Each responds differently to market cycles, inflation, and global demand, therefore, understanding how they work can help investors balance risk and opportunity in a changing economy.

In today’s volatile markets, commodities and stocks stand out as core building blocks of a diversified portfolio. While both can drive strong returns, they operate under different principles and appeal to investors with distinct risk appetites and time horizons.

Whether you’re new to investing or refining your portfolio strategy, understanding the key differences between commodities and stocks can help you make smarter, data-driven decisions in 2025 and beyond.

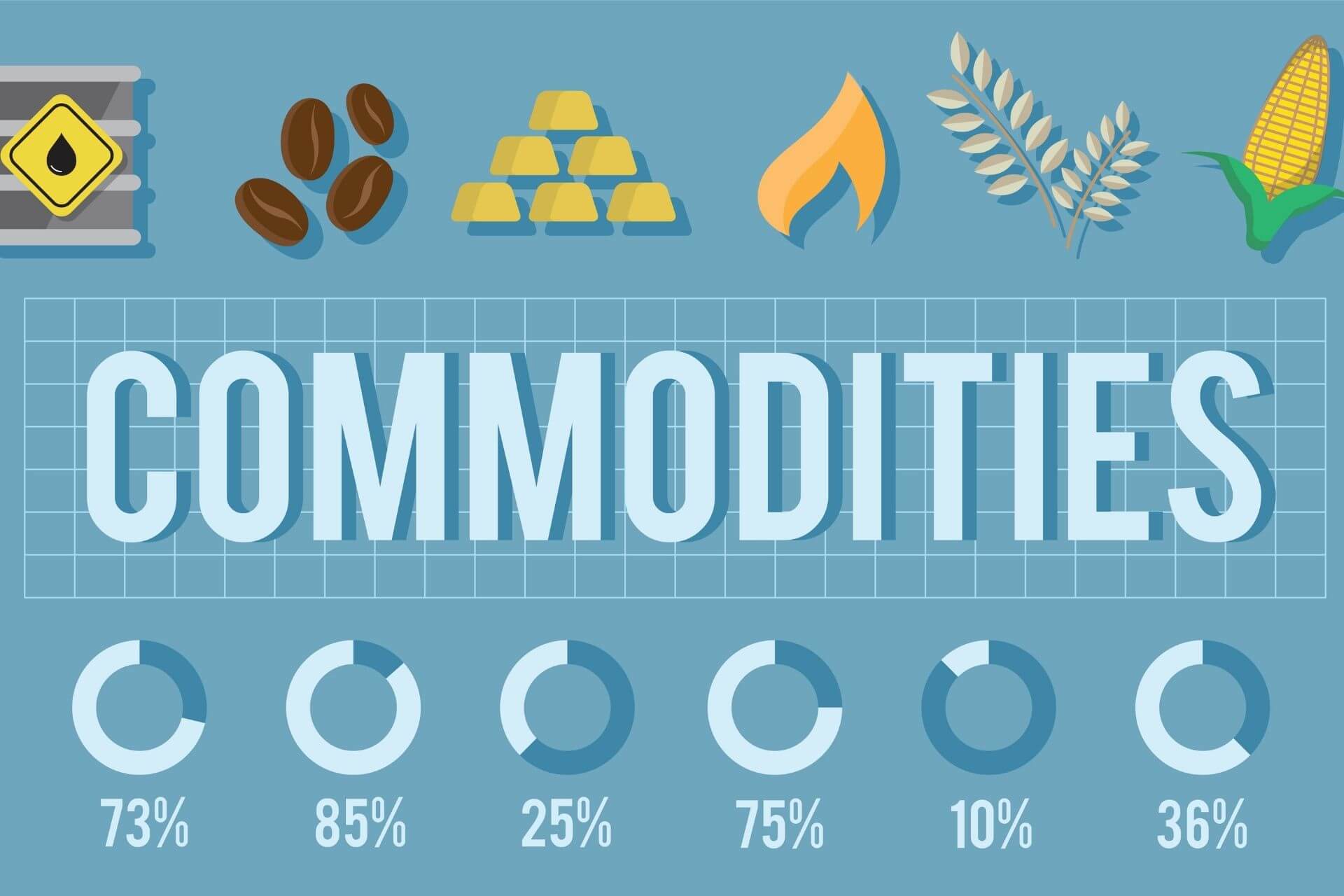

What Are Commodities?

Commodities are physical goods: raw materials and agricultural products that are standardized and traded globally. They form the backbone of industrial production and daily consumption, influencing everything from fuel prices to food costs.

Commodities are physical goods: raw materials and agricultural products that are standardized and traded globally. They form the backbone of industrial production and daily consumption, influencing everything from fuel prices to food costs.

Categories of Commodities:

Hard Commodities: Natural resources that are mined or extracted.

Examples: Gold, silver, oil, natural gas

Soft Commodities: Agricultural or livestock products.

Examples: Corn, wheat, coffee, cocoa, cotton, soybeans, cattle

How Commodities Are Traded:

Futures contracts on exchanges such as the Chicago Mercantile Exchange (CME) or Intercontinental Exchange (ICE)

Spot markets, where transactions occur for immediate delivery

ETFs and mutual funds for simplified exposure

Options and derivatives for advanced hedging or speculation

What Are Stocks?

Stocks, or equities, represent ownership in a company. When you purchase a stock, you effectively own a share of that business and can benefit from its growth and profits.

Stocks, or equities, represent ownership in a company. When you purchase a stock, you effectively own a share of that business and can benefit from its growth and profits.

Types of Stocks:

Where Stocks Are Traded:

Major global exchanges such as NYSE, NASDAQ, London Stock Exchange, and Tokyo Stock Exchange

Through brokerage platforms, ETFs, or mutual funds for diversified access

Key Differences Between Commodities and Stocks

While both asset classes can generate strong returns, they behave differently under various economic conditions. The table below outlines their main differences in structure, risk, and performance drivers.

| Feature |

Commodities |

Stocks |

| Nature |

Tangible goods |

Ownership in a company |

| Volatility |

Often more volatile |

Moderate, depending on the stock |

| Returns |

Short-term trading potential |

Long-term capital appreciation |

| Dividends |

None |

Possible dividend income |

| Influenced by |

Supply-demand, geopolitics, weather |

Company earnings, economic indicators |

| Market Hours |

Often 24/5 |

Limited to stock exchange hours |

| Hedge Against Inflation |

Strong (gold, oil) |

Moderate |

| Diversification Role |

Excellent portfolio diversifier |

Core portfolio component |

Risk and Volatility Comparison

Commodities:

Highly sensitive to global factors such as geopolitical tensions, weather disruptions, and supply chain shocks.

Energy commodities like oil can move 5–10% in a single day, especially with leveraged instruments such as futures or CFDs.

Stocks:

Driven by company earnings, macroeconomic data, and investor sentiment.

Large-cap blue-chip stocks are generally more stable than small-cap or tech-focused companies, which face higher volatility.

2025 Market Overview: Commodities vs. Stocks

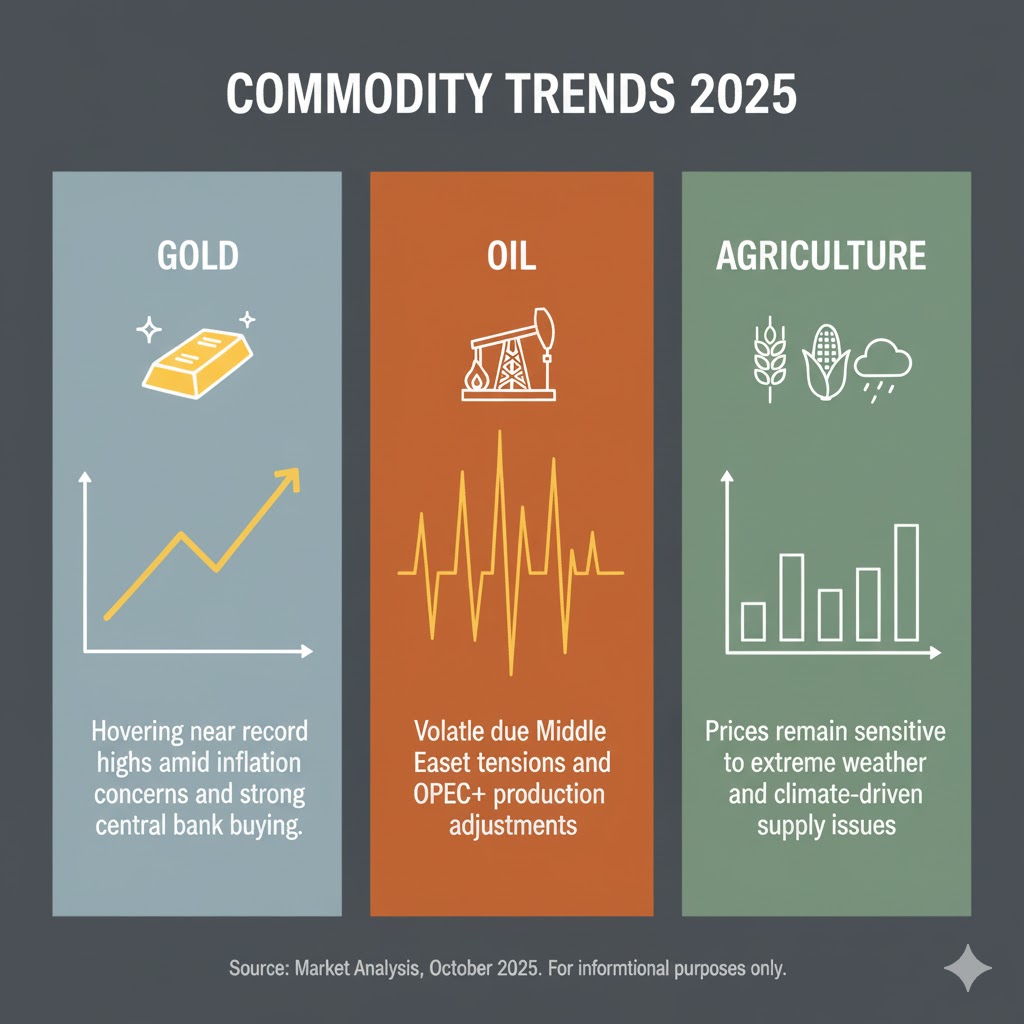

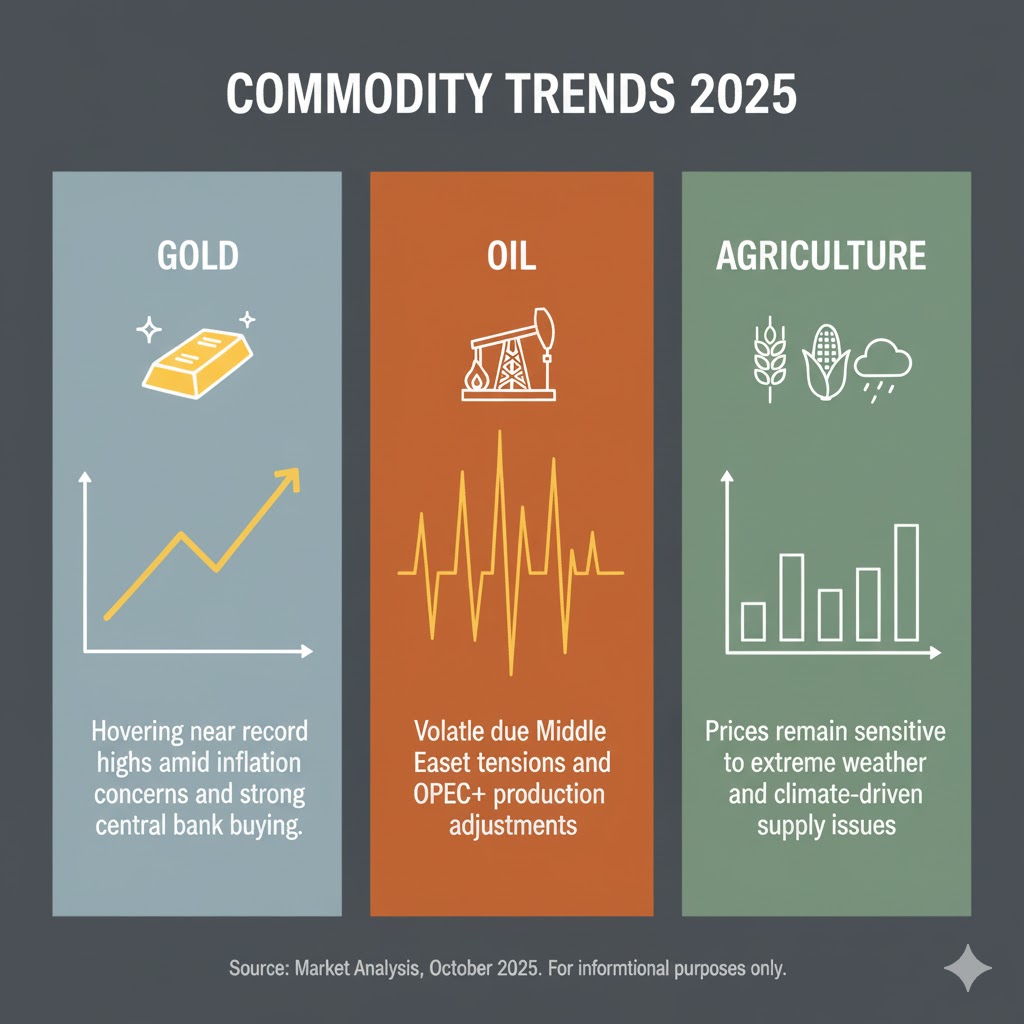

Commodity Trends in 2025:

Gold: Hovering near record highs amid inflation concerns and strong central bank buying.

Oil: Volatile due to Middle East tensions and OPEC+ production adjustments.

Agriculture: Prices remain sensitive to extreme weather and climate-driven supply issues.

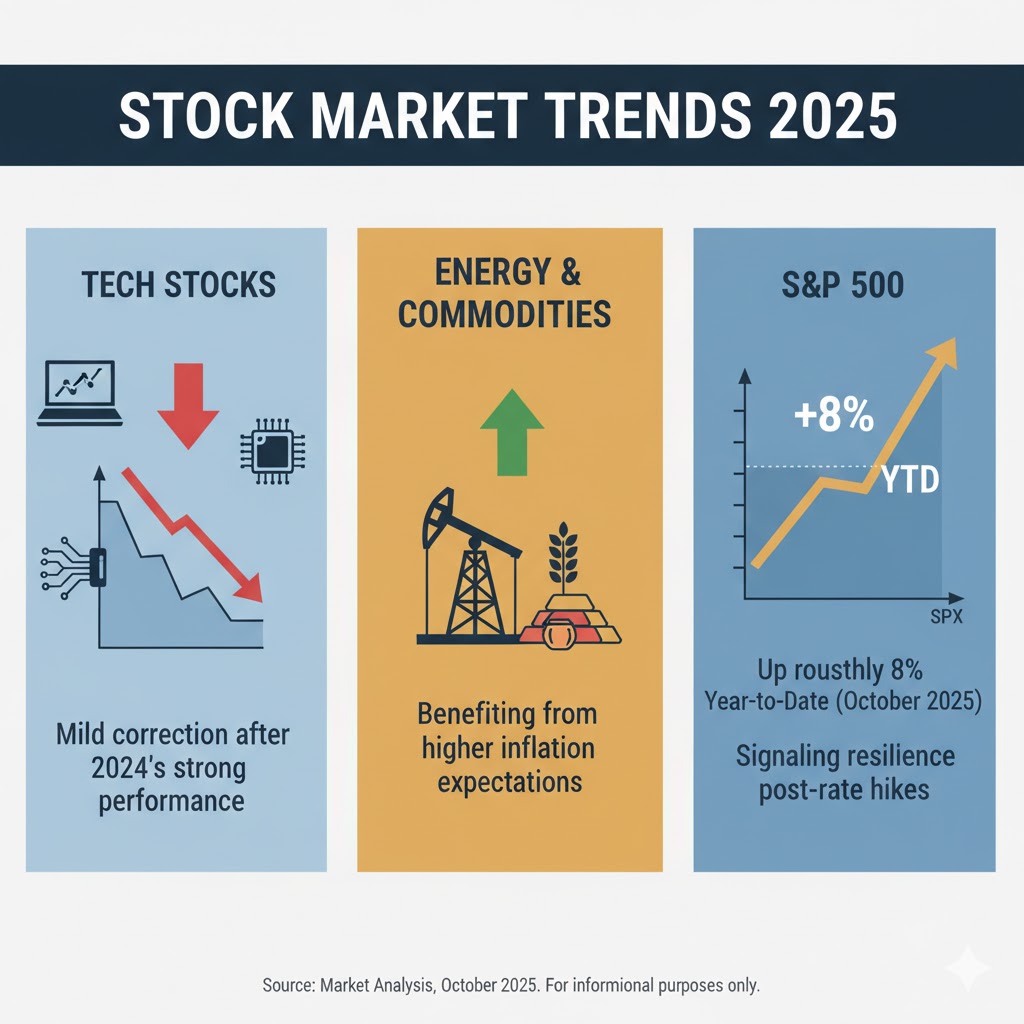

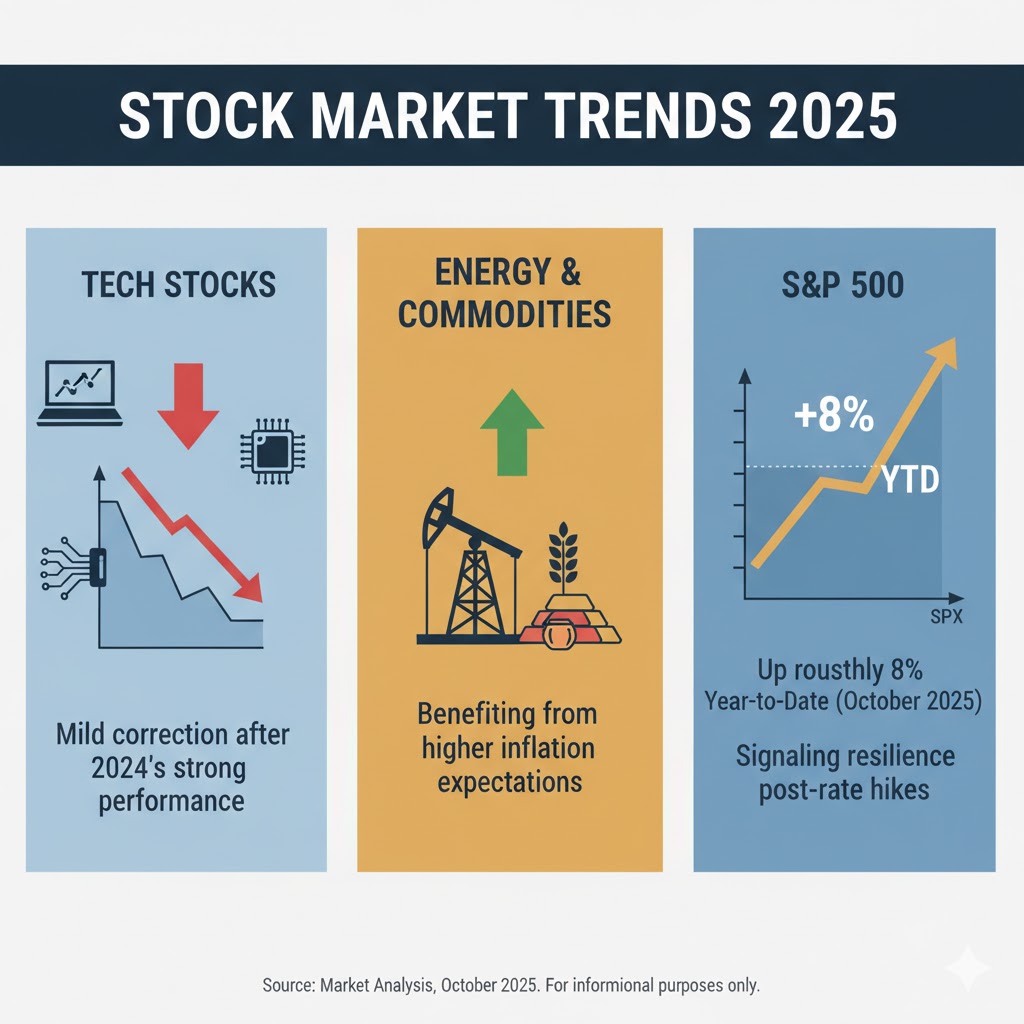

Stock Market Trends in 2025:

Tech stocks: Undergoing a mild correction following 2024’s strong performance.

Energy and commodity-linked equities: Benefiting from higher inflation expectations.

S&P 500: Up roughly 8% year-to-date (as of October 2025), signaling resilience post-rate hikes.

Commodities Or Stocks: Which One Should You Invest In?

| Aspect |

Commodities |

Stocks |

| Primary Benefit |

Effective inflation hedge (especially gold and oil) |

Long-term capital growth through reinvested profits |

| Portfolio Role |

Diversification with low correlation to equities |

Core portfolio component for steady appreciation |

| Income Potential |

None (no dividends) |

Dividend income for consistent returns |

| Trading Appeal |

Short-term trading opportunities in volatile markets |

Suitable for long-term holding and compounding |

| Accessibility |

Traded via futures, ETFs, or commodity funds |

Easily accessible through global stock exchanges |

Choosing between commodities and stocks isn’t just about chasing returns, it’s about aligning your strategy with your goals, time horizon, and risk tolerance.

Before investing, it’s crucial to assess your comfort with volatility and ensure your portfolio remains balanced rather than reactionary.

Real-World Portfolio Strategy in 2025

In 2025, many investors are moving beyond the traditional 60/40 stock-to-bond portfolio and adopting a core-satellite strategy for better balance and flexibility.

Core: Broad-based equity funds such as the S&P 500 ETF (SPY) remain the foundation, providing long-term growth and market stability.

Satellite: Targeted allocations to commodities like gold, oil, and agriculture ETFs act as inflation hedges and enhance returns during market volatility.

Examples of Popular Commodity ETFs in 2025:

| ETF Name |

Focus |

YTD Return (2025) |

| SPDR Gold Trust (GLD) |

Gold |

+12.3% |

| Invesco DB Agriculture Fund (DBA) |

Agriculture |

+8.6% |

| United States Oil Fund (USO) |

Crude Oil |

+10.1% |

This strategy allows investors to stay diversified, hedge against inflation, and capture opportunities across multiple sectors as market conditions evolve.

Frequently Asked Questions (FAQ)

1. Are commodities riskier than stocks in 2025?

Yes. Commodity prices react faster to inflation, supply issues, and geopolitical events, making them more volatile than stocks.

2. How can beginners invest in commodities in 2025?

Use commodity ETFs or mutual funds for simple exposure to gold, oil, or agriculture without trading futures directly.

3. Which is better during inflation, commodities or stocks?

Commodities often perform better as prices of goods rise, while stocks may take longer to adjust.

Conclusion

Commodities and stocks serve distinct but complementary purposes in a portfolio. Stocks remain the foundation for long-term capital appreciation, while commodities provide valuable protection during inflationary or uncertain periods.

For new investors, diversified ETFs or mutual funds can offer exposure to both markets with lower risk and built-in balance. As your experience grows, direct trading or sector-specific strategies can further optimize performance.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.