During market volatility, investors often seek refuge in assets that can provide stability and potential growth. For context, gold prices have surged past $3,300 per ounce in 2025, driven by geopolitical tensions, inflation concerns, and stock market corrections.

Therefore, this environment has made gold mining stocks attractive for investors seeking stability and growth.

Without further ado, this article explores top gold mining stocks to consider during turbulent market conditions, highlighting their recent performance and strategic positions in the industry.

Why Gold Mining Stocks During Market Volatility?

Gold mining stocks offer leveraged exposure to gold prices. When gold prices rise, mining companies' profits can increase disproportionately, leading to potential stock price appreciation.

Moreover, many gold mining companies pay dividends, providing income during uncertain times.

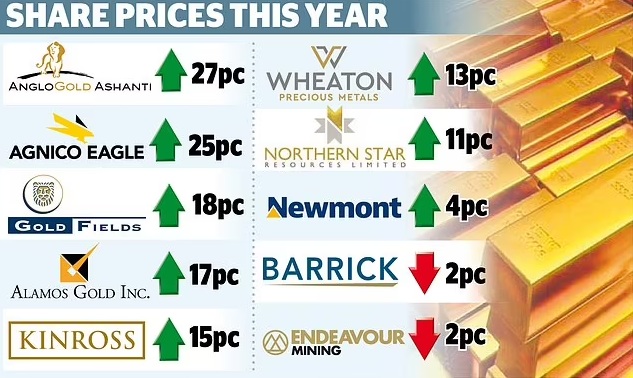

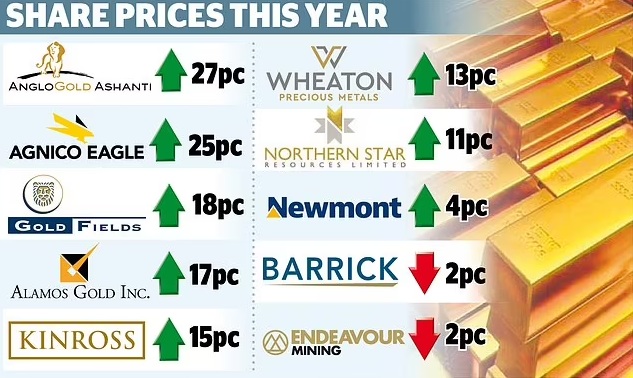

Top 10 Gold Mining Stocks to Consider

1. Newmont Corporation (NEM)

As the world's largest gold producer, Newmont has demonstrated resilience and strategic growth. For 2025, the company reported a record free cash flow of $1.2 billion, driven by a 41% year-over-year increase in realised gold prices.

Despite an 8.3% decline in production, Newmont's strategic divestitures have strengthened its balance sheet, generating over $2.5 billion in cash proceeds.

2. Barrick Gold Corporation (nyse: gold)

Barrick Gold is undergoing a strategic transformation in 2025, focusing on optimising its asset portfolio. The company announced the sale of its 50% stake in the Donlin Gold Project in Alaska for up to $1.1 billion, aiming to strengthen its financial position and enhance shareholder returns.

3. Agnico Eagle Mines Limited (AEM)

Agnico Eagle has solidified its position as a leading gold producer, with operations in multiple countries. In 2025, the company reported a 1% year-over-year increase in mineral reserves, totalling 54.3 million ounces.

Agnico Eagle also declared updated mineral reserves at its Upper Beaver project and a 9% increase in inferred mineral resources.

4. Kinross Gold Corporation (KGC)

Kinross Gold has shown impressive performance, with a 118.99% one-year return. The company's strategic operations and cost management have contributed to its strong stock performance.

5. AngloGold Ashanti Limited (AU)

AngloGold Ashanti has been a standout performer, with its stock rising significantly amid market volatility. The company operates mines in Africa, the Americas, and Australia, providing geographical diversification.

Analysts project significant earnings growth for AngloGold Ashanti.

6. Franco-Nevada Corporation (FNV)

Franco-Nevada is a company focused on gold royalties and streaming, providing financing to mining firms in exchange for future production. This business model offers exposure to gold prices without the operational risks associated with mining.

Franco-Nevada's diversified portfolio includes interests in gold, silver, oil, and gas projects.

7. Gold Fields Limited (GFI)

Gold Fields operates mines in Australia, Ghana, peru, and south africa. The company's South Deep mine in South Africa is one of the world's largest gold deposits. Gold Fields' commitment to sustainable mining practices and operational efficiency has bolstered its reputation in the industry.

8. Wheaton Precious Metals Corp. (NYSE: WPM)

Wheaton Precious Metals, a leading precious metals streaming company, continues to perform strongly in 2025. The company exceeded its 2024 production guidance, delivering over 633,000 gold equivalent ounces.

For 2025, Wheaton projects production between 600,000 and 670,000 gold equivalent ounces and anticipates a 40% growth to approximately 870,000 ounces by 2029.

9. Greatland Gold plc (GGP)

Greatland Gold is a mining company that recently acquired the Telfer gold and copper mine and the Havieron project in Australia. This strategic acquisition has transformed Greatland into a significant producer, with strong cash flows and a solid balance sheet.

The company's growth trajectory and strategic partnerships position it well in the gold mining sector.

10. Chifeng Jilong Gold Mining Co., Ltd.

Chifeng Gold, a Chinese gold mining company, has shown remarkable growth, with annual gold output growing at a compound rate of 33.1% from 2021 to 2023.

The company operates a diversified portfolio of mines across China, Southeast Asia, and West Africa. In 2025, Chifeng plans to pursue a secondary listing on the Hong Kong Stock Exchange to raise approximately HK$2.89 billion for expansion.

Factors to Consider When Investing in Gold Mining Stocks

Operational Efficiency: Companies with low production costs can maintain profitability even when gold prices fluctuate.

Geopolitical Risks: Mines in politically stable regions are less likely to face disruptions.

Reserve Replacement: Companies that consistently replace and expand their gold reserves are better positioned for long-term growth.

Financial Health: Strong balance sheets and cash flows enable companies to invest in growth opportunities and weather downturns.

Conclusion

In conclusion, investing in gold mining stocks can provide a hedge against market volatility and economic uncertainty. The companies listed above have demonstrated strong operational performance, strategic growth initiatives, and resilience in market challenges.

As always, investors should conduct thorough research and consider their financial goals and risk tolerance before making investment decisions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.