The recent decline in Oracle’s stock price reflects a rational repricing of risk rather than a narrative of slowing growth. Oracle is undergoing a capital-cycle regime shift, funding a hyperscale cloud infrastructure buildout through a combination of new debt and explicit equity issuance, while its backlog converts to reported revenue over a multi-year period.

The current decline highlights the mismatch between capital outflows and revenue recognition. The market is discounting (1) dilution and security overhang, (2) negative free cash flow resulting from data center capital expenditures, and (3) execution and counterparty-timing risk associated with long-term cloud commitments.

What Matters Most Right Now For ORCL

Oracle has formalized a $45 billion to $50 billion funding program for 2026, which explicitly includes common equity issuance, equity-linked securities, and a one-time investment-grade bond offering. This development shifts the equity narrative from one of buybacks funded by steady cash flow to new supply driven by infrastructure expansion. [1]

Trailing free cash flow flipped deeply negative as capex surged, and Oracle guided that the capex uptrend should continue for multiple years. [2]

Trailing free cash flow flipped deeply negative as capex surged, and Oracle guided that the capex uptrend should continue for multiple years. [2]

The backlog headline is enormous, but the revenue timing is slow: Oracle disclosed that only about 10% of remaining performance obligations are expected to be recognized as revenue over the next 12 months, with the rest spread across years. [2]

Reason 1: A Dilution Overhang Just Became Policy, Not Speculation

Oracle’s 2026 funding plan is unusually direct: roughly half of the targeted 2026 funding is expected to come from equity-linked and common equity issuance, including an at-the-market common stock program up to $20B, as well as mandatory convertible preferred securities. [1] [3]

Three mechanics matter for price:

Price-insensitive supply: at-the-market programs can sell shares into the tape over time, which tends to cap rallies because every rebound can become an issuance window. The prospectus explicitly frames the program as an “at-the-market” offering where different buyers pay different prices. [3]

Equity-linked math: mandatory convertibles ultimately become common stock. Even before conversion, they compete with common equity for “equity value,” because investors price in future share count and the dividend burden. [6]

Quantifying the overhang (high-level): Oracle disclosed approximately 2.874B common shares outstanding as of January 12, 2026. [5]

At a $20B common issuance ceiling, the share impact depends on the average sale price. At $136 per share, a full $20B would imply roughly 147M shares, about 5% dilution, before considering any mandatory convertible conversions. [5] [3] [6]

Reason 2: Oracle Is Being Valued More Like A Capital-Intensive Infrastructure Builder

Software stocks usually trade on operating margin and recurring revenue. Hyperscale infrastructure trades on return on invested capital, capacity utilization, and funding cost. Oracle is moving toward the second bucket.

In its 10-Q, Oracle disclosed that:

Capital expenditures jumped from $6.3B in the first half of fiscal 2025 to $20.5B in the first half of fiscal 2026, primarily tied to data center expansion. [2]

Oracle expects the capex uptrend to continue through the remainder of fiscal 2026 and for the next few fiscal years. [2]

On a trailing four-quarter basis ended November 30, 2025, Oracle showed operating cash flow of $22.296B, capex of $35.477B, and free cash flow of negative $13.181B. [2]

This combination provides a clear explanation for the decline in Oracle’s stock price: equity is now being used to finance a multi-year infrastructure buildout before the corresponding revenue is recognized. Markets seldom assign premium software valuations to companies with negative free cash flow unless the path to conversion is both near-term and highly visible.

Reason 3: The “RPO Is Huge” Narrative Has A Timing Problem

Oracle reported remaining performance obligations above $523B and highlighted large new commitments. [4]

The overlooked detail is the revenue schedule: Oracle expects to recognize only about 10% of RPO as revenue in the next twelve months, with substantial portions recognized in later years. [2]

This creates a duration mismatch:

Capex is now hitting (and accelerating). [2]

Revenue recognition is back-end weighted across multiple years. [2]

Oracle is expanding capacity in advance of revenue realization, prompting the market to demand a higher risk premium until there is evidence of accelerated monetization and more consistent cash conversion.

Reason 4: Counterparty Timing Risk Is Now Explicit In Oracle’s Own Offering Language

Oracle’s financing documents flag risks tied to customer purchase timing and customer ability to fund commitments, plus delays or operational problems in constructing and implementing data centers. [1]

That matters because long-dated cloud commitments can be economically strong yet still produce equity volatility if:

For a stock, the market trades the gap between contracted demand and recognized revenue, especially when the funding stack includes equity issuance.

Reason 5: Earnings Optics Were Boosted By A One-Off Gain While The Mix Is Still Evolving

Oracle’s fiscal Q2 2026 release showed strong cloud growth (including OCI), but it also disclosed that GAAP and non-GAAP EPS were positively impacted by a $2.7B pre-tax gain from selling its interest in Ampere. [4]

At the same time, the release showed software revenue down year over year, a reminder that the legacy mix is not the growth engine. [4]

When a company introduces new equity supply to the market, investors typically require high-quality earnings and strong cash conversion. One-time gains may improve earnings per share, but they do not provide funding for multi-year capital expenditures.

Reason 6: Higher Leverage And Higher Carry Cost Are Becoming More Visible

Oracle’s balance sheet and interest line are now part of the equity conversation:

Notes payable and other borrowings totaled about $108.1B (current plus non-current) as of November 30, 2025. [2]

Quarterly interest expense rose to $1.057B (up versus the prior-year quarter), and Oracle attributed the increase primarily to higher average borrowings, including the September 2025 senior notes issuance. [2]

If markets are concerned about both the duration of long-dated remaining performance obligations and the funding mix of debt and equity, the discount rate applied to the equity may increase even in the absence of a demand shock.

Oracle’s Q1–Q2 FY2026 Snapshot: Growth, Backlog, and the Cash Cost

| Metric |

Q1 FY2026 |

Q2 FY2026 |

What The Market Is Reading |

| Total revenue |

$14.9B |

$16.1B |

Solid growth, not enough to offset cost of growth |

| Total cloud revenue (IaaS + SaaS) |

$7.2B |

$8.0B |

Cloud scale improving, but mix matters |

| OCI revenue (IaaS) |

$3.3B |

$4.1B |

Infrastructure ramp is real and accelerating |

| RPO (contract backlog) |

$455B |

$523B |

Huge demand, but long-duration conversion risk |

| Trailing operating cash flow |

Noted in release |

$22.3B |

Still strong, but eclipsed by capex |

| Trailing capex |

Shown in release tables |

$35.5B |

The key bearish input driving funding needs |

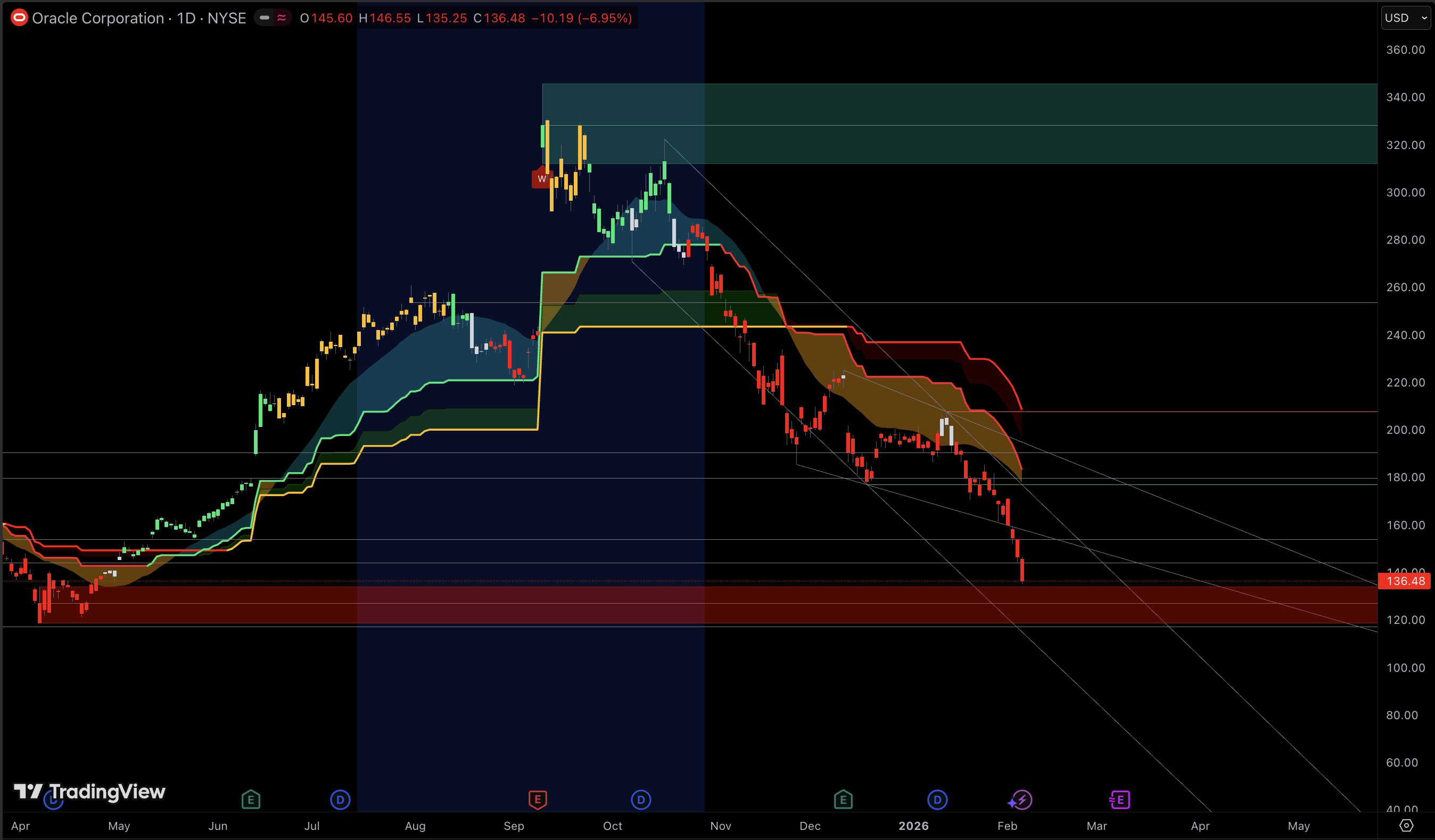

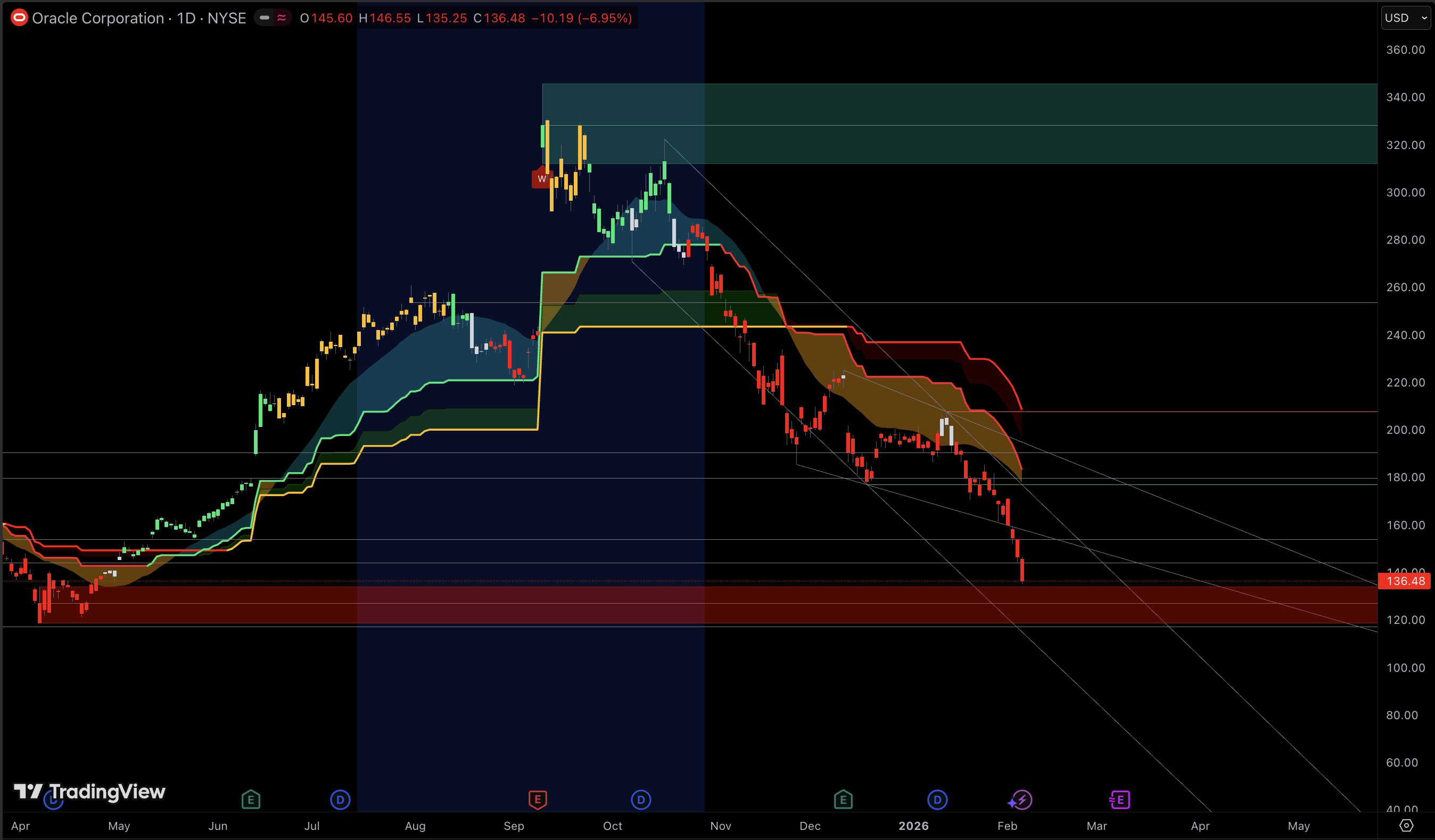

ORCL Support Levels And Resistance Zones To Watch

Using today’s tape and nearby reference points:

Immediate Support: $132 to $135

This range corresponds to the current intraday low, a level where forced selling frequently stabilizes temporarily. A daily close below this support zone increases the likelihood of further liquidation.

Next Support: $130 (Psychological), Then $120

Psychological price levels become significant when issuance overhang and systematic flows are present. If the $130 support level fails, the next likely downside target is the subsequent major price threshold.

Near-Term Resistance: $146 to $150

This range encompasses the prior closing price and the current rebound high. If Oracle cannot regain this zone, upward movements may continue to face selling pressure, particularly given the ongoing at-the-market supply narrative. [3]

Next Resistance: $160

A recovery above $160 would indicate that the market is prepared to move beyond concerns about financing overhang and instead focus on operational execution.

Technical Indicators and Trend Table

| Indicator |

Reading |

Signal |

| RSI (14) |

23.8 |

Oversold |

| MACD (12,26) |

-6.43 |

Sell |

| 20-day MA |

146.56 |

Overhead resistance |

| 50-day MA |

159.18 |

Overhead resistance |

| 200-day MA |

182.94 |

Long-term downtrend |

A Practical Roadmap (Base, Bull, Bear)

Base Case (Stabilization, Then A Range)

Oracle maintains support in the $132 to $135 range and trades between approximately $135 and $150 as investors await greater clarity regarding the 2026 funding actions. The market seeks evidence that capital expenditure intensity will translate into recognized cloud revenue more rapidly than currently anticipated. [2] [1]

Bull Case (Overhang Clears, Execution Tightens)

The upside potential is driven by clarity in financing and improved cash conversion, rather than broad enthusiasm for artificial intelligence. A sustained rebound generally requires (1) reduced uncertainty regarding the pace of equity issuance, (2) evidence of improved utilization and revenue realization from remaining performance obligations, and (3) continued capital expenditures that become increasingly productive. [2] [3]

Bear Case (Support Breaks, Duration Fear Deepens)

If Oracle’s stock price falls below $132 on significant trading volume, it would indicate that the risks associated with dilution and capital expenditures are not yet fully reflected in the share price. The primary bearish catalyst is an expanding gap between capacity buildout and revenue recognition, particularly if customer ramp timing becomes increasingly uncertain. [2] [1]

What To Watch Next: Catalysts That Can Change The Tape

A sustained movement in Oracle’s stock price is most likely to result from increased transparency regarding funding and demonstrable progress in execution, rather than from general market optimism.

1) Terms and timing of the bond issuance and equity-linked funding

Investors will watch whether pricing confirms investment-grade confidence without materially raising the firm’s weighted average cost of capital.

2) Capex discipline and cash conversion updates

The market will seek indications that capital expenditures are resulting in billable capacity and enhanced cash generation, rather than merely expanding construction pipelines.

3) March earnings window and options pricing

Oracle’s next earnings release is anticipated around March 9, 2026, and recent earnings announcements have been associated with significant implied moves in the options market. In a stock exhibiting technical weakness, volatility pricing is important as it influences systematic flows and hedging activity.

Frequently Asked Questions (FAQ)

1) Is Oracle Diluting Shareholders?

Oracle has announced plans to issue common equity through an at-the-market program up to $20B and equity-linked securities that can ultimately become common shares. The realized dilution depends on how much is issued and at what average price. [1] [3] [6]

2) Why Would A Company With Strong Cloud Growth Need So Much Funding?

Because building cloud infrastructure is capital-intensive. Oracle disclosed sharply higher capex tied to data center expansion and said it expects that elevated trend to continue for multiple years, which can overwhelm near-term operating cash flow. [2]

3) What Is RPO, And Why Is It Not Automatically Bullish For ORCL Stock?

RPO is contracted revenue not yet recognized. The key is timing: Oracle expects to recognize only about 10% of RPO as revenue in the next 12 months, with large portions spread across later years. Stocks trade the near-term cash and earnings path. [2]

4) Is Oracle’s Recent EPS Strength Fully “Real”?

Oracle’s Q2 FY2026 release disclosed that EPS benefited from a sizable pre-tax gain related to selling its interest in Ampere. That can boost reported earnings without improving recurring cash generation, which matters when funding needs are rising. [4]

5) What Are The Most Important ORCL Support Levels Right Now?

The initial support level is in the $132 to $135 range, corresponding to current lows. If this support fails, $130 and $120 represent subsequent downside targets. Resistance is found at $146 to $150, followed by $160, where a recovery would indicate that the market is absorbing the supply overhang.

6) What Would Change The Story From Bearish To Constructive?

Two factors could shift the outlook from bearish to constructive: (1) evidence that increased capital expenditures are leading to faster revenue recognition and improved cash conversion, and (2) reduced uncertainty regarding the pace and terms of equity issuance. Until these conditions are met, upward movements may remain constrained by supply. [2] [3] [1]

Conclusion

Oracle’s stock price is declining as the market adjusts its valuation to reflect a new environment characterized by large-scale cloud infrastructure expansion funded through a defined mix of debt and equity, negative free cash flow, and a backlog that monetizes over several years. If Oracle maintains support and investors gain greater visibility into the pace of equity issuance and the conversion of remaining performance obligations to revenue, the trajectory may shift from liquidation to consolidation and eventual recovery. Otherwise, current market signals suggest that the risk premium associated with financing and duration may continue to increase.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.

Sources

[1] https://www.sec.gov/Archives/edgar/data/1341439/000119312526032650/d36096dfwp.htm

[2] https://www.sec.gov/Archives/edgar/data/1341439/000119312525315925/orcl-20251130.htm

[3] https://www.sec.gov/Archives/edgar/data/1341439/000119312526032756/d77737d424b5.htm

[4] https://www.oracle.com/news/announcement/q2fy26-earnings-release-2025-12-10/

[5] https://www.sec.gov/Archives/edgar/data/1341439/000119312526032645/d90752dposasr.htm

[6] https://www.sec.gov/Archives/edgar/data/1341439/000119312526032654/d60756d424b5.htm

Trailing free cash flow flipped deeply negative as capex surged, and Oracle guided that the capex uptrend should continue for multiple years. [2]

Trailing free cash flow flipped deeply negative as capex surged, and Oracle guided that the capex uptrend should continue for multiple years. [2]