If you've ever typed "NYSE: GOLD" into a search bar and wondered what exactly it means, you're not alone. This ticker symbol represents Barrick Gold Corporation, one of the world's largest gold mining companies. But it's more than just a stock tied to the price of gold—it's a way for traders to gain exposure to a valuable commodity without having to buy physical gold.

In 2025. with economic uncertainty still lingering and inflation concerns on the rise, gold is back in focus. So, is NYSE: GOLD worth your attention?

What Is NYSE: GOLD?

NYSE: GOLD refers to Barrick Gold Corporation, a Canadian company that's traded on the New York Stock Exchange. It focuses mostly on gold mining, though it also produces copper.

Barrick operates in over a dozen countries, including the US, Canada, Mali, the Democratic Republic of Congo, and saudi arabia. So, buying this stock doesn't just mean investing in one mine—it's about backing a global business tied to one of the world's oldest stores of value.

If you're thinking, "Why GOLD, though?", the ticker symbol is meant to be simple and memorable—and it's one of the easiest ways to get exposure to gold through the stock market.

How Much Is NYSE: GOLD Worth Today?

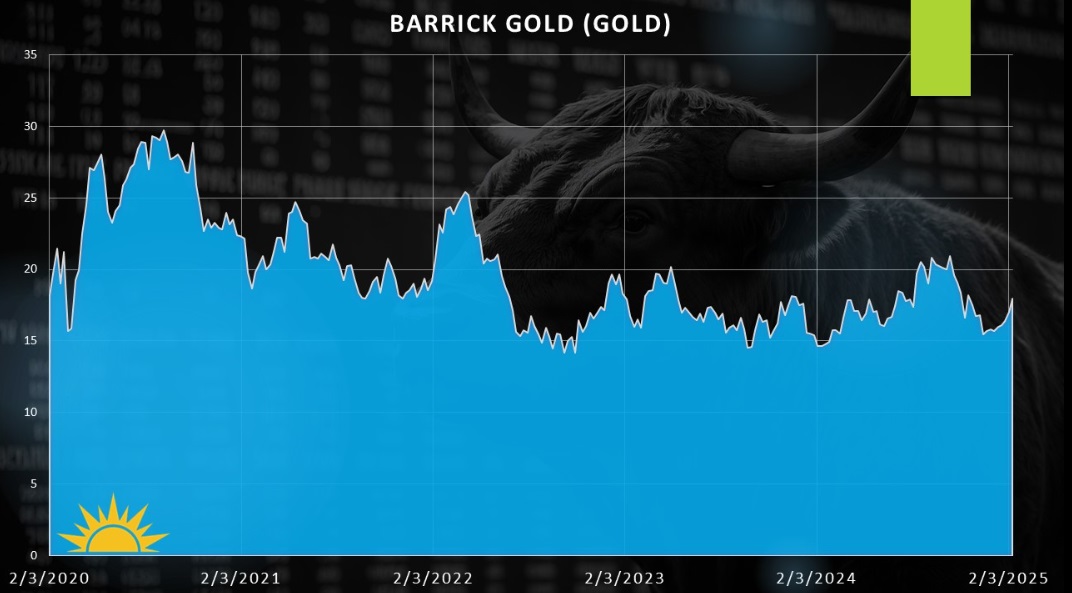

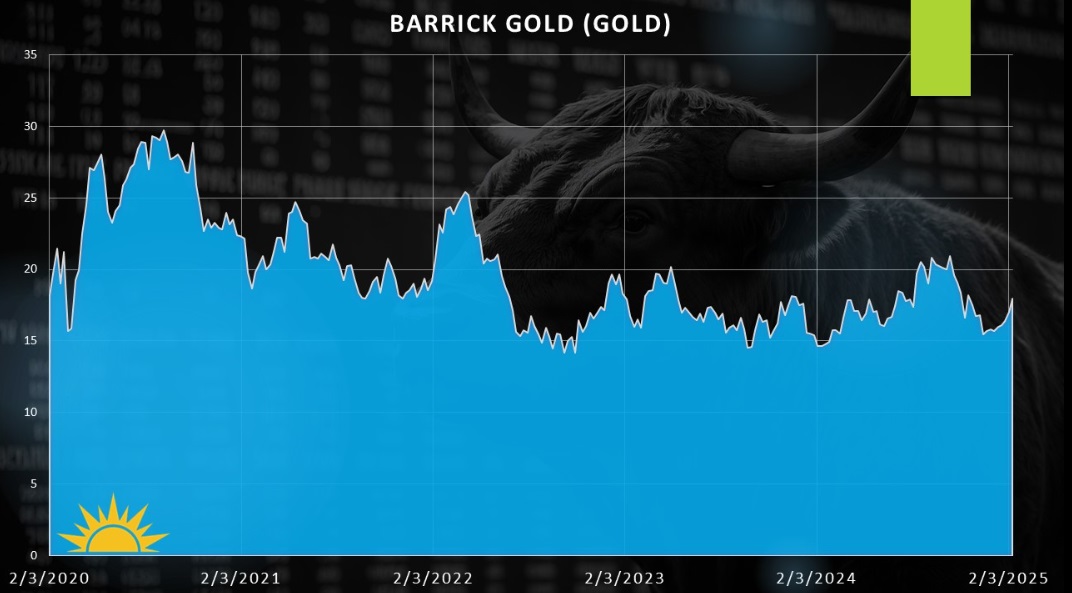

As of 2025. Barrick Gold's market value sits around $32.5 billion. Its share price usually rises and falls alongside the price of gold, but it's also affected by how efficiently the company operates and how much metal it's producing.

Barrick's latest earnings report showed around $3.64 billion in quarterly revenue and nearly $1 billion in profit. That's solid performance, especially considering how volatile the mining business can be.

So if you're looking up the stock price, just know that what you're really seeing is a mix of gold prices, company performance, and global demand for metals.

Is NYSE: GOLD a Good Investment in 2025?

That depends on your investment goals.

If you're after something that moves differently from tech or consumer stocks, NYSE: GOLD could be useful. Gold is seen as a safe-haven asset—people often buy it when the economy looks shaky or inflation is high. And since Barrick makes its money from gold, the stock tends to benefit in those times too.

In 2025. with ongoing inflation concerns and economic uncertainty in parts of the world, gold demand remains strong. Barrick is one of the more stable companies in the space, with low debt and good cash flow.

Of course, it's not risk-free. Gold prices can swing sharply, and mining operations can be affected by politics, weather, and environmental regulations. But as a long-term play or portfolio diversifier, many traders think NYSE: GOLD is still worth considering.

How Does Barrick Gold Make Money?

Barrick's main business is extracting gold and copper from its mines and selling it on global markets. That sounds simple, but the process is massive. It involves exploration, permits, mining, processing, transport, and then finally, sales.

One thing to note: Barrick doesn't hedge its gold prices. That means the company gains more when gold goes up—but also feels it when prices fall. This gives traders more direct exposure to the gold market, compared to some other mining stocks that smooth out those price changes.

Copper, though a smaller part of the business, is becoming more important as demand grows for green energy and electric vehicles.

What Do Analysts Say About NYSE: GOLD?

Analysts generally view Barrick Gold as a well-run company with reliable operations. It's not the flashiest stock, but it's respected for having strong management, solid financials, and a focus on long-term value.

It also pays a modest dividend, which is a bonus for long-term holders. Some analysts like its performance-based dividend policy, which adjusts payouts depending on the company's results—helping it stay flexible in tougher times.

On the downside, analysts do flag geopolitical risks, since Barrick operates in some high-risk regions. But overall, it's often seen as a relatively low-risk gold stock, especially for beginners looking to dip into commodities.

Conclusion

NYSE: GOLD gives traders a direct line to one of the most established names in the gold mining sector—Barrick Gold Corporation. In a year where many are turning to gold as a hedge against uncertainty, Barrick stands out for its global reach, steady cash flow, and clear focus on long-term value.

Whether you're building a balanced portfolio or simply exploring alternatives to traditional stocks, NYSE: GOLD offers a way to gain exposure to gold without holding the metal itself. It's not without its risks, but for those who believe in gold's role as a store of value—especially in uncertain times—this stock remains a strong contender.

As always, the key is knowing your goals, understanding what you're investing in, and keeping an eye on the broader economic landscape. NYSE: GOLD may not be flashy, but in a world where stability matters, that might just be the point.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.