Cerebras Systems, one of the most innovative AI chipmakers globally, has been preparing for a long-awaited IPO. Known for its Wafer-Scale Engine (WSE), the world's largest AI chip, Cerebras has generated major buzz among investors looking to capitalise on the AI hardware boom.

However, despite expectations earlier in 2025, the IPO has not yet taken place. With regulatory reviews dragging on, Cerebras' road to Wall Street is proving to be more complicated than expected.

Here's the latest on the IPO date, valuation, risks, and opportunities.

When Is the Cerebras IPO Date?

Cerebras initially aimed for a Q2–Q3 2025 IPO after filing confidentially with the SEC in late 2024. Many analysts expected the listing to come in the summer.

However, as of September 2025, the IPO remains delayed with no official date set. The holdup stems largely from a national security review by the Committee on Foreign Investment in the United States (CFIUS) regarding Cerebras' close partnership with G42. It is an Abu Dhabi-based AI company that has invested in and purchased from Cerebras.

While CFIUS has granted partial clearance, they have not yet finalised the process. Reports suggest that the IPO could slip into late 2025 or early 2026, depending on the pace of regulatory approvals.

In short, investors waiting for the IPO will need more patience.

Cerebras IPO Journey: From Private Funding to SEC Filing

Cerebras was founded in 2015 and has raised approximately $720 million in private funding across six rounds, including a $250 million Series F round in November 2021.

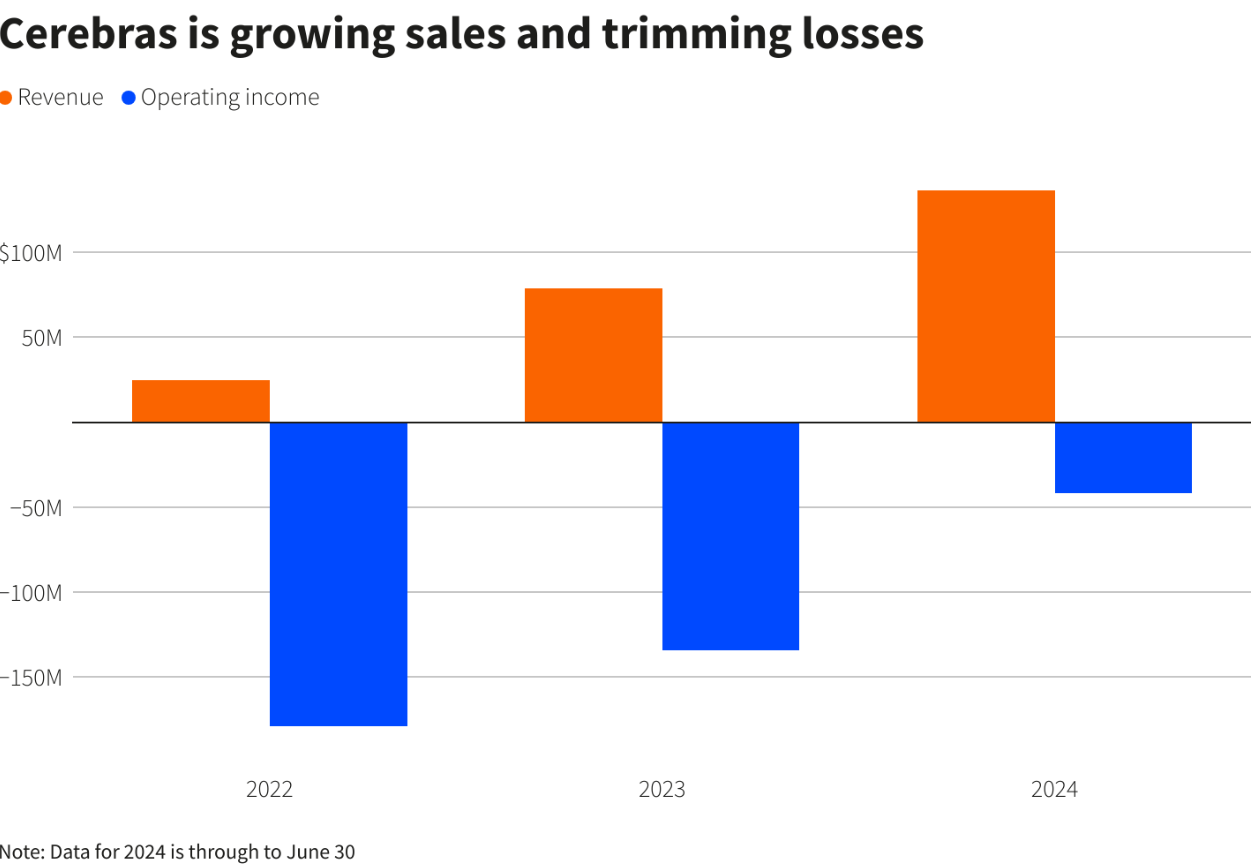

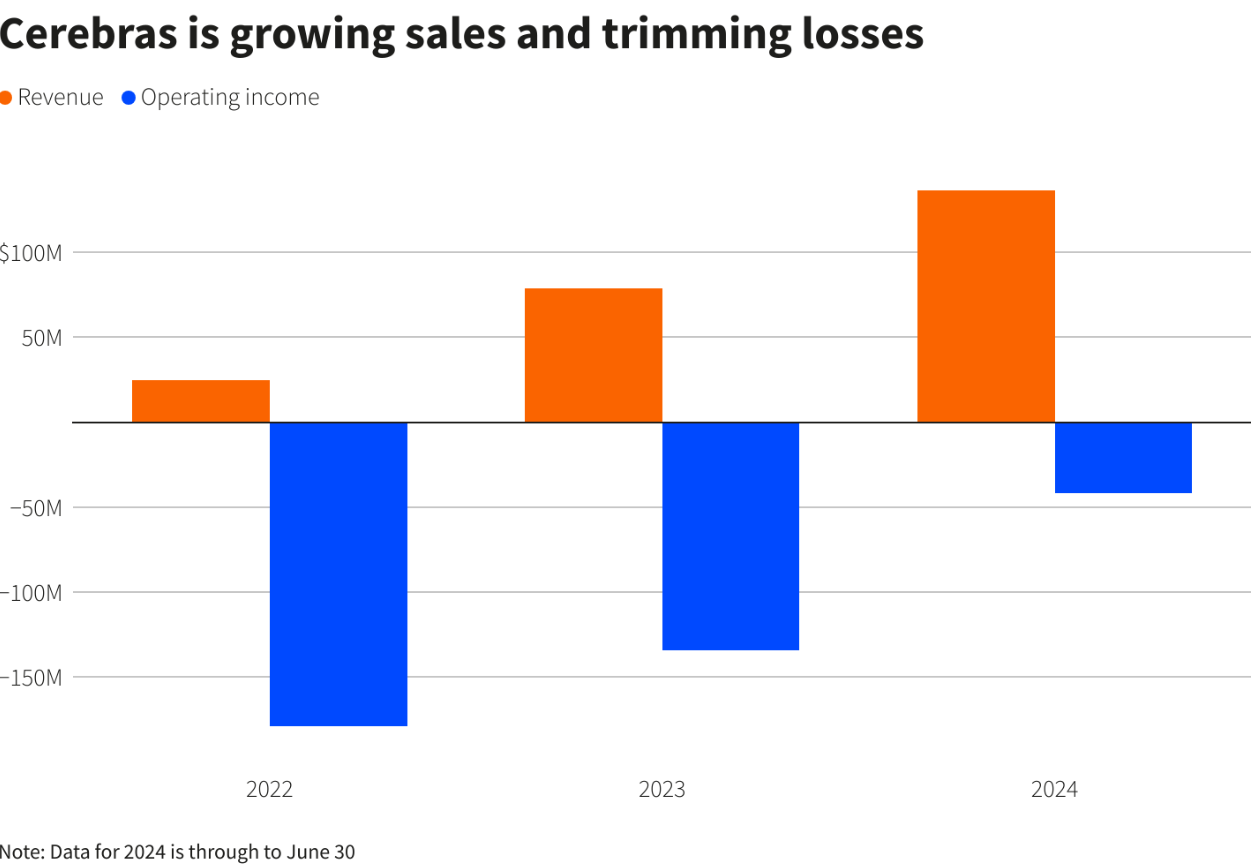

On September 30, 2024, Cerebras confidentially filed its Form S-1 with the SEC to launch an IPO under the ticker CBRS on Nasdaq. The documents disclosed that a customer and investor from the UAE, G42, made up more than 80% of hardware sales in 2023, prompting a required CFIUS (Committee on Foreign Investment in the U.S.) assessment.

The CFIUS review, initiated due to G42's strategic ties and past connections to Chinese entities like Huawei, caused significant delays. As of March 2025, CFIUS cleared the investment after Cerebras adjusted terms so that G42 would hold non-voting shares, removing a massive barrier to the IPO path. (Bloomberg)

Despite that clearance, the IPO remain on hold, pushed into late 2025 or early 2026 amid broader caution in the tech IPO market and macro volatility.

Cerebras Valuation: What Is It Worth?

Cerebras was last valued at around $4.7 billion in private markets (2024 Series F funding). Analysts estimated an IPO valuation of $7–8 billion based on the robust demand for its AI chips and agreements with government and corporate clients.

That range still seems realistic, but investors should note:

IPO uncertainty may pressure valuations, especially if the delay extends into 2026.

Competitors such as Nvidia, AMD, and Intel continue to dominate AI hardware markets, which may affect relative pricing.

New government contracts, including a $45 million DARPA award in April 2025 (in partnership with Ranovus), strengthen Cerebras' credibility and may support higher investor appetite.

Bottom line: Cerebras continues to appear as a multi-billion-dollar IPO contender, yet the precise valuation will depend on regulatory approvals and market conditions at the time of its eventual listing.

Cerebras IPO Outlook: What Investors Should Expect

While Cerebras' IPO is delayed and uncertain, the fundamentals of its business remain strong. The DARPA contract demonstrates its ability to secure key U.S. government contracts, alleviating worries about international collaborations.

Most analysts currently anticipate a public launch in late 2025 or early 2026, contingent on the outcome of the CFIUS review. Valuation projections stay within the $7–8 billion range, but extended delays might reduce that figure.

For investors seeking exposure to the AI hardware revolution, Cerebras remains a company to watch closely, even if the IPO timeline stretches further than first expected.

Why Investors Are Excited About Cerebras

Despite the delays, Cerebras remains one of the most observed private firms in AI hardware. Its appeal comes from:

Unique Technology: The Wafer-Scale Engine is the largest chip ever built, offering a performance leap over conventional GPUs.

High-Value Contracts: Cerebras has worked with national labs, Fortune 500 companies, and now DARPA.

AI Infrastructure Growth: With AI adoption booming, demand for specialised hardware is expanding rapidly.

Together, these factors explain why Wall Street views Cerebras as a potentially strong IPO candidate, comparable in buzz to other AI listings such as Arm (2023) and Astera Labs (2024).

Market Sentiment and Investor Considerations

After a prolonged slowdown, the U.S. IPO market is experiencing a renewed surge. As of mid-2025, IPO volumes and proceeds are up significantly. Morgan Stanley shows a robust performance in equity capital markets with 499 transactions, comprising 168 IPOs during the first half of 2025. He further anticipates an additional recovery in H2 2025 and extending into 2026.

Despite this, investor scrutiny remains high as only about 25% of tech IPOs this year have been profitable at listing, highlighting a persistent demand for fundamentals over hype.

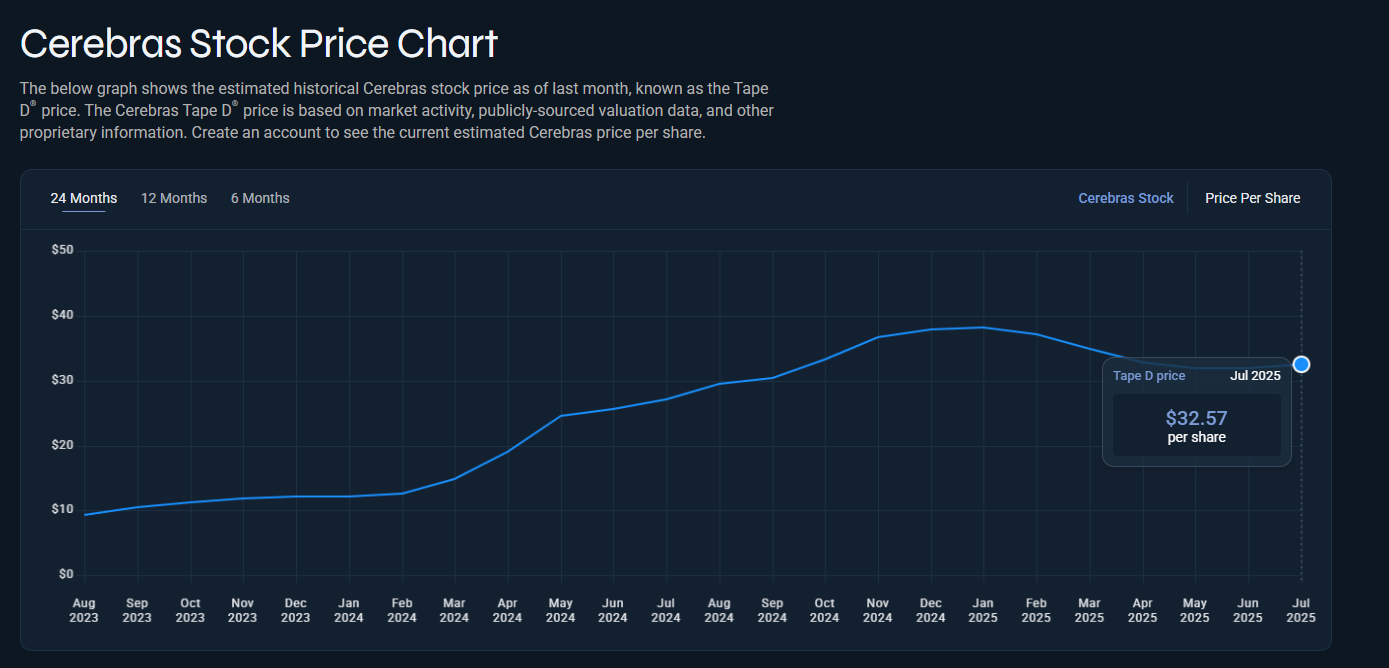

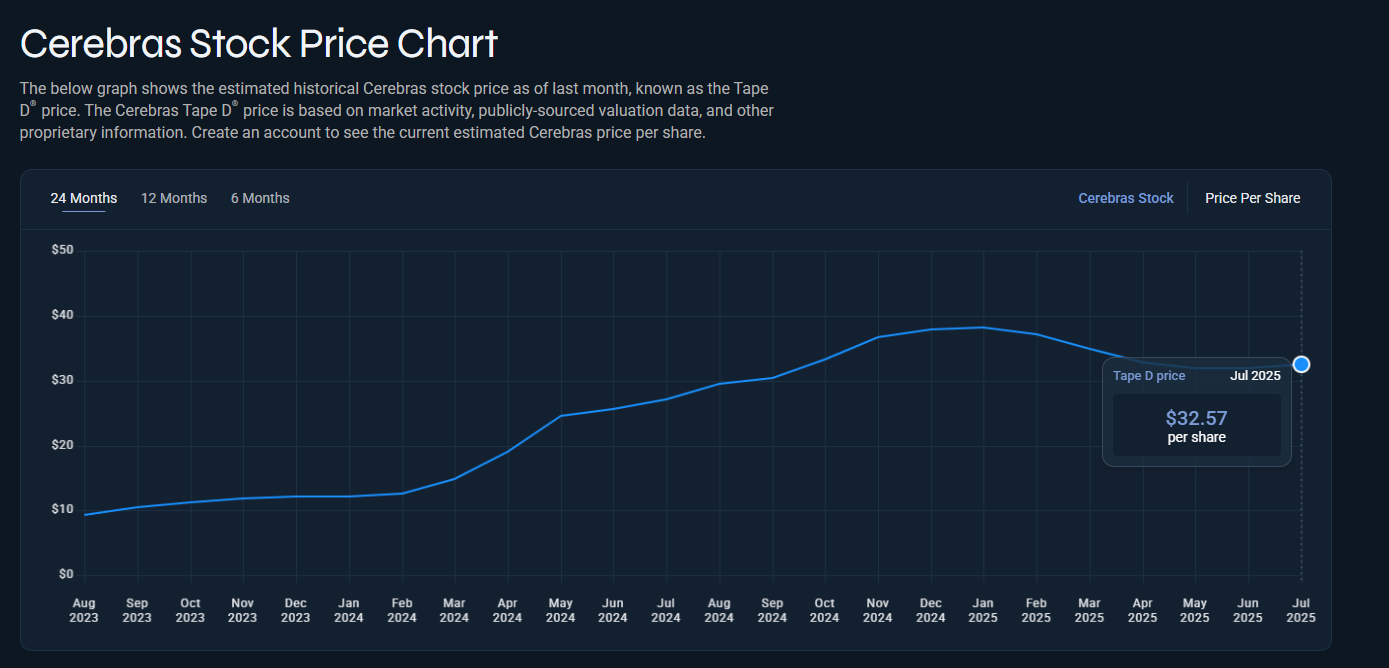

As one of the few AI-first chipmakers eying a public debut, Cerebras has the potential to break through market hesitation if it can navigate regulatory delays and timing. Secondary-market interest underscores this: recent estimates place Cerebras' private share price around $32–$33 per share on platforms like Nasdaq Private Market.

However, several red flags could hold back enthusiasm:

Geopolitical scrutiny remains a wildcard, particularly if the ownership structure or national security context shifts.

Macroeconomic volatility and inflated valuations continue to dampen investor confidence, as seen with underwhelming debuts from CoreWeave and SailPoint.

Reports suggest that investor confidence may only fully return once public markets show consistent long-term value, as some IPO veterans caution that overhyped offerings with weak fundamentals may continue to deter listings.

Frequently Asked Questions

1. When Is the Cerebras IPO Date?

As of August 2025, Cerebras has no confirmed IPO date. It may launch in late 2025 or early 2026, depending on regulatory approvals.

2. Why Is Cerebras' IPO Delayed?

The main reason is the ongoing CFIUS national security review of its relationship with Abu Dhabi-based G42.

3. Should Investors Buy In at IPO?

That depends on IPO pricing, competitive dynamics, and resolution of regulatory risks. Long-term AI hardware demand makes it attractive, but risks remain high.

Conclusion

In conclusion, Cerebras' IPO remains a prime contender for one of the most anticipated tech listings of the decade. Yet, the road ahead is not without obstacles, with CFIUS oversight, valuation pressures, and a cautious investor base continuing to shape the timeline.

Whether Cerebras debuts in late 2025 or slips into 2026, its eventual listing will serve as a litmus test for investor appetite in AI hardware IPOs, which may influence the upcoming wave of semiconductor contenders targeting Nvidia's supremacy.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person