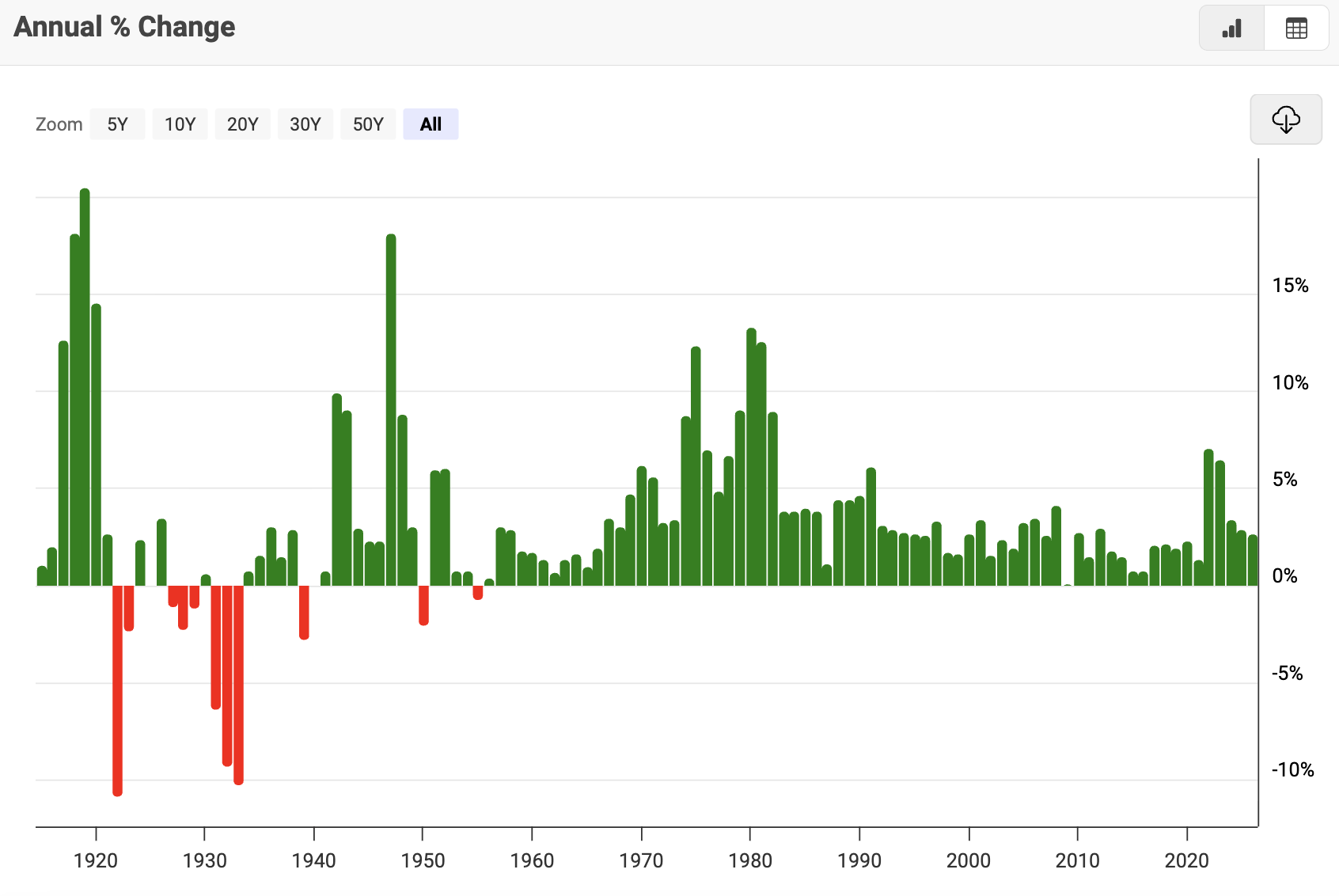

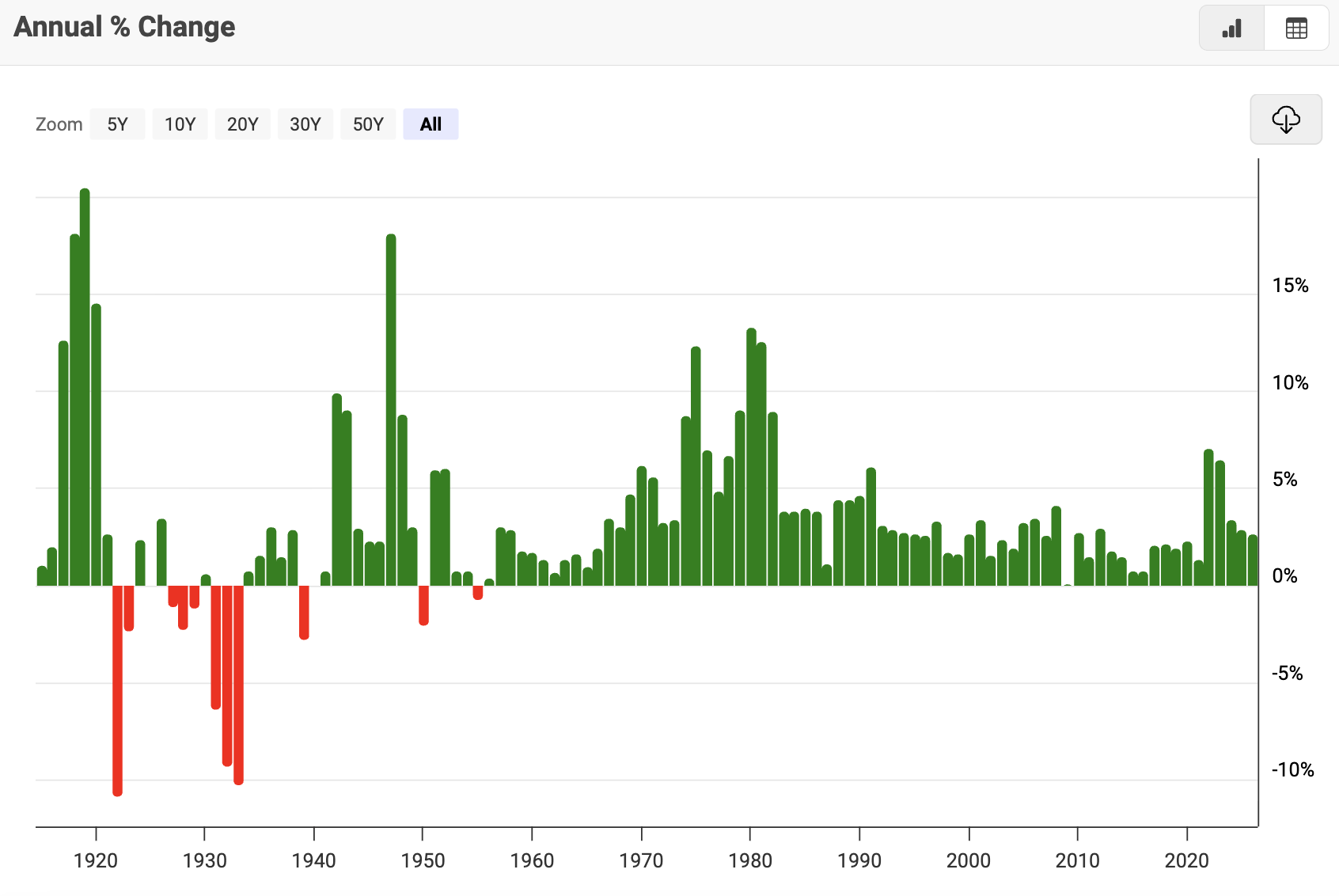

The highest recorded US inflation rate in history, as measured by the Consumer Price Index (CPI), reached 23.7 percent in June 1920. The CPI is the official metric for tracking average price changes paid by urban consumers for goods and services, and it is widely used to monitor inflation.

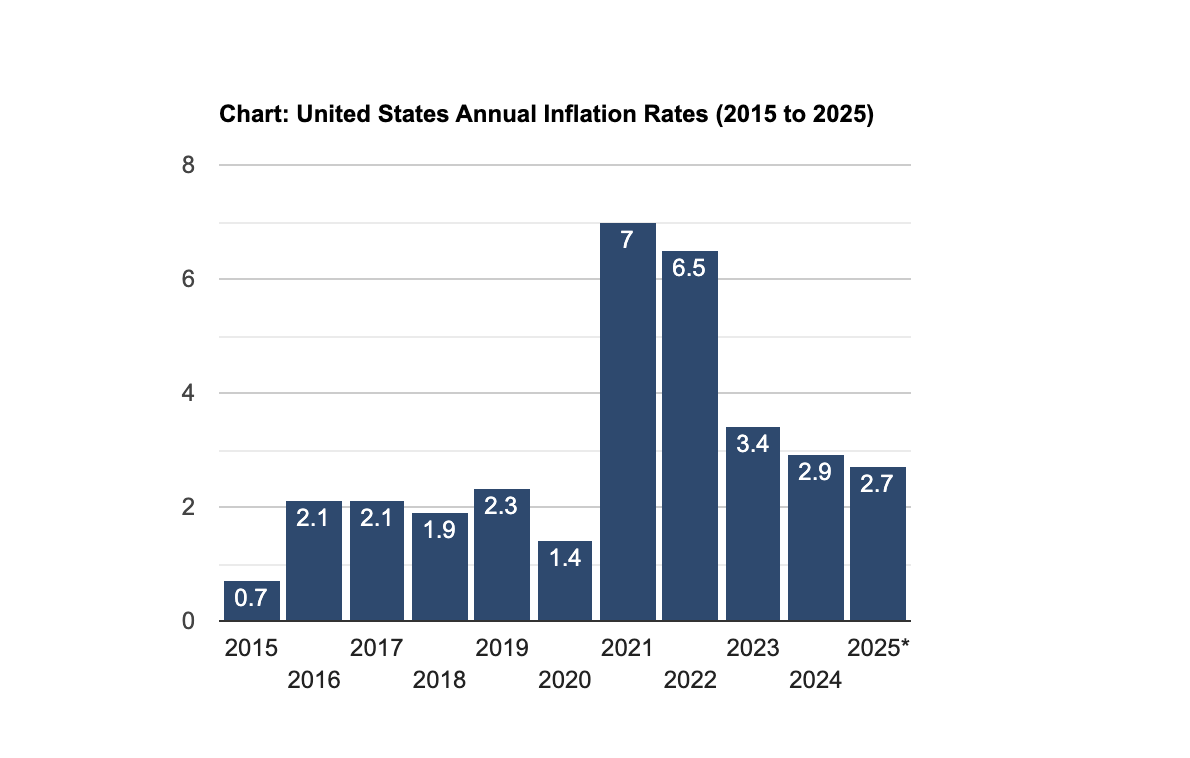

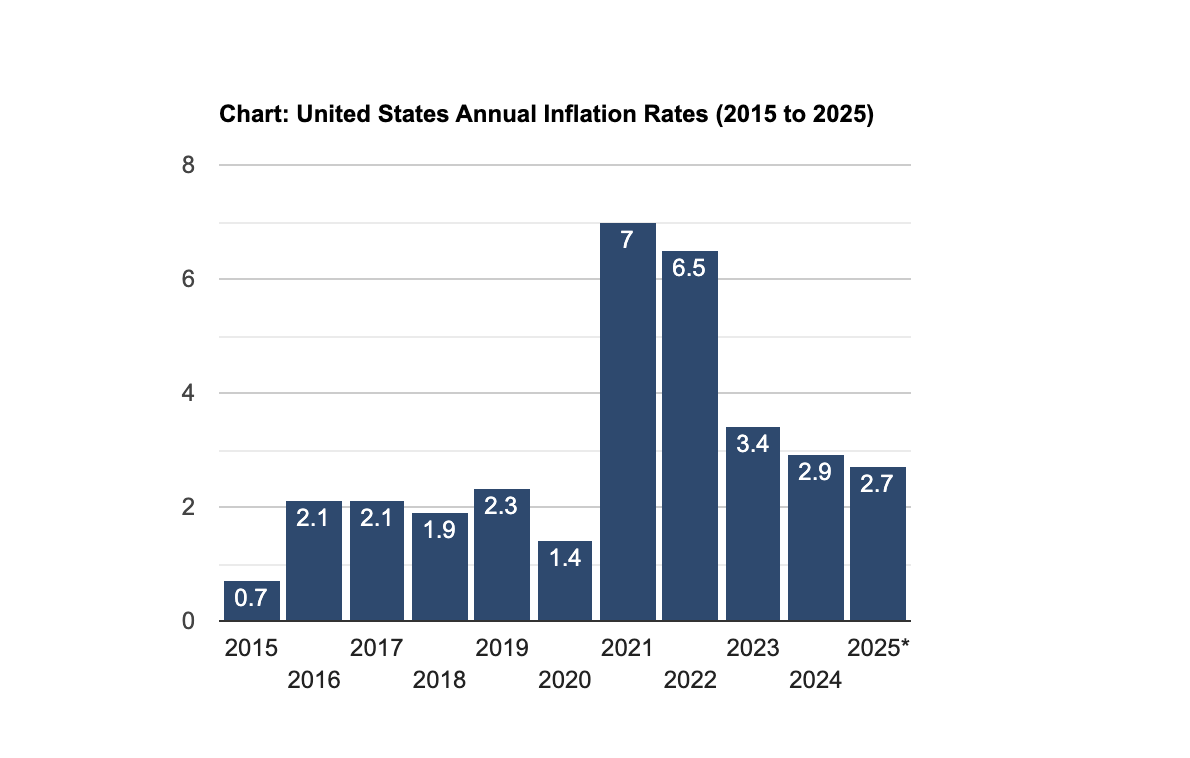

As of 22 January 2026, the most recent complete CPI data are for December 2025. Headline CPI inflation, which includes all categories, stands at 2.7 percent year over year. Core CPI, excluding food and energy prices to reflect underlying trends, is 2.6 percent, while shelter inflation, representing housing-related costs, is 3.2 percent.

These figures indicate that the inflation rate has moderated, although the overall price level remains significantly higher than in the pre-pandemic period.

Top Peaks Ranked: The Highest Inflation In US History (CPI-U, 12-Month Change)

The following rankings utilize the most comparable headline benchmark: the 12-month percent change in CPI-U. This statistic is typically cited when discussing 'highest inflation,' as it reflects a full year of household price pressures and avoids distortions from annualized monthly fluctuations.

| Rank |

Peak (12-month CPI-U) |

Peak month |

Inflation regime |

Why it stands out |

| 1 |

23.7% |

Jun 1920 |

World War I aftermath |

Fastest recorded repricing, followed by a sharp reversal |

| 2 |

20.1% |

Mar 1947 |

Post-World War II normalization |

Controls lifted into bottlenecks and pent-up demand |

| 3 |

14.8% |

Mar 1980 |

Stagflation climax |

Expectations regime met restrictive monetary tightening |

| 4 |

9.1% |

Jun 2022 |

Pandemic and energy shock |

Broad surge, then disinflation without a decade-long spiral |

| 5 |

6.4% |

Jan 2023 |

Post-peak disinflation hangover |

Inflation cooled from 2022, but shelter and services stayed sticky |

| 6 |

2.7% |

Dec 2025 |

Post-disinflation baseline |

Inflation rate near target zone, but services remain sticky (comparison point)

|

Why The “Highest Inflation” Label Gets Misused

The phrase 'highest inflation in US history' frequently reflects personal experience rather than statistical record. The early 2020s hit households with fast-rising bills for everyday essentials, then inflation cooled only gradually. After years of stable prices, that kind of shock naturally seemed unprecedented, even though earlier periods saw much higher inflation rates.

Two common mix-ups drive the confusion:

Inflation rate vs. price level: Inflation can fall back to 2–3 percent, but the higher prices from the earlier surge don’t roll back. It just means prices are rising more slowly from a higher starting point.

Different yardsticks: People often cite different measures such as annual averages, CPI-U, the PCE index, or older “basket” reconstructions. They’re all useful, but they don’t always point to the same “peak.”

For a clean, apples-to-apples ranking of inflation spikes, the 12-month CPI-U is the simplest and most widely understood benchmark, which is why it’s used for the list that follows.

1) June 1920 (23.7%): The War-Aftershock Template

The June 1920 peak is the record holder for the highest US inflation in history because it combines two accelerants rarely seen together: an economy reshaped by war and a postwar surge in demand, and the easing of pricing frictions. Supply chains were strained, trade patterns were disrupted, and the labor market was anything but normal. When the wartime framework loosened, prices adjusted quickly rather than gradually.

This episode is a reminder that extreme inflation can be followed by an equally dramatic swing the other way. After the 23.7 percent surge, the CPI record shows prices turning down sharply, moving into a rapid disinflation and, in parts of the period, outright deflation.

A broader lesson emerges: inflation does not always behave as a smooth macroeconomic variable. During regime shifts, it can exhibit abrupt discontinuities.

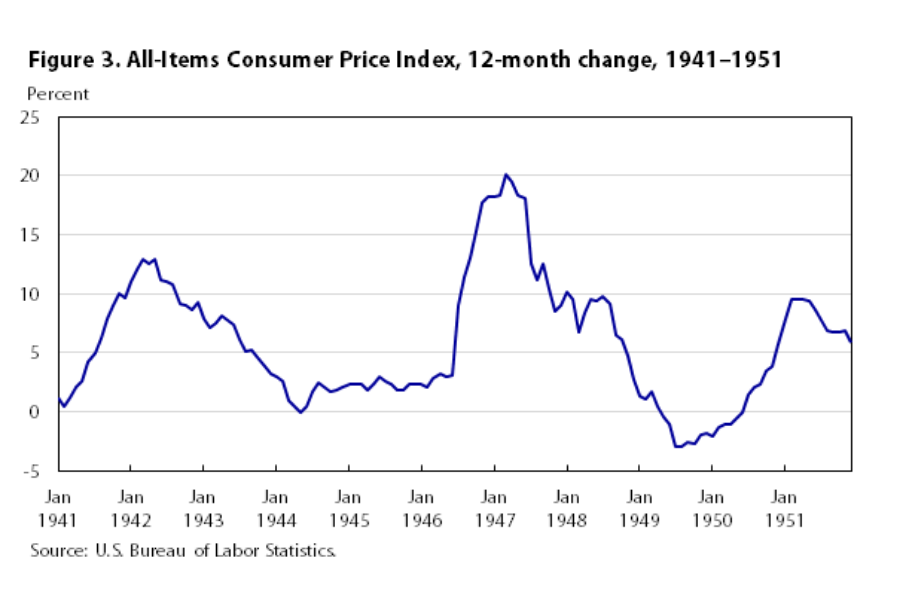

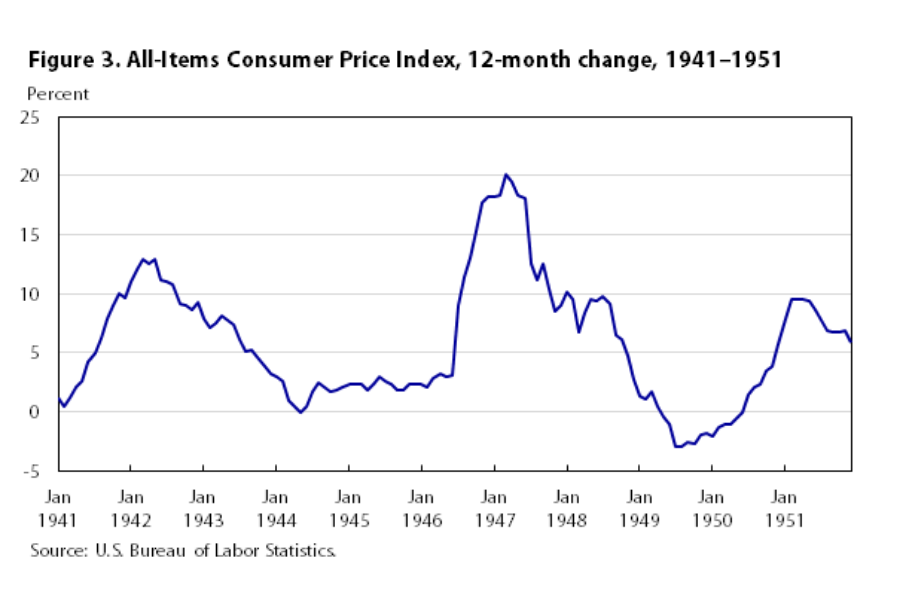

2) March 1947 (20.1%): The “Controls Come Off” Shock

The March 1947 peak is the second-highest in the modern CPI record at 20.1 percent. Its structure differs from 1920, but the mechanism rhymes: policy constraints suppressed price adjustment during the war, then normalization compressed that adjustment into a short window.

When price controls come off faster than supply can catch up, inflation is basically the economy’s way of clearing the backlog. Prices rise not because people suddenly got richer, but because rationing gives way to real market pricing while factories, shipping, and inventory remain behind.

The key takeaway is that not every spike is the start of a long inflation era. Episodes like this can be sharp and painful, then fade as supply improves and the post-control adjustment runs its course.

3) March 1980 (14.8%): The Expectations Trap

The March 1980 peak of 14.8 percent is the modern inflation episode that still haunts policy circles because it wasn’t a quick, one-time price reset. It was the high point of a long stretch during which people began to expect inflation, and that expectation quietly worked its way into wage talks, price setting, and long-term contracts.

That’s what made it so hard to break. When businesses assume their costs will keep rising, they raise prices earlier and more aggressively. When workers assume prices will keep climbing, they push for bigger wage increases just to stay even. Lenders respond too, building higher inflation into interest rates and credit terms. The whole system starts behaving as if inflation is “normal,” which makes it stubborn and slow to bring down.

This is why the early-1980s playbook still matters in 2026. Central banks would rather risk a softer growth spell than let inflation expectations drift higher again, because once the inflation anchor slips, getting it back can take years, not months.

4) June 2022 (9.1%): The Modern Cost-Of-Living Shock

The June 2022 inflation peak of 9.1 percent was the largest 12-month increase since the early 1980s. It ranked far below the war-era extremes, but it landed with unusual political force because it followed decades of low, stable inflation.

The composition of the 2022 inflation surge accounts for its significant psychological impact.

Energy was the standout driver: Energy prices rose 41.6% over 12 months, while gasoline surged 59.9%.

Energy inflation is highly “visible”: Fuel prices are posted everywhere, change frequently, and are easy to track day to day.

Broader cost linkage: Energy feeds directly into transportation and logistics, which can cascade into food and other essentials through supply chains.

Perception accelerant: Frequent fuel-price changes can make households feel inflation is accelerating, even when other categories are comparatively stable.

However, the trajectory following the 2022 peak is equally important. Inflation declined substantially thereafter, indicating that, although the shock was severe, it did not evolve into a prolonged, expectations-driven regime like that of the 1970s.

5) 2023 (6.4%): The Slow-Cooling Hangover

The January 2023 peak of 6.4 percent wasn’t a new inflation breakout. It was the economy still digesting the 2022 price shock. Inflation was coming down, but not in a clean, straight line. After prices had jumped so quickly in essentials like energy, food, and rent, the next phase was always going to feel messy and uneven.

What made 2023 tricky was where inflation “hid.” Goods prices began to calm as supply chains improved and demand cooled, but services and housing-related costs remained stubbornly high. Rent and shelter measures move slowly, and many service businesses adjust prices with a lag. So even as the headline number eased, households still felt the squeeze in the categories that matter most month to month.

That’s why 2023 is the bridge between the spike and the reset. It shows how inflation can fade in the headlines while still lingering in day-to-day life.

6) December 2025 (2.7%): Why Inflation Still Feels Unresolved

By December 2025, headline CPI inflation was 2.7 percent, core was 2.6 percent, and shelter inflation was 3.2 percent. This is not historically high. It is close to what a stable inflation regime typically looks like.

So why does inflation still feel like the main issue in early 2026? Households don’t experience inflation as a percentage. They experience it as a new price floor. The CPI-U rose from 256.974 in December 2019 to 324.054 in December 2025, a 26.1 percent cumulative increase in the overall price level. That jump is sticky: lower inflation slows the pace of increases going forward, but it doesn’t unwind the increases that already happened.

The Federal Reserve’s target range of 3.50 to 3.75 percent as of mid-December 2025 signals an intent to protect the disinflation path and prevent a second-round flare-up in services and shelter.

Will The US Follow the Footsteps of Past Inflation Peaks In 2026?

A repeat of the historic “top-ranked” inflation spikes would require a shock that forces rapid economy-wide repricing, plus a policy environment that allows the impulse to persist.

Historically, US inflation peaks have been associated with war-related disruptions, the removal of price-control regimes, or expectation-driven spirals in which wages and prices reinforce each other. As of early 2026, none of these conditions is present.

Historically, US inflation peaks have been associated with war-related disruptions, the removal of price-control regimes, or expectation-driven spirals in which wages and prices reinforce each other. As of early 2026, none of these conditions is present.

The starting point for 2026 is disinflation, not acceleration. The latest CPI print (December 2025) shows headline inflation at 2.7 percent year over year and core inflation at 2.6 percent, with shelter at 3.2 percent. That is uncomfortable for households, but it is far from the regime implied by “the highest inflation in US history.”

Monetary policy is also structured to counter the risk of a renewed inflation surge. The Federal Reserve's current federal funds target range is 3.50 to 3.75 percent, and the December 2025 Summary of Economic Projections suggests a median trajectory in which inflation gradually approaches the target rather than accelerating.

Analyst updates from January 2026 similarly characterize the global disinflation trend as ongoing, while cautioning that the United States' return to target inflation levels may be gradual rather than immediate.

That said, “unlikely” is not “impossible.” The logical way to think about 2026 is as a tail-risk year: inflation can re-accelerate if one of a few high-impact channels reopens.

| Channel That Could Mimic Past Episodes |

What It Would Look Like in 2026 |

Why It Matters |

| Energy shock |

Sustained surge in oil, gasoline, and utility costs |

Energy prices transmit rapidly across the economy and can reset inflation expectations before other components adjust |

| Shelter re-sticks |

Rent and owners’ equivalent rent stop cooling |

Shelter inflation moves slowly and carries heavy weight in core inflation, making reversals persistent |

| Wage-price feedback |

Faster wage growth paired with strong services pricing power |

Once expectations adjust, wage and price dynamics can reinforce each other and entrench inflation |

| Supply disruption |

Renewed logistics constraints or commodity shortages |

Shortages force price adjustments into compressed timeframes, amplifying volatility |

| Policy credibility slip |

Financial conditions ease before inflation is fully anchored |

Premature easing increases the risk of a second inflation wave rather than a controlled glide path |

A Practical Interpretation For Investors And Households

The historical record of inflation provides important context for understanding three key forward-looking considerations:

True inflation extremes are rare, mainly during war or stagflation, not during normal expansions.

Energy shocks can rapidly alter economic behavior, even when overall inflation is not at historical highs, as demonstrated in 2022.

Persistently elevated shelter inflation sustains public concern about inflation, even when prices for goods stabilize.

Frequently Asked Questions (FAQ)

1. What was the highest inflation in US history by CPI?

The CPI-U record for the largest 12-month increase is 23.7 percent, peaking in June 1920. This episode occurred in the post-World War I adjustment and exceeds the post-World War II spike and the early-1980s stagflation peak.

2. Was 2022 the highest inflation in US history?

No. Inflation peaked at 9.1 percent in June 2022, which was the highest since the early 1980s but far below historical highs such as 23.7 percent in 1920 and 20.1 percent in 1947.

3. What caused the 1947 inflation spike?

The 20.1 percent peak in the 12 months ending March 1947 reflects a postwar normalization dynamic: controls and wartime constraints eased while supply capacity and logistics were still tight. Prices adjusted quickly as markets cleared pent-up demand.

4. Why does inflation still feel high in 2026 if CPI is near 2-3 percent?

Because the price level reset higher. CPI-U rose from 256.974 (Dec 2019) to 324.054 (Dec 2025), a 26.1 percent cumulative increase. Lower inflation means slower future increases, not a reversal of past increases.

5. What is the most recent US inflation reading as of 22 January 2026?

The latest complete CPI report is for December 2025, showing headline inflation of 2.7 percent and core inflation of 2.6 percent year over year, with shelter up 3.2 percent.

Conclusion

The statistical record provides a clear answer: the highest inflation rate in the modern CPI-U series reached 23.7 percent in June 1920. The subsequent peaks of 20.1 percent in March 1947 and 14.8 percent in March 1980 reflect two distinct inflation mechanisms: postwar control release and the entrenchment of inflation expectations.

As of early 2026, inflation is no longer at historically elevated levels. Its economic and political significance persists because the price level has risen materially since 2019. Read in context, these rankings are not just historical trivia. They provide a framework for understanding normalization, the sources of persistence, and what would constitute a true inflation regime shift.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment, or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction, or investment strategy is suitable for any specific person.

Sources

Consumer Price Index History

Bureau Of Labor Statistics

US Federal Reserve Press Release

US Federal Reserve Monetary Policy

Historically, US inflation peaks have been associated with war-related disruptions, the removal of price-control regimes, or expectation-driven spirals in which wages and prices reinforce each other. As of early 2026, none of these conditions is present.

Historically, US inflation peaks have been associated with war-related disruptions, the removal of price-control regimes, or expectation-driven spirals in which wages and prices reinforce each other. As of early 2026, none of these conditions is present.