Gold has been considered a symbol of wealth and security for thousands of years. Unlike paper currency, which can be affected by inflation and government policies, gold holds intrinsic value. It has historically served as a hedge against economic instability and a tool for preserving wealth across generations.

For beginners, investing in gold may seem complex, but with a clear understanding of the market, investment types, and strategies, anyone can start building a gold portfolio confidently.

Understanding Gold as an Investment

Before diving in, it's important to understand why gold is an attractive investment:

Safe Haven Asset:

Gold often retains value during stock market volatility, geopolitical uncertainty, or economic crises.

Hedge Against Inflation:

When inflation rises and paper currency loses purchasing power, gold prices generally increase, protecting wealth.

Liquidity:

Gold can be easily bought or sold through various platforms, including brokers, exchanges, and online marketplaces.

Portfolio Diversification:

Gold often moves inversely to stocks or bonds, making it a stabilising element in a diversified portfolio.

Investing in gold isn't about short-term gains. It is primarily a long-term strategy to protect and grow your wealth.

There are multiple methods to invest in gold, each with its own benefits and risks. Beginners should understand all options to make informed decisions.

1. Physical Gold

Forms: Coins, bars, or jewellery.

Pros:

Cons:

Requires secure storage (safes, bank lockers)

Premiums on purchase and resale can reduce profits

Less convenient for quick trading

Tip: Only buy physical gold from reputable dealers and always verify authenticity with proper certification.

2. Gold ETFs (Exchange-Traded Funds)

Gold ETFs are funds that track the price of gold. They trade like stocks on a stock exchange.

Pros:

Cons:

Example: SPDR Gold Shares (GLD) or iShares Gold Trust (IAU) are popular ETFs for beginners.

3. Gold Mutual Funds

Gold mutual funds invest in a mix of gold-related assets, including gold mining companies and physical gold.

Pros:

Cons:

Investing in companies that mine gold offers exposure to gold prices plus potential company growth.

Pros:

Cons:

Tip: Beginners should start with large-cap, established mining companies before exploring smaller miners.

5. Digital Gold Platforms

These online platforms allow users to buy gold in digital form, often redeemable as physical gold later.

Pros:

Cons:

How to Start Investing in Gold: Step-by-Step

Investing in gold is simple if you follow these steps:

Step 1: Set Your Investment Goals

Define why you want to invest in gold:

Your goals will determine whether you choose physical gold, ETFs, or a combination.

Step 2: Determine Your Investment Amount

Financial experts recommend allocating 5–15% of your total portfolio to gold. This provides a balance between growth and security without overexposure.

Step 3: Choose the Right Investment Method

Physical gold: Ideal if you value tangible assets and security.

ETFs or mutual funds: Suitable for convenience and liquidity.

Digital gold: Best for small, flexible, or online investments.

Consider combining methods to diversify exposure.

Step 4: Research Providers and Platforms

Compare brokers, ETFs, mutual funds, or online gold sellers.

Check for fees, storage safety, liquidity, and reputation.

Look for user reviews and regulatory approvals.

Step 5: Start Small and Track Performance

Begin with small investments to learn the market.

Regularly monitor gold prices and market trends.

Use a mix of investment types to balance risk and returns.

Understanding Risks and Market Dynamics about Investing in Gold

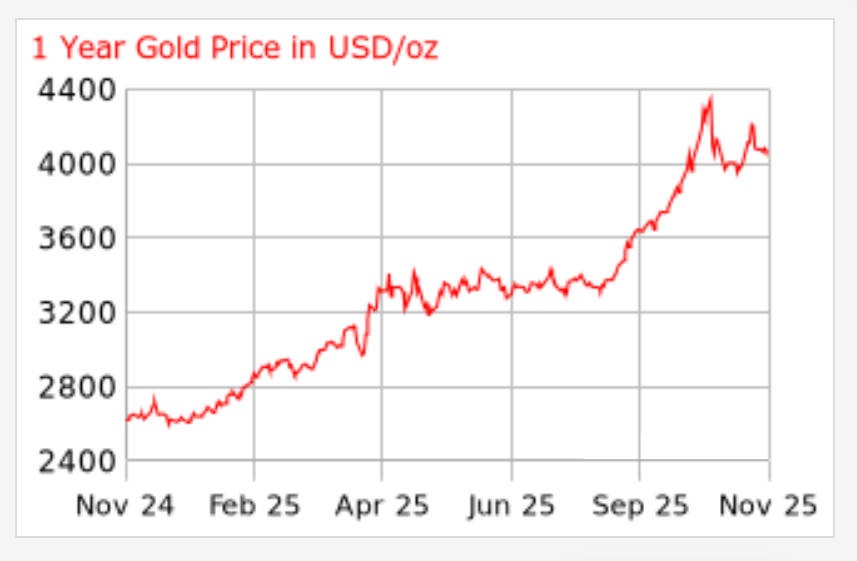

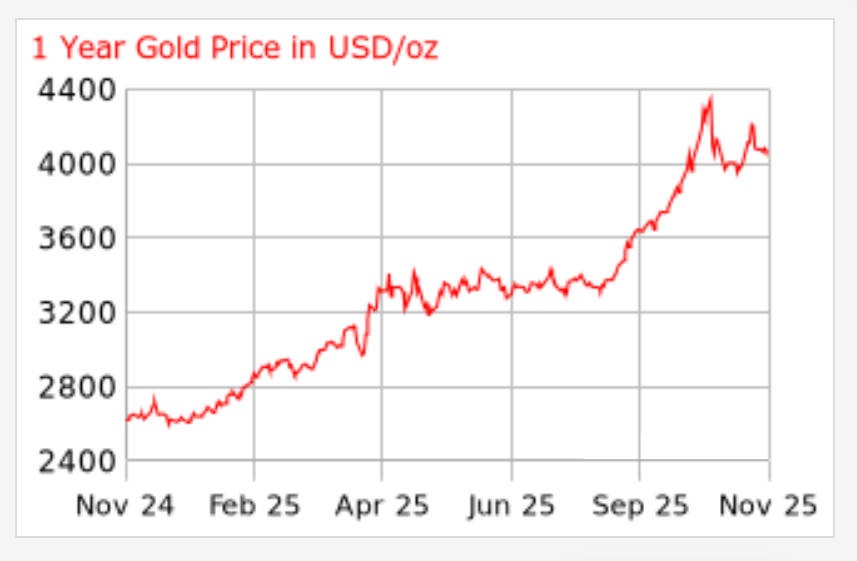

While gold is generally viewed as safe, it is not without risk. Prices can fluctuate in the short term due to changes in supply and demand, currency strength, central bank policies, or geopolitical events.

Physical gold carries additional considerations, including storage security and insurance, while digital or ETF holdings are subject to counterparty risk and market volatility.

Moreover, gold does not generate regular income. Unlike dividend-paying stocks or interest-bearing bonds, returns are realised solely through price appreciation. Investors must be prepared to hold gold over the long term to benefit from its value preservation and potential growth.

Best Practices for Beginners of Investing in Gold

Successful gold investing combines knowledge, discipline, and strategic allocation.

Diversification is critical. Gold should complement, not dominate, your portfolio.

Avoid high-premium purchases or funds with steep management fees, as these can erode returns.

Stay informed about global economic developments, as geopolitical tensions or inflationary trends often influence gold prices.

Finally, patience is essential; gold investment is most effective as a long-term strategy rather than a short-term speculative play.

A balanced approach might include a mixture of physical gold, ETFs, mutual funds, or digital gold, adjusted based on your risk tolerance and investment horizon. Monitoring performance and staying flexible in response to market conditions will help beginners manage risk while optimising potential returns.

Sample Gold Investment Allocation for Beginners

| Investment Type |

Suggested Allocation |

Notes |

| Physical gold |

30% |

Coins or small bars |

| Gold ETFs |

40% |

Low-cost tracking ETFs |

| Gold mutual funds |

20% |

Diversified gold mining exposure |

| Digital gold |

10% |

Flexible, small investments |

Tip: Adjust allocation depending on risk tolerance, investment goals, and market conditions.

Conclusion

Gold is a reliable and time-tested investment option for beginners seeking to diversify portfolios and protect wealth from economic uncertainty. By understanding the types of gold investments, risks, and best practices, even novice investors can start confidently.

A successful gold investment strategy involves education, patience, and careful planning. Start small, monitor performance, and diversify methods to gradually build a secure, gold-backed portfolio.

Frequently Asked Questions

1. What is the best way for beginners to invest in gold?

Low-cost gold ETFs or digital gold platforms are ideal for beginners, offering convenient access, liquidity, and small minimum investments, while avoiding storage and security challenges of physical gold.

2. How much of my portfolio should be in gold?

Experts suggest 5–15% of your total portfolio in gold. This allocation balances growth and protection, acting as a hedge without overexposing your portfolio to a single asset.

3. Is physical gold safer than digital gold?

Physical gold is tangible and has no counterparty risk but requires secure storage. Digital gold is convenient and tradable online but relies on the platform's trustworthiness and operational reliability.

4. Can gold generate income like stocks or bonds?

No, gold does not produce interest or dividends. Its value comes from price appreciation over time, making it primarily a store of wealth and a hedge against inflation.

5. How do gold prices fluctuate?

Gold prices are influenced by inflation, currency strength, geopolitical events, central bank policies, and supply-demand dynamics. Short-term volatility is normal, but gold maintains long-term value in most market conditions.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.