For a moment on Tuesday, it felt like the internet itself had cracked. ChatGPT froze, X feeds stopped loading, Spotify streams died mid-song, and thousands of brands saw their digital storefronts replaced by blunt error messages. At the centre of that storm was one company: Cloudflare – the quiet infrastructure layer that normally stays invisible, until it fails.

Equity markets do not ignore that kind of stress test. As the outage rippled through core online services, Cloudflare’s stock (NET) gapped lower, wiping out around 4% of its value intraday and roughly $1.8 billion in market capitalisation, as investors quickly priced in reliability risk on top of already rich growth valuations.

A rare “single point of failure” moment

On 18 November 2025, a global outage at Cloudflare disrupted access to X, ChatGPT, Spotify, Canva, Shopify, Coinbase, NJ Transit and many other services. Users saw 500-level errors, “internal server error” pages and broken app functionality across devices.

Cloudflare said the incident was tied to a spike in “unusual traffic” around 11:20 UTC that triggered failures across parts of its edge network and control plane. The company rolled out a fix and reported a gradual recovery, but residual errors persisted for hours.

This matters because Cloudflare is not a niche vendor; it sits in front of an estimated 20% of global web traffic, handling security, content delivery and performance for millions of domains. When that layer falters, the outage looks systemic, not localised – and equity investors react accordingly.

How much did Cloudflare stock actually drop?

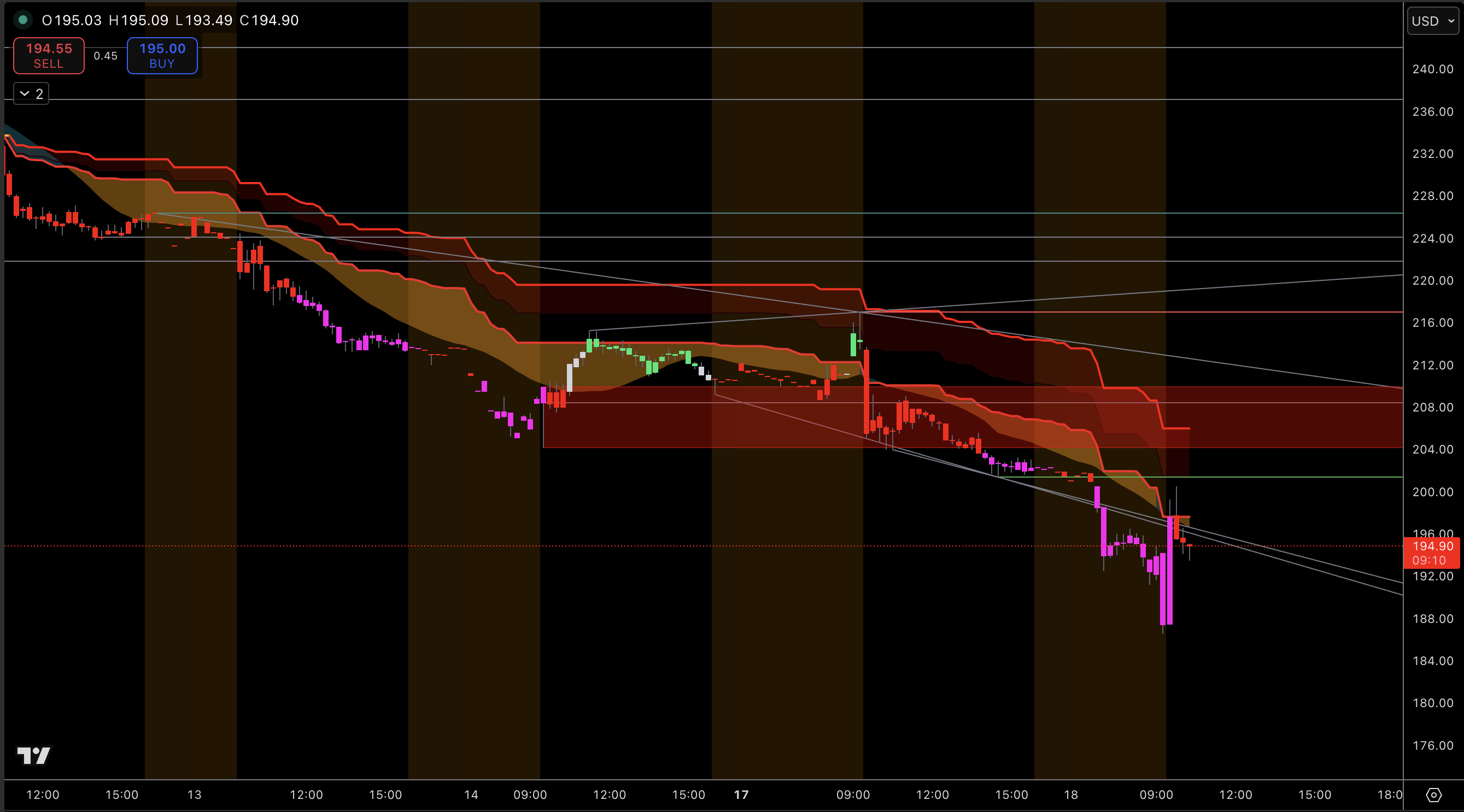

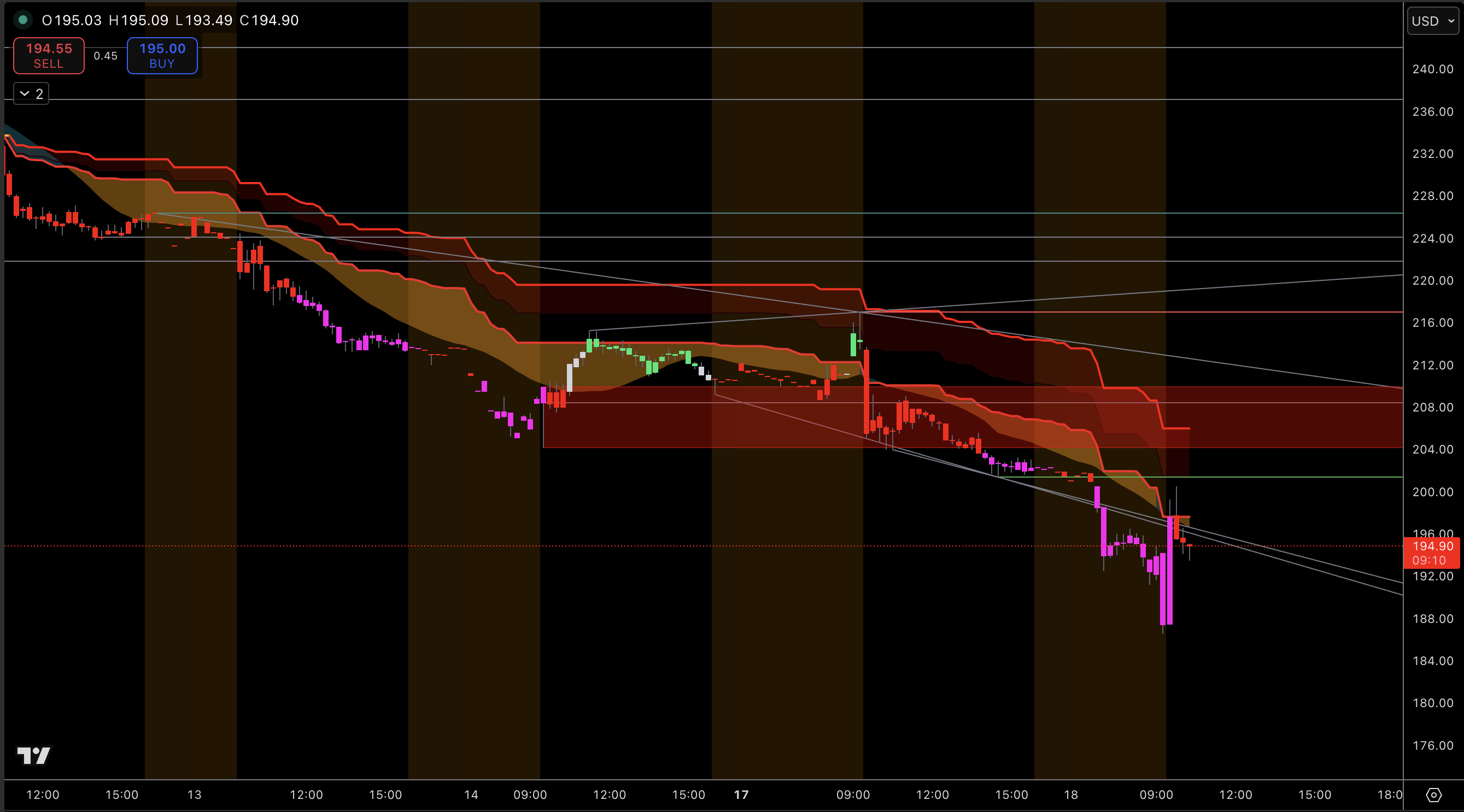

By midday New York time, Cloudflare shares were trading near $200–$202, down roughly 3.5–4% from the prior close, after earlier pre-market losses of about 3.3–3.9%. The stock opened sharply lower around $212 and quickly slid towards an intraday low just below $187 before stabilising.

In percentage terms, that is a standard “bad headline” sell-off for a high-beta growth name. But in dollar terms, it’s meaningful: finance estimates put the immediate hit at around $1.8 billion in lost market value. For a company that has just been rewarded for flawless execution and fast growth, it’s a very public reminder that reliability is part of the valuation multiple.

Zooming out, NET has had a huge run. The share price recently printed an all-time high near $260 in early November and is still more than 100% higher year-on-year, with a 52-week range between roughly $89 and $260. Today’s drop sits on top of an almost 20% pullback from those highs, meaning the outage is hitting a stock that was already correcting.

The fundamental backdrop: a high-growth name priced for perfection

Critically, this sell-off is not happening in a vacuum. Only a few weeks ago, Cloudflare reported Q3 2025 revenue of $562 million, up 31% year-on-year, with strong non-GAAP operating margins around 15% and robust large-customer growth.

Management guided full-year 2025 revenue to roughly $2.1–2.14 billion, representing about 28% growth, and lifted Q4 guidance above consensus. The market rewarded that with a sharp leg higher: NET had been trading as a classic high-multiple, high-growth infrastructure stock riding AI-driven demand, especially through its Workers developer platform and security products.

In other words, investors were paying up for three things:

Durable growth in security, edge computing and AI-adjacent workloads

Expanding profitability as scale kicks in and network capex normalises

Implied reliability – the assumption that Cloudflare “just works” in the background

Today’s outage hits the third pillar directly, which is why the reaction, though not catastrophic, is sharp. When a stock is priced for perfection, reliability failures get amplified through the discount rate investors apply to future cash flows.

What the outage tells investors about systemic risk

The internet’s “concentration problem”

We’ve seen this movie before: the 2024 CrowdStrike update failure that crashed Windows machines, major outages at Microsoft Azure, and Amazon Web Services incidents that knocked out parts of the web. Cloudflare now joins that list with its own systemic stress test.

For an economist, the key issue is concentration risk. When a small number of infrastructure providers sit on critical paths for communications, payments, AI and public services, the system becomes more efficient – but also more fragile. Today’s outage disrupted not just social media and music, but transport systems and business platforms.

For equity holders, that fragility shows up as a higher risk premium. Investors may now require a slightly higher expected return to own NET, which, in valuation terms, means a lower justified multiple if growth and margins are unchanged.

Reputational damage vs switching costs

In the short run, enterprises will be angry, boards will ask hard questions, and some IT teams will raise the topic of multi-CDN or alternative providers. But the switching costs around Cloudflare can be high, especially for customers deeply integrated into its security stack, Workers platform and zero-trust services.

We should expect:

A tougher enterprise sales cycle for a quarter or two, with more due diligence on redundancy

Possible service credits or pricing concessions for affected large customers

A strong push from Cloudflare to publish a detailed post-mortem and harden its controls

From a macro-equity perspective, that leans more towards margin drag and slightly slower bookings, rather than wholesale customer flight. But in a name trading on elevated revenue multiples, even a small perceived hit to durability can move the stock.

Technical view: what today’s candle is signalling

Technically, NET is in a pullback phase after its vertical rally to $260 in early November. The stock had already slipped about 20% in less than a month, from $253.30 to roughly $202 ahead of today’s outage-driven slide, as some analysts flagged stretched valuation and potential downside towards the $140s.

Today’s action adds:

A gap down from the low $210s with a fast flush towards the low $187s

A growing volume spike relative to normal intraday trading, consistent with short-term capitulation and stop-loss triggers

A likely break below recent short-term support around the mid-$200s, confirming the correction

From a chart perspective, several levels stand out:

$190–195 – today’s intraday low area and first line of tactical support. If buyers step in here by the close, it suggests the market sees this as a one-off shock rather than the start of a structural de-rating.

$180 – a prior consolidation shelf from late summer, where a lot of volume changed hands. A move into this zone would signal deeper profit-taking by longer-term holders. (This level is inferred from recent price history and common volume behaviour.)

$160–145 – the deeper value-hunt zone, where some fundamental analysts are already modelling fair value around the low $140s if growth multiples compress.

On most traders’ screens, momentum indicators like RSI were already cooling from “overbought” levels after the earnings spike. Today’s candle is less about starting a downtrend and more about accelerating an ongoing mean reversion in a volatile, high-beta name.

Macro and sector context

This outage also lands in a risk-off session more broadly. Global equities have been under pressure on concerns about stretched tech valuations, mixed economic data and fading risk appetite; major indices in Asia and Europe were in the red even before the outage headlines crossed.

Cloudflare’s business is tied to:

Global digital activity – ecommerce, streaming, SaaS and AI workloads

Corporate IT spending – especially security and network modernisation budgets

The AI build-out – as developers push more work to edge networks and inference near users

If macro conditions tighten and risk-free yields stay elevated, rich multiple names like NET feel that through both earnings uncertainty and valuation compression. Today’s outage doesn’t change that macro story, but it gives traders a fresh, concrete reason to sell into weakness.

Does this change the long-term Cloudflare thesis?

Fundamentally, the long-term bull case around Cloudflare still rests on three pillars:

Secular tailwinds in web security, zero-trust networking and AI-driven traffic

Scalable network economics – high gross margins and leveraged operating costs

Developer mindshare – especially around Workers and the emerging AI ecosystem

Recent earnings confirm those drivers remain intact: 31% revenue growth, improving non-GAAP operating margins, and strong large-customer expansion all support the idea that Cloudflare is evolving into a core internet utility with growing monetisation per customer.

What changes after today is the perceived risk profile. Investors must now assume:

Outage risk, while still low probability, is not “zero” for Cloudflare

Regulatory and customer scrutiny of single-vendor dependence will increase

Management will need to allocate capital and mindshare to resilience, not just growth

None of that kills the story, but it may cap the valuation multiple versus where it traded pre-outage, unless Cloudflare can credibly demonstrate that this was a rare, fully-remedied event with clear architectural improvements.

Trading angle: panic or buying opportunity?

For short-term traders, today’s move is about positioning, not just fundamentals. NET was crowded on the long side after an exceptional earnings beat, a 100%+ 12-month rally and aggressive AI-themed flows.

The outage provides:

A catalyst for fast money to take profits

A chance for new money to enter at a discount if they believe in the long-term story

A test of how strong the dip-buying community really is in this name

If the stock holds above the $190–195 zone into the close and we see a classic “long lower wick” on the daily candle, that would hint at strong dip demand and reinforce the idea that this is more of a one-day volatility event. A close near the lows, or follow-through selling into $180 and below, would suggest the market is still working off positioning and re-rating risk.

Long-horizon investors will focus less on today’s tick and more on:

The quality and transparency of Cloudflare’s post-mortem

Evidence that large customers stay on the platform

Any sign that growth guidance or capex plans are being revised because of the incident

FAQs

1. Why did Cloudflare stock drop today?

Cloudflare’s stock fell after a global outage linked to its network took down major services like ChatGPT, X and Spotify, exposing reliability risk in a company viewed as core internet infrastructure. With NET priced for aggressive growth, investors quickly marked down the shares by around 4% intraday.

2. How big is the financial impact of this outage on Cloudflare?

The immediate impact is in market value rather than reported earnings. NET lost roughly $1.8 billion in capitalisation on the day, according to early estimates. Future costs may include service credits, potential churn and extra investment in resilience, but those will likely show up as modest margin pressure rather than a collapse in revenue.

3. Is Cloudflare still a good long-term investment after this incident?

That depends on your risk tolerance. The growth story remains strong - 30%+ revenue growth, expanding margins and rising large-customer counts. The outage doesn’t erase that, but it forces investors to acknowledge reliability risk and may justify a slightly lower valuation multiple until Cloudflare proves the fix is robust.

4. What are the key price levels to watch now for NET stock?

Near-term, traders are watching the $190–195 band as first support after today’s low. Below that, the $180 region is a prior consolidation area, and deeper value hunters may eye the $160–145 zone, which some analysts see as fair value if the multiple compresses further.

5. Could regulators react to the Cloudflare outage?

Regulators in the US and Europe are already focused on systemic digital infrastructure risk after recent outages at cloud and security providers.A high-profile Cloudflare failure that disrupts transport, finance and AI services could strengthen arguments for resilience standards, redundancy requirements or reporting rules, though any formal response will likely take time.

6. Should businesses using Cloudflare switch providers after this?

Most won’t switch outright. Migrating security, CDN and zero-trust setups can be complex and risky. The more common response is to add redundancy – for example, multi-CDN setups or failover paths – and push Cloudflare for stronger SLAs and technical safeguards. The outage is a wake-up call to diversify, not necessarily to abandon the platform.

Conclusion

Cloudflare’s outage is a brutal reminder that the invisible plumbing of the internet carries real financial risk. When a provider handling a fifth of global web traffic falters, it doesn’t just irritate users – it wipes billions from its own valuation and rattles confidence across the digital economy.

For NET shareholders, the question is not whether today’s drop is justified, markets always punish reliability failures in richly valued names – but whether this marks the start of a durable re-rating or a painful, one-day reset in an otherwise intact growth story. The answer will depend on how quickly Cloudflare restores trust, not just uptime.