The forex market runs 24 hours a day across four major sessions: Sydney, Tokyo, London, and New York. Among these, the New York session is the most influential, often driving sharp market moves and setting the tone for the daily close.

In India, the New York session runs from 5:30 PM to 2:30 AM IST, a late-evening-to-night window for Indian traders. The most active period is between 5:30 PM and 8:30 PM IST, when it overlaps with the London session and market liquidity.

This guide will explain why the New York session matters, the best times to trade from India, the top currency pairs, key economic events, and proven strategies to maximise opportunities in this high-volatility window.

Best Time to Trade the New York Session from India

| Time (IST) |

Activity Level |

Key Advantage |

| 5:30 PM – 8:30 PM |

Very High |

London–New York overlap, most volatile, tight spreads |

| 8:30 PM – 11:30 PM |

Moderate |

U.S. market continues but with reduced European volume |

| 11:30 PM – 2:30 AM |

Low–Moderate |

U.S. equity close, Asian market positioning |

While the full session lasts from 5:30 PM to 2:30 AM IST, the prime window for Indian traders is:

During these hours, traders can expect:

The latter part of the session (after 8:30 PM IST) may still present opportunities, especially for U.S. equity indices, gold, or late-day reversals, but liquidity generally tapers off.

Pro Tip: For short-term traders and scalpers, the first 3 hours are golden. Longer-term traders may watch for late-session reversals.

Why New York Session Forex Time in India Matters to Traders?

The New York session is crucial because it:

Accounts for 17–20% of daily forex trading volume, second only to London.

Features USD-based pairs, which make up nearly 90% of forex trades.

Coincides with major U.S. economic releases that drive global markets.

Offers tight spreads and strong price moves during peak liquidity hours.

For Indian traders, this session provides opportunities after work hours, making it more accessible than the London or Tokyo sessions.

Additionally, these elements establish a trading atmosphere characterised by narrow spreads, significant volatility, and a distinct price trend, particularly in the initial three hours.

Major Economic Events During the New York Session

Most major US economic reports release between 6:00 PM and 8:30 PM IST. The most market-moving events include:

Non-Farm Payrolls (First Friday of each month)

Federal Reserve rate decisions and statements

US CPI and PPI inflation data

ISM Manufacturing & Services PMI

Weekly Unemployment Claims

Fed Announcements

Such occurrences can lead to sudden spikes in volatility, ideal for trading based on news. However, effective risk management is crucial.

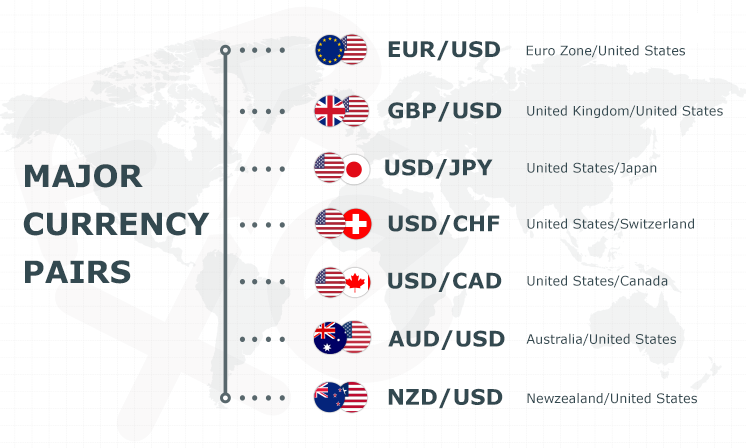

Currency Pairs Most Active During the New York Session

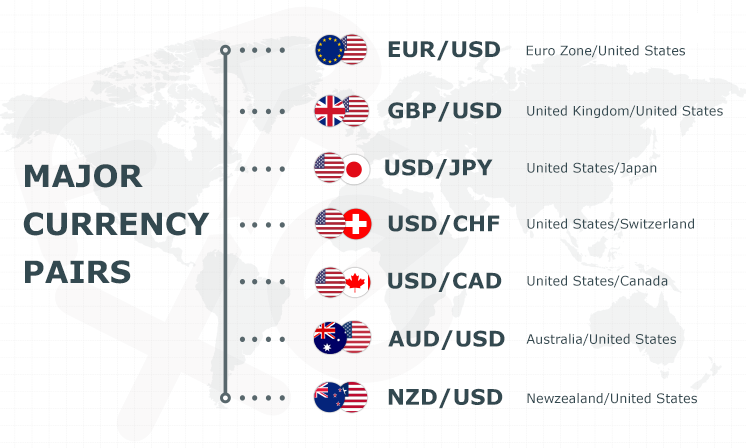

The U.S. dollar (USD) thrives this session. For Indian traders, the top pairs and instruments include:

EUR/USD: Most liquid pair globally, ideal for all strategies

GBP/USD: Volatile and reactive to both UK and U.S. news

USD/JPY: Strong movements during U.S. data releases

USD/CAD: Influenced by U.S. and Canadian economic news

AUD/USD: Responsive to global risk sentiment

USD/CHF: Safe-haven play during market uncertainty

XAU/USD (Gold): High volatility tied to USD strength/weakness

NASDAQ & S&P 500 (via CFDs): Strongest movements when the NYSE is open

Trading Strategies That Work Well in the New York Session

1. Breakout Trading During Overlap

Watch for price breaking key support/resistance from earlier Tokyo/London sessions. Confirm with volume and volatility spikes.

2. News-Based Scalping

Trade immediate market reactions to major U.S. data releases, but only with tight stop-losses.

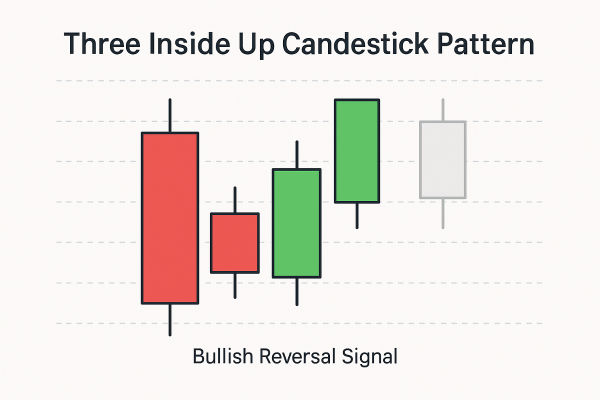

3. New York Reversal Strategy

After the London close (~8:30 PM IST), look for trend exhaustion and potential reversals.

4. Gold & Index Volatility Plays

Gold and U.S. indices often react sharply to macroeconomic news, ideal for short-term traders during U.S. market hours.

Additional Tips for Indian Traders:

Use an Economic Calendar: Plan trades around high-impact events.

Mind the Time Zone: Ensure your trading platform matches IST or ET correctly.

Risk Management First: Volatility can be an advantage or a danger; thus, use stop-loss orders.

Leverage Moderately: Avoid overexposure during news spikes.

Frequently Asked Questions

Q1. What Is the New York Session Forex Time in India?

The New York forex session runs from 5:30 PM to 2:30 AM IST, with the most active trading period between 5:30 PM and 8:30 PM IST during the London–New York overlap.

Q2. Which Currency Pairs Are Best to Trade During the New York Session From India?

Popular choices include EUR/USD, GBP/USD, USD/JPY, USD/CAD, USD/CHF, and XAU/USD (Gold) due to their high activity and market-moving potential during this time.

Q3. Is It Possible to Trade the Full New York Session From India?

Yes, but trading the full 5:30 PM–2:30 AM IST window can be exhausting. Numerous traders concentrate on the initial three hours to enhance efficiency and minimise fatigue.

Conclusion

In conclusion, for Indian traders in 2025, the New York session (5:30 PM–2:30 AM IST) is one of the best forex trading opportunities of the day.

Best time: 5:30 PM–8:30 PM IST for peak liquidity and volatility

Best assets: USD-based forex pairs, gold, and U.S. stock indices

Best approach: Monitor significant U.S. news occurrences and employ breakout or news-oriented tactics

By aligning your trading plan with these market dynamics, you can maximise profits and reduce risks in the world’s second-largest forex trading session.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.