers such as urbanisation, rising incomes, and technological adoption across multiple regions.

For portfolio builders with a multi-decade horizon, the IEMG ETF can serve as a core component of a globally diversified equity allocation. It provides a simple yet effective way to capture the upward mobility of developing economies as they mature and integrate into global markets.

Final Thoughts

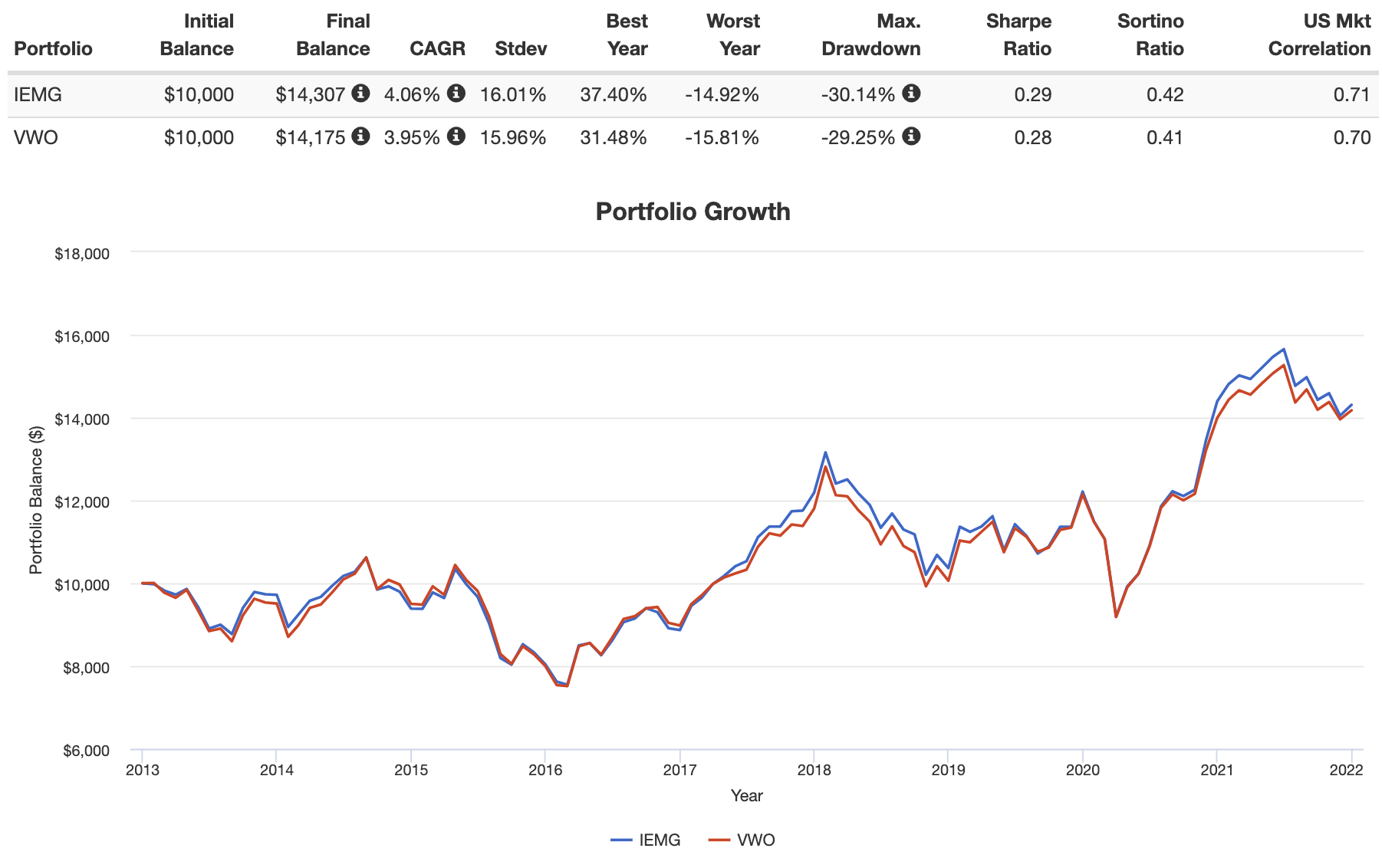

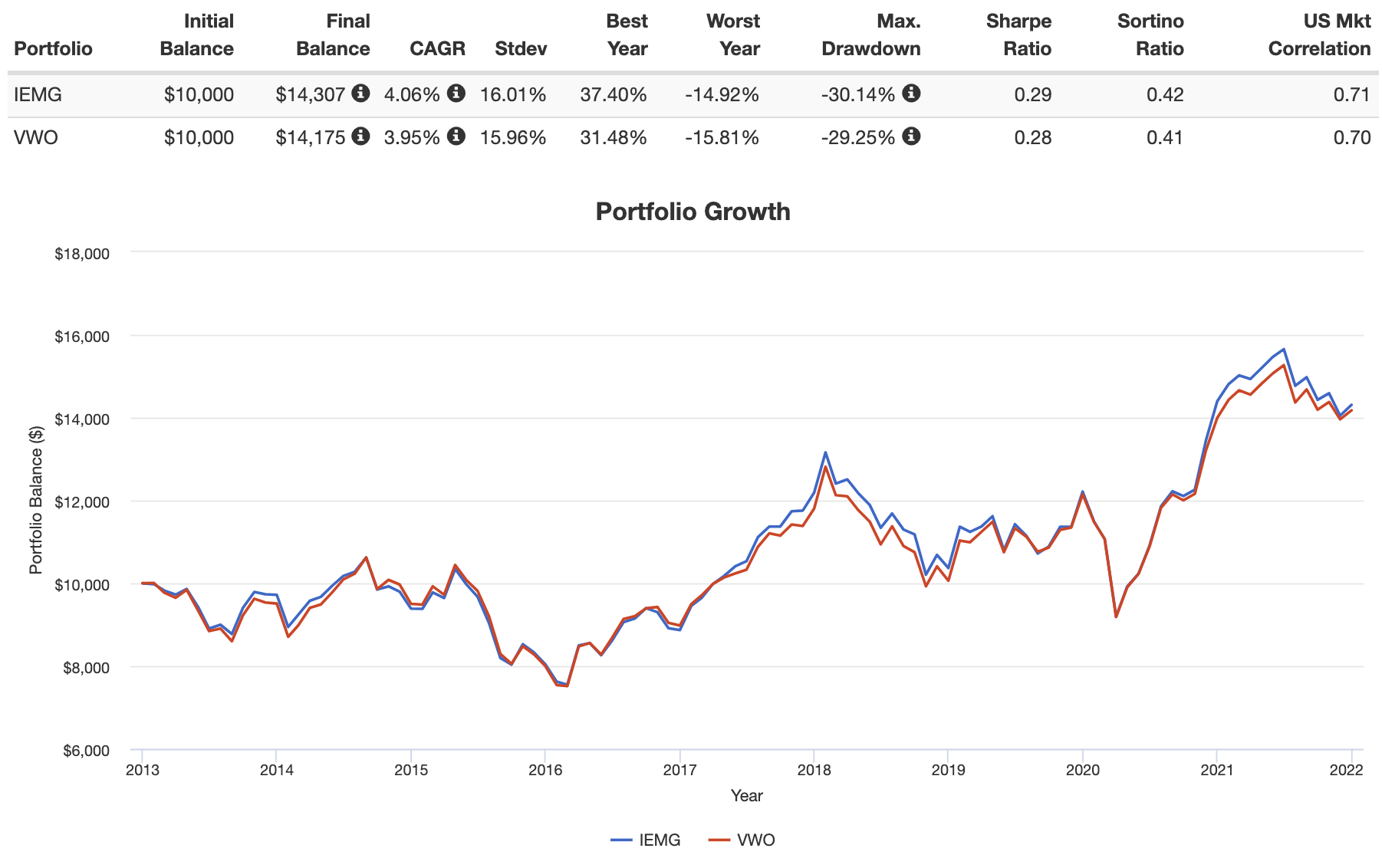

Choosing between emerging market funds involves more than comparing recent performance. Understanding what makes the IEMG ETF different from other EM funds helps clarify its role in a diversified investment approach.

Its broader market coverage, extensive stock count, inclusion of smaller and transitional economies, and investor-friendly cost and structure make it a strong candidate for those looking to access global growth opportunities with balance and efficiency.

The IEMG ETF is not about chasing short-term trends. It is about accessing the dynamic potential of emerging economies through a well-diversified, transparent, and accessible investment vehicle that suits both strategic and long-term financial goals.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.