To simplify, commodity trading provides investors and traders opportunities to speculate on gold, crude oil, natural gas, agricultural products, and other items.

Whether you're looking to diversify your portfolio, hedge against economic risks, or profit from price swings, commodities can provide profound opportunities.

This guide explores how commodity trading works, the various types of contracts, successful strategies for newcomers, and crucial risk management principles to enhance your trading confidence.

What Is Commodity Trading?

Commodity trading refers to the buying and selling of raw materials, natural resources, and agricultural products in financial markets. These assets consist of energy (oil, gas), precious metals (gold, silver), industrial metals (copper), and agricultural products (wheat, coffee, corn).

The majority of these are exchanged through derivative contracts such as futures, options, or CFDs on official exchanges. These platforms establish standardised agreements to guarantee transparency and liquidity.

How Commodity Trading Works

Futures Contracts

A futures contract obligates you to buy or sell a specific commodity at a predetermined price on a set date. Standardised by exchanges, futures allow traders to hedge or speculate. Traders use futures by anticipating price moves and either buying (long) or selling (short) based on expected direction.

Options on Futures

Options give the right, but not the obligation, to buy or sell a futures contract at a strike price before expiration. They limit downside risk to the premium paid but offer leveraged exposure.

CFDs (Contracts for Difference)

CFDs allow traders to speculate on price changes without owning the underlying commodity. They provide the option to take long or short positions and usually employ leverage, without issues related to physical delivery. It makes CFDs beginner-friendly and accessible.

Why Beginners Should Consider Commodity Trading?

Trading commodities offers several advantages:

Diversification: Commodity prices often move differently from stocks and bonds, helping reduce overall portfolio risk.

Inflation hedge: Commodities such as gold and oil increase in value, serving as a natural safe-haven.

Leverage opportunities: Instruments like futures and CFDs allow you to trade larger positions with smaller capital, amplifying profit potential.

These traits appeal to traders with minimal capital who are keen to acquire knowledge.

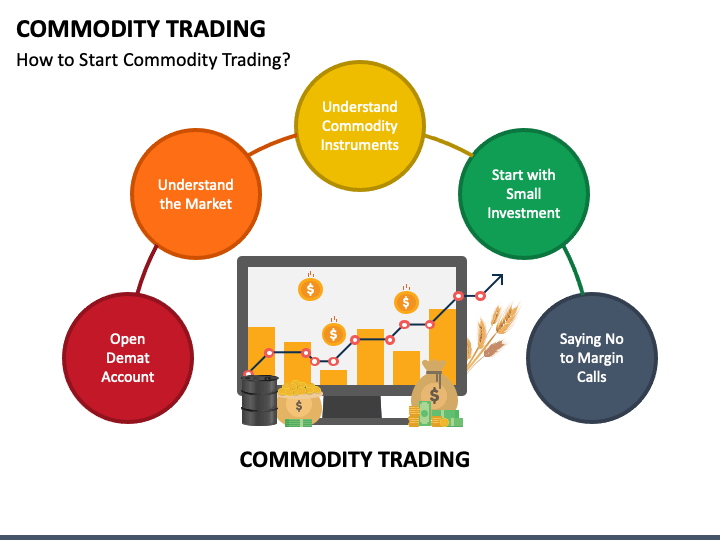

How Beginners Can Start Trading Commodities

1. Educate Yourself

Start with free webinars, courses, reputable articles, and demo trading platforms. Moreover, practice trading virtual contracts to grasp how markets respond.

2. Select a Reliable Broker or Platform

Choose regulated brokers offering strong security, low fees, competitive spreads, and access to a wide variety of commodity markets. Demo accounts and good educational support are a plus.

3. Understand Market Fundamentals

Having comprehensive knowledge of economic cycles, the supply-demand dynamics, geopolitical risks, inflation, and weather patterns is vital. Commodities often react sharply to macro events.

4. Choose a Trading Strategy

Select a strategy that fits your risk tolerance and time frame. Examples include trend-following, swing trading, breakout trading, and even seasonal approaches (e.g., crop cycles or energy demand rhythms).

5. Develop a Strict Risk Management Plan

Set realistic risk limits (e.g., risking 1-2% per trade), use stop-loss orders diligently, diversify across commodities, and avoid excessive leverage. These principles help protect capital in volatile markets.

Common Commodity Trading Strategies for Beginners

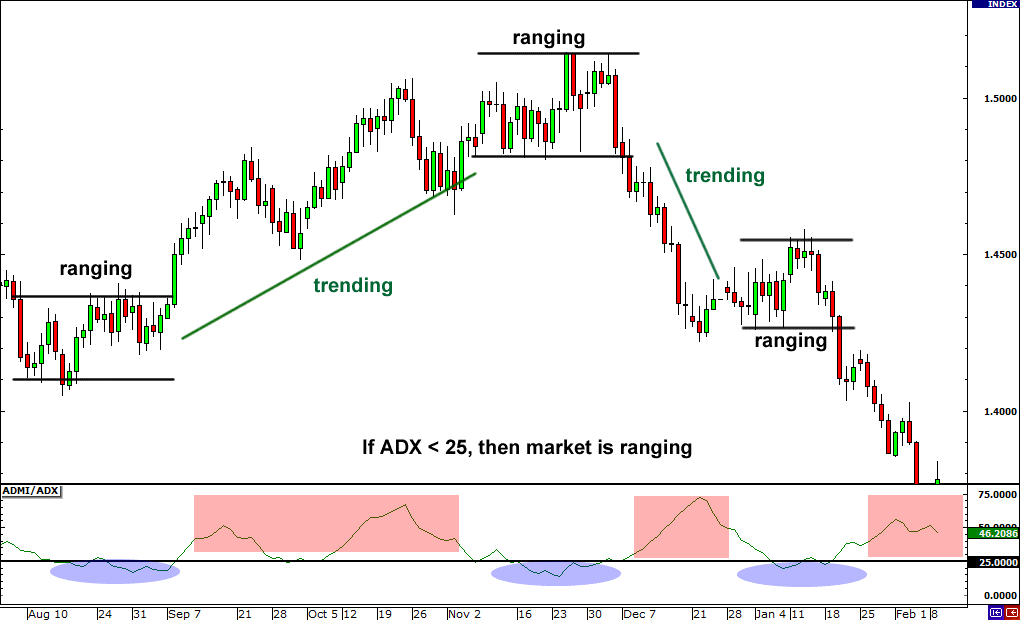

Trend-Following

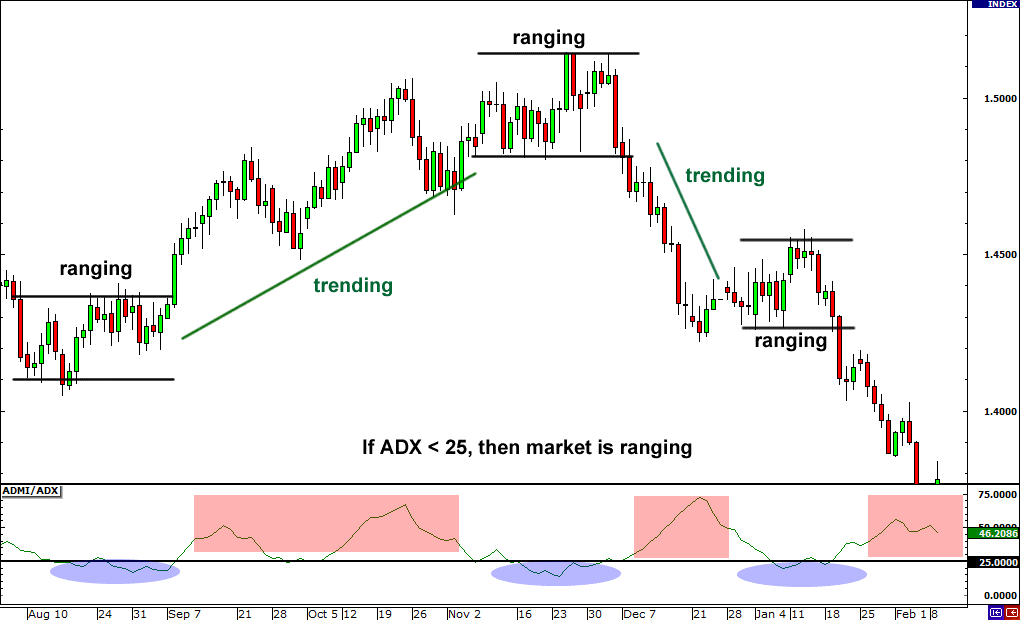

Approximately used by Commodity Trading Advisors (CTAs), trend-following focuses on entering when an established price trend is present. Traders ride the trend until it shows signs of reversal. Indicators such as moving averages, channel breaks, or momentum confirm directionality.

Range Trading

Traders can purchase near lows and sell near highs when commodity prices fluctuate within expected support and resistance ranges. RSI or Bollinger Bands can help identify entry and exit points.

Breakout Trading

Traders enter positions when the price breaks key technical levels with momentum. News events or supply shocks often trigger a breakout. This method is suitable for trading oil or gold.

Fundamental Plays

Traders can trade price moves fueled by tightening supply (e.g., drought affecting crops) or demand surges (e.g., rising energy usage) based on fundamental outlook rather than chart patterns.

How Beginners Can Profit Long-Term

Profit in commodities typically stems from patience, consistency, and managing edge:

Start with demo trading to internalise mechanics without risk.

Concentrate on teachable, consistent patterns such as distinct trend-following setups or clearly outlined breakout tactics.

Keep an eye on economic calendars and supply statistics such as inventory figures for oil and planting.

Use technical analysis tools (chart patterns, trendlines, oscillators) to time entries and exits.

Leverage market volatility intelligently but not recklessly. High volatility may deliver big moves, but only when you control exposure and risk.

Risk Management Essentials and How to Avoid Them

Given inherent volatility, disciplined risk management is non-negotiable:

Utilise stop-loss and take-profit orders to limit losses.

Keep leverage low initially, often no more than 5:1 or 10:1 as a beginner.

Diversify across commodity sectors and don't overcommit to a single market.

Always avoid risking more than you can afford to lose. Begin small and scale gradually.

Monitor significant economic and geopolitical developments, as macro events can swiftly eliminate positions.

2025 Example: Trading Gold or Oil

Gold, as a major commodity, often reflects inflation and central bank moves. When real interest rates drop or global tensions rise, gold tends to rally.

In 2025, gold prices rose almost 20%, indicating macroeconomic changes and changes in USD value. Traders using trend-following setups with moving average crossovers managed to ride these moves profitably.

Similarly, new micro contracts launched for corn and soybeans now allow retail traders to access these markets via smaller, more manageable trades. Micro-contract futures trade with one-tenth the size of standard contracts and eliminate delivery risk, ideal for beginners.

Conclusion

In conclusion, commodity trading provides newcomers with a robust path to access global markets by capitalising on macro trends and diversifying from traditional asset classes.

With financial derivatives such as futures, options, and CFDs, traders can benefit from leverage, both rising and falling price scenarios, and reduced barriers to entry. The keys to success are patience, education, and disciplined risk management.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.