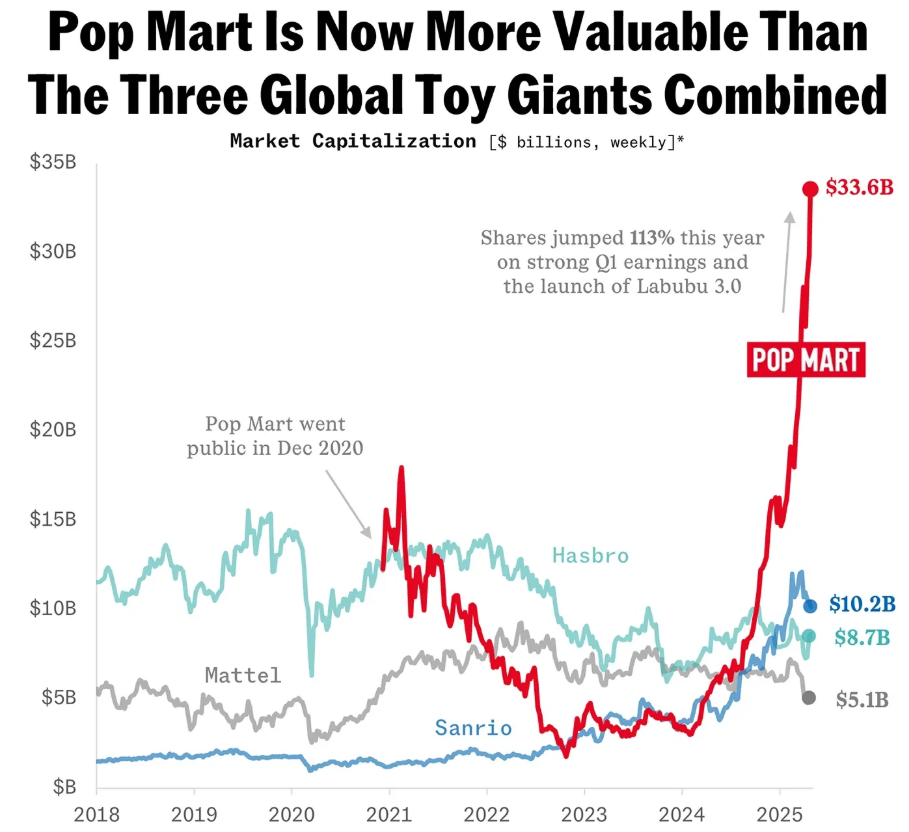

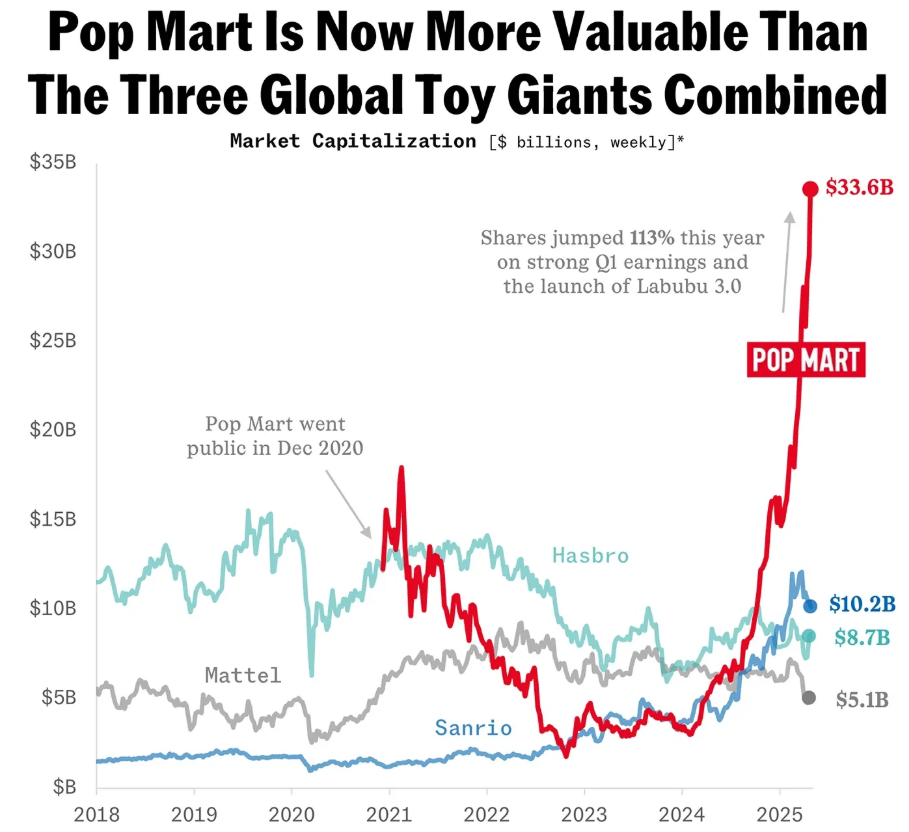

Pop Mart International Group has become one of the most talked-about stocks in Asia, delivering a staggering 600% rise in recent years. For traders, understanding the drivers behind this explosive growth is essential—not just for stock picking, but for identifying broader trends in the global collectibles and consumer sectors.

Here's a deep dive into what's powering Pop Mart's meteoric ascent and how traders can gain exposure to this dynamic story through ETFs and diversified trading products available on EBC.

Pop Mart Stock's Explosive Revenue Growth and Overseas Expansion

Pop Mart's financial performance in 2025 has been nothing short of extraordinary. In the first quarter alone, revenue surged by 165–170% year-on-year, with overseas markets delivering much of the momentum. The company's US revenue in Q1 2025 exceeded its entire 2024 total, and Europe posted a 600%+ jump. The Americas, including the US, saw a nearly 900% increase.

This rapid expansion is underpinned by the opening of flagship stores in high-profile locations, such as the Louvre in Paris, and a goal of launching around 100 new overseas stores in 2025.

Pop Mart's footprint now spans nearly 100 countries, with a robust presence in Asia Pacific, North America, and Europe. This global reach is transforming the company from a regional player into a global cultural phenomenon.

IP Powerhouse: The Labubu Effect

A key ingredient in Pop Mart's success is its intellectual property (IP) strategy. The company's flagship character, Labubu, has emerged as a “super IP,” driving both sales and brand recognition. Labubu and other hit series like The Monsters have achieved cult status, with viral social media campaigns (over 1.6 million Labubu TikTok posts) amplifying their reach.

Major investment banks have highlighted the impact of Pop Mart's expanding IP portfolio, with projections that overseas sales will grow at a compound annual rate of 42% from 2025 to 2027, potentially making up 65% of total revenue by 2027. This recurring revenue from beloved characters creates a strong foundation for both growth and brand loyalty.

Experiential Retail and Product Innovation

Pop Mart's aggressive retail expansion is paired with innovative store formats and pop-up experiences. The company's POPOP pop-up stores are a hit in cities like Shanghai and Chengdu, while “super-flagship” stores are planned for the US, France, thailand, and Australia. This focus on experiential retail boosts foot traffic and strengthens customer engagement.

On the product side, frequent new releases—such as the Labubu “Wacky Mart” food-inspired series launched in June 2025—keep collectors engaged and drive repeat purchases. Limited editions and collaborations with global brands and artists further fuel demand and secondary market activity.

Margin Expansion and Analyst Optimism

Pop Mart's growth isn't just about top-line numbers. The company is also improving profitability through category diversification, supply chain optimisation (notably via expansion in Vietnam), and rising store productivity. Investment banks have responded by raising sales and profit forecasts, with some predicting sales and earnings growth at compound annual rates of 44% and 56%, respectively, from 2024 to 2027.

As of June 2025, Pop Mart's market capitalisation is approaching HK$300 billion, with shares trading near record highs and analysts maintaining “overweight” ratings and raising price targets.

What Traders Need to Know

-

Volatility and Valuation: Pop Mart's meteoric rise means its valuation is rich compared to peers. Traders should be aware of potential corrections if growth slows or market sentiment shifts.

-

IP Concentration Risk: Heavy reliance on a few blockbuster characters, especially Labubu, means shifts in consumer trends could impact sales.

Global Execution: Continued success depends on flawless execution in overseas markets and maintaining the freshness of its product lineup.

Accessing Growth Opportunities with ETFs on EBC

Not every trader can directly invest in individual stocks listed on foreign exchanges, but there are flexible alternatives. EBC Financial Group offers a comprehensive selection of ETF Contracts for Difference (CFDs), covering global and regional indices across a wide range of sectors—including technology, consumer, innovation, and emerging markets.

These ETFs often include high-growth companies, giving traders the chance to participate in sector trends and market momentum without the need to buy individual shares.

With EBC, traders can:

Trade ETF CFDs on major global and regional indices, gaining exposure to a broad array of industries and markets.

Go long or short to take advantage of both rising and falling market conditions.

Utilise leverage to increase capital efficiency and pursue tactical trading strategies.

Diversify portfolios across multiple sectors and geographies, helping to manage risk and capture growth wherever it appears.

EBC's expanding suite of US-listed and international ETF CFDs provides traders with even more options to access the world's most dynamic markets and sectors—whether you're targeting technology, consumer trends, or the next wave of emerging market growth.

Conclusion

Pop Mart's 600% stock surge is the result of explosive revenue growth, global expansion, IP-driven brand loyalty, and relentless innovation. For traders, the story offers insights into the power of cultural trends and the potential of emerging market consumer brands.

While direct exposure to Pop Mart stock may not be available to all, EBC's ETF offering provides a flexible, efficient way to tap into the growth of Asia's most dynamic sectors—whether you're seeking momentum, diversification, or tactical trading opportunities.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.