What is the TIP ETF and who manages it?

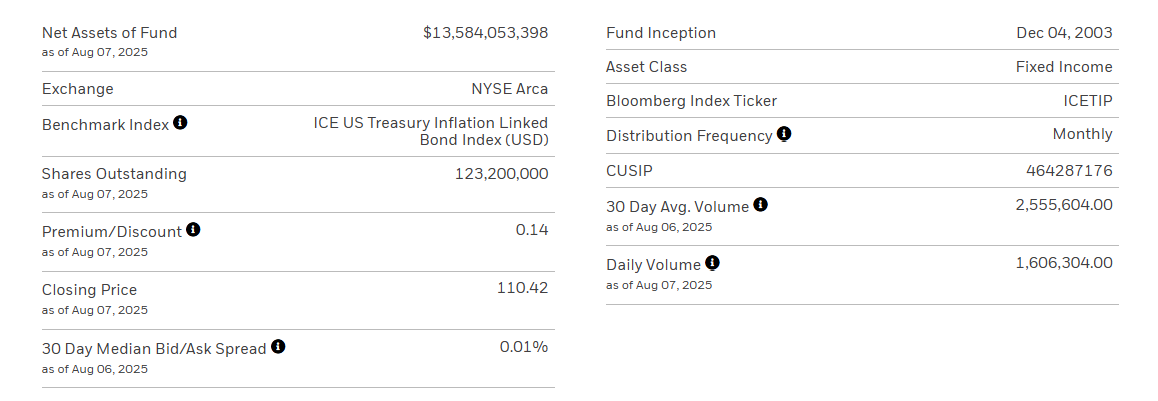

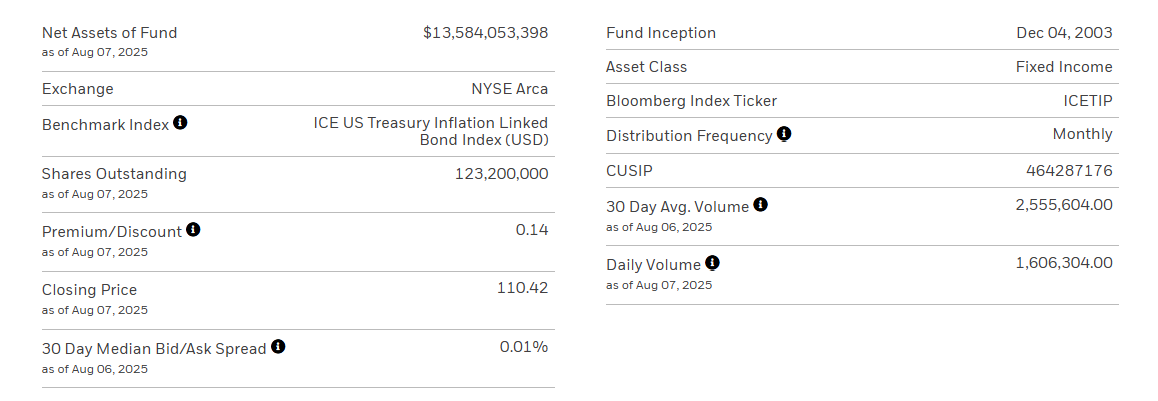

The iShares TIPS Bond ETF (ticker: TIP) is an exchange-traded fund (ETF) managed by BlackRock under its iShares brand. It invests solely in US Treasury Inflation-Protected Securities (TIPS)—government bonds explicitly designed to preserve investor purchasing power by adjusting their principal value in line with changes in the US Consumer Price Index (CPI).

The iShares TIPS Bond ETF (ticker: TIP) is an exchange-traded fund (ETF) managed by BlackRock under its iShares brand. It invests solely in US Treasury Inflation-Protected Securities (TIPS)—government bonds explicitly designed to preserve investor purchasing power by adjusting their principal value in line with changes in the US Consumer Price Index (CPI).

These adjustments mean the fund's capital base rises with inflation and shrinks with deflation, offering a built-in buffer against inflation (while guaranteeing at least the original principal on maturity). The fund tracks a broad TIPS index—typically the Bloomberg U.S. Treasury Inflation-Linked Securities (Series-L) Index—delivering transparency and broad exposure.

Best suited for investors seeking a cost-efficient, liquid shield against inflation via exposure to US real-yield bonds.

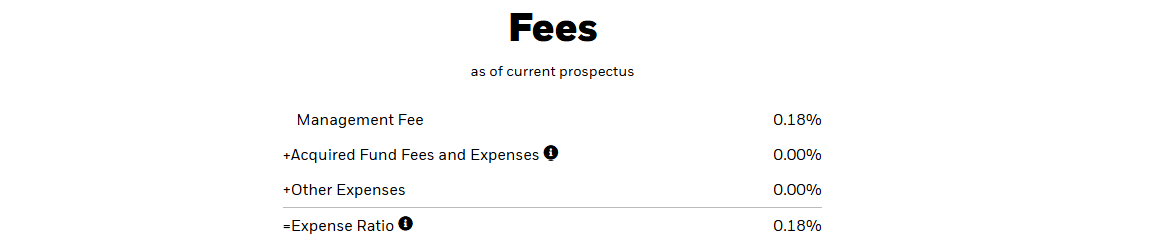

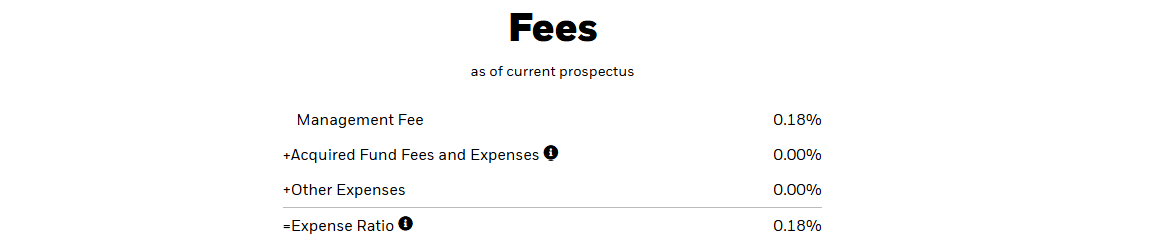

How much does TIP cost? (expense ratio and trading liquidity)

TIP stands out for its relatively low expense ratio, 0.18% annually, making it very competitive among bond ETFs. On the trading front, TIP is highly liquid, with substantial daily trading volume and tight bid-ask spreads—ideal for efficient execution. While trading costs vary slightly across brokers, the ETF's tight spreads and ample volume often result in minimal transaction costs. This low-cost, high-liquidity profile makes TIP accessible for both institutional and retail investors, including those in the UK using international or US-based trading platforms.

Does TIP protect me from inflation?

Yes, TIP is specifically designed to hedge against inflation. Here's how that works:

The principal value of each security in the fund rises in line with increases in the US CPI, so when inflation ticks up, the adjusted principal and, consequently, future coupon payments increase.

If deflation occurs (i.e., CPI falls), the principal decreases—but at maturity, holders receive at least the original par value, ensuring downside protection.

Thus, TIP offers a practical route for investors to maintain purchasing power, particularly in environments where inflation outpaces the yields of nominal bonds.

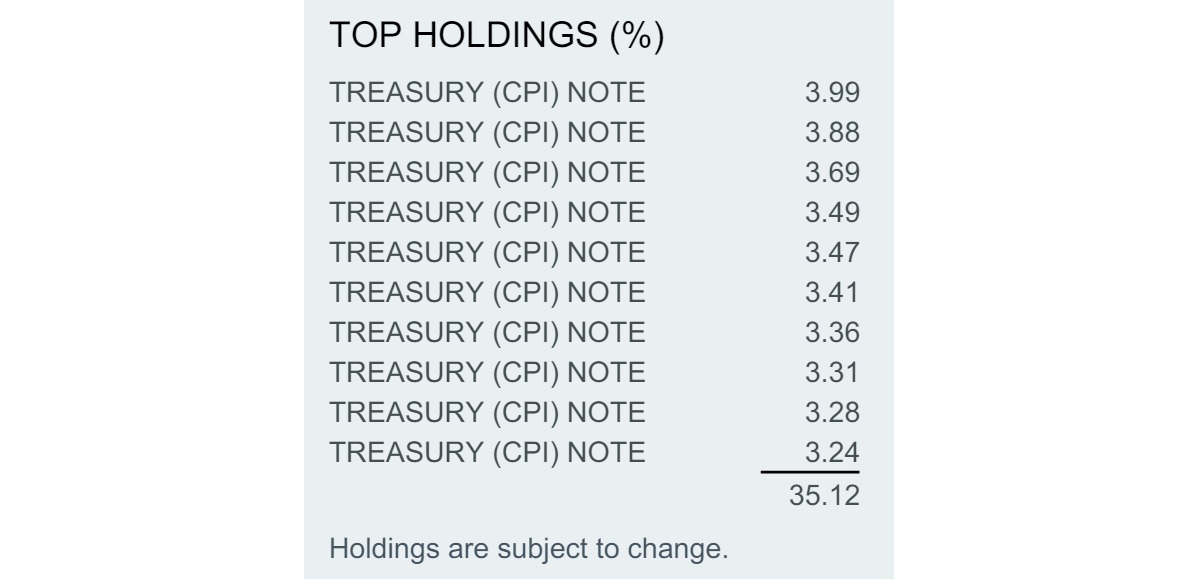

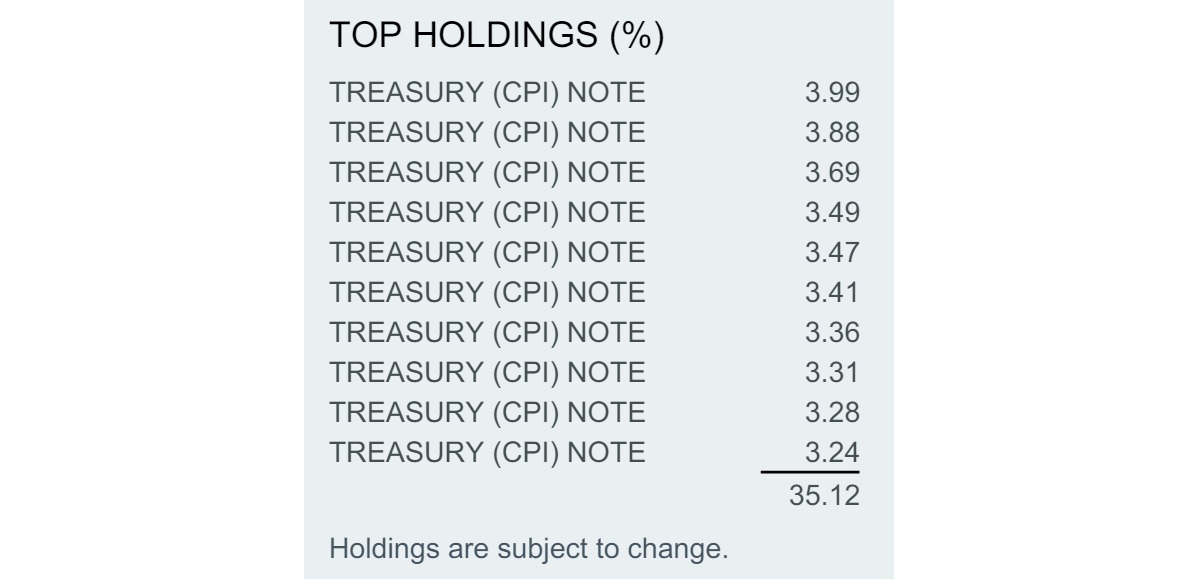

What are TIP's top holdings and maturity profile?

TIP holds a diversified portfolio of TIPS with varying coupon rates and maturities, typically spanning short- to long-term securities. The exact holdings change over time, but the fund generally reflects the composition of its underlying index, which includes a broad mix of TIPS issuances. The effective duration—a measure of interest-rate sensitivity—is often between 6 and 9 years, meaning a 1% rise in real yields could lower the fund's NAV by that amount. Conversely, a drop in real yields or a surge in inflation expectations can enhance returns. Investors interested in specifics can refer to the latest fact sheet or prospectus, which lists top holdings, maturity breakdowns, and duration metrics in detail.

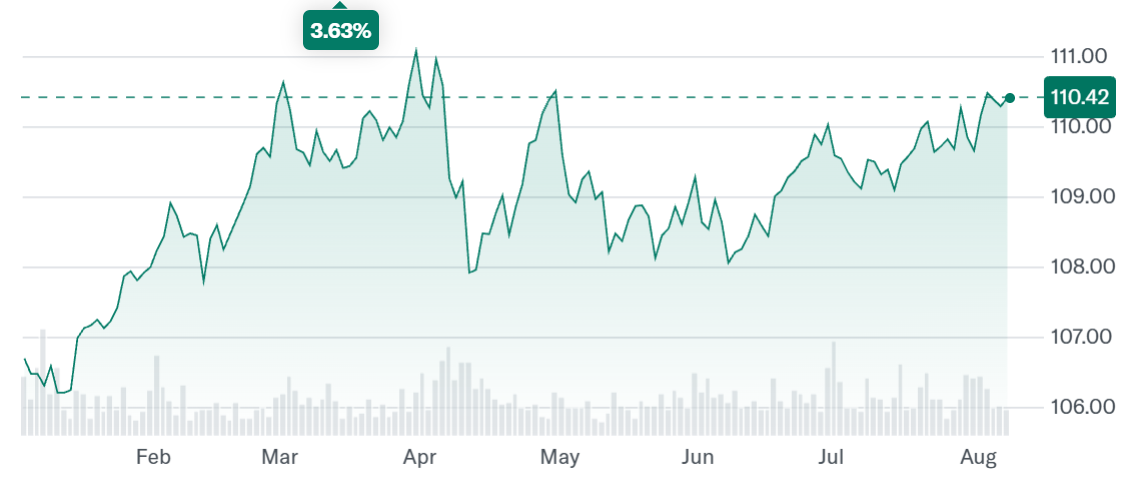

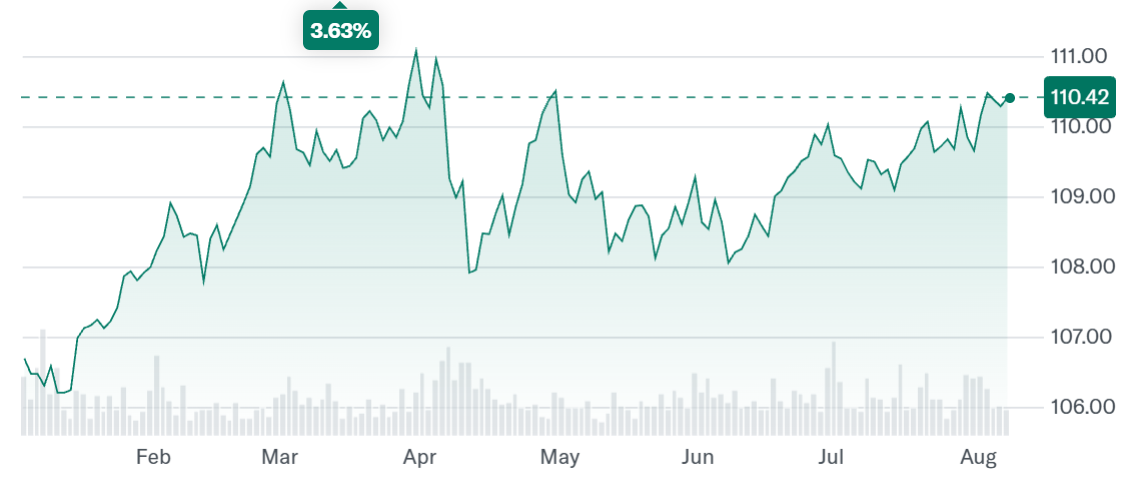

Is TIP a good buy today? (when to consider buying/selling)

Whether TIP is a "good buy" depends largely on your inflation outlook and yield expectations:

Favourable scenario: If you anticipate rising or persistent inflation—or believe real interest rates are likely to fall—TIP becomes compelling due to its inflation protection and yield component.

Less favourable scenario: If you expect inflation to subside and real yields to climb, TIP may underperform compared with plain nominal Treasuries or other fixed-income options.

Also consider broader macro conditions, such as US monetary policy, global growth expectations, and yield curves. A well-diversified portfolio may allocate somewhere between 10–30% of bond holdings to TIP, depending on risk tolerance and inflation expectations.

How do I hold TIP — taxable account vs ISA vs pension, and tax implications?

For UK-based investors (or those in similar jurisdictions), selecting the right account to hold TIP can significantly affect your tax outcome:

Pension (SIPP or workplace pension): Similarly, pensions often shelter investment income and gains, including TIP's inflation-linked adjustments. Although withdrawals are taxable when taken, the fund grows tax-efficiently during accumulation.

Given UK investors face complex tax reporting for US TIPS—especially regarding phantom income and double taxation relief—holding TIP within an ISA or SIPP is generally advisable, avoiding annual UK tax on unseen income and simplifying reporting.

Summary Table

TIP ETF at a Glance

| Question |

Key Takeaway |

| What is TIP ETF and manager? |

A US inflation-protected bond ETF managed by BlackRock's iShares. |

| Cost and liquidity? |

Low cost (0.10–0.20%), highly liquid with tight spreads. |

| Inflation protection? |

Principal adjusts with CPI; provides real-yield income and inflation hedge. |

| Holdings & maturity? |

Diversified TIPS holdings; effective duration ~6–9 years. |

| Is it a good buy today? |

Depends on inflation and real rate outlook; useful for diversification. |

| How to hold for UK investors? |

ISA or pension preferred to avoid phantom income taxation in taxable accounts. |

Final Thoughts

The iShares TIPS Bond ETF (TIP) presents a focused yet flexible way to invest in US inflation-linked securities. With low fees, strong liquidity, and an embedded inflation hedge, it's an attractive tool for investors worried about eroding purchasing power. However, it's not entirely risk-free: duration sensitivity and tax complexities—especially for UK investors—warrant thoughtful placement and timing.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

The iShares TIPS Bond ETF (ticker: TIP) is an exchange-traded fund (ETF) managed by BlackRock under its iShares brand. It invests solely in US Treasury Inflation-Protected Securities (TIPS)—government bonds explicitly designed to preserve investor purchasing power by adjusting their principal value in line with changes in the US Consumer Price Index (CPI).

The iShares TIPS Bond ETF (ticker: TIP) is an exchange-traded fund (ETF) managed by BlackRock under its iShares brand. It invests solely in US Treasury Inflation-Protected Securities (TIPS)—government bonds explicitly designed to preserve investor purchasing power by adjusting their principal value in line with changes in the US Consumer Price Index (CPI).