Gold just suffered its biggest one-day drop in 12 years, plunging over 8% to $4,068/oz after recently hitting record highs above $4,380.

Silver retreated to US$48.11 per ounce, registering a decline of nearly 9%.

The market faced a multivariate sell-off in precious metals, leading to a broad re-rating of risk and extensive profit-taking.

Below, we will explains what happened, why it happened, who was affected, and what investors should watch next.

What happened and Why it matters

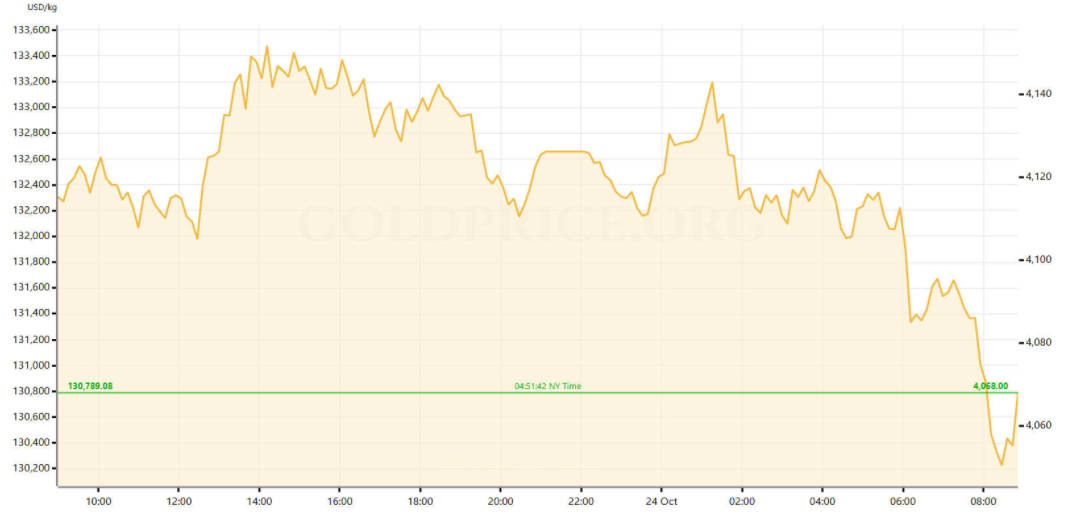

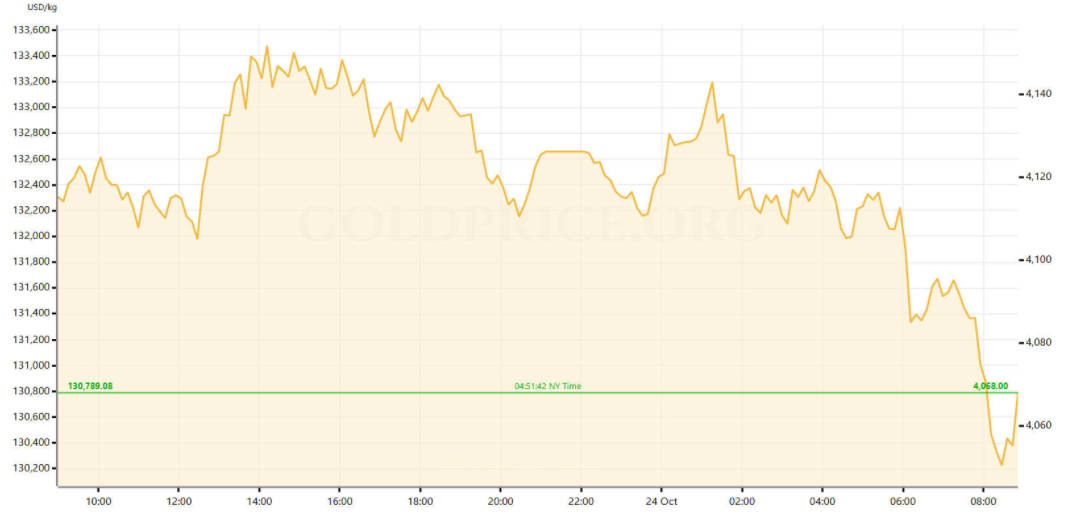

1) Gold Price Movements Over the Past Three Days

Gold prices experienced heightened volatility over the past three sessions, marked by sharp fluctuations and broad intraday swings.

On Monday, 20 October, gold reached an elevated level of USD 4,368.67/oz, before undergoing a sharp correction the next day.

By Tuesday evening, prices had fallen to USD 4,038.27/oz, a decline of roughly 7.6%, as profit-taking and easing risk sentiment weighed on safe-haven demand.

During Wednesday, 22 October, gold continued to trade erratically. After briefly climbing to USD 4,149.59/oz in early Asian trading, the metal slipped to USD 4,016.17/oz in the New York morning session, then recovered to USD 4,083.37/oz by the close.

As of Friday, 24 October 2025, 04:51:12 New York time, gold was trading at USD 4,068 per ounce.

The metal appears to be stabilising near the USD 4,070 level after the sharp early-week correction, suggesting a short-term technical consolidation amid an ongoing tug-of-war between profit-taking and safe-haven inflows driven by global uncertainty.

2) Why it matters

This sharp reversal underscores the fragility of the current gold rally and highlights the market's sensitivity to shifts in global risk sentiment.

For months, gold had benefited from inflation concerns, slowing growth forecasts, and record-level central-bank purchases.

Yet, as risk appetite improved and the dollar regained strength, investors swiftly rotated out of safe-haven assets.

The current level near US $ 4,070 suggests the market is testing short-term support, with analysts divided on whether the move signals the end of the bull run or a healthy correction within a longer-term uptrend. [1]

Silver's steeper fall reinforces the view that speculative excess may have built up in the sector.

For institutional investors, the episode serves as a reminder of gold's dual nature:a hedge against uncertainty but also a highly traded asset subject to sudden liquidity squeezes.

The coming weeks will determine whether buyers re-emerge at lower levels or whether a deeper re-pricing of precious-metal risk is underway.

Gold and Silver Movements at a Glance

| Metric |

Move (intraday) |

Notable level |

| Spot gold intraday decline |

~6.3% |

Low US$4,082.03/oz. [2] |

| Spot silver intraday decline |

~8.7% |

Low ~US$47.89/oz. |

| Prior record / recent peak |

Gold had traded above US$4,300–4,400 in the days before the drop. |

|

| Market reaction |

Sharp ETF & derivatives flows; mining equities fell steeply. |

|

Why the Gold price plunged

The move was not caused by a single event but by a confluence of factors that, together, flipped sentiment quickly.

1) Profit-taking after a parabolic run

Gold had rallied aggressively in recent weeks, leaving technical indicators in "overbought" territory.

Professional and retail players who bought late in the advance used the opportunity to lock gains, producing a cascade of sell orders that overwhelmed natural buyers at those levels.

2) A firmer US dollar and improving risk appetite

A rebound in the US dollar lowered demand from non-dollar buyers, as gold is priced in USD globally.

At the same time, improved risk sentiment, such as indications of progress in US-China trade talks, diminished the immediate need for exposure to this safe-haven metal.

Those shifts directly undercut demand at the margin.

3) Idiosyncratic banking headlines and credit-news dynamics

Recent headlines about alleged fraud and losses at several regional US banks prompted market repositioning and a reassessment of liquidity and credit risk.

However, senior banking executives described some of those incidents as idiosyncratic rather than systemic. [3]

In short, banking news amplified volatility but was not the sole cause.

4) Technical unwind and derivative positioning

Large derivative books and leveraged positions can magnify price moves.

When a critical mass of stop-losses and margin calls is hit, market makers and funds may be forced sellers, accelerating the fall beyond what fundamental news alone would justify.

Broader Market Implications of the Gold Price Decline

1) For investors

Short-term holders and momentum traders experienced sudden losses; volatility spiked.

Long-term holders were reminded that gold, despite its reputation, can undergo sharp drawdowns and should be treated as a portfolio diversifier, not a volatility-free asset.

2) For miners and industry participants

Mining equities, especially higher-cost producers, fell in sympathy with bullion, as margins are sensitive to spot prices.

Lower gold prices may delay certain exploration and high-cost projects while providing relief to jewellery manufacturers who face lower input costs.

3) For policy and central banks

Drivers and Likely Near-term Impact of Gold Price Plunge

| Driver |

Why it mattered |

Likely near-term impact |

| Profit-taking / overbought technicals |

Heavy prior gains created a vulnerable positioning backdrop |

Continued volatility; potential for further short squeezes or relief rallies. |

| US dollar strength |

Makes gold more expensive in other currencies |

Weakens physical demand; headwind for price recovery. |

| Easing trade tensions / improved risk appetite |

Reduces safe-haven buying |

Short-term downward pressure unless risk returns. |

| Bank-sector headlines |

Affected credit spreads and liquidity perception |

Amplifies |

Conclusion

Gold and silver's recent plunge highlights the volatility of precious-metal markets. While sharp, the drop is viewed as a healthy correction rather than the end of the rally.

Investors should stay disciplined, watch macro indicators, and use the correction as an opportunity to adjust positions strategically.

Frequently Asked Questions

Q1: Why did gold and silver prices drop?

Gold and silver prices fell due to profit-taking, a stronger U.S. dollar, and rising Treasury yields, which reduced demand for non-yielding assets. Improved global risk sentiment and easing geopolitical tensions also prompted investors to rotate from safe-haven metals to equities.

Q2: How steep was the fall?

The fall in precious metals was sharp and notable. Spot gold declined to USD 4,068/oz, representing a drop of over 8%, while silver retreated to USD 48.11/oz, falling nearly 9%, reflecting strong profit-taking and risk-off sentiment in the market.

Q3: Is the rally over?

Not necessarily. Analysts view the recent decline as a short-term correction, with the long-term outlook for gold remaining intact. Factors such as inflation hedging, central-bank purchases, and safe-haven demand continue to support potential future gains in the market.

Q4: How should investors react?

The recent decline is a normal market correction. Long-term investors can consider accumulating gold and silver at lower levels, while short-term traders should remain cautious, tracking U.S. dollar movements and central bank signals that may impact future prices.

Q5: Are other metals affected?

Yes. Silver and other precious metals often experience greater volatility during market sell-offs. Their prices can swing sharply in response to investor sentiment, safe-haven flows, and movements in the U.S. dollar and Treasury yields, amplifying the impact of broader market corrections.

Sources:

[1] https://www.investopedia.com/gold-plunges-from-record-high-with-biggest-one-day-decline-in-12-years-11834137

[2]https://www.moneycontrol.com/news/business/commodities/gold-and-silver-post-steepest-drops-in-years-as-rally-cools-13626544.html

[3] https://www.reuters.com/business/finance/asia-financial-stocks-slip-us-credit-worries-jolt-investors-2025-10-17/

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.