Expected to debut on February 5, 2026, the Forgent Power Solutions (FPS) IPO lands at a moment when AI-led data center buildouts are colliding with constrained grid capacity, turning electrical distribution hardware into a real bottleneck.

For investors, the offering is less about a single listing and more about whether public markets will pay premium multiples for power infrastructure tied to AI-related load growth.

Forgent Power Solutions is marketing itself into that scarcity premium. The IPO is being positioned at a size and valuation that invite immediate scrutiny, with the company pointing to rapid revenue expansion, a swelling backlog, and a major capacity build intended to unlock a step-change in output through 2026.

FPS IPO Key Takeaways

Timing is near-term: the deal is broadly expected to price in early February 2026, with an anticipated first trade date around February 5, 2026, subject to market conditions and final SEC effectiveness.

Valuation is the first debate: at the indicated range, the implied equity value sits between $7.6 billion and $8.8 billion, putting the stock in a “must-execute” bracket from day one.

Backlog is the second debate: backlog stood at about $1.03 billion as of September 30, 2025, up 44 percent year over year, which investors will treat as both visibility and timing risk.

End-market exposure is concentrated but logical: data centers represented 42 percent of fiscal 2025 revenue and 47 percent of backlog, embedding the AI power narrative into both growth and cyclicality.

Capacity expansion is the operational hinge: a roughly $205 million expansion plan is designed to more than triple fiscal 2025 production volume by end-2026, but ramp risk is real.

Is the FPS IPO launching in February 2026

Public signals point to a classic “file, launch roadshow, price within 1–2 weeks” setup. Forgent launched the IPO roadshow in late January 2026, with deal terms broadly framed for a large NYSE listing targeting up to $1.62 billion in gross proceeds at the top of the indicated range.

Deal terms at a glance

| Item |

Details |

| Issuer |

Forgent Power Solutions |

| Ticker / exchange |

FPS (NYSE) |

| Expected pricing / first trade |

Early February 2026 (timing can change)

|

| Price range / shares |

$25 to $29; 56.0 million shares (mix of primary and secondary shares)

|

| Lead underwriters |

Goldman Sachs, Jefferies, Morgan Stanley |

Market calendars and IPO trackers have coalesced around an expected first trade date of February 5, 2026. That is not a guarantee, but it is a reasonable base case unless volatility spikes or demand weakens, which would affect pricing.

FPS IPO latest timeline: What we know so far

| Date |

Milestone |

Why it mattered |

| Aug 28, 2025 |

“Forgent” becomes parent brand, integration milestone |

Clarified the platform identity ahead of public-market scrutiny |

| Jan 9, 2026 |

S-1 filed publicly |

Opened the formal IPO pathway and disclosed scale and margins |

| Jan 26, 2026 |

Roadshow launched |

Converted “filed” into “live” execution mode |

| Early Feb 2026 (expected) |

Pricing window |

Valuation meets real demand, sets aftermarket tone |

| Feb 5, 2026 (widely expected) |

First trade date |

Becomes the market’s daily referendum on the narrative |

The rebrand and platform consolidation date anchors the “how new is this company” question, while the S-1 and roadshow dates anchor the “how soon is this IPO” question.

Three realistic timing scenarios

| Scenario |

What would need to happen |

What could delay it |

| On-time (early Feb 2026) |

Sufficient institutional demand at the range |

Risk-off tape, rate volatility, weak comparable performance |

| Short delay (weeks) |

A reset of pricing expectations or size |

Soft bookbuilding, investor pushback on multiples |

| Defer (later 2026) |

A decision to wait for better windows |

Broad IPO market closure, sector drawdown, macro shock |

FPS IPO Valuation: What The Range Implies

The offering is priced at $25 to $29 per share, with 56 million shares offered in total and an implied equity value rising to roughly $8.8 billion at the top end. A key detail investors will check in the final prospectus is the split between primary (new) shares and secondary (selling shareholder) shares, because that affects how much cash the company actually raises.

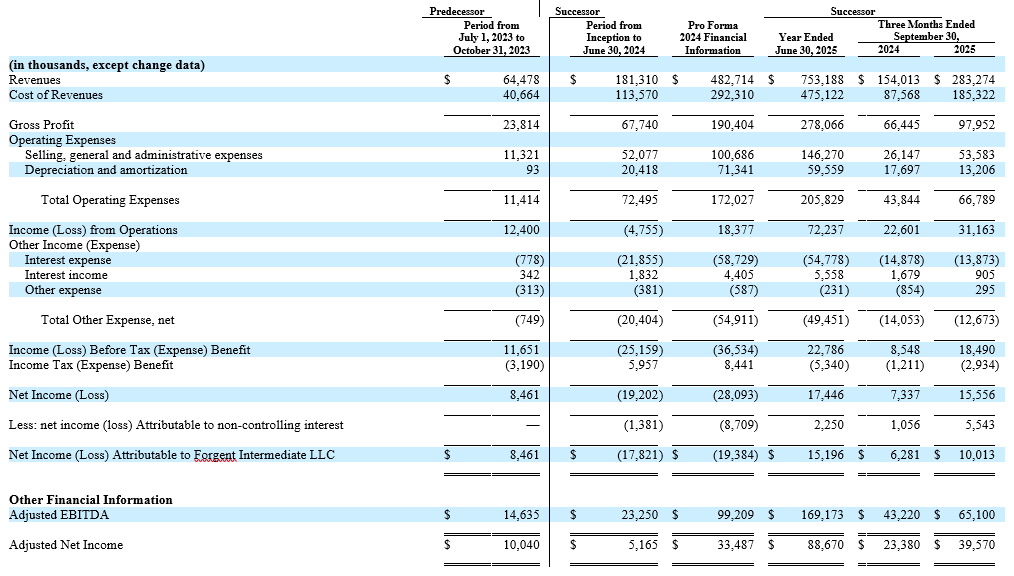

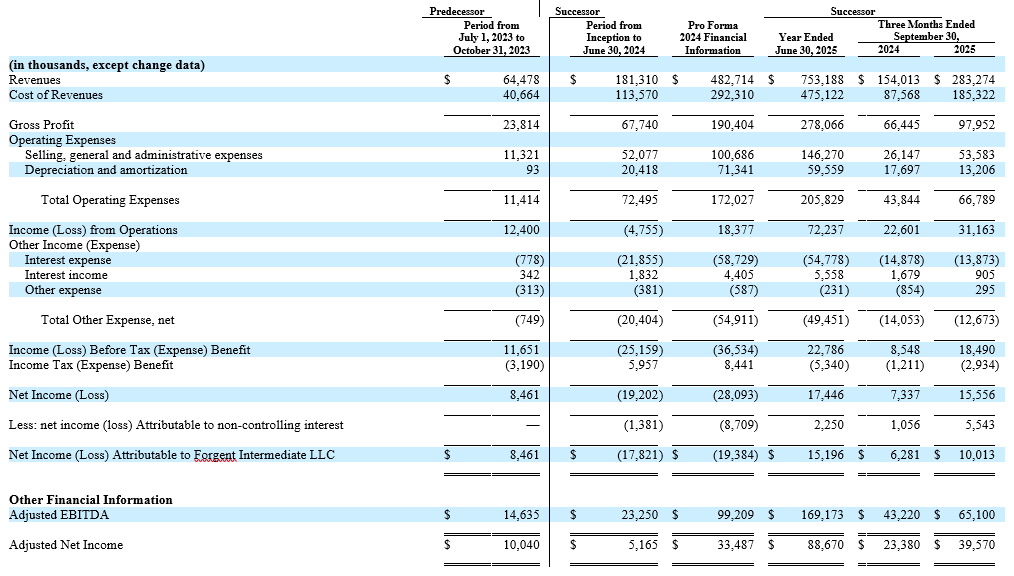

To keep the math simple, the table below presents simple equity-value multiples relative to fiscal 2025 revenue of $753.2 million and adjusted EBITDA of $169.2 million.

| Assumed IPO price |

Implied market cap |

Price-to-sales (FY2025) |

Equity value / Adj. EBITDA (FY2025) |

| $25 |

~$7.6B |

~10.1x |

~44.9x |

| $27 (mid) |

~$8.2B |

~10.9x |

~48.5x |

| $29 |

~$8.8B |

~11.7x |

~52.1x |

Those are demanding multiples for an industrial manufacturer, even one tethered to data center capex and grid upgrade cycles. The immediate question is whether investors treat Forgent as “electrification infrastructure with scarcity pricing” or “cyclical electrical equipment with private-equity exit dynamics.”

Fundamentals Investors Will Pressure-Test

Forgent’s headline numbers are strong enough to justify attention. Fiscal 2025 revenue reached $753.2 million, up 56 percent from fiscal 2024, while backlog reached about $1.03 billion as of September 30, 2025, up 44 percent year over year.

Revenue and backlog mix

Revenue and backlog mix

| Metric (FY2025 / Sep 30, 2025) |

Data Centers |

Grid |

Industrial |

Other |

| Revenue mix |

42% |

23% |

19% |

16% |

| Backlog mix |

47% |

29% |

20% |

4% |

This mix helps explain the valuation posture. The backlog is not just “demand,” it is demand concentrated where power intensity is rising fastest. Data centers already consume around 415 TWh, or about 1.5 percent of global electricity use in 2024, and the growth rate is what forces grid and powertrain upgrades.

Product mix and what it signals about pricing power

| FY2025 revenue mix by offering |

Share |

| Standard products |

5% |

| Custom products |

78% |

| Powertrain solutions |

13% |

| Services |

4% |

A business that derives the overwhelming majority of revenue from custom and engineered-to-order work can defend margins better than a distributor-driven commodity model, but it also inherits execution risk: lead times, change orders, and project timing become central to quarterly outcomes.

Backlog Visibility versus Backlog Risk

Backlog is the core “investor anticipation” metric for FPS IPO because it links end-market capex to near-term factory throughput. A backlog above $1.0 billion is meaningful, but public markets will focus on conversion cadence, cancellation behavior, and whether capacity catches up to demand without damaging quality or margins.

This is where the capacity expansion plan becomes the operating fulcrum.

Capacity expansion plan: what is being built

| Location |

New capacity added (000s ft²) |

Expected total investment ($M) |

| Minnesota |

544 |

42 |

| Tijuana, Mexico |

508 |

55 |

| Texas |

459 |

51 |

| Maryland |

155 |

30 |

| California |

140 |

27 |

| Total |

1,806 |

205 |

Management describes this expansion as a 374 percent increase in manufacturing square footage, with an ambition to more than triple fiscal 2025 production volume by end-2026 and support up to $5 billion of annual revenue capacity. That is a powerful narrative, but it also concentrates execution risk into 2026: hiring, training, equipment commissioning, and process control all have to work in sequence.

Deal Structure and Incentives: Who Benefits From the FPS IPO

Investors should separate “company growth” from “transaction mechanics.” The IPO includes both primary and secondary shares, and the company is using an Up-C structure in which public shareholders own the corporation, while legacy owners retain operating-company interests alongside high-vote stock.

Two implications follow:

Governance: the company expects to qualify as a controlled company, which may reduce board independence standards relative to widely held peers.

Cash flow economics: the tax receivable agreement framework can require the company to remit a large share of realized tax savings to legacy holders over time, which can lower cash available for reinvestment or deleveraging.

These are not automatic negatives. They simply mean valuation should incorporate governance and cash flow leakage risk, not just revenue growth.

Key Risks That Can Re-rate FPS IPO After Pricing

| Risk |

What it looks like |

Why markets punish it |

| Valuation risk |

High multiple meets a risk-off tape |

Multiple compression can dominate even if results are “good” |

| Capacity ramp risk |

Missed delivery schedules, higher scrap, overtime |

Margins and credibility deteriorate quickly |

| Backlog timing risk |

Pushouts, change orders, uneven quarterly conversion |

Volatility rises, guidance loses authority |

| Commodity exposure |

Copper, steel, and component inflation |

Gross margin pressure and working-capital swings |

| Competitive pressure |

Large incumbents and focused niche rivals |

Pricing power weakens, lead-time advantage narrows |

| Governance and TRA complexity |

Controlled-company dynamics and cash payments |

Discount rate rises for minority shareholders |

The prospectus language makes clear that the ramp itself carries operational risk, and the business model is exposed to commodity price fluctuations that can be substantial even with pass-through mechanisms. Competition is also credible, with multiple large global players active across the same end markets.

What Investors Should Watch Next

Final pricing and allocation: whether the deal prices at the top of the range or requires concessions will shape trading in the first quarter.

Backlog updates and order cadence: investors will look for evidence that backlog converts without margin erosion, not just that it exists.

Factory ramp milestones: installation completion timelines and hiring progress matter because the expansion plan is central to the growth bridge.

End-market mix stability: data center exposure supports the narrative, but it also raises sensitivity to hyperscaler capex pacing and interconnection constraints.

Governance signals: board composition, related-party frameworks, and transparency around tax receivable agreement mechanics will influence long-only appetite.

Frequently Asked Questions (FAQ)

1) When is the FPS IPO launching?

The FPS IPO is widely expected to price in early February 2026, with an anticipated first trade date around February 5, 2026. As with all offerings, the exact date depends on SEC effectiveness, market volatility, and final investor demand into pricing.

2) How much is Forgent Power Solutions aiming to raise?

At the marketed range, the offering targets gross proceeds up to roughly $1.62 billion at the top end, making it one of the larger early-2026 IPOs. The final amount depends on the offer price, the final share count, and any overallotment exercise.

3) What does Forgent Power Solutions actually make?

Forgent designs and manufactures electrical distribution equipment across data centers, grid applications, and energy-intensive industrial facilities. The revenue mix skews heavily toward custom products and integrated powertrain solutions, reflecting engineered-to-order work rather than commodity distribution.

4) Why does backlog matter so much for this deal?

Backlog functions as a forward indicator for factory utilization and near-term revenue conversion. A large backlog can signal strong demand, but it also introduces timing risk because projects can shift, re-spec, or phase deliveries, creating quarterly volatility if capacity and execution lag.

5) What are the biggest risks to the FPS IPO thesis?

The key risks cluster around valuation, execution, and governance. If the stock trades at a premium multiple, any evidence of capacity ramp friction or margin pressure can trigger a sharp re-rating. Controlled-company governance and TRA-style cash flow leakage can also keep a structural discount in place.

Conclusion

The FPS IPO is a clean test of an emerging market preference: paying growth multiples for physical infrastructure that sits upstream of AI and electrification demand. Forgent brings credible scale, rapid revenue expansion, and backlog visibility, alongside a capacity plan that could reshape output through 2026.

The same elements also define the risk map. At this valuation, the market will demand operational precision, transparent conversion of backlog into cash earnings, and governance terms that do not dilute minority shareholder economics.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

1) Energy Demand From AI

2) Forgent Power To Launch IPO