Imagine this: you're trading stocks or forex, and suddenly the market swings the opposite way. Before you even have time to react, your account balance starts shrinking. What if there was a built-in safety net that could limit your losses or even help you lock in profits while you're away from the screen?

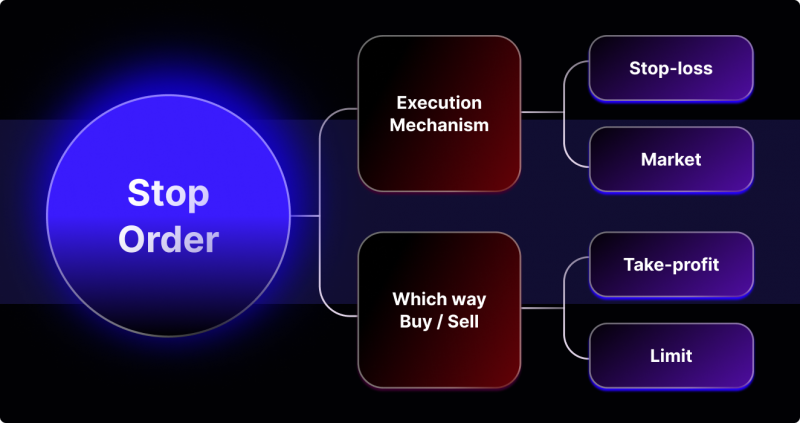

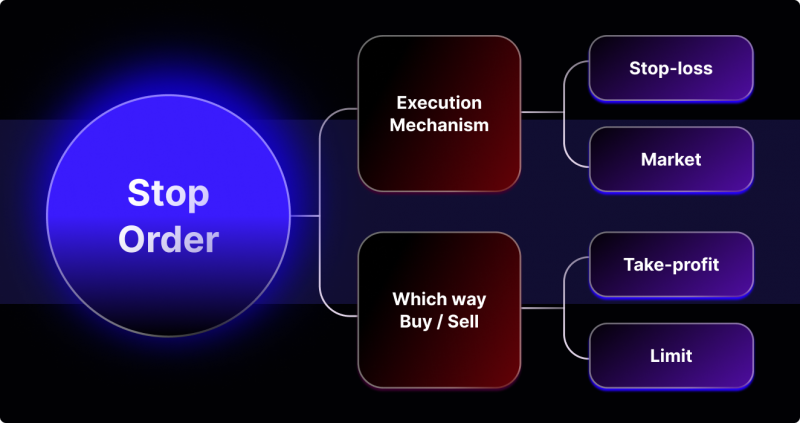

That's where stop orders come in. Stop orders are instructions you give your broker to buy or sell an asset once its price reaches a specific level, known as the stop price.

This guide breaks down what stop orders mean in trading, why they matter, how they work in real-world markets, and how you can start using them today.

Stop Order Meaning in Trading Explained

As mentioned above, a stop order is an instruction you give your broker to automatically buy or sell an asset once its price reaches a specific level, called the stop price.

When the market hits the stop price, the stop order becomes a market order, which means it will execute at the most favourable price available.

If the stop price is not reached, the order stays inactive, almost like a guard waiting for the right trigger.

For example:

You own a stock at $1,000.

You don't want to lose more than 10%.

You place a stop order at $900.

If the stock falls to $900, your broker will automatically sell it.

Think of it as a conditional order: "If this happens, then execute my trade."

How Stop Orders Work in Different Markets

1) Stock Trading

Investors often use stop orders to protect portfolios. For example, setting a stop-loss on long-term holdings can safeguard against sudden downturns such as the 2020 COVID crash.

2) Forex

Stop orders are critical in forex, where currencies can move dramatically within minutes. A stop-loss prevents a single bad trade from wiping out your account.

3) Crypto

Volatility in crypto makes stop orders essential. Many exchanges allow stop orders to help traders avoid panic selling while keeping risk in check.

4) Commodities

Stop orders help manage risk when trading oil, gold, or agricultural products, which are sensitive to geopolitical events and changes in supply and demand.

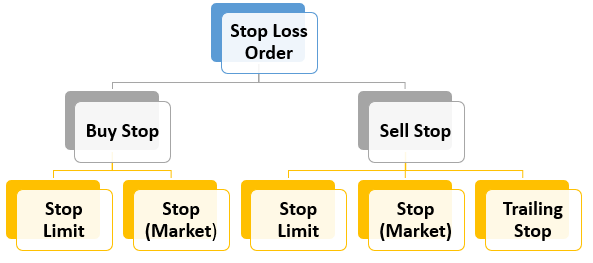

Other Types of Stop Orders You Should Know

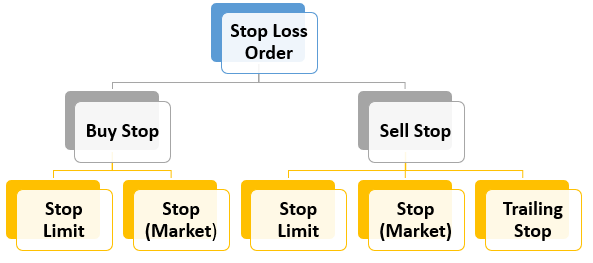

1. Stop-Loss Order

A stop-loss order automatically sells (or buys) an asset when it hits the stop price to limit losses.

For example, you purchase a stock for $50 and establish a stop-loss at $45. Should the price drop to $45, your stop order will trigger, avoiding further losses.

2. Stop-Buy Order

A stop-buy order triggers when a stock's price increases to a designated stop level.

For instance, a stock is priced at $40, and you believe that if it surpasses $42, it will continue to increase. You set a stop-buy at $42 to seize the rising trend.

3. Trailing Stop Order

A trailing stop moves along with the market price. It locks in profits while giving room for growth.

For example, you set a trailing stop at 5% below the market price. If the stock rises from $50 to $60, your stop moves from $47.50 to $57, protecting your gains.

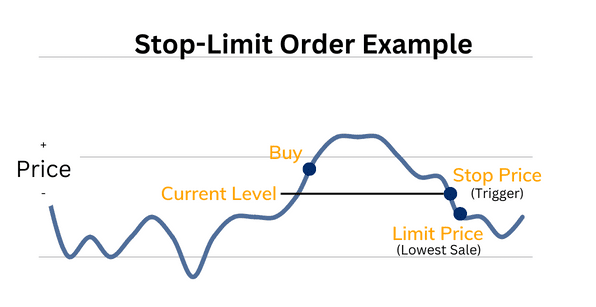

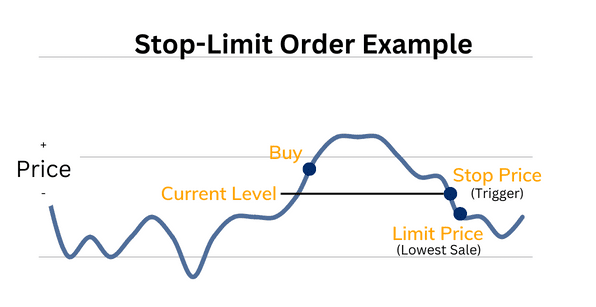

4. Stop-Limit Order

A stop-limit order combines a stop price and a limit price. Instead of becoming a market order, it turns into a limit order once triggered.

This gives more control but carries the risk of not being filled if the market moves too quickly.

Stop Orders vs Limit Orders: What's the Difference?

Stop Order: Triggers when the stop price is reached, then becomes a market order.

Limit Order: Executes only at the limit price or better, ensuring price control but not execution certainty.

Think of it like this:

A stop order says, "Get me out at any price if it gets bad."

A limit order says, "Only execute at my chosen price, or don't do it at all."

Why Are Stop Orders Important for Beginners to Learn?

Unsurprisingly, trading carries risks, particularly in the forex market or cryptocurrency. Beginners frequently allow feelings such as anxiety, desire, and hysteria to drive their choices.

Stop orders help by:

Limiting losses when the market turns against you.

Locking in profits by automatically selling at a target level.

Removing emotional decision-making by sticking to a predefined plan.

Providing peace of mind, so you don't need to monitor the market 24/7.

For example, if you bought Bitcoin at $100,000 in 2025 and placed a stop order at $95,000, you'd limit your potential loss if bitcoin prices dropped sharply.

Successful Traders Who Utilise Stop Orders

Even professional traders rely on stop orders.

Paul Tudor Jones, the legendary hedge fund manager, often emphasises risk management above all else, using stops to cut losses quickly.

Retail forex traders in Asia and Europe commonly use stop-loss strategies to prevent account wipeouts.

Many long-term investors also use stop orders, particularly trailing stops, to protect gains in bull markets.

These examples prove stop orders aren't just for beginners; they're a universal risk-control tool.

Advantages and Limitations of Stop Orders

| Advantages |

Limitations |

| Protects traders from catastrophic losses by automatically exiting losing trades |

Price gaps can cause execution at a worse level than expected (slippage) |

| Removes emotions from decision-making, enforcing discipline |

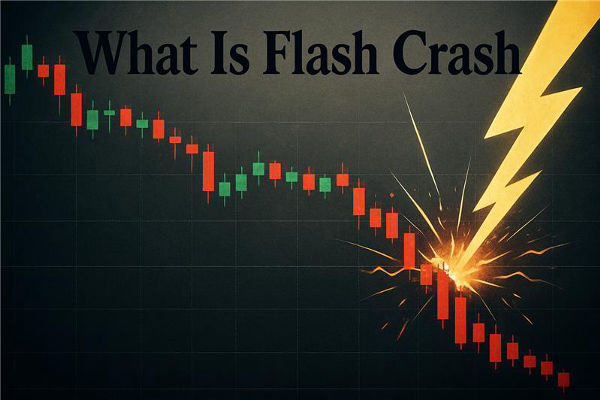

Volatile price spikes may trigger stops prematurely, kicking traders out too early |

| Allows hands-off trading; no need to monitor markets 24/7 |

No guarantee of profit as stops only limit losses, they don’t create winning trades |

| Helps lock in profits when used with trailing stops |

Stop orders may not execute at the desired level during fast-moving markets |

| Flexible and can be used in stocks, forex, crypto, and commodities |

Relying solely on stops without a proper trading plan leads to poor outcomes |

How Do I Set a Stop Order Correctly?

Setting stops is part science, part art:

Use technical analysis: Place stops near support/resistance levels.

Volatility factor: Utilise tools like Average True Range (ATR) to set reasonable stop distances.

Match your risk tolerance: Never risk more than 1–2% of your trading account on a single trade.

Adjust as you go: If the trade moves in your favour, trail your stop to lock in profits.

In 2025, trading platforms such as EBC Financial Group have made stop orders even more sophisticated:

This makes stop orders more accessible globally and easier than before. Thus, no matter where you trade, you will feel like it's a level playing field with the pros.

Frequently Asked Questions

1. What Is the Meaning of a Stop Order in Trading?

A stop order is an instruction to your broker to buy or sell a security once its price reaches a predetermined level (the stop price).

2. Can Stop Orders Guarantee Profits?

No. Stop orders are risk-management tools. They can limit losses or lock in profits, but cannot guarantee that you will make money.

3. What Happens if the Market Gaps Beyond My Stop Order Price?

If the market jumps past your stop price, your order will execute at the next available price. This phenomenon is referred to as slippage and may occasionally result in a greater loss than anticipated.

4. How Do I Decide Where to Place a Stop Order?

Utilise technical analysis, support and resistance levels, or volatility indicators like ATR (Average True Range) to place stops strategically.

Conclusion

In conclusion, trading without stop orders is like driving without brakes; you might enjoy the ride until a sudden turn comes. By understanding what stop orders mean in trading, you give yourself a crucial advantage: risk control, discipline, and peace of mind.

If you're serious about trading, mastering stop orders is among the initial steps toward achieving long-term success and ultimately the profits you desire.

Disclaimer: This material is for general information purposes only and is not intended as (and should not be considered to be) financial, investment or other advice on which reliance should be placed. No opinion given in the material constitutes a recommendation by EBC or the author that any particular investment, security, transaction or investment strategy is suitable for any specific person.