Some investments act like ballast in a ship, keeping your portfolio steady when the seas turn rough. Others are sails, catching every gust and sprinting ahead when the weather is fair. The Consumer Discretionary Select Sector SPDR Fund, ticker XLY, is a sail. It concentrates on companies whose fortunes rise and fall with consumer confidence, wage growth, and credit conditions. When households feel flush, XLY ETF often flies. When wallets tighten, it can stall.

That dual nature is exactly why XLY draws so much attention in 2025. Inflation pressures have cooled from their peaks but are still part of the conversation, interest rates remain elevated compared with the pre-2020 era, and the consumer is selectively resilient. If you are weighing an allocation, you need to understand not only what XLY ETF owns, but how it behaves across cycles, what has actually happened year to date, and which risks will matter most over the next few quarters.

What Is XLY ETF, Exactly?

XLY ETF is the Consumer Discretionary Select Sector SPDR Fund. It tracks the Consumer Discretionary Select Sector Index, which slices the S&P 500 into the discretionary cohort and holds only those names. Think retailers, online platforms, autos and auto components, apparel and luxury, hotels and leisure, home improvement, and restaurants.

Structure and cost. XLY is a traditional index ETF with a gross expense ratio around the low-single-digit basis points and quarterly distributions. It is designed to deliver sector beta with minimal tracking difference and high liquidity, which is why you will find tight bid ask spreads even on busy days.

Holdings count and concentration. The fund holds roughly 50 names, but it is not equal weight. It uses market-cap weighting, so a small handful of giants account for a large slice of total exposure. That concentration is part of the appeal when the leaders run, and part of the risk when they wobble.

Who uses it. Asset allocators use XLY to tilt a core portfolio toward the consumer cycle. Traders use it for tactical views around earnings seasons and macro data. Options desks like its liquid chain for covered calls, collars, and hedges.

What XLY Holds: Leaders, Mix, and Sensitivities

Although “consumer discretionary” sounds broad, XLY’s personality is shaped by a few franchises.

Megaplatform retail and services. A dominant ecommerce and cloud-adjacent platform is typically the largest weight. Its performance tends to drive a meaningful chunk of XLY ETF’s daily beta and factor exposure, including momentum and quality.

Autos and related. A leading electric vehicle maker has often been a top-two holding. That brings exposure to EV demand, pricing cycles, and margin volatility. Autos amplify cyclicality inside XLY.

Home improvement and housing adjacencies. Big box home improvement chains pull XLY ETF toward housing turnover, renovation spend, and mortgage rate dynamics.

Global brands in restaurants, apparel, and luxury. These names add pricing power and international reach, which can help when the US slows but overseas demand stays firm.

Hotels, travel, and leisure. Reopening dynamics have faded, but travel normalisation still contributes to revenue resilience in leisure segments.

Takeaway: If you buy XLY ETF, you are implicitly expressing a view on US consumer strength, ecommerce and digital advertising health, autos and EV adoption, housing activity, and discretionary services demand.

Recent History: How XLY Entered Q4 2025

Investors like stories, but you should anchor on numbers.

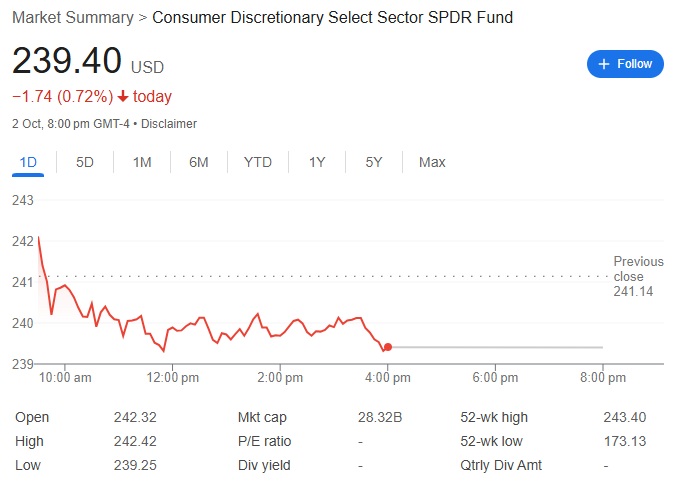

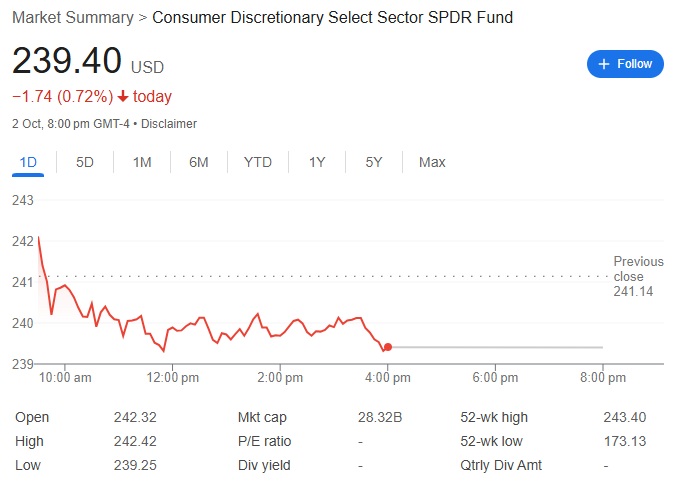

Year to Date Profile

Through late summer 2025, XLY posted a single digit YTD gain, aided by a summer rebound in large cap discretionary and a strong August for retail and platform leaders. The move was not one way. Spring saw fits and starts as rate expectations swung with inflation prints and as autos traded choppily on delivery headlines.

Rolling 12-Month View

On a one-year basis into early autumn, XLY ETF delivered a mid-20 percent total return, reflecting a strong back half of 2024 and a resilient holiday season that flowed into early 2025 earnings.

Volatility Shape

Implied and realised volatility for discretionary ran richer than the S&P 500, which is typical for this sector. Drawdowns around earnings clusters were deeper than the broad market, while upside bursts on positive guidance outpaced the index.

Breadth Under the Surface

Leadership remained top heavy. Mega caps and a few category killers carried a disproportionate share of performance. Small and mid cap discretionary trailed whenever financial conditions tightened.

What this means: XLY entered Q4 2025 with modest YTD gains, strong trailing 12-month returns, higher than average choppiness, and leadership concentrated in a few large franchises. If those leaders continue to execute, XLY ETF can compound. If they stumble, XLY’s sensitivity will show quickly.

Macro Backdrop That Matters To XLY

Consumer discretionary lives at the intersection of incomes, borrowing costs, and sentiment. Watch these drivers if you own XLY ETF:

Labour Market And Wage Growth

Paychecks fuel discretionary spend. A still-healthy labour market with slowing but positive wage growth supports restaurants, apparel, travel, and online retail. If job openings retreat sharply or wage growth cools too quickly, discretionary outlays are typically the first to be trimmed.

Inflation Mix

Headline inflation has moderated from its peak, but pockets like services inflation and shelter remain sticky. Stable prices help protect real purchasing power. Sticky inflation that keeps policy rates high for longer can weigh on credit card APRs and big ticket purchases.

Rates And Credit Conditions

Mortgage rates influence home improvement chains, while auto loan APRs shape demand and affordability for vehicles. Tighter lending standards or rising delinquency rates can ripple into traffic and ticket sizes across retailers.

Consumer Sentiment

Surveys do not spend, people do. That said, sentiment troughs often precede softer discretionary categories, and rebounds tend to align with better same-store sales and bookings. Track card-spend aggregates, retailer traffic updates, and guidance commentary.

2025 So Far: What Drove The Tape

Surprises in megacap retail and electric vehicle names have moved XLY ETF in large daily increments throughout 2025. Positive earnings reports, particularly upside in advertising revenues, cloud-adjacent services, and improving retail margins, pushed the fund higher and reaffirmed the strength of consumer discretionary leaders. At the same time, pressure on auto margins and cautious guidance for the second half of the year created sharp pullbacks. These mixed outcomes underscored just how sensitive XLY ETF’s performance is to individual giants like Amazon and Tesla.

Mortgage rate spikes weighed on the housing sector, cooling renovation plans for many households and slowing discretionary spending on home improvement projects. Yet, whenever 30-year mortgage rates backed away from their highs, sentiment improved. Increased foot traffic in home improvement stores and better commentary from retailers offered XLY a source of support. The ebb and flow of housing affordability has remained an important swing factor in the ETF’s returns, reflecting the close relationship between consumer confidence, borrowing costs, and discretionary demand.

Travel and leisure have remained surprisingly resilient. Hotels, restaurants, and related service industries delivered steady same-store sales growth in many quarters over the past year, helping cushion softness in goods-heavy categories like apparel and autos. This steadiness highlighted how consumer discretionary spending is not limited to physical goods but increasingly leans on services and experiences. For XLY investors, the durability of travel spending provided a stabilising factor in an otherwise uneven environment.

Global exposure has added another layer of complexity to XLY ETF’s 2025 performance. Luxury and multinational consumer brands with significant sensitivity to Chinese demand delivered mixed results. On the one hand, travel retail channels remained strong as tourists resumed international spending. On the other, uneven consumer data from China and restrained corporate guidance introduced uncertainty. While this mattered less for the ETF’s U.S.-centric holdings, it played a role at the margin, especially for companies relying on global growth to meet investor expectations.

Risks You Cannot Ignore

Concentration risk. A handful of companies often represent a large percentage of XLY. A single earnings miss or guidance reset can swing the fund more than you expect.

Rate sensitivity. Higher for longer rate regimes weigh on valuation multiples and on consumer financing costs, especially for autos and housing-related categories.

Cyclicality. If growth slows or a recession probability rises, discretionary is usually among the first sectors to de-rate.

Competitive dynamics. In e-commerce, advertising, streaming, and EVs, competitive intensity is high. Pricing power can be tested quickly.

Regulatory and policy. Antitrust scrutiny, auto credit standards, and international trade policies can affect key holdings.

How to Use XLY in a Real Portfolio

If your core allocation is in a broad S&P 500 or total market fund, adding XLY can serve as a precise way to express a view that the consumer remains resilient, that interest rates stabilise, and that platform leaders continue to execute well. Many investors treat XLY as a tactical tilt within their portfolios, often sizing positions in the range of 5 to 15 percent of the equity sleeve depending on individual risk tolerance and conviction in the consumer discretionary sector.

Another common approach is to use XLY ETF as part of a barbell strategy. In this setup, investors balance discretionary exposure with a defensive sector such as consumer staples or healthcare. The logic is straightforward: allow the discretionary allocation to participate when growth momentum and consumer sentiment improve, while the defensive holdings help soften drawdowns when the cycle cools. This blend creates a portfolio that can adapt more smoothly across economic phases.

Options strategies on XLY can also provide flexibility. Covered calls may be used to harvest option premium in range-bound periods, offering incremental income when the ETF consolidates. Protective puts can act as insurance, capping downside risk during sensitive periods such as U.S. CPI releases or large auto delivery updates that often move consumer discretionary stocks. Collars, which combine the two approaches, allow investors to trade some potential upside for protection at a relatively low cost, striking a balance between growth and safety.

Finally, rebalancing discipline is essential when holding XLY ETF because of its potential for sharp moves. Setting clear rebalance bands can prevent emotional decision-making. For example, if the target weight is 10 percent of the equity allocation, trimming back when the ETF drifts up to 12 percent or adding when it falls to 8 percent ensures consistent exposure. This rules-based approach helps investors avoid chasing heat at peaks or panic-selling during corrections, ultimately keeping the strategy aligned with long-term goals.

Who Should Consider XLY in 2025

Investors who believe in a soft-landing or even a no-landing scenario may find XLY particularly attractive. If you expect real incomes to keep growing and interest rates to gradually drift lower through 2026, the consumer discretionary sector should benefit. For example, as mortgage rates eased slightly in mid-2025 after peaking above 7 percent earlier in the cycle, home improvement retailers and big-ticket discretionary purchases such as autos began to show more stable demand. In such an environment, XLY ETF acts as a vehicle to capture that consumer rebound without betting on any single stock.

Allocators who want growth exposure without the concentration risk of individual names also gravitate toward XLY. The ETF spreads its weight across giants like Amazon, Tesla, McDonald’s, and Nike, offering diversified access to themes like ecommerce scale, electric vehicle adoption, brand strength, and leisure spending. For instance, rather than choosing between Tesla’s delivery growth or Amazon’s ecommerce dominance, an allocator can hold XLY ETF and gain both exposures within one regulated, liquid product. This makes it a pragmatic choice for long-term portfolios seeking growth tempered by diversification.

Traders who prefer to capture sector beta rather than stock-picking alpha also rely on XLY. The fund is highly liquid, with average daily volumes exceeding tens of millions of shares, which makes it suitable for tactical entry and exit. For example, during earnings season in August 2025, surprises from Amazon’s retail segment and Tesla’s margin commentary created sharp intraday swings in the ETF itself. A trader following macro catalysts like retail sales reports, CPI releases, or quarterly earnings can use XLY ETF as a clean proxy for sector exposure, hedging or speculating without needing to manage multiple individual positions.

FAQs About the XLY ETF

Q1. Is the XLY ETF a good investment in 2025?

Yes. Despite market volatility, XLY has delivered a positive year-to-date return of around 12 percent as of September 2025, supported by strong consumer discretionary spending and resilient corporate earnings.

Q2. Does the XLY ETF pay dividends?

Yes, but its dividend yield is relatively low (typically under 1 percent) since most of its companies reinvest heavily into growth. Investors looking for income may find other ETFs more suitable.

Q3. How much of my portfolio should go into XLY ETF?

It depends on your risk tolerance. Growth-oriented investors may allocate 10 to 15 percent of their equity portfolio to consumer discretionary. More conservative investors might stick to 5 percent or less, balancing it with defensive sectors like healthcare or staples.

Final Word: Is XLY A Good Buy In 2025?

XLY remains one of the cleanest tools for expressing a view on the American consumer, large cap retail platforms, EV adoption, housing-adjacent spend, and leisure demand. In 2025 it has delivered modest gains year to date with stronger trailing performance, but with the usual sector choppiness and a heavy reliance on a few leaders.

If you believe the consumer stays resilient, rates ease from restrictive levels, and the sector’s champions keep executing, XLY deserves a seat in your portfolio. Size it thoughtfully, pair it with a defensive counterweight, and use rebalancing rules so the position does not quietly grow beyond your risk comfort. If, on the other hand, you expect a sharper slowdown in jobs or credit, keep XLY on a watchlist and revisit when the macro tone improves.

Bottom line: XLY is not a set-and-forget income fund. It is a growth-tilted sector bet. Used with discipline, it can be a powerful engine for returns when the wind is at the consumer’s back.

Disclaimer: This material is for general information purposes only and is not intended as, and should not be considered to be, financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation that any particular investment, security, transaction, or investment strategy is suitable for any specific person.